How Does The Employer Match Work

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution: a percentage of the employees own contribution and a percentage of the employees salary. Employers might match 25%, 50%, or even 100% of an employees contribution up to a set percentage of the employees salary.

Some companies may match contributions dollar for dollar, while others match at a smaller percentage. Other employers may set a hard dollar-based cap instead of limiting match contributions to a percentage of the employees total salary. Total employer contributions cannot exceed 25% of eligible employees annual salary or compensation.

No matter what your companys match program is, its important to strategize. Retirement experts regularly encourage employees to contribute enough to reach the maximum possible employer contribution, or at least as much as they can comfortably contribute. This ensures employees arent leaving money on the table, especially since its part of their total compensation.

A Closer Look At Your Available Options

The good news is whatever money thats in your 401 is yours to do with as you like. But when you no longer work for a company, any retirement accounts you have through your former company might need to be moved to your new employer. Or you may need to roll it over or into a brokerage account that you own completely.

Getting The Most From Your Employer 401 Match

Klaus Vedfelt / Getty Images

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. That’s because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you haven’t already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Also Check: Can I Roll My Ira Into My 401k

How Does 401 Employer Matching Work

Siân Killingsworth / 14 Sep 2022 / 401 Resources

A 401 is the standard retirement plan offered by companies across the nation as part of their employment benefits package. Many of those employers also offer whats known as a matching contribution as an added benefit. Matching means that the employer contributes a specified amount to the employees retirement plan based on the employees annual contribution.

Why would an employer give money away? Well, there are three valuable benefits employers can derive from small business 401 matching:

- Increased employee retention and morale

- The ability to attract and retain top talent

- Significant company tax incentives

Start Making 401 Contributions Immediately

Some employers have a waiting period after you start a job before they begin matching your 401 contributions. However, Vanguard notes that 68% of plans let you start making contributions immediately as a new employee. Dont wait for the matching contribution to kick in start contributing when you begin your new job.

If youre intimidated by the investment options, take advantage of the plans target-date funds. The vast majority of employers have their default investments set up as a target-date fund, which is tied to your age and retirement year, said Taylor. You can put your money in there, and its a sort of do-it-for-me option where its allocated across equities appropriate for your age.

Also Check: How To Transfer 401k Balance To New Employer

Matching Contributions: How Much And When

The specific terms of 401 plans vary widely. Other than the necessity to adhere to certain required contribution limits and withdrawal regulations dictated by the Employee Retirement Income Security Act , the sponsoring employer determines the specific terms of each 401 plan.

Your employer may elect to use a very generous matching formula or choose not to match employee contributions at all. Some 401 plans offer far more generous matches than others. Whatever the match is, it amounts to free money added to your retirement savings, so it is best not to leave it on the table.

Refer to the terms of your plan to verify if and when your employer makes matching contributions. Not all employer contributions to employee 401 plans are the result of matching. Employers may elect to make regular deferrals to employee plans regardless of employee contributions, though this is not particularly common.

Types Of Company Matching Contributions:

- Partial matching

Partial matching means that the employer matches part of your 401 contribution, up to a specified amount. For instance, many employers offer a 50% match of the employees contribution, up to 6% of their salary.

Full 401 matching as a dollar-for-dollar match where the employer puts in the same amount of money the employee does up to a specified amount. For instance, if the employee put in 4%, you as the employer contribute 4%. However, if the employee contributes 6%, you will still only need to contribute 4%.

Recommended Reading: How To Stop Your 401k

How A 401 Works

A 401 works by contributing a part of your salary or wages to a dedicated account. You can contribute up to a certain amount per year to your 401, with an additional contribution known as a catch-up contribution available for those over 50.

Employers usually work with a dedicated financial professional to invest your funds in the market and offer matching up to a certain percentage or gross amount. That way, your funds continue to grow based on the investment plan. Your employer may give you different investment options that include varying stock and bond mixes.

A 401 provides taxation benefits, either when contributing or withdrawing. In a traditional 401, your contributions are tax-free, while your withdrawals include taxes. An employer may instead offer a Roth 401 plan in which contributions to a retirement plan occur after taxation, allowing for tax-free withdrawal in the future. This may make a Roth 401 preferable early in your career when youre likely to be in a lower tax bracket than you may be in retirement.

Related: Salary vs. Hourly Earnings: What Are the Differences?

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Also Check: How Much Invest In 401k

How To Know If A Potential Employer Offers A 401k Match

If youre applying for a job at a new company, make sure you ask about benefits like the 401k. This is a meaningful part of your compensation and should be a consideration as you weigh the differences between a current job and potential new job. If youre going from a job that has a generous 401k match to a job with none at all, dont overlook that in the salary negotiation or decision process.

What Is A 401 Employer Match

A 401 plan is a retirement account sponsored by employers, while a 401 employer match is a type of added employee benefit.

Employees can contribute part of their salary towards a 401 retirement account. This is typically done via a percentage amount, but can also be done by an employee choosing a dollar amount. But when employers match 401 contributions, they also contribute to their employees accounts.

So, if an employee contributes to their 401, employers will match this contribution up to a certain amount. Put simply, a 401 match program is essentially free money for employees.

The average employer 401 match is at an all-time high at 4.7%. This means that, on average, companies will match 4.7% of an employees salary toward their retirement.

Employee contributions to 401 plans vary greatly. But on average, employees contribute 8.8% yearly. This percentage, combined with a 4.7% match from an employer, means an employee could save 13.5% of their total salary in their 401 plan.

So, if you make $45,000 per year, you can expect to save an average of $6,075 per year in your 401 savings account.

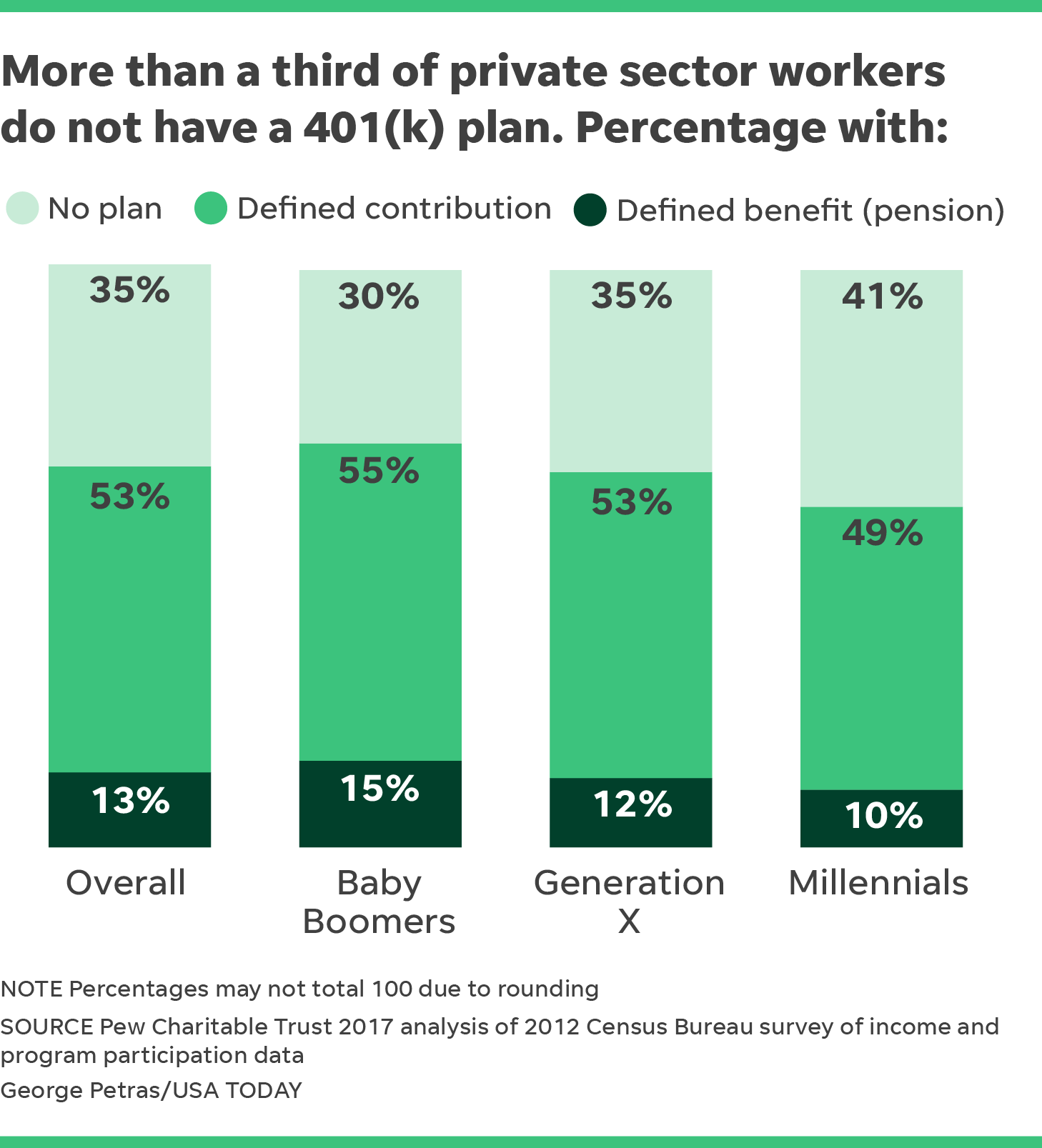

Its important to note that not everyone has a savings account. About 54% of millennials dont have a retirement account.

Recommended Reading: When Can I Use My 401k

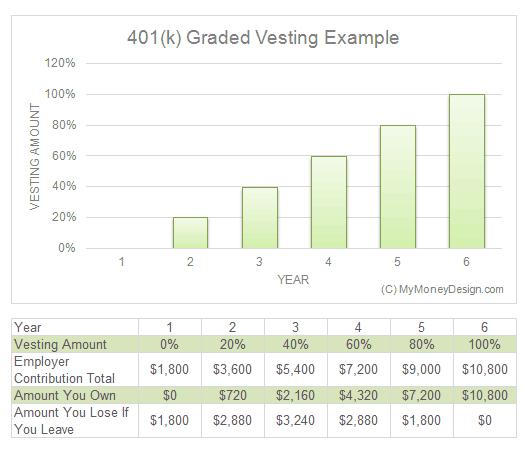

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employers matching contributions.

Do Employers Match Contributions To A Roth 401

Yes, but theres a catch. If you contribute money to a Roth 401 plan, which allows you to make contributions with after-tax dollars in return for tax-free withdrawals during retirement, your employers matching contributions will be made in a separate traditional 401 plan. This is because youre required to pay taxes on contributions made by your employer and those taxes wouldnt be paid if they were made to a Roth 401 plan.

Also Check: How Do You Max Out Your 401k

Matching Makes Financial Sense

401 matching makes financial sense for employers and employees alike. Employee matching is the best way for employees to maximize their retirement savings, while employers get the benefits that come with investing in their team members futures namely, tax savings and reduced employee turnover. Learn more about employee retirement plans and their features in our buyers guide.

Kimberlee Leonard contributed to the writing and reporting in this article.

What Are The Benefits Of Offering A 401k To Employees

Helping employees plan for the future is a big responsibility, but it can also be very rewarding. Employers who offer a 401k may be able to:

- Attract and retain talent In addition to competitive salaries and health benefits, retirement savings plans can be a major influencer with candidates who are weighing different job offers.

- Improve retirement readiness Employees who are financially prepared for retirement can leave the workforce when the time is right, thereby creating growth opportunities for other employees and new talent.

- Take advantage of tax savings Businesses that sponsor a 401k are potentially eligible for a $500 tax credit to cover startup administration costs during the first three years of the plan. Additional tax deductions may be available if the employer matches employee contributions.

- Enhance productivity through financial wellness A retirement savings plan is one of the cornerstones of financial wellness. And when employees feel secure about their future, they tend to be less stressed and more productive at work.

Also Check: How To Pay Off 401k Loan

K Employer Match Example

Let’s say your employer offers a 100% match up to 4.5% of your $50,000 pretax salary. To benefit from the full employer match, you will need to contribute $2,250 to your 401. Your employer matches that amount dollar-for-dollar, so at the end of the year, you have $4,500 saved for retirement, plus any additional contributions you make. Keep in mind that anything you contribute over $2,250 is unmatched by your employer.

With a partial match, your employer matches 50% of your contributions up to 4.5% of your $50,000 pretax salary. You would still have to contribute $2,250 to get the full match, but your employer would have contributed half the amount , for a total of $3,375 at the end of the year.

What Are The Benefits Of Contributing To A 401 Plan

One major benefit is the employer match, says Ward. Its like getting free money. Contributing up to the match is one of the best ways an employee can take full advantage of this benefit, he adds.

Providing an easy, tax-advantaged method of saving for retirement, plus the ease of automatic deductions from your paycheck to your account, are also benefits of participating in your employers 401 plan.

You May Like: How To Split 401k In Divorce

You May Like: What Happens To Your 401k When You Quit Your Job

How Roth 401 Matching Works

Your employer can match your Roth 401 contributions just as they do with a traditional 401, but with one major difference: Matching contributions go into a traditional 401 account instead of your Roth 401. Even if you choose to contribute to a Roth 401 only, you’ll maintain both a Roth and a traditional 401 accountthe latter for your employer’s matching contributions. Because your employer’s contributions go into a traditional 401, you don’t pay taxes on them.

Employer plans vary. Some offer generous matching policies as a benefit to employees, while others don’t offer matching at all. Two common types of matching programs include:

How Can Deskera Help With 401 Matching

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions as well as contributions.

Also Check: How To Get Money Out Of Your 401k Early

Matching In A Nutshell

A 401 match is essentially free money. It can help you achieve your retirement goals more quickly, so its important to understand how your employers 401 match works and how to maximize that match.

A 401 is only one of several types of retirement funds. You can also learn about a Roth IRA, another common kind of retirement account.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

Capital One does not provide, endorse or guarantee any third-party product, service, information, or recommendation listed above. The third parties listed are solely responsible for their products and services, and all trademarks listed are the property of their respective owners.

Related Content

Do Most Employers Match 401 Contributions

There are several variables to look at when trying to figure out whether or not a 401 plan is generous:

- Is the employer contributing anything?

- Is it a matching or a non-matching contribution?

- How much of your contribution is matched?

- Is the match capped?

Start with perhaps the simplest question: Should you expect your employer to contribute anything?

The answer is yes.

According to Vanguard plan provider), 51% of all plans provide just matching contributions and another 34% provide both matching and non-matching contributions.

In the latter scenario, the employer will contribute something on your behalf no matter what but you can increase that contribution if you direct some of your paycheck into the 401 plan to earn a match as well.

In total, 85% of 401 plans provide some form of matching contributions. Another 10% of plans provide just non-matching contributions.

What all this adds up to is that only 5% of 401 plans provide no form of employer contribution. If you are in one of those, you are in one of the least generous 401 plans around.

Also Check: Can You Move 401k To Ira While Still Working

What If I Have A Roth 401

If you have a Roth 401, you pay income taxes on your contributions now, rather than when you take that money out during your retirement. But your employer isnt likely to pay the taxes on matching contributions , so if you have a Roth, their matching contributions usually go into a separate, traditional 401. Youll pay the taxes on the traditional when you withdraw the money.

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Read Also: How To Start A 401k Without An Employer

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

The Average Employer 401 Match Is At An All

Many retirement professionals recommend that individuals put at least 15% of their annual income into retirement accounts. Employer match contributions reached an all-time high average of 4.7% in 2019, and that can be a powerful incentive for employees. Employers who want to encourage employee retention and good financial planning among their employees can use match programs to help their employees save and attract talented prospects to their company.

If you want to learn more about your 401, were here to help. Contact our team at Human Interest today to learn about our flexible management tools and how to help your employees save for their retirement.

If you want your company to start offering a 401 match program, you can also read our Employees Guide to Asking Your Manager or Boss for a 401 for Your Company. If you want to encourage them to offer a retirement savings plan, this article may give you a strong foundation to demand a re-evaluation of a matching contribution policy. After all, the better the workplace retirement plan, the more useful it is as a recruiting tool.

Recommended Reading: Where Does My 401k Go If I Quit My Job