Look For Contact Information

If you dont know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you dont have an old 401 statement handy or yours doesnt tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement accounts tax return, known as Form 5500. That will most likely have contact information for your 401s plan administrator.

Why Do Uncashed Distribution Checks Occur

Uncashed distribution checks are a growing problem for plan sponsors, as the numbers of small-balance accounts and separated participants grow.

Uncashed, or stale-dated checks typically occur under the following circumstances:

- Mandatory Distributions, less than $1,000: When plans cash out participants with balances of less than $1,000, its common for these checks to go uncashed.

- Uncashed Plan Distributions: Participants request distributions at their normal retirement age, or required minimum distributions at age 70-1/2 yet they never cash their checks.

- Returned Checks: Checks of any amount that are returned as undeliverable by the U.S. Postal Service

- Unresponsive Participants: Checks of any amount that are requested, but simply not acted upon by the participant

These problems can persist, as plan sponsors will often have incorrect address information, and neither alternate payees or beneficiaries can be found.

Recommended Reading: Who Can I Talk To About My 401k

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Its due to an immediate and heavy financial need.

- Its limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

You May Like: How Can I Pull Money Out Of My 401k

What Are The Disadvantages Of Borrowing Money From Your 401

- If you dont repay your plan loan when required, it will generally be treated as a taxable distribution.

- If you leave your employers service and still have an outstanding balance on a plan loan, youll usually be required to repay the loan in full within 60 days. Otherwise, the outstanding balance will be treated as a taxable distribution, and youll owe a 10 percent penalty tax in addition to regular income taxes if youre under age 59½.

- Loan interest is generally not tax deductible .

- In most cases, the amount you borrow is removed from your 401 plan account, and your loan payments are credited back to your account. Youll lose out on any tax-deferred investment earnings that may have accrued on the borrowed funds had they remained in your 401 plan account.

- Loan payments are made with after-tax dollars.

Recommended Reading: What Are The Benefits Of A 401k Plan

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.

Also Check: How To Close My Fidelity 401k Account

How Can Keybank Clients Cash Checks At Keybank

As a KeyBank client, check-cashing services are available anytime, without a check-cashing fee. Cash your checks quickly and easily at any KeyBank branch or drive-thru. Or, deposit your checks at KeyBank ATMs or in the app with mobile check deposit. To cash a check in the branch, bring your check and one form of ID, like a drivers license, state I.D. card, or Matricula consular.

Is It A Good Idea To Cash Out A 401

If you need money today, a 401 may seem like an easy place to find it, but this could end up costing more than you think. When you compare the pros and cons, you may find it better to take out a personal line of credit, a life insurance policy loan, or utilize other assets, rather than pay a 10% penalty.

If you have a true emergency, and this is the only way to get money, then perhaps it is the best option for you. But a 401 is usually not the best place to look for emergency savings.

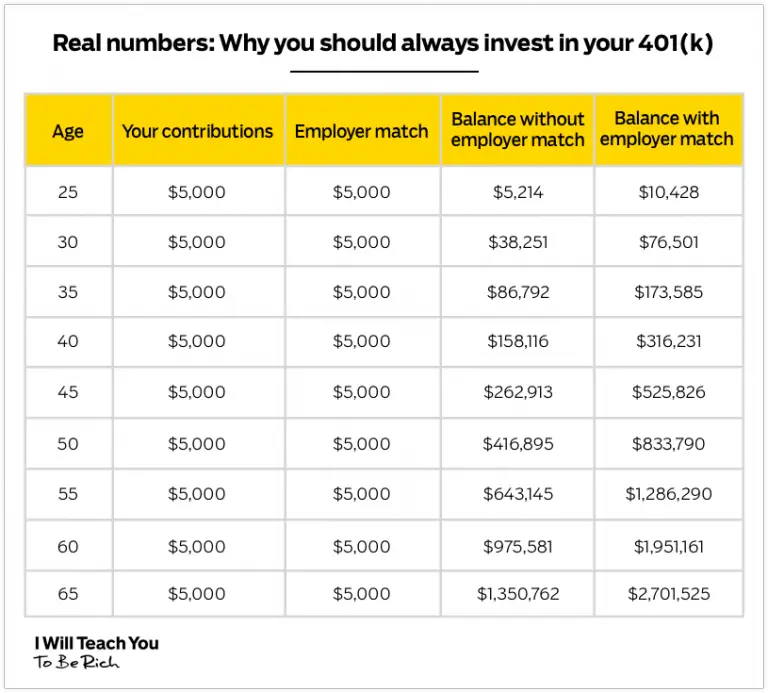

If a 401 is part of your plan for retirement and you take a withdrawal, realize that you will suffer a loss of compounding and time, and it is not possible to just put the money back into the 401 in a few years.

Don’t Miss: How To Open A Solo 401k Account

How To Make An Electronic Signature For The Distribution Form 401k Online

Follow the step-by-step instructions below to eSign your fidelity withdrawal form 401k:

After that, your 401k withdrawal form get is ready. All you have to do is download it or send it via email. signNow makes eSigning easier and more convenient since it provides users with a number of additional features like Add Fields, Invite to Sign, Merge Documents, and so on. And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system.

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Recommended Reading: What Will My 401k Be Worth At Retirement

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Lets define short-term as being roughly a year or less. Lets define serious liquidity need as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Lets dig a little deeper to explain why.

Number Of Months Of Disaster Payments

If this 1099-R is:

- from a pension for which you use the simplified method to calculate the taxable amount,

- and some, but not all, of the payments reported on this 1099-R are qualified disaster recovery distributions

You must enter the months your client received disaster recovery payments in Number of months of disaster recovery payments, if simplified method. Under this circumstance, two simplified method worksheets will be completed one for the qualified disaster recovery distributions, and one for the other pension distributions. The number of months you enter will be used to calculate line 5 of both simplified method worksheets.

If this 1099-R doesnt meet both of the above conditions, you can leave the Number of months of disaster recovery payments, if simplified method field blank.

Read Also: What Is The Average Employer Contribution To 401k

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Eligibility For Cashing A 401 Plan

In the event that you are still under the employment of the company that is paying for your 401, you wont be eligible for cashing out your 401 plan. The only exceptions to this would be if the plan, in particular, allows for a 401 loan, an in-service withdrawal, or a hardship withdrawal.

One piece of advice would be to avoid taking out a 401 loan as much as you can. The cash you have in your 401 needs to be given as much time as you can in order to grow. The loan is also required to be paid back with interest, so youll just end up losing money in the long run.

If you are no longer under the employment of the companies that sponsor your 401 plan, then you are indeed eligible to get the money. You can either cash it out, or you may roll it over through an IRA.

If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 plan over into another plan, then the IRS does not see this as cashing out.

Also Check: When Can I Cash In My 401k

Endorse Your Check To A Friend

You can also endorse your check to a friend who can cash it for free. After all, what are friends for?

Endorsed checks are sometimes called third party checks.

Endorsing a check to a friend to cash is simple. On the back of the check, follow these steps:

- On the top line, write Pay to the order of Friends Name

- You sign the check underneath this endorsement

Every bank has different policies for cashing endorsed checks. To fight check fraud, you might have to accompany your friend to the bank branch to verify your identity too.

Some banks require you to complete a form. This form states your friend has permission to cash your check. Check online or call the bank before your friend goes alone to cash the check.

Certain banks including Ally Bank, Discover Bank and Regions do not accept third-party checks.

When Will I Get My December Social Security Check

Here’s the for when you could get your Social Security check and/or SSI money:

- Payment for those who receive SSI.

- Social Security payment for those who receive both SSI and Social Security, or have received Social Security since before May 1997.

- 14: Social Security payment for those with birthdays falling between the first and 10th of any given month.

- 21: Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

- 28: Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

- January SSI payment. This check will have the COLA increase.

Note that was the final payment date for November.

Don’t Miss: What Percentage Of 401k Is Required Minimum Distribution

Rule : Desired Annual Retirement Income X 25

This rule follows the 4% withdrawal rate rule. They are pretty much the same, but this is easier to calculate for those who would rather not dabble in fractional math. It infers that in order to meet your income needs in retirement, you want to have at least 25 x your desired annual retirement income.

For example, say you estimate that your expenses per year in retirement are $40,000. You would be expected to save up a minimum of $1 million in retirement savings.

â $40,000 x 25 = $1,000,000

Also Check: Is 4 Million Enough To Retire At 65

Things To Remember When Cashing A Personal Check

There are a few things to remember the next time you cash a check:

- You always need to bring a photo ID

- Some locations wont cash handwritten checks

- Certain stores and banks charge more to cash a check than others

- Most places have a daily redemption limit

For the most part, cashing a check in-person is extremely easy.

This is true when you have a pre-printed check from one of these issuers:

- Government Agencies

- Your tax refund

All you need to do is sign your check and show a photo ID card. You instantly receive the balance minus any cashing fees.

Don’t Miss: Where Can I Start A 401k

Borrowing From And Rolling Over Your 401

Cashing out isn’t the only way for those who need it to get money out a 401. Many plans also allow employees to take loans from their 401 to be repaid with after-tax funds at pre-defined interest rates. The interest proceeds then become part of the 401 balance. The benefit of this type of loan is that the borrower repays himself — by eventually putting the borrowed money back into the 401 — rather than a bank.

If loans are permitted under terms of the 401 plan, the employee may borrow up to 50 percent of the vested account balance up to a maximum of $50,000 without the money being taxed. The borrower must repay the loan within five years unless the loan is used to buy a primary residence, and loan repayments must be made at least quarterly in substantially level amounts. If the borrower defaults on the loan, the money becomes a taxable distribution with all the same tax penalties and implications of a withdrawal.

401 holders looking for extra cash should keep all these options in mind when considering whether to tap into retirement savings early. Other savings tools may also provide penalty-free ways to get at money, depending on the holder’s circumstances. For more information on 401s and retirement savings strategies, check out the related articles and links on the next page.

How To Check My Social Security Retirement Or Disability

How to check my social security retirement or disability? You can check the status of your application online using your personal my Social Security account. If you are unable to check your status online, you can call us 1-800-772-1213 from 8:00 a.m. to 7:00 p.m., Monday through Friday.

How can I find out my Social Security benefits amount? Most people can receive an estimate of their benefit based on their actual Social Security earnings record by going to www.socialsecurity.gov/estimator. You also can calculate future retirement benefits by using the Social Security Benefit Calculators at www.socialsecurity.gov.

Is Social Security retirement the same as disability? your disability benefits automatically convert to retirement benefits, but the amount remains the same. If you also receive a reduced widows benefit, be sure to contact Social Security when you reach full retirement age, so that we can make any necessary adjustment in your benefits.

How do I know if I get SSI or SSDI? The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

Read Also: Who Do I Contact To Cash Out My 401k