How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Don’t Miss: How To Use 401k For Business

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. Before you take any money out, ask yourself an important question:

Do you actually need the money now?

Rather than putting money away, you are actually paying it forward.

If you are relatively early on in your career, you may be single and financially flexible. But your future self may be neither of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement.

Consider contributing to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Some people find the ease of access comforting.

Keep a few factors in mind:

- There are income limits on contributing to a Roth IRA.

- You will still be taxed if you withdraw the funds early or before the account has aged five years.

Don’t Miss: Does Vanguard Have 401k Plans

If You Are 59 1/2 Or Older

Once you are six months away from your 60th birthday, you can begin making withdrawals from your Fidelity 401k without having to worry about any additional tax penalties. Your 401k is now money thats there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

However, that doesnt mean you dont have to worry at all about taxes. Money withdrawn from your 401k is taxable income, so you should be careful to consider just how much you need to withdraw in any given tax year to ensure youre not hitting a higher tax bracket and seeing more of your hard-earned money lost to taxes. If you have a Roth IRA or Roth 401k, though, you can make tax-free withdrawals from those, so you can balance withdrawals to minimize the tax impact.

Your Fidelity 401k comes with the option to schedule regular withdrawals so that you can do the paperwork for your withdrawal once and then set up a recurring payment. With structured, regular withdrawals, you can set up a budget that will limit your withdrawals to what you need, and youll be able to have checks showing up on a set schedule.

Learn: The Best 401k Companies

Information For Tricare Beneficiaries

If you have TRICARE and your withdrawal includes your Medicare Part A coverage, you may lose your TRICARE coverage. If you do not withdraw your Medicare Part A coverage, you may need to stay enrolled in Medicare Part B to keep your TRICARE coverage. For more information, visit TRICARE’s Beneficiaries Eligible for TRICARE and Medicare.

Read Also: Should I Transfer My 401k To My New Employer

How Long Does It Take For A Withdrawal From A Merrill Edge Account

Redemptions or withdrawals may not appear for up to 15 days after the receipt of the checks, and subject to applicable laws and regulations, within six days of the receipt of funds. How do I link an account? You can add new single accounts to your online portfolio view using a simple three-step process.

Dont Miss: What Is The Best Fund To Invest In 401k

Determining If A Hardshipwithdrawal Is Allowed

As Plan Administrator, you can determine whattypes of hardship withdrawals if any are allowed from your plan by checkingthe adoption agreement. In general, hardship withdrawals may be allowed fromprofit sharing plans and profit sharing plans with 401 features.

There are two types of hardship withdrawals:401 and non-401. Check your adoption agreement to see if either or bothhardship withdrawal types are allowed by your plan. The 401 hardshipwithdrawals apply only to pre-tax 401 source contributions contributions, source N). The non-401 hardshipwithdrawals apply only to employer profit sharing and employermatching contributions and only if the participant is 100% vested inthese contributions. See the Contributions section for more details oncontribution types.

Both types of hardship withdrawals may berequested by an active participant if he or she has a financial hardship andmust satisfy an immediate and heavy financial need.

Read Also: How To Pull Money Out Of 401k Fidelity

How Long Does It Take To Get A 401k Loan Check From Merrill Lynch

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

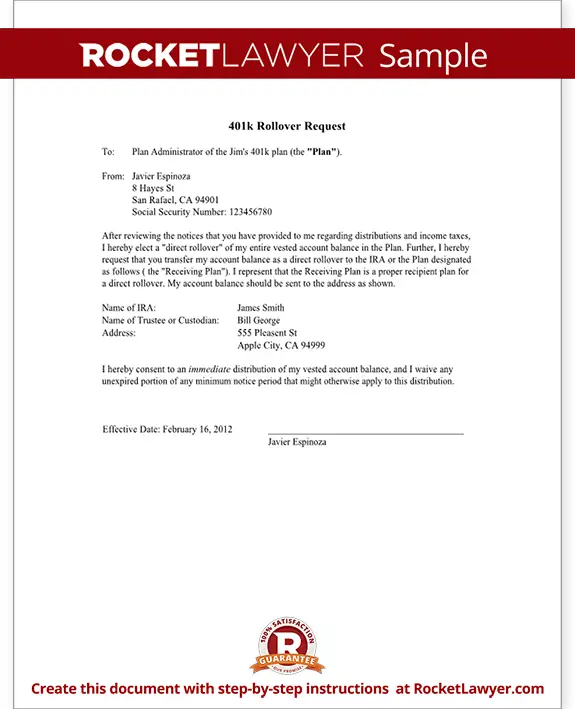

How Do I Cash Out My 401 From An Old Job

If you have a 401 from a previous job, you may wonder how to cash it out. The process is actually relatively simple. You will need to contact the plan administrator and request a distribution form. Once you have completed the form, you must submit it to the plan administrator. They will then process your request and issue a check for the amount of your distribution. It is important to note that taxes and penalties may be associated with cashing out your 401.

Recommended Reading: How Much Needed In 401k To Retire

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

Read Also: How To Withdraw From Merrill Lynch 401k

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

Provide The Withdrawal Amount

Indicate how much you want to withdraw from your retirement account in the third section of the form. You are not held to any minimum or maximum withdrawal amounts unless you have a traditional IRA and are age 70 1/2 or older. In these cases the IRS requires you to withdraw a minimum amount from your accounts each year. The required minimum distribution amount varies depending on your age and how much you have in your retirement accounts. If you do not take the distribution, you will incur an additional 50 percent tax on the amount you should have taken. Merrill Lynch provides a required minimum distribution calculator, as well as an automatic required minimum distribution service to help customers determine how much they must take out. Roth IRA holders do not have to meet this requirement.

Also Check: How To Set Up Self Employed 401k

How Do You Get Money Out Of Your 401k

You can do a rollover of your 401 account balance to an IRA at a company of your choice. You pay no taxes if you do a rollover to an IRA, and your money can stay in your IRA for your later use. Then you can withdraw amounts from your IRA only as you need it. You only pay taxes on the amount you withdraw each year.

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

Don’t Miss: How To Withdraw From 401k

What Happens If You Leave Your Job

If you leave your job with a 401 loan outstanding, you must repay the loan within 90 days. Otherwise, the remaining loan balance will be treated as a distribution and youâll owe taxes and a 10% early withdrawal penalty on that amount. You will not be able to replace those withdrawals later on when you have more money. That means that youâll also lose out on tax-deferred growth for that money that is offered through your 401.

Read Also: What Is The Max I Can Put In My 401k

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

401 loans must be repaid with interest in order to avoid penalties.

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

Read Also: How To Rollover 401k To Ira Td Ameritrade

Hardship Withdrawals From Roth401 Contributions

Special tax consequences apply to hardshipwithdrawals from Roth 401 contributions. The taxation of a hardshipwithdrawal from Roth 401 contributions depends on whether or not thewithdrawal is a qualified distribution. Qualified distributions from Rothaccounts are fully excludable from gross income. To be qualified, thedistribution must be made after:

- The participant has reached age5912, become disabled, or died, and

- The Roth account has beenmaintained for at least five years.

In all other cases, the distribution isnonqualified. Nonqualified distributions are treated partly as a tax-freereturn of contributions and partly as taxable investment earnings.

If withdrawals are distributed before age5912, the taxable portion of the payment is subject to an early distribution10% tax penalty. This extra tax does not apply to the payment if theparticipant is:

- At least age 55 when separatedfrom service,

- Terminated due to disability,

- Paid in equal payments over the life expectancy of the participant or joint life expectancyof the participant and beneficiary,

- Using the payment to cover certainmedical expenses that can be deducted on a tax return, or

How 401 Loans Work

A 401 loan lets you borrow money from your workplace retirement account on the condition that you pay back the amount you borrow with interest. The good news is that the payment amounts and the interest go right back into your account.

The interest rate you pay on a 401 loan can change over time. According to Debt.org, the interest rate you would pay on a 401 loan is usually a point or two above the lending rate used by banks. The rates used by banks is called the prime rate and it’s influenced by the federal funds rate, so it can change over time. So if the prime rate is 5.2%, the interest rate you pay on your 401 loan may be around 6.2% to 7.2%.

Because your 401 is an employer-sponsored account, you’ll need to abide by your employer’s plan rules around taking out a 401 loan. Many employers have limits for how much of your balance you’re allowed to borrow and how many loans you can take from your account per year you’ll need to double check the guidelines around your employer’s plan before you take the next steps to borrow from your 401.

Keep in mind that if you were to leave your job before repaying a 401 loan in its entirety, you might have to repay the money you borrowed immediately .

Also Check: Can You Make Your Own 401k

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

What Qualifies As A Financialhardship

The following reasons qualify as a financialhardship as set forth in the plan document:

- Buying the participants primaryhome

- Post-secondary educational feesfor the next 12 months, including tuition, room and board, and other relatedcharges for the participant or the participants spouse, children ordependents, or the participants primary beneficiary* under the plan

- Unreimbursed medical expenses, forthe participant or the participants spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Preventing eviction from orforeclosure on the participants primary home

- Burial expenses for theparticipants deceased parent, spouse, children or dependents, or theparticipants primary beneficiary* under the plan

- Expenses to repair damages to theparticipants primary home that would qualify as a casualty deduction underSection 165 of the Internal Revenue Code .

*The primary beneficiary under the plan is theindividual who has an unconditional right to all or a portion of theparticipants account balance upon his or her death.

Because hardship withdrawals can only beapproved by the Plan Administrator, you will need to keep on file theapplicable documentation in the event your plan is audited.

You May Like: How Do You Collect Your 401k