Keep Your Documents In Good Order

The auditor is going to be asking for A LOT of documents first during the Plan Document & Design Review, but then also during the 401 Deposit Review and Participant-Level Sampling. Having all your 401 documents thats everything from plan documents to timestamped communications to payroll data well-organized in one place can save you A TON of time.

Heres an example of how we do it at ForUsAll using our Fiduciary Vault:

Dont Miss: What Is The Tax Rate On 401k Withdrawals

What Does The Audit Entail

401 plan audits are different from a traditional financial statement audit that you may have experienced because the audit of the plan isnt solely focused on financial reporting, but also on compliance and adherence to DOL and IRS regulations. Your auditor will assess the plans compliance with plan documents as well as DOL and IRS regulations. Making sure that you have a knowledgeable and qualified employee running the plan will help to ensure operational compliance of the plan. Your auditor will check the plans compliance from a number of perspectives including eligibility of participants, automatic enrollment, vesting eligibility, ineligible participants, etc. A good way to get ahead of any operational issues is to speak with your third party administrator and to request the most recent plan documents. Familiarity with plan documents will help the plan to not only operate within the prescribed guidelines, but will help you to manage the plan more effectively and ultimately reduce the auditors time spent on the engagement, saving you money.

When Must A 401k Plan Be Audited

401 audits can be stressful for employers. Even hearing the word audit can be enough to induce panic. The truth is that 401 audits are a normal part of doing business and therefore, not as scary as they sound.

According to IRS rules, a 401 plan must be audited if it meets certain requirements as laid out by the Employee Retirement Income Security Act . There are three questions to ask to determine if your company plan requires an audit.

Read Also: What Age Can I Draw From My 401k

Who Is Eligible For An Annual 401 Plan Audit

A 401 audit assesses whether a plan is compliant with the Department of Labor , the Internal Revenue Service , and plan-related documents and whether the Form 5500 financial information is reported accurately per plan financial statements and disclosures. The Employee Retirement Income Security Act of 1974 requires that certain benefit plans be audited based on the number of eligible participants in the plan. as such, a plan requires auditing by a third party when it meets either of the following conditions:

- More than 100 eligible participants on the first day of the plan year

- 120 eligible participants if the plan has not previously been audited, and 100 every year thereafter

Eligible participants are defined as any employees that meet eligibility requirements, even if they choose not to participate. This also includes any terminated or retired employees with balances in the plan on the first day of the plan year and any deceased employees with beneficiaries who either receive or are eligible to receive benefits.

Employee Participation Standards Must Be Met

In general, an employee must be allowed to participate in a qualified retirement plan if he or she meets both of the following requirements:

- Has reached age 21

- Has at least 1 year of service

- plan may require 2 years of service for eligibility to receive an employer contribution if the plan provides that after not more than 2 years of service the participant is 100% vested in all plan account balances. However, the plan must allow the employee to participate by making elective deferral contributions after no more than 1 year of service.)

A plan cannot exclude an employee because he or she has reached a specified age.

Leased employee. A leased employee is treated as an employee of the employer for whom the leased employee is providing services for certain plan qualification rules. These rules apply to:

- Nondiscrimination requirements related to plan coverage, contributions, and benefits.

- Minimum age and service requirements.

- Vesting requirements.

- Limits on contributions and benefits.

- Top-heavy plan requirements.

Certain contributions or benefits provided by the leasing organization for services performed for the employer are treated as provided by the employer.

You May Like: How To Get Money From 401k Fidelity

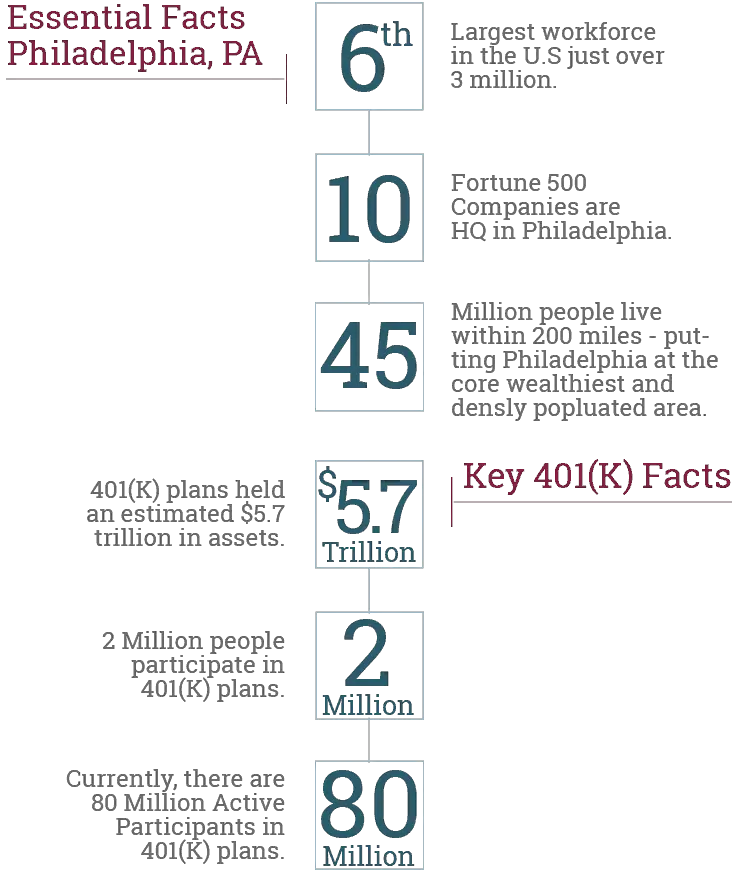

Everything You Need To Know About 401k Audit Requirements

This post was originally published January 19, 2016 and extensively updated May 7, 2020.

In the world of employee benefits, 401 plans are considered the gold standard of retirement savings plans. They are easy for employers to manage and they allow employees the freedom to allocate their assets to the investments that they choose. Most employees, even those with little investment experience, are familiar with 401 plans.

At Cook Martin Poulson, we work with many of our clients to set up and manage retirement plans. One of the most common questions we get is this:

We expect to get asked about audits, and we understand that the requirements for 401k plan audits can be difficult for employers to understand. Here is everything you need to know.

Difficulty Moving Up The Career Ladder

While seniors are putting off their retirement plans, the next generation may find it difficult to climb the career ladder. Moving up to the middle and higher position can be difficult if there are no vacant positions. Various surveys show that most employees view career growth opportunities as one of the top factors in employment.

As a result, most younger workers are switching jobs hoping to seek higher positions and increased pay. Ultimately, retaining competent employees is increasingly difficult for companies, which may sometimes harm the business.

With the younger workers switching to seek higher positions and seniors not ready to quit, the next generation is trapped in the middle, without many scopes for promotions or increments.

Don’t Miss: Can I Take My 401k If I Leave My Job

How Do You Prepare For An Audit

The simplest way to prepare for an audit is to keep track of plan-related documents throughout the year. In addition, audit document requirements include the most recent Form 5500 as well as W-2s, loan requests, loan repayments, distributions, and other information related to your employees and their 401 activity.For smaller companies experiencing steady growth, its important to monitor the number of eligible participants you have in your plan. Planning will prevent any surprises and give you a head start in tracking the necessary documents leading up to your first audit.Regardless of the size of your plan, be sure to consult your 401 provider for assistance in gathering the necessary information for your plan auditor. They can also work directly with your auditor to reduce the amount of time youre involved in the project. According to the Chief Executive Officer of ERISA Consultants, Richard Phillips, its important to thoroughly research your service provider beforehand to ensure a seamless audit.Vet your service provider. Make sure youve done your due diligence so that you know you have good support from them and know they can provide the documents and records that are needed to make it a smooth audit process, Phillips states.

Plan Document & Design Review

What the auditor does in step 1: The auditor here is trying to get a birds eye view of your 401 operation. During this step, theyre looking for

- The plan design and rules that have to be followed

- An understanding of the 401 operation and the controls that are in place to ensure its run correctly

- The definition of compensation thats eligible for 401 contributions contributions might only be based on W-2 compensation).

- Financial data on contributions, loans, rollovers, or other transactions made during the plan year

What the plan administrator does in step 1: Assembles the initial documents needed for the audit into an Audit Packet. This giant folder goes to the auditor.

Heres a quick checklist of what 401 auditors usually ask for:

Plan Documents

- Compliance Testing Package

- Rollover Report

- Distribution Report

Here’s a tip from from one of our 401 auditor partners on how to make this step go smoothly:

“Absent major changes in the plan, the list of documents auditors need is often similar year-to-year. So always be sure note where the documents came from. Or, even better, keep your documents well-organized in one easy-to-reach place so you dont have to spend time digging through filing cabinets or chasing down documents from other departments.” -Kristine Boerboom, Senior Manager, Wegner CPAs

Once youve handled all the auditors initial requests, the bulk of the work begins in step 2.

You May Like: Where To Move Your 401k Money

Our Team Has Over 25 Years Experience In Auditing 401k Plans Our Combined Knowledge And Experience Means You Wont Need To Re

For over 30 years, Maria has served clients in a variety of areas including financial statement audits, reviews and compilations as well as business and individual taxation. Maria excels working with clients in the real estate, and healthcare industries, along with employee benefit plans.

As an expert in the real estate industry Maria brings tax strategies such as Cost Segregation, 1031 exchanges, debt restructuring, capital financing and cash flow projections to the table. Maria manages LSLs Cost Segregation department and is responsible for the implementation and completion of all Cost Segregation studies. Maria is involved with Commercial Real Estate Women of Orange County , one of the leading commercial real estate organizations for executive women in Orange County.

Great Clients for Mariavalue a partner in their business to help guide them to greater success.LSL candidate tip Ask her about her kids and traveling and her big fat Cuban Family.Personal Her son, Kyle, was married in August 2018.

Dont Miss: Can You Convert A Roth 401k To A Roth Ira

How To Set Up A 401k Plan For Your Business

Setting up a 401k plan for your employees is relatively easy. And if you work with retirement plan experts like CMP, youll have a plan ready to share with your employees in no time.

There are a lot of choices out there when it comes to retirement plans such as the following:

- profit sharing plans

- cash balance plans

- multiple employer plans and more

Working with retirement plan experts can help you understand the pros and cons of each and determine what is right for your organization.

Recommended Reading: How To Convert Your 401k To A Roth Ira

When Do You Need A 401 Audit

Your business is required to file Form 5500 by the end of the fiscal year. There are two versions of Form 5500. The long version is intended for large benefit plans, and the short version is intended for small plans. The correct form for your company depends on the number of employees you have who are eligible for the retirement plan.

Your 401 audit requirements also vary depending on the number of eligible participants. If your business has 100 or more eligible participants at the beginning of the plan year, you must undergo a 401 audit through a third party. The keyword in this situation is eligible, so even if some of your employees choose not to participate, they still count toward the audit requirement. With most businesses, employees are eligible for the 401 plan if they are age 21 or older and have at least one year of employment with the company. Your plan criteria may differ, though, so you should look into your plans specifics to determine how many eligible participants you have.

The number of eligible participants includes active employees and retired or separated employees who currently receive or can receive 401 benefits. It also includes deceased employees with beneficiaries who receive or are eligible to receive benefits.

Look For Volunteering Or Part

While more and more seniors wish to continue working for the love of what they do, some seniors have a different reason. They choose to continue working because they want to stay engaged. With an increased life span and good health conditions, people view 20 years as too long for hobbies or to sit around doing nothing. Hence they prefer to stick to their current job for as long as possible.

Instead, it is an excellent time to volunteer for a cause or take up some part-time jobs that can allow free time while also keeping busy for some time with work.

Recommended Reading: What Is A Traditional Ira Vs 401k

Has The 401 Auditor Worked On Similar Plans

Technically, any qualified independent accountant can do your 401 audit. But of course, not all 401 auditors are created equal. Youll want to ask: how many 401 audits do they do each year? Are 401 audits a side project for them, or are they a main focus of the firm? An experienced 401 auditor will likely have detailed processes in place to ensure that everything is done correctly, which greatly reduces the risk that something slips through the cracks.

Plan Audit Requirements: Complete Guide To Staying Compliant

When your business reaches a threshold number of participants who are eligible to participate in your 401 plan, your organization will be required by national law to conduct an independent audit of your retirement plan. Big corporations may have been doing this for years, but for growing firms facing their first 401 audits, the transition can be a bit rough. Your business has grown, and thats great news. But as with anything in life, you may have been met with a few growing pains. DHJJs tax, audit, and accounting experts are here to help. Read on to learn more about 401 plan audit requirements from DHJJ.

Recommended Reading: How To Pull Money From 401k

Audited Financial Statement Example

We love examples, but no, we arent going to burden you with an entire stack of audited benefit plan documents. But its still helpful to see whats happening with the actual paperwork.

Here are a couple of the most important pages from the essential documents youll receive at the end of the audit:

What Are The Common Governance Responsibilities

As a plan sponsor, you should keep an updated Fiduciary File documents which includes current copies of plan documents and disclosures. These include:

- Adoption Agreement, Basic Plan Document , and Plan Sponsor Fee Disclosure notice)

- Vendor and Advisory Service Agreements

- Participant Disclosures and Notices

- Retirement Committee Meeting minutes and material

- Documentation on any plan corrections

- Annual testing, audited plan financials, and Form 5500

- Any IRS or DOL communications

You May Like: Can I Transfer Part Of My 401k To An Ira

Audits: Answers To Frequently Asked Questions

When a business reaches a certain number of eligible participants for their 401 plan, federal law requires an independent audit of that retirement plan. Larger companies are more accustomed to this annual requirement. However, owners and managers of growing businesses may never have experienced a 401 audit or don’t know enough about it.

You probably have a lot of questions if youre about to undergo an audit for the first time. At what point is an employer required to complete a 401 audit? What is an “eligible participant,” and why is this important? Who performs the audit, and what documents do they need?A little homework will help you determine whether or not a 401 audit is required. Plus, itll help you better prepare for one.

What Is A 401 Audit

A 401 audit is a review of your companys 401 plan by a third-party accounting firm to ensure that the plan is within the guidelines and regulations set by both the IRS and the Department of Labor. During the audit, the accountant will identify any errors in the plan, which provides an opportunity for you to correct the issues right away.

Not only is a 401 audit necessary to comply with the governments regulations, but it also helps you offer a successful and effective retirement plan to your employees. Not all businesses need to undergo an annual 401 audit, though. The requirements for auditing are set by the Employee Retirement Income Security Act .

You May Like: What To Invest My 401k In

Large Plan Audit Due Date

The financial statement you receive at the end of your 401 audit should be submitted together with Form 5500, 7 months after the end of your plan year. For those of us using the calendar year, thats July 31st.

Now, fortunately, because the plan audit is submitted alongside Form 5500, the two share an extension option. Which leads us toâ¦

What Is The Goal Of A Plan Audit

Plan sponsors fulfill their fiduciary responsibility of compliance when meeting the audit requirements of their retirement plan.

An audit may also provide insight as to the plan sponsors control environment of the plan processes or lack thereof may uncover operational errors or identify prohibited transactions. These occurrences should result in plan remediation and corrections providing the plan sponsor with success in administration and management of the plan.

Auditors consider several questions in their analysis, including:

- Do all eligible employees have the same opportunity to participate?

- Are assets of the plan fairly valued?

- Have contributions to the plan been made in a timely manner?

- Are accounts of the participants fairly stated?

- Were benefit payments made according to the terms of the plan?

- Were there any issues identified that may impact the plans tax status?

- Have there been any transactions made that are prohibited under ERISA?

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

New Financial Audit Rule Increases Requirements For Plan Sponsors

Reported by

Retirement plan sponsors that are required to submit a financial audit with their Form 5500 filings next year will find they have more responsibilities related to the audit.

In July 2019, the American Institute of Certified Public Accountants issued a new audit standard for employee benefit plans, SAS 136, or Statement on Auditing Standards No. 136, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA . SAS 136 was originally effective for periods ending on or after December 15, 2020 however, due to the COVID-19 pandemic, the effective date was delayed to this coming December 15.

Timothy Verrall, a shareholder in law firm Ogletree Deakins Houston office, notes that the effort to enhance audit requirements has been in the works for years. The 2010 ERISA Advisory Council studied employee benefit plan auditing and financial reporting models and found that many deficiencies in limited-scope audits of retirement plans might be due to misunderstandings. In a 2011 report, the council concluded that the limited-scope audit should not be repealed, but its quality and required certifications should be reinforced and strengthened.

The agency found some were deficient based on audit standards and some were deficient by ERISA standards, Verrall says. Audit quality was all over the place. Information was not getting assessed correctly, and noncompliance was not getting surfaced.