Talk With An Investment Pro About Your Roth 401

If you want to learn more about Roth 401s versus traditional 401s and other investment options, its a good idea to sit down with an investment professional who can help. Remember, its never a good idea to invest in something you dont fully understand.

If you need help looking for a qualified investment pro, be sure to try our SmartVestor program. SmartVestor is a free way to get connected with local financial advisors near you.

You can start building a relationship with a pro who understands and can help guide your financial journey today!

How Would Early Withdrawals From Retirement Accounts Be Impacted By The New Law

The SECURE 2.0 Act of 2022 includes several rule changes that would benefit Americans who need to withdraw money early from their retirement accounts. Normally, withdrawals from retirement accounts made before the owner of the account reaches 59 and a half years old are subject to a 10% penalty tax.

First, Congress plans to add a basic exception for emergencies. Account holders who are younger than 59 and a half could withdraw up to $1,000 per year for emergencies, and have three years to repay the distribution if they want. No further emergency withdrawals could be made within that three-year period unless repayment occurs.

The bill also specifies that employees would be allowed to self-certify their emergencies, that is, no documentation is required beyond personal testimony. The bill would also eliminate the penalty completely for people who are terminally ill.

Americans impacted by natural disasters would also get some relief with the proposed changes. The proposed new rules would allow up to $22,000 to be distributed from employer plans or IRAs in the case of a federally declared disaster. The withdrawals wouldn’t be penalized and would be treated as gross income over three years. If the bill passes, the rule would apply to all Americans affected by natural disasters after Jan. 26, 2021.

Convert The Traditional Ira Funds Into A Roth Ira

Once you have money in your traditional IRA, you have to convert those funds into a Roth IRA. There are three ways to get that done:

- Same-trustee transfer: Are your IRAs with the same financial institution? Fantastic! All you have to do is tell your financial institution to transfer the money from your traditional IRA into the Roth account.

- Trustee-to-trustee transfer: If you have your traditional and Roth IRAs at different financial institutions , you can have the institution that holds your traditional IRA transfer the money to the Roth at the other institution.

- Rollover: In this scenario, youll get a check from your IRA provider and you will have to deposit that money into a Roth account within 60 days. Doing a backdoor Roth this way is riskier, because if you forget to deposit that money for whatever reason, youll have to pay a withdrawal penalty on top of the taxes you owe. Thats why we made this number three on the list!

Again, if you have a bunch of money already inside a traditional IRA and want to convert all of it to a Roth, you can. While there are limits to how much new money you can contribute in an IRA each year, there are no restrictions on how much you can convert from an existing investment account to a Roth IRA.

But as we mentioned beforekeep in mind, you have to pay taxes on all the money you convert into your Roth account. Which brings us to . . .

Don’t Miss: What Happens To 401k When You Leave A Company

Rules For Early Withdrawals

Withdrawals from both Roth 401s and Roth IRAs are tax-free if they meet certain criteria:

- The accounts must be held for at least five years.

- The account holder reaches age 59½, or distributions are made in the event of disability or death.

With a Roth IRA, you can always take out the money you contributed without tax repercussions. But with a Roth 401, if you want to withdraw money early, you may end up paying a 10 percent penalty tax on any earnings taken out, but not on your contribution amounts. Otherwise, to access your 401 funds without tax, you generally would have to take out a loan with the Roth 401, if the plan permits.

With a Roth IRA, you can withdraw up to $10,000 to buy, build or rebuild a first home and avoid paying taxes and the 10 percent early withdrawal penalty even if you are under age 59½. You can also take out money for qualified educational expenses while avoiding taxes and penalties.

How Does An Employer Match A 401 Plan

An employer might match 100% of an employees contributions, up to 5% of their income. If that person earns $50,000 per year and contributes $2,500 to their Roth 401, their employer will match that contribution, adding an additional $2,500. These matching contributions help employees contribute even more to their Roth 401s.

Also Check: How Do I Know What 401k I Have

Can I Take A Loan From My Roth Ira

Technically, no. There is no provision for borrowing against your Roth individual retirement account , only for taking qualified or non-qualified distributions. However, if you initiate a Roth IRA rollover, you have 60 days to use that money at 0% interest before depositing it in your new accountessentially, a short-term loan.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Transfer Voya 401k To Fidelity

What About A Traditional Ira

The 401 and Roth IRA are two of the most popular choices available for retirement savings, but wed be remiss if we didnt also mention the traditional IRA.

This account combines some benefits of a 401 with a Roth IRA. Traditional IRA contributions are pre-tax, meaning they allow you to reduce your tax burden in the current year and defer the taxes until retirement. And like a Roth IRA, a traditional IRA offers a wider selection of investments than a 401.

Of course, a traditional IRA also has the downsides of a Roth IRA. Theres a low contribution limit of $6,000. Additionally, while anyone can contribute to a traditional IRA, not everyone can deduct their contributions. If you are eligible for an employer-sponsored retirement plan or your spouse is then youre subject to income limitations on your traditional IRA deduction.

Traditional IRAs can be deductible or non-deductible, so I would also caution you to check to see if you are even eligible to deduct your IRA contribution, Elise said.

So who is a traditional IRA right for? First, a traditional IRA is a great option for anyone who doesnt have access to a retirement plan through work, since you wont be subject to the income limits on your contribution deductions.

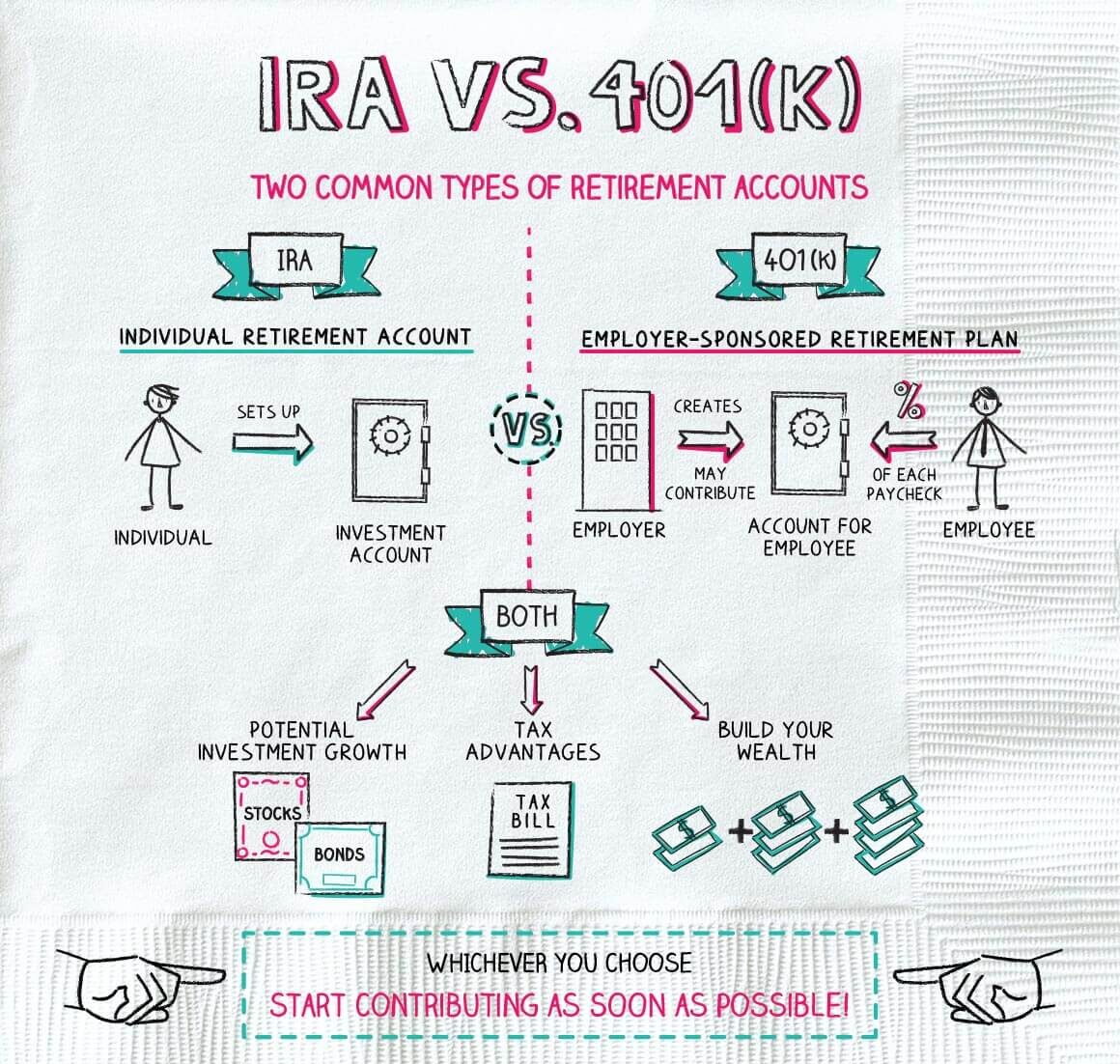

What Are Traditional And Roth Iras

Traditional and Roth IRAs are retirement accounts that individuals can set up and manage by themselves. IRAs are easy and inexpensive to set up and can be established through brokerage firms, mutual fund companies, and banks.

Contributions to a traditional IRA are generally tax-deductible, while contributions to a Roth IRA are not. But the money in a traditional IRA will be taxable when you ultimately withdraw it, while the Roth IRA contributions will not be taxed upon withdrawal.

Roth IRAs are thus similar to Roth 401 plans in terms of taxation. The main differences are that 401 plans allow larger annual contributions but will restrict your investment choices to whatever your plan sponsor allows.

You May Like: How To Cash Out My 401k Early

How Many Roth Conversions Per Year Does The Irs Allow

The IRS does not put a cap on the number of Roth conversions per year you can make. You could convert all of your savings to a Roth IRA in one go or spread them out over several conversions throughout the year.

You can also complete Roth IRA conversions in multiple years, which could make sense in certain situations. Converting a large amount of money all at once could trigger a sizable tax bill if youre pushed into a higher tax bracket. Completing multiple conversions over a period of several years could help ease the associated tax burden.

There are no dollar amount limits on how much you can convert to a Roth IRA. The IRS does, however, impose limits on contributions to Roth IRAs. The annual limit is $6,000 for 2022 and $6,500 for 2023. Theres an additional $1,000 catch-up contribution allowed for savers aged 50 and older.

Is A Roth 401k Worth It

Taxes are a key factor when choosing a Roth 401 over a traditional 401. If youre young and currently in a low tax bracket, but expect to be in a higher tax bracket when you retire, then a Roth 401 may be a better deal than a traditional 401.

What are the disadvantages of a Roth 401k?

3 Cons of Saving for Retirement in a Roth 401

- Tax bracket risk. When you put money into a Roth account or an IRA), youre gambling namely, that your tax bracket will be higher than it is now.

- RMDs remain in play.

- Fewer investment choices.

Is it smart to have a 401k and a Roth?

Contributing to both a 401 and a Roth IRA allows you to grow your retirement savings and take advantage of tax benefits. With a 401 account, youll be contributing tax-free money. Your employer can also match contributions up to a certain percentage of your annual income.

Read Also: How Can I Find Old 401k Accounts

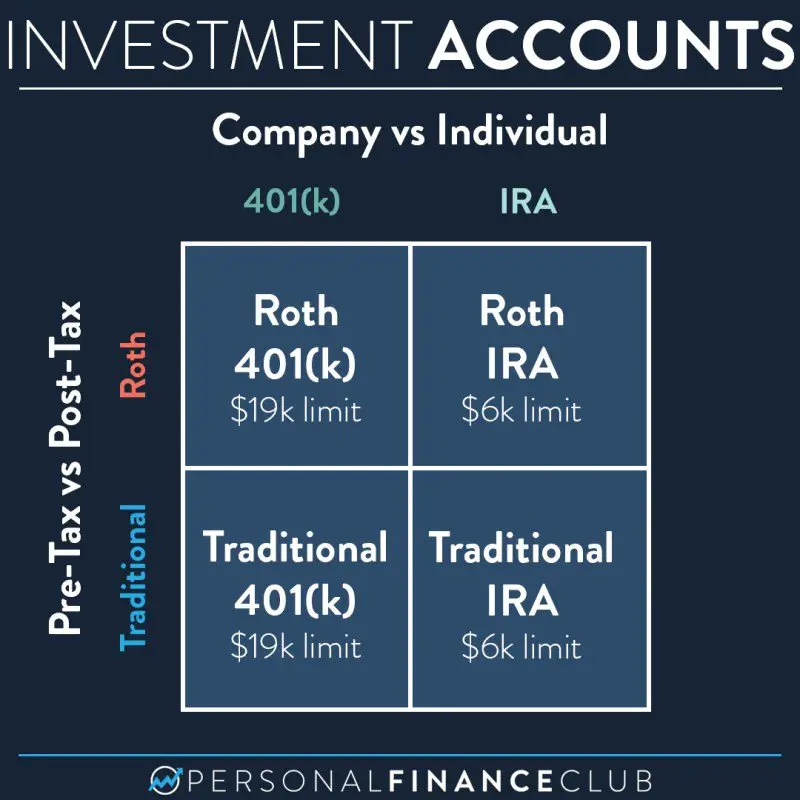

Roth 401 And Roth Ira Contribution Limits 2023

For 2023, a Roth IRA has a maximum yearly contribution limit of $6,500 with an additional $1,000 catch-up contribution if youre over age 50.

The Roth 401 contribution limit is $22,500 with an additional $7,500 catch-up contribution if youre over age 50. This is an obvious and huge benefit to a Roth 401. Prior to 2001, Roth 401s did not exist. The maximum amount anyone could put into a Roth account was the yearly maximum for Roth IRAs.

How Much Does The Average 45 Year Old Have In 401k

Here are the reported numbers: Average 401 balance ages 35â44: $86,582 $32,664 Average 401 balance ages 45â54: $161,079 $56,722

How much does the average 40 year old have in their 401k?

How much do 40-year-olds actually have in retirement savings? The average 401 balance for Americans ages 40 to 49 was $120,800 as of the fourth quarter of 2020, according to data from retirement platform Fidelity. Americans in this age group contribute an average of 8.9% of their wages.

You May Like: How To Allocate My 401k

Q: Are There Income Limits To Make A Roth Ira Contribution

A: Yes, there are income limits for Roth IRA contributions.

With a traditional IRA, you can still make an IRA contribution, even if you exceed the income limits . But with a Roth IRA, you are not permitted to make a contribution at all once you exceed the income limit .

You May Like: How To Get My Walmart 401k

Claim Solo 401k Contributions On Your Tax Return For An S

Is your business a corporation? If so, business income and contributions do not pass directly to your personal income tax return. There is a different tax reporting process that requires different tax forms.

Most, but not all, corporations are separate business entities. Therefore, they do not allow earned income to pass directly through to your personal income tax return. An important exception is S-corporations. For an S-corp, business income passes through to owners/shareholders. Youll then report that income to the IRS as taxable. However, S-corporations do have other tax obligations as a corporate entity. This requires the S-corporation to file a tax return separate from the business owners.

The S-corporation files with the IRS using Form 1120-S. List the business portion of the Solo 401k contribution on line 17 . Additional supporting IRS forms are generally required for S-corporations. Some of these are Form 5500, or Form 5500-SF.

You May Like: Where Is My Fidelity 401k Account Number

Don’t Miss: Do I Need Life Insurance If I Have A 401k

Can I Borrow From My 401

This depends on your employer, but in most cases, you can borrow from a traditional or Roth 401. You cant borrow more than the lesser of $50,000 or 50 percent of your balance, and you must repay the loan within five years. The loan can be longer if its for the down payment on a home. You will owe interest on the loan .

The drawback: If you cant repay the loan, its considered an early withdrawal taxes and penalties will apply.

What Is The Downside Of A Roth 401k

The biggest downside to a Roth 401 for many people is that you pay taxes on the contributions. For some people, the tax-free payout and earnings can more than make up for it, but for others it may not be worth it.

What are the pros and cons of a Roth 401k?

Pros and Cons of a Roth 401

- Special situations allow early distribution without penalty.

- There is no income limit.

- Contributions are not tax deductible.

- Minimum distributions required.

Why you shouldnt use a Roth 401k?

The biggest reason not to fund a Roth 401 is if your tax rate will be lower when you withdraw money from the account in retirement. If so, youre better off putting the money in a tax-deferred account. But if youre really rich, youll still have the highest rate for life.

You May Like: Does 401k Count As Income

So Which Is Better: A Roth Or A Traditional 401

Traditional IRAs make it easier for you to save, because youre contributing pre-tax income. If your biggest interest is saving as much money as possible, the benefits of tax-free earnings in a traditional 401 are hard to beat.

If youre a great saver, a Roth 401 might be better for you. Although youll pay taxes on your contributions, they will come out tax-free, provided you follow the rules for withdrawals at retirement. Its nice to look at your 401 balance and not have to worry about how much goes to taxes and when you have to send your checks.

More on Money

Roth 401 Vs Roth Ira: Rmds

We cannot talk about Roth IRA vs Roth 401 without emphasizing the required minimum distributions.

RMDs are withdrawals required for some retirement plans when you turn the age of 72. Failure to take RMDs may result in a 50% penalty on the amount that was not distributed.

The Roth IRA does not have RMDs as long as the account belongs to the original owner. However, beneficiaries are required to take RMDs after the original owner dies and the account must be distributed within 10 years. The internal revenue service has exceptions to this rule.

For example, when the beneficiary is a surviving spouse or a minor child, RMDs will not be required.

You May Like: How Can I Access My 401k Money

Consider Your Current And Future Tax Rates

The main thing youll want to consider when choosing between Roth and Traditional accounts is whether your tax rate will be higher or lower during retirement than your marginal rate is now, says Young. If you think your tax rate will be higher, paying taxes now with Roth contributions makes sense. If your tax rate is likely to be lower in retirement, you can use Traditional contributions to defer taxes instead. Federal tax rates are scheduled to revert to pre-2018 levels after 2025, which may make Roth contributions more attractive today. In addition, investors who expect to leave a legacy may want to consider the tax impact on their beneficiaries.

Of course, tax rates are hard to predict due to changes in the law as well as uncertainty around your future income levels.

| Contributes 6% to 401 to get full company match. Pretax savings provide $216/year more net pay. | Traditional |

*Brackets are for federal taxes, based on rates as of January 1, 2023. While rates are scheduled to revert to pre-2018 levels after 2025, those rates are not shown in this table. Income refers to gross earnings the current bracket reflects the standard deduction and potential retirement contributions. State taxes are not considered in the examples. Married status reflects joint filing.

What Can Your Budget Accommodate

If you were to contribute the same amount to your 401 via Traditional or Roth, your take-home pay would be higher if you opted for Traditional. Depending on your expenses and financial plans, that might be more important for you.

If you are not as reliant on that money today, and prefer that your retirement savings be out of sight, out of mind, Roth contributions are a way to save a bit more for tomorrow . Your contributions and earnings on interest will grow tax-free and you wont be tempted to spend that money youve earmarked for retirement in your checking account. Moreover, when you make a qualified withdrawal from a Roth account, you wont owe any taxes. Think of it like a gift to future you.

In contrast, when you withdraw from a Traditional account when you retire, you will owe taxes on everything you withdraw â theres no delineation between your contributions and your earnings.

Recommended Reading: How To Invest In A 401k For Dummies

Also Check: What Does A 401k Do