The Ins And Outs Of Opening And Contributing To A Roth Ira

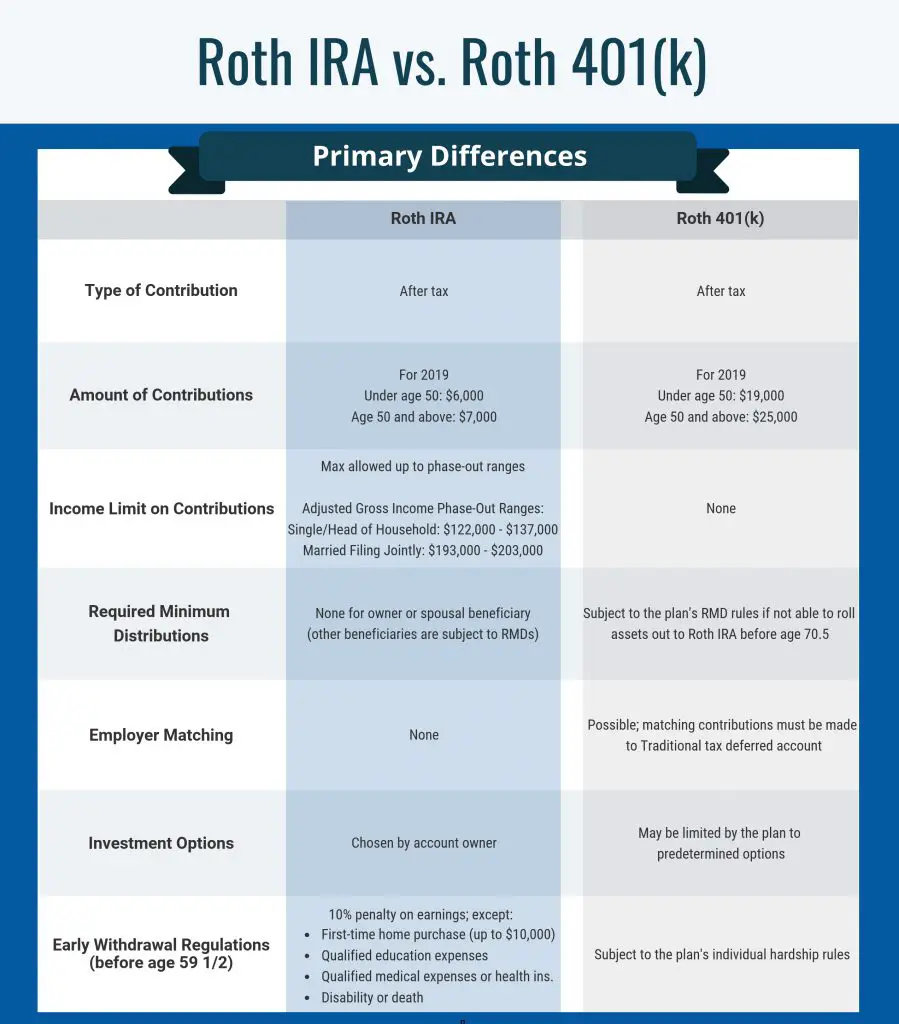

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

The Build Back Better infrastructure billpassed by the House of Representatives and currently under consideration by the Senateincludes provisions that would eliminate or reduce the use of Roth conversions for wealthy taxpayers in two ways, starting January 2022: Employees with 401 plans that allow after-tax contributions of up to $58,000 would no longer be able to convert those to tax-free Roth accounts. Backdoor Roth contributions from traditional IRAs, as described below, would also be banned. Further limitations would go into effect in 2029 and 2032, including preventing contributions to IRAs for high-income taxpayers with aggregate retirement account balances over $10 million and banning Roth conversions for high-income taxpayers.

But this can be tricky, so if a serious amount of money is involved, its probably best to consult with a financial advisor to weigh your options.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

- Pros

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

- Cons

-

- You may have a limited range of investment choices in the new 401.

- Fees and expenses could be higher than they were for your former employer’s 401 or an IRA.

- Rolling over company stock may have negative tax implications.

Recommended Reading: When Can You Take Money Out Of 401k Without Penalty

How Can I Do An In

If your plan allows them, you can do an in-plan Roth:

- Direct rollover by asking the plan trustee to transfer your non-Roth amount to a designated Roth account in the same plan , or

- 60-day rollover by having the plan distribute an eligible rollover distribution to you from your non-Roth account and then depositing all or part of that distribution to a designated Roth account in the same plan within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Roll Over Your 401 To A Traditional Ira Then Convert It To A Roth Ira

Contributions to your 401 plan were pretax. This means your employer deducted them from your taxable salary when reporting your income to the IRS. Same goes for any employer matches. So you have yet to pay taxes on any contributions and on any accrued earnings.

Traditional IRAs are also tax-advantaged. The difference, of course, is that individuals rather than employers send their contributions to their financial institutions and claim the deduction when filing their taxes. So like 401 balances, the money in an IRA is tax-deferred. You wont owe taxes on it until you retire and start taking distributions.

This is why rolling over your 401 to a traditional IRA is fairly straightforward. Its an apples-to-apples transaction.

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

- Youre married filing jointly and have a modified adjusted gross income of less than $204,000

- Youre single or head of household and have a MAGI of less than $129,000

Don’t Miss: How Does Company 401k Match Work

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

However, you should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

Retirement Plans Faqs On Designated Roth Accounts

A designated Roth account is a separate account in a 401, 403 or governmental 457 plan that holds designated Roth contributions. The amount contributed to a designated Roth account is includible in gross income in the year of the contribution, but eligible distributions from the account are generally tax-free. The employer must separately account for all contributions, gains and losses to this designated Roth account until this account balance is completely distributed.

These FAQs provide general information and should not be cited as legal authority.

Recommended Reading: What Companies Offer The Best 401k Match

K Rollover To Roth Ira

The procedure to roll over your retirement savings from one account type to another is straightforward. Heres how to covert a 401k to a Roth IRA:

Learn More: 401k Rollover Rules

Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Dont Miss: How To Take A Loan Out On Your 401k

You May Like: Can You Convert A 401k Into A Roth Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

S To Convert 401 To Ira

The inspiration from this post came while I was helping my wife rollover her Traditional and Roth 401 .

Our goal was to convert her Traditional 401 to a Traditional IRA and convert her Roth 401 to a Roth IRA.

Here are the steps we took:

Recommended Reading: How Do I Get My 401k

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options arent usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: How To Find Out If You Have A 401k Account

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

You May Like: How Can I Get My 401k Money Without Paying Taxes

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59 and a half, then the IRS levies an additional 10% penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

What Is The Tax Rate On A Conversion

Your conversion will be taxed at your marginal tax rate: The top tax bracket that the withdrawal puts you in when its added to your other income. And tax brackets arent carved in stone. They are adjusted periodically to accommodate inflation and legislation.

For instance, you would have been in a high, 28% tax bracket if filing as single on income of $85,000 in 2010, including the amount of retirement savings you withdrew to make a conversion. Now fast-forward to 2021. That $85,000 would put you at a marginal tax rate of just 22% because 2018 legislation changed the percentage rates and the spans of income they applied to. You would have paid less in taxes if you had waited 11 years to take that tax-deferred distribution and convert it to a Roth account.

Add your anticipated taxable income for the year to the amount of Roth conversion withdrawal you plan to take to find out the percentage rate youll pay on your top earningsthat portion of your income that includes the conversion distribution you tookin 2021:

| 2021 Rate |

| $628,301 or more |

President Biden has expressed his intention to increase the tax rates of higher-income Americans, so the tax bite could increase for high earners in coming years.

Also Check: Can I Open A 401k By Myself

How Does An Ira Or 401 Into An Annuity Rollover Work

Say youre interested in using your retirement funds to buy an annuity. Should you withdraw the funds from your retirement account, pay the taxes and then buy the annuity? Or can you just roll over the funds directly into the annuity, continuing to avoid taxes until you receive the income stream payments?

In most cases, the IRS allows qualified funds to be transferred into, or out of, qualified annuities. So, its important to know the annuity rollover rules before making this decision.In short, there are two ways to roll over your retirement account into an annuity directly through a transfer, or indirectly through taking a qualifying withdrawal.

Tax Implications Of 401 To Roth Ira Conversion

To understand the tax implications, the most important thing to know is whether your 401 is a traditional or a Roth . About 75% of 401 plan participants choose to make pre-tax contributions, according to a 2018 survey by the Plan Sponsor Council of America, a non-profit trade association.

That means the majority of conversions from 401 to Roth IRA will trigger a tax bill during the year in which the conversion takes place. Depending on how much money youre converting, this could mean a significant and immediate increase in your tax bill. For that reason, a conversion is not to be taken lightly.

You have to be prepared for that tax bill, says Stanley. Its a good idea to do it in stages and talk to your tax professional.

You May Like: How To Transfer 401k When Changing Jobs