What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

You May Like: What Happens To My Roth 401k When I Quit

Recommended Reading: Should I Take A 401k Loan To Pay Off Debt

Dont Cash Out Your 401 Early

Another lesson: Whatever you do, dont cash out your 401 savings. If you leave your job, you are allowed to spend your 401 funds if you pay taxes on the amount, including a 10% penalty tax assessed on most withdrawals made before age 59 ½. You may be tempted to take the cash and spend it on a vacation before you start your next job, but thats not a very good idea.

Roll over that retirement money, sign up for the retirement plan with your new employer and take a nice and affordable staycation instead. Your retired self will be very grateful to your working self for making a small sacrifice that could have a big impact down the line.

How Much Should I Have In My 401k At 40

Fidelity says that by age 40 you should aim to have three times your salary saved. This means that if you earn $75,000, your retirement account balance should be around $225,000 when you turn 40. If your employer offers both a traditional and a Roth 401, you may want to split your savings between the two.

How much should you have saved for retirement by age 40? To stay on track for retirement at age 67, you should have saved 3 times your income by age 40, according to retirement plan provider Fidelity Investments.

You May Like: What Will My 401k Be Worth In 20 Years

Contribute More When Youre Young

Kyle Kroeger, Founder of Financial Wolves

I’ve been contributing the max amount to 401 since my second year out of college. I think anyone should strive for contributing the max contribution limit as soon as possible out of college, even if it requires you to find a job on the side. Why? Because as a young professional your income is only expected to rise. If you can price in the max contribution into your budgeting right from the start, your income will rise too.

A lot of people will increase their contributions when they get a raise. That just means that your take-home pay will stay the same. That makes it much harder psychologically to continue to increase your contributions. Most people don’t even end up doing it. Bite the bullet early and max out from the get-go!

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways well need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, its okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially free money so you dont want to leave any sitting on the table.

You May Like: How Do I Get My Money From My 401k

Consider Working More And Retiring Later

If you dont have enough money to fund additional retirement accounts, consider taking on additional work to earn that money. This can range from freelance or gig work to a formal part-time job.

This is not a recommendation we make lightly. By the time youre in your 50s, the last thing most people will want to do is hustle. However, secondary work is a good way to boost your finances, and if you need the money for retirement then it has to come from somewhere. More importantly, while it would be unpleasant to need a second job at 55, it would be far worse to need a job at 75. Working today might help ensure that you dont have to do so tomorrow.

The jump in Social Security payments from normal retirement age to 70 is significant. If you were born between 1943 and 1954, If you start receiving benefits at age 66 you get 100% of your monthly benefit. Should you start receiving retirement benefits at age 67, youll get 108% of the monthly benefit because you delayed getting benefits for 12 months. If you start receiving retirement benefits at age 70, youll get 132% of the monthly benefit because you delayed getting benefits for 48 months.

How Much Should You Save For Retirement

How much one can save for retirement often depends on a number of factors, including income and salary, household expenses, and marco-economic conditions. A more important question is how much someone should save for retirement. Typically financial planners recommend saving around twelve to fifteen percent of ones income on your retirement.

More than half of workers have access to a private retirement account like a 401, which is protected from taxation until retirement . To ensure people do not use these accounts as a tax shelter, US Federal Reserve conducted a survey of retirees and workers to determine how they were saving and whether their nest egg was enough when they decided to exit the workforce.

In speaking with non-retirees, a quarter of respondents, twenty-five percent, said they were not saving for retirement. More concerning was that only forty percent stated that they believed their retirement saving was on track, with rates for minorities significantly lower than their white and Asian counterparts. Those with disabilities find themselves in the most precarious spot, with only seventeen reporting that they are on track to save what is necessary to survive in their later years.

Seniors and Baby Boomers are concerned about their retirement savings

Don’t Miss: How To Check My Walmart 401k

Contribution Limits In 2021 And 2022

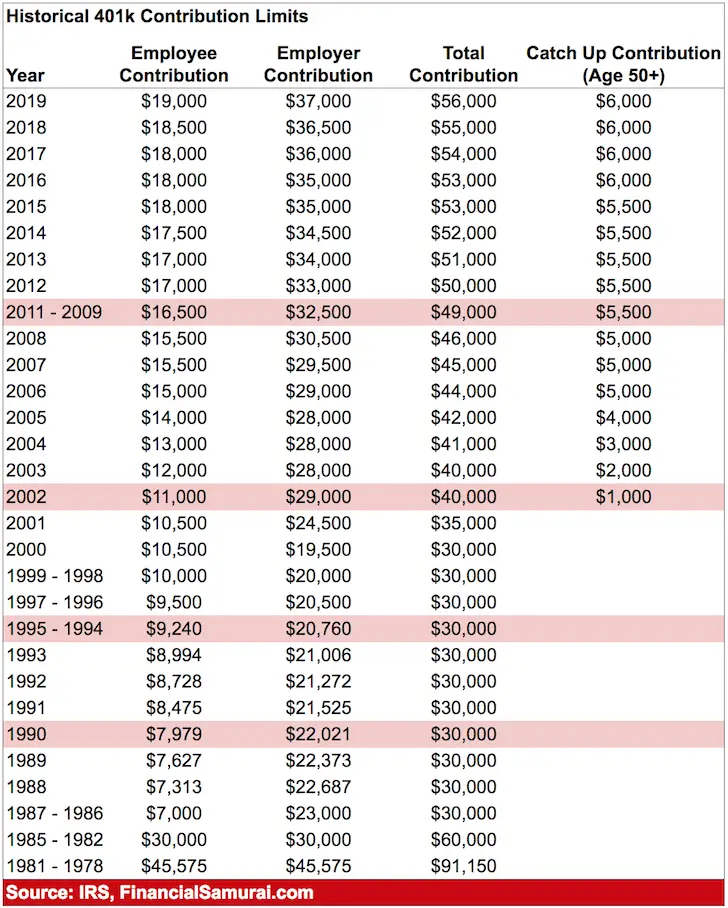

For 2022, the 401 limit for employee salary deferrals is $20,500, which is above the 401 2021 limit of $19,500. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $61,000 in 2022, up from $58,000 in 2021.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits | ||

|---|---|---|

| Maximum salary deferral for workers | $19,500 | |

| Catch-up contributions for workers 50 and older | $6,500 | |

| Total contribution limit, plus catch-up contribution | $64,500 | |

| Compensation limit for figuring contributions | $290,000 | |

| Compensation threshold for key employee nondiscrimination testing | $185,000 | |

| Threshold for highly compensated employee nondiscrimination testing | $130,000 | +$5,000 |

The Four Levels Of Retirement Savings

The lesson is: Figure out what percentage of your income you can save in total, and allocate it appropriately:

Level 1: Max out your employer match in your 401.

Level 2: Max out your emergency savings .

Level 3: Max out your Roth IRA .

Level 4: Max out your 401 .

This flowchart from my post on creating an automated investing program will also help:

You May Like: When You Leave An Employer What Happens To Your 401k

Invest In Iras And Roth Iras

If you remember the rule of thumb earlier, experts advise saving 10% to 20% of your gross salary each year for retirement. You could put this all in your 401, but you should consider some other options once you cover your 401 match.

If you are single and earn less than $140,000, you qualify for a Roth IRA in 2021 for 2022 youll qualify for a Roth IRA if you earn less than $144,000. If you are married and earn less than $208,000 in 2021 you qualify for a Roth IRA for 2022 youll qualify for a Roth IRA if you earn less than $214,000.

This is a retirement savings vehicle that you can open at virtually any bank or financial institution. You fund these with after-tax dollars. So your contributions wont reduce your taxable income. However, eligible withdrawals you make after turning 59.5 are tax free. Its good to have a mix of taxable and non-taxable income in your retirement.

Roth IRAs are particularly useful for young people who are just starting their careers. Chances are that if you just graduated from college, youre in a lower tax bracket than you will be in when you retire. Paying the income tax now instead of later can save you money, especially when you need it the most

In 2021 you can contribute up to $6,000 to a Roth IRA. The $1,000 catch-up contribution for those who are at least 50 years old applies here, too. You can also contribute up to $6,000 in 2022 and the catch-up contribution limit remains as it was in 2021.

What Is A 401 Overcontribution

An overcontribution happens when you defer more than the maximum allowed by the IRS to a 401 plan in any given year. For both 2020 and 2021, the IRS limits 401 employee contributions to $19,500. If youre 50 or older, you can contribute an extra $6,500 as a catch-up contribution.

Overcontributions most commonly happen when a person contributes to more than one 401 plan in a year.

This can happen if you switch jobs midyear, if you work two jobs, or if you get a substantial raise midyear while keeping your contributions as a percentage of your paycheck the same.

Its important to differentiate between what is an overcontribution and what isnt. Catch-up contributions are not overcontributions. Any matching contributions from your employer wont push you above the wage deferral limit, either. The IRS allows total contributions from both the employee and the employer to reach a much higher limit than the employee salary deferral. For 2021, that amount is $58,000, or $64,500 for those 50 and older. For 2022, the limits have increased to $61,000, or $67,500 for those 50 and older.

Recommended Reading: How To Buy A House With 401k

Read Also: How Do I Draw From My 401k

How Much Should I Put Into My 401 Out Of Each Paycheck

Aiming to put at least 15% of each paycheck into your 401 as long as you can still comfortably afford your living expenses is an excellent start on your way to saving for retirement. Its suggested that if you cant meet this amount, aim for the minimum amount to where your employer will match your 401 investment.

If You Have A 401 Do You Need An Ira Too

Dear Carrie,

I already have a 401. Does it make sense to open an IRA, too?

A Reader

Dear Reader,

A 401 or other employer-sponsored retirement planif youre lucky enough to have onecan be considered the backbone of your retirement savings. Contributions are easy because they automatically come out of your paycheck you may get an upfront tax deduction and annual contribution limits are sizeable$20,500 for tax-year 2022, plus a $6,500 catch-up for those age 50 or older.

That means, depending on your age, you could contribute up to $27,000 in 2022. Plus, if you get an employer match, thats extra savings in your pocket. Add tax-deferred growth of earnings, and whats not to like?

But as positive as all this is, theres a good case for having an IRA in addition to your 401. An IRA not only gives you the ability to save even more, it might also give you more investment choices than you have in your employer-sponsored plan. And if you have a Roth IRA, theres also the potential for tax-free income down the road.

But the type of IRA that makes sense for you personally will depend on your filing status and your income, so theres a bit more to consider.

You May Like: Where Do I Go To Borrow From My 401k

Can You Contribute To A 401k And A Roth Ira In The Same Year

You can have both a 401 and a Roth IRA at the same time. Contributions to both are not only allowed, but can be an effective retirement savings strategy. However, there are some income and contribution limits that determine your eligibility to contribute to both types of accounts.

How much can you contribute to a 401k and a Roth IRA in the same year?

You can contribute up to $20,500 in 2022 to a 401 plan. If youre 50 or older, the maximum annual contribution jumps to $27,000. You can also contribute up to $6,000 to a Roth IRA in 2022. That jumps to $7,000 if youre 50 or older.

Can I max out 401k and Roth 401k in same year?

and a traditional 401, the total amount of money you can contribute to both plans cannot exceed the annual maximum for your age, $19,500 or $26,000 for 2021. If you exceed it , the IRS could fine you a 6% overcontribution penalty.)

Dont Miss: How To Find 401k From Former Employer

Traditional Vs Roth 401

Some employers offer both a traditional 401 and a Roth 401. With a traditional 401 plan, you can defer paying income tax on the amount you contribute. In other words, if you earn $80,000 a year and contribute the maximum $20,500, your taxable earnings for the 2022 tax year would be $59,500.

With a Roth 401 plan, you dont get an upfront tax break, but when its time to withdraw that money in retirement, you wont owe any tax on it. All your accumulated contributions and earnings come out tax free.

Investing in both types of plans provides you with tax diversification, which can come in handy during retirement.

If you have access to both a Roth and a traditional 401 plan, you can contribute to both, as long as your total contribution to both as an employee doesnt exceed $20,500.

In addition to the Roth and traditional 401, some employers also offer an after-tax plan, allowing you to save up to the total annual limit of $61,000. With this account you can put away money after-tax and it can grow tax-deferred in your 401 account until withdrawal, at which point any withdrawn earnings become taxable.

Read Also: How Do I Access My 401k Account