Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

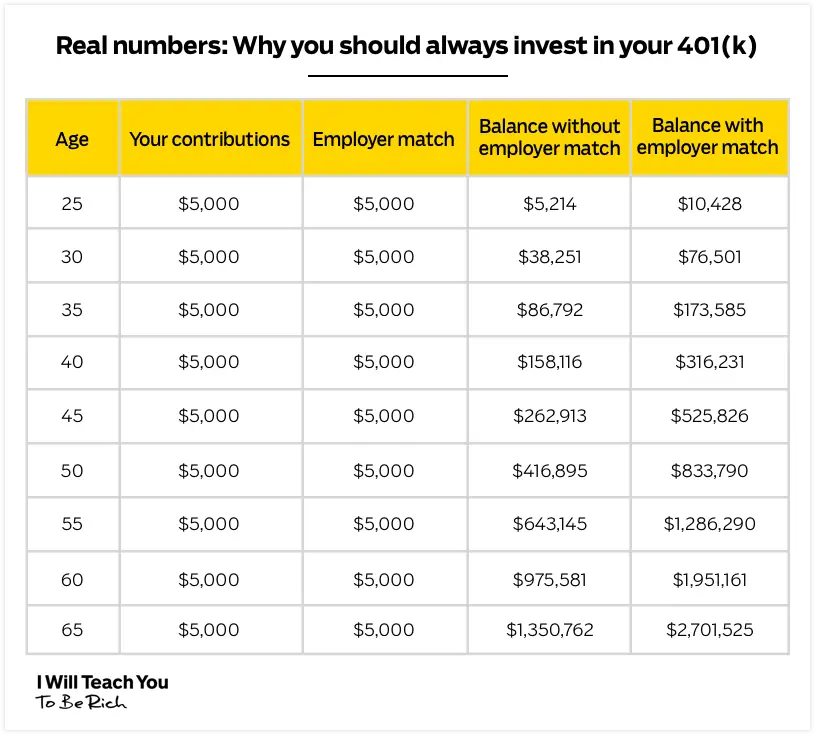

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

How Much Tax Do I Pay On 401k Withdrawal

When you withdraw funds from your 401 account, you will owe income taxes and a potential penalty. Find out how much you will owe.

One of the attractive features of a 401 plan is that it is tax-deferred, meaning that there is no tax charged on contributions, or on interest and gains earned on the retirement savings until you withdraw it. This allows individuals to contribute a bigger portion of their paycheck to their retirement savings up to the 401 contribution limit. However, you will still have to pay taxes when you withdraw money from a 401 plan.

When you make a withdrawal from a 401 account, the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. For example, if you fall in the 12% tax bracket rate, you can expect to pay up to 22% in taxes, including a 10% early withdrawal penalty if you are below 59 ½. However, if you are above 59 ½, you will only pay income taxes on the amount withdrawn. You must file your annual tax return, reporting all the income earned during the year, including the 401 distributions, and taxes you have already paid.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

You May Like: How To Avoid Taxes On 401k

Withdrawal At Age 59 1/2 To 70

The point when one reaches 59 and six months is the time an investor can make withdrawals without penalties from previous works 401 assets. If one is still working as a full-time employee or doing a part-time job, they will need the guidance of their 401 administrator to make withdrawals penalty-free.

Keep in mind, however, the government still considers these withdrawals as taxable income.

Better Options For Emergency Cash Than An Early 401 Withdrawal

It can be scary when suddenly you need emergency cash for medical expenses, or when you lose your job and just need to make ends meet.

The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, a financial professional with Principal® who helps clients on household money matters.

The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

In short, he says, You may be harming your ability to reach and get through retirement. More on that in a minute. First, lets cover your alternatives.

You May Like: How Do You Take A Loan Out Of Your 401k

How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

A 401 Loan Or An Early Withdrawal

Retirement accounts, including 401 plans, are designed to help people save for retirement. As such, the tax code incentivizes saving by offering tax benefits for contributions and usually penalizing those who withdraw money before the age of 59½.

However, if you really need to access the money, you can often do so with a loan or an early withdrawal from your 401 just remain mindful of the tax implications for doing so.

Don’t Miss: Can My Wife Get My 401k In A Divorce

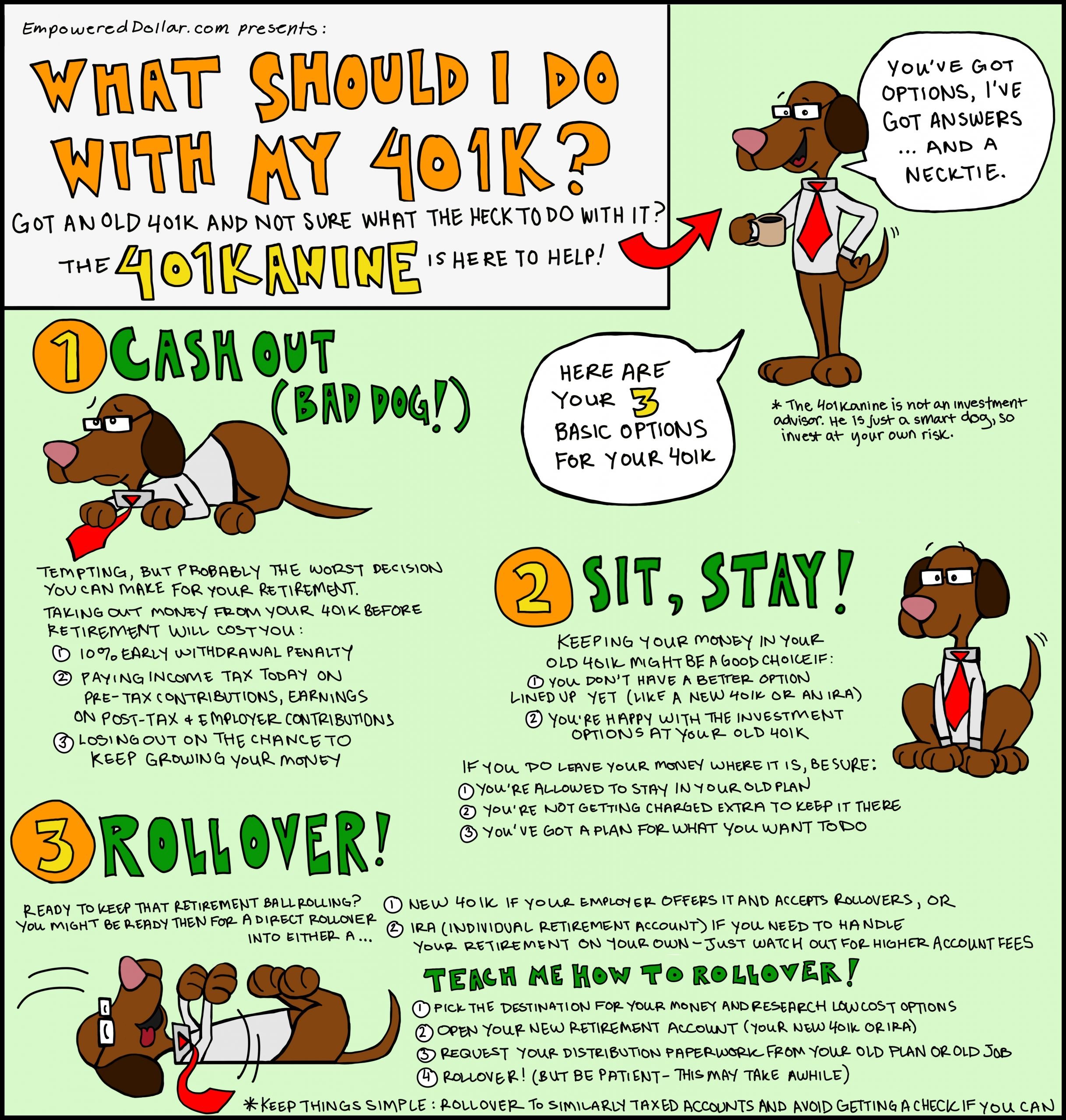

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

How To Withdraw From Your 401

Accessing the funds of your 401 depends on your age and eligibility.

If youre over 59 ½

Once youre over the age of 59½, youre free to withdraw funds from your 401 without penalty although distributions are still subject to income tax. There are a few different ways to tap into your 401, and the best option depends on your life circumstances:

- Lump-sum withdrawal. If your company allows it, you can request a lump-sum distribution up to the total vested amount in your account. After receiving the funds, your 401 account is closed.

- Take qualified distributions. Request periodic distributions as an annuity, over a fixed period or for your lifetime.

- Let it sit. If you have more than $5,000 in your 401, opt to forgo distributions and let your savings continue to earn investment income up until the age of 72. At this time, youll need to start taking required minimum distributions.

- Roll it into an IRA. If you want to continue adding to your retirement savings after you retire, youll need to roll your 401 into an individual retirement account.

If youre under 59 ½

Those who want to access their 401s early can, but withdrawal options are limited and often come with penalties. Heres how to get the ball rolling:

Don’t Miss: Should I Convert My 401k To A Roth 401 K

What Are The Penalties For Not Taking Mandatory Withdrawals

Failing to withdrawal the required amount each year could cost you a pretty penny. Although the IRS has been waiting patiently to get their share of your retirement via income tax, they arenât too patient once you reach 72.

Any mandatory amount that hasnât been withdrawn from a 401 by December 31 of the applicable year will be subject to a 50 percent penalty.

If your calculated mandatory amount is $10,000 and you fail to withdraw it, you could lose $5,000 automatically.

Itâs best to review your mandatory withdrawal amount at the beginning of each year and make a plan to withdraw that amount before the end of the year.

What Are The Exceptions To Mandatory Withdrawals

Despite IRS imposing these mandatory withdrawals and penalties, there are scenarios that allow you to delay taking money out of a 401.

If youâre 72 and older and still working for the company that sponsors your 401 plan and donât more than 5% of that company, you can delay your mandatory withdrawals.

However, if you leave that company, you will be required to begin taking mandatory withdrawals from that 401 plan.

Additionally, this exception only applies to the 401 plan held by that employer. Any old 401s with former employers you still have are subject to mandatory withdrawals.

You May Like: How To Get A Personal 401k

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

How Do I Withdraw Money From My Retirement Account

Many worry about how they will generate income during retirement, especially if they do not have a pension. One way to ensure a steady income stream during retirement is to purchase an annuity with a guaranteed lifetime withdrawal benefit.

You can transfer or roll your retirement account into the annuity when you retire. The annuity will then provide you with an income stream for the rest of your life.

This can be a very effective way to use your retirement account, as it ensures that you will have a consistent income throughout your retirement years.

Read Also: Can I Convert My 401k Into A Roth Ira

Make A 401 Withdrawal

Your second option would be to make a direct 401 withdrawal for your home purchase. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Read Also: How To Turn 401k Into Roth Ira

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Recommended Reading: Where Can I Start A 401k

Accessing Money Before Traditional Retirement Age

But what happens if you retire before age 59 ½? Can you access your money early without penalties?

You could use the 401 option discussed above.

Unfortunately:

You must retire from the company with the 401 in the calendar year you turn 55 for this to work.

If the 401 option doesnt work for you, there is another option called Rule 72. This rule requires you to follow strict guidelines. That said, it allows you to take penalty-free withdrawals from traditional retirement accounts.

To do so, you must take substantially equal periodic payments.

If Youre Required Minimum Distribution Age* Take Your Distributions

*The age at which you must begin taking RMDs differs depending when you were born:

- If you were age 70½ before January 1, 2020 , you were required to begin taking RMDs for each year beginning with the year you turned age 70½.

- If you were not age 70½ before January 1, 2020 , you must begin taking RMDs for each year beginning with the year you reach age 72.

If you havent reached RMD age, you can skip this step. But if you have, youre now required to withdraw a certain amount from many types of retirement accounts so that you can start paying the taxes youve been deferring all these years.

Consider moving your yearly RMD amount into your money market fundunless you dont need it to cover your expenses. If thats the case, you can move the money into any taxable account.

Just dont leave it in your retirement account. There are steep IRS penalties if you dont take your RMDs.

Also Check: How To Find My 401k Contributions

Three Consequences Of A 401 Early Withdrawal Or Cashing Out A 401

Taxes will be withheld. The IRS generally requires automatic withholding of 20% of a 401 early withdrawal for taxes. So if you withdraw $10,000 from your 401 at age 40, you may get only about $8,000. Keep in mind that you might get some of this back in the form of a tax refund at tax time if your withholding exceeds your actual tax liability.

The IRS will penalize you. If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 or 10% of that $10,000 withdrawal in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

It may mean less money for your future. That may be especially true if the market is down when you make the early withdrawal. If you’re pulling funds out, it can severely impact your ability to participate in a rebound, and then your entire retirement plan is offset, says Adam Harding, a certified financial planner in Scottsdale, Arizona.