When To Pay Off Debt Vs Invest

In general, the rule of thumb is that you should both pay debts and invest. Try to consistently contribute to three bucketsdebt payoff, retirement, and an emergency fundsaid Linda Davis Taylor, former CEO of Clifford Swan Investment Counselors in Pasadena, California, and host of the podcast Money Stories with LDT. Even if that means you can only contribute $10 or $20 per paycheck per month to retirement or savings in addition to debt payoff, it’s worth doing.

If you overcommit to investing and only make minimum debt payments, you could wind up paying too much in interest over time, he pointed out, which can hamper your ability to buy a home or start a family. If you neglect to invest entirely, however, you may fall short of your retirement goals.

Alternatives To Using Your 401 To Buy A House

Even if youre short on cash and facing hardship, there are other options you might want to consider before tapping into your 401 account to cover the down payment on a house.

IRA Account

If you have an IRA, you should look there for extra funds before considering an early withdrawal from your 401. IRAs are built with special provisions for first-time home buyers, which the IRS defines as anyone who hasnt owned a primary residence within the previous 2 years.

Under these provisions, first-time home buyers are allowed to withdraw up to $10,000 without incurring the 10% penalty. However, that $10,000 is still subject to state and federal income taxes. If your withdrawal exceeds $10,000, then the 10% penalty is applied to the additional distribution.

A Roth IRA is an even better option, if you have one. Some plans allow you to make a hardship withdrawal, and up to $10,000 can be withdrawn tax-free for the express purpose of a first-time home purchase.

FHA Loan

A Federal Housing Administration loan is a government-backed mortgage with looser requirements designed to make it easier for first-time home buyers to purchase a property. This includes low down-payment options and lower credit score requirements. For this reason, an FHA loan may be a better option than making a withdrawal from your 401.

- Size of your down payment

Paying Off Your Mortgage Early May Reduce Costs In Retirement But It Also Reduces Liquidity

Using extra income or savings to pay down a mortgage faster moves your most liquid asset into a very illiquid asset . In the most extreme examples, this is referred to as being house poor. Since being house poor is never a goal, youll want to consider your entire pool of resources before opting to accelerate mortgage payments.

On the flip side, not having a mortgage in retirement can be beneficial if it reduces overall lifestyle costs and how much youll need to draw from your portfolio in retirement. Depending on the situation, this may mean being able to retire earlier or a higher probability of not running out of money. Particularly in down markets, having relatively low fixed costs is important as you may be able to avoid forced selling to pay bills.

However, if the goal is to pay off a mortgage before retirement to spend would-be mortgage payments on other things during retirement, the math may not work out. For one, any savings from retiring home debt is a one-time savings . Adding new line items to a retirement budget in perpetuity, increasing by inflation each year, wont result in a net cost savings.

Aside from that, the money isnt there if you want to use it on something else in retirement, like a down payment on a snowbird condo or helping put your grandkids through college.

Don’t Miss: How To Find Out Whats In My 401k

Downsize Especially If Home Prices Are Rising

If you own your homeâor most of your homeâconsider scaling back on your house size and amenities, particularly if you are lucky enough to live in an area where housing prices have risen significantly.

Take that hard-earned equity and move into a smaller home thatâs cheaper to maintain, and hopefully has more predictable repair costs and property taxes into the future. You may also choose to take your money and use it to buy a house in an area with a lower cost of living, if family circumstances allow.

âThe problem is that a retiree may find it difficult to qualify for a mortgage. So, if there is equity in the house, that may well be the upper limit of a downsize,â Chen says.

Should You Use Your 401 Or Ira To Invest In Real Estate

Investing in real estate can be a great path to create wealth while diversifying a portfolio of stocks, bonds, and other securities. But if you’re thinking of using your 401 or IRA as the vehicle in which you make real estate investments, you need to consider what you gain and what you give up by doing so.

There are lots of ways to invest in real estate. Sometimes holding those investments in a retirement account works out great, but sometimes it’s a huge mistake.

Recommended Reading: How To Take Out 401k Money For House

Consider A Credit Card Balance Transfer

Transferring a credit card balance to a card with a lower rateâor a low intro rateâare two good ways to get out from under oppressive interest rates. But they come with one very large caveat: The tactic should really be a one-time tool.

Borrowing money to pay debts doesnât solve the underlying problem. Thatâs why the best answer for older people with oppressive levels of debt is oftenâ¦

Why You Shouldn’t Take Money Out Of Your 401k

There may be early withdrawal penalties Since you contribute pre-tax money to a traditional 401, you’ll owe income taxes on any withdrawn money. However, if you make an early withdrawal from your 401 — which is before the age of 59 ½ — you’ll likely be subjected to an additional 10% early distribution tax.

Don’t Miss: What To Ask 401k Advisor

Should I Use My 401 To Pay Off Credit Card Debt

Absolutely not, and heres why.

Become a personal finance expert

In this weekly column, well help you sort out financial gray areasfrom prenups to inheritances and more. Submit your money matter here.

Hey, Money Scoop! Im debating cashing out the $48,000 I have invested in my companys 401 to pay off my $30,000 credit card debt. The credit card payments are brutal, and I feel like Ill never pay them off making minimum payments, just to see half that payment disappear due to interest. Is this a good or bad idea?401 to Pay

Dear 401 to Pay,

Cashing out your 401 to pay off credit card debt is a bad idea. Were talking worse than Quibi levels of badness.

Why? Because as soon as you pull that money out of your retirement account, youre going to get hit with two large billsa tax bill and a 10% early withdrawal penalty. The IRS may automatically withdraw that money from your 401 account, or you may have to set it aside on your own either way, you need to be prepared to lose a good chunk of your 401 right off the top.

If you liquidate your 401 before youre fully vested in your companys retirement plan, you could lose even more moneynot to mention the money youre going to lose by selling your 401 investments during a bear market.

This is a lose-lose-lose-lose scenario.

Depending on your credit score, you may also want to look into a low-interest personal loan. Use the loan to pay off your credit card debt, then start paying down the loan at its lower interest rate.

Finding A Way To Do Both

Rules of thumb are guidelines, and there will always be exceptions. Take this one with a grain of salt if it doesn’t exactly fit your circumstances.

Virtually no investment can provide a reliable return of 18% or more that’s comparable to your high-interest credit card fees, points out the SEC. If you’re dealing with extremely high-interest debt, focus on that firstspecifically the highest-rate card or loan. Taylor said credit card balances are “the biggest risk to gaining long-term financial health.” Super-high-interest loans, such as payday loans, should take even higher priority for paydown in your budget.

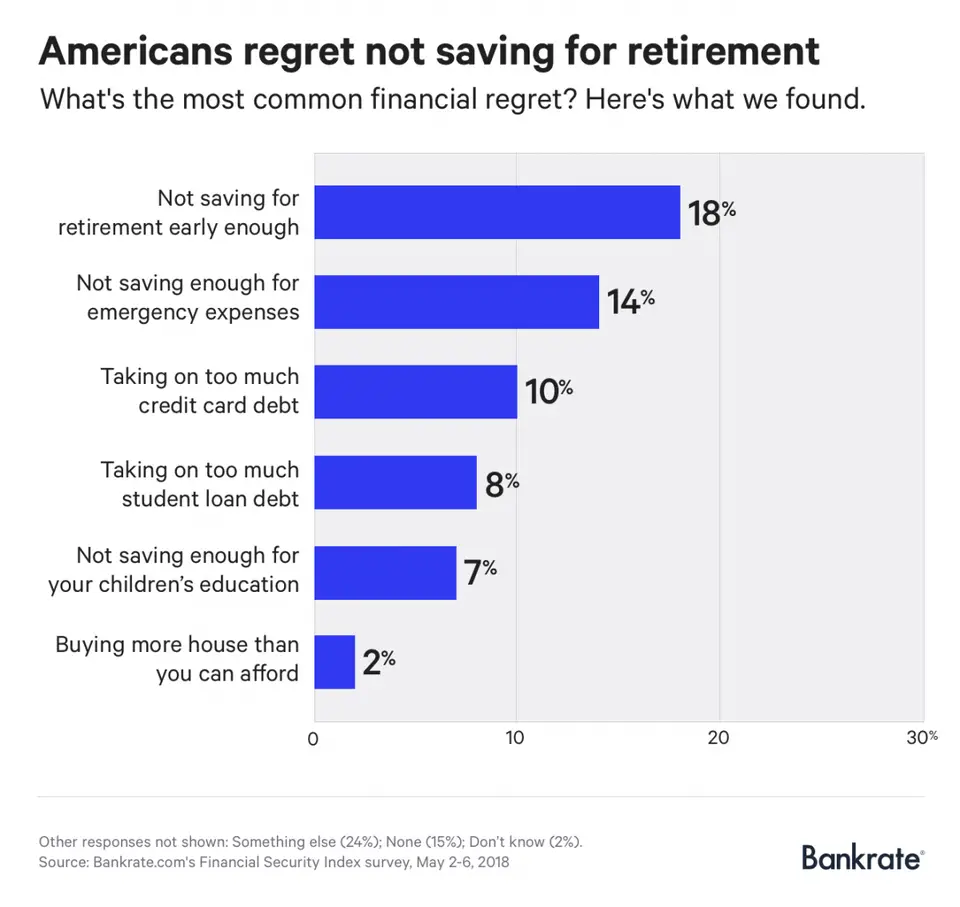

But the average person should always make monthly progress on both retirement and paying off debt, in Lynch’s opinion. “Too many people freeze up because they routinely use credit and feel they can’t afford to invest because their credit accounts aren’t paid in full,” he said, which leads to a “troublingly high” percentage of people who don’t save for enough for retirement.

“In truth, they can’t afford not to invest for their retirement. Consumers need to find a way to do both. There are no scholarships for retirees,” he said.

Also Check: How To Find Your Old 401k Account

People With Cosigners On Their Debts

Betts says, “If you’re single with no dependents, and you have a car loan of $20,000, the automobile company might repossess your car, but they won’t come after any other person in your family because nobody cosigned for you.” In contrast, cosigners are responsible for paying off unpaid debts after a person dies.

So if someone cosigned with you on a personal loan, for example, you’ll want to have a life insurance policy that covers the cost of that debt.

- Lemonade Life Insurance

Does Withdrawing From Your 401 Affect Your Credit Score

Borrowing from your 401 can put your retirement at risk, but it wont hurt your credit score.

Unlike applying for a credit card, no lender will do a credit check if you borrow from your retirement fund. And even if you miss payments or default on your loan, this information wont be submitted to credit-reporting agencies.

You May Like: Why Is Ira Better Than 401k

Should You Pay Off Your Car Or Invest

Whether you should pay off your car or invest depends on the loans interest rate and your overall financial situation. Paying off the loan early gives you full ownership of your vehicle, which can come in handy if you need to sell it quickly. If you have high-interest debt, you may want to pay that off before you pay off your car or invest. If your car loan has a high interest rate, it would make sense to pay it off before you invest.

Other Factors To Consider Before Prepaying Your Mortgage Before Retirement:

- Are you going to live in the house long enough to enjoy years of living mortgage-free?

- If you cant pay off your mortgage, there may be little reason to pay it down Unless you have a variable-rate loan, making extra mortgage payments wont change your monthly payment.

- As the chart earlier illustrates, rates have recently, and sharply, gone up. But theres little reason to think mortgage rates will stay at current levels for the long run. So for borrowers with higher rates, future opportunities to refinance may cast doubts on whether free cash flow should go to paying down a mortgage today.

- Homeowners on the last legs of a mortgage may see a small and declining principal balance and be tempted to wipe it out before retiring. Before making that final transfer, recall how loan amortization works. When a new loan is issued, the interest component of the fixed payment is far greater than the amount going towards loan principal. But by the end of the loan term, this relationship reverses, and debt service costs are only a fraction of the payment.

Emotional reasons usually drive the decision to prepay a mortgage. Peace of mind may help you sleep at night , but it wont fund a decades-long retirement. So before using extra cash or an unexpected windfall to pay off your mortgage ahead of schedule, consider the value of future flexibility. After all, goals often change over time.

Read Also: Where To Invest 401k Now

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason that they deem necessary. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Two Great Ways To Invest In Real Estate In Your Retirement Accounts

That said, there are a couple of ways to get exposure to the real estate market that are more suitable for retirement accounts. That’s because they don’t come with the tax benefits of directly buying physical real estate and renting it out.

If you’re looking for exposure to individual real estate investments, you could write private notes from your self-directed IRA or 401 for other investors. For example, someone investing in a rehab project may not be able to get a traditional mortgage for their fixer-upper. You may be able to generate very good returns by offering to lend some of the money in your retirement account to investors you know and trust.

The advantage of doing this in an IRA or 401 is that you can defer the income tax on the interest collected on those notes. Unlike investing in a property directly, there aren’t any ways to offset the earnings.

Likewise, you can invest in REITs in a 401 or IRA. A REIT is required to pay out 90% of its taxable income as a dividend to shareholders. Those profits are passed through to shareholders, so they don’t typically get the lower qualified dividend tax rate investors have to pay their regular income tax rate on them. Holding a REIT in a retirement account allows you to defer the taxes, save more of your money to invest in the near term, and control your tax rate in retirement.

SPONSORED:

The $18,984 Social Security bonus most retirees completely overlook

The Motley Fool has a disclosure policy.

Don’t Miss: Can I Take A Loan Out Of My 401k

What About Reverse Mortgages

A reverse mortgage, or “home equity conversion mortgage” , is a type of home equity loan for people 62 and older that converts a portion of home equity into cash. The lender makes payments to the homeowner, who maintains ownership of the home throughout his or her life. However, there are nuances to reverse mortgages, and the terms and conditions should be considered carefully since they affect your beneficiaries. In addition, because lenders require that you live in the home as your primary residence, youll need to repay the loan if you want or need to move.

Should You Cash Out 401k To Pay Off House

Utilizing 401 funds to pay off a mortgage early results in less total interest paid to the lender over time. However, this advantage is strongest if you’re barely into your mortgage term. If you’re instead deep into paying the mortgage off, you’ve likely already paid the bulk of the interest you owe.

Also Check: What Employees Can Be Excluded From A 401k Plan

What Are The Rules For 401 Withdrawal

Tax-deferred retirement accounts, such as 401 plans and 403 plans, were designed to encourage workers to save for retirement. So the rules arent super friendly when it comes to withdrawals before age 59 ½.

Depending on your financial situation, however, you may be able to request what the IRS calls a hardship distribution. Employer retirement plans arent required to provide hardship distribution options to employees, but many do. Check with your HR department or plan administrator for details on what your plan allows.

According to the IRS, to qualify as a hardship, a 401 distribution must be made because of an immediate and heavy financial need, and the amount must be only what is necessary to satisfy this financial need. Expenses the IRS will automatically accept include:

Certain medical costs.

Costs related to buying a principal residence.

Tuition and related educational fees and expenses.

Payments necessary to avoid eviction or foreclosure.

Burial or funeral expenses.

Certain expenses to repair casualty losses to a principal residence .

You still may not qualify for a hardship withdrawal, however, if you have other assets to draw on or insurance that could cover your needs. And your employer may require documentation to back up your request.

Recommended: How Does a 401 Hardship Withdrawal Work?

How To Pay Off Your Mortgage Early Without Touching Your 401

If youre thinking of using your 401 to pay off a mortgage, youre probably looking for an instant hit: this month a mortgage, next month debt-free.

Thats understandable. But with a little strategy and patience, you could free yourself from your mortgage several years early without taking money from your golden years.

Here are five ideas:

Also Check: Can I Roll My 401k Into An Ira