Continued Growth Vs Inflation

Remember that your retirement savings accounts dont grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because youll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement moneys purchasing power.

Also Check: How To Borrow Money From 401k Fidelity

Withdrawing From Your 401 Before Age 55

You have two options if you’re younger than age 55 and if you still work for the company that manages your 401 plan. This assumes that these options are made available by your employer. You can take a 401 loan if you need access to the money, or you can take a hardship withdrawal but only from a current 401 account held by your employer. You can’t take loans out on older 401 accounts. However, you can roll the funds over to an IRA or another employer’s 401 plan if you’re no longer employed by the company, but these plans must accept these types of rollovers.

Think twice about cashing out. You’ll lose valuable creditor protection that stays in place when you keep the funds in your 401 plan at work. You could also be subject to a tax penalty, depending on why you’re taking the money.

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

Also Check: Should I Buy An Annuity With My 401k

Pension Benefit Guaranty Corporation

The PBGC is a good place to start for anyone who has already lost track of their pension. They maintain a database2 of unclaimed pensions that lists approximately 38,000 people who are eligible for pension payments that could not be located by the PBGC or their former employer.

The PBGC does not have anything to do with defined contribution plans like 401s and 403s. To find one of these plans start with your former employer. If the company has gone out of business, try the Department of Labors Form 5500 search. Plan administrators are generally required to file Form 5500 annually. The form should contain the name of the plan administrator and their contact information. Unfortunately, the search only goes back to 2009. This wont help if the plan went out of business before 2009.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

You May Like: What Does It Mean To Roll Over Your 401k

Recommended Reading: How Do I Open A Solo 401k

Taking Withdrawals From A 401

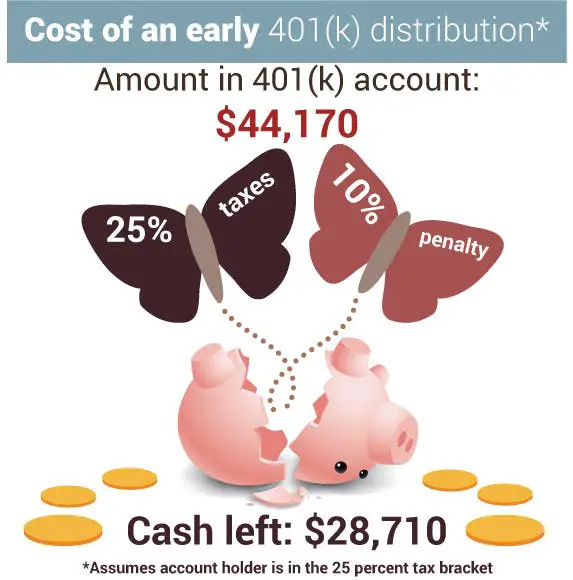

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Alternatives To Withdrawing From 401

How can you access cash without withdrawing or borrowing from your 401? If youâre a homeowner with equity, you can consider a cash-out refinance, home equity loan or home equity line of credit . All three of these options typically come with competitive interest rates because the financing is secured by your home.

Permanent life insurance policies with cash value components are another option. In this case, your death benefit serves as collateral for the loan. Once the loan balance is paid off, your death benefit is restored in full.

Don’t Miss: How Do I Know If I Have A 401k Account

Can I Keep 401k With Old Employers

If youâve changed jobs recently, find out if you can keep 401 with old employer, and the alternative options you might have.

When you switch jobs, you have several options with your 401. You can decide to leave it where it is, rollover to a new employer, or transfer the money to an individual retirement account . Each of these options has different tax implications, and you should understand the particulars of each option before deciding the option to take.

You can leave your 401 in your former employerâs plan if you meet the minimum balance requirement. Employers require employees to have at least $5,000 in 401 savings if they decide to leave their money behind indefinitely. This option does not require any action on the employees part, and you can leave your job without doing anything to your 401 money. The employer will continue managing the 401 funds, but you wont be able to make contributions to the retirement account once you leave.

What Happens To Your Benefits When You Quit Your Job

When you quit your job, your benefits usually end as well. This can include things like your health insurance, your 401k, and any other job-related benefits you may have had. You may be able to continue your benefits through COBRA, but you will have to pay for them yourself.

When you leave your job, you should be aware of how your benefits will be handled. As soon as a new employee starts at a new company, they are offered health insurance. Keeping your 401 money in your account may be beneficial if your 401 has a great investment option. When changing jobs, there are several options for benefits. If your insurance coverage gap is relatively small, you may want to stick with the plan youre already covered by. It is simple to switch to the new employers plan at a later time. You may or may not be able to keep your pension if you are fortunate enough to have it at work.

If an employee quits or resigns, the employer is usually required to provide the employees final payment within 72 hours. If an employee leaves without prior notice, his or her employer may be required to pay unemployment benefits. If you believe you have quit for a good reason, you should inform your employer so that the situation can be resolved.

Don’t Miss: Where To Start A 401k Plan

Retirement Savings In Your 30s

As in your 20s, saving for retirement may compete with other financial goals that youve asked your financial professional to help you plan for, like saving for a down payment for a house, paying for a graduate degree, or supporting a family.

Yet Millennials, who are now about 25 to 40 years old, are making progress in saving for retirement. The median household retirement savings for Millennials is about $68,000 versus about $26,000 for Generation Z, according to the nonprofit Transamerica Center for Retirement Studies® and its annual retirement study.5

So how much should you have saved as a 30-something? One theory suggests youll need retirement income of about 70 percent of what you earned annually pre-retirement, with Social Security benefits representing perhaps 40 percent of that amount and your savings representing the rest.6 So if you retire in your 60s and need to have 30 or so years worth of savings, youll want to have at least nine times your salary saved up by the time you retire.

Thanks to compounding growth, you may only need to have one to two times your salary saved for retirement when youre in your 30s.

The takeaway: As you earn raises and promotions, see if you can devote slightly more of your paycheck to your retirement account each year. Focus on budgeting so you can continue to make retirement savings a priority along with your other financial goals. And if you change jobs, remember to explore your retirement savings benefits at your new employer.

What Happens To Your 401k When You Quit Or Fired

Shawn Plummer

CEO, The Annuity Expert

If you are considering quitting your job or have been recently fired, its important to know what will happen to your 401k. What happens to your 401k when you quit? What should you do with it? Can I cash out my 401k if I quit? What if I dont have a 401k account at all? Well answer these questions and more in this guide!

Don’t Miss: When Can You Roll Over 401k To Ira

Withdrawal Penalty Before Age 59

If youâre under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

Donât Miss: What Is The 401k Retirement Plan

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Also Check: How To Project 401k Growth

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

How Much Does It Cost To Send $100 By Moneygram

Within the United States, Western Union is slightly cheaper than MoneyGram to send $100 via an online bank account: $0.99 for Western Union compared to $1.99 for MoneyGram. However, the two platforms charge the same amount if sending via debit card, and Western Union charges more when sending through a credit card.

Also Check: How To Find A 401k From Previous Employer

Most People Have Two Options:

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Recommended Reading: How Do You Take Money Out Of 401k

Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Don’t Miss: Can I Roll Part Of My 401k To An Ira

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Can I Claim Moneygram In Lbc

With over 1,500 LBC branches nationwide, MoneyGram now has over 15,000 locations across the country to provide choice and convenience for our customers to pick up cash remittances with ease, he added. This partnership gives us the opportunity to make remittance even more accessible and convenient.

Dont Miss: What To Ask 401k Advisor

Recommended Reading: Can I Take 401k Money To Buy A House

Impact Of Inflation On Pensions And Savings

The amount you get from public pensions, like the Old Age Security pension and Canada Pension Plan, is protected against inflation. This means as the cost of living goes up, the value of your benefit goes up as well.

Not all employer pensions are protected against inflation. Ask your pension administrator or employer whether your pension is protected against inflation.

Personal savings and investments, such as mutual funds or guaranteed investment certificates , are usually not directly protected against inflation. Your savings need to grow by at least the rate of inflation. If not, the amount of things your savings can buy in the future will be less than what they can buy now.

For example, something bought for $100 in 2002 would cost $129.92 in 2016. If your income isnt protected against inflation, you may have a hard time maintaining your lifestyle in retirement as the cost of goods and services increases.

Also Check: What Is The Penalty For Taking Money Out Of 401k

How Do I Find My Previous 401 Process

- Method 1 of 3: Contacting Your Old Employer or Plan Administrator. Find I let you know the outdated saying.

- Method 2 of 3: Searching the National Registry and Other Databases. Search for the plan administrator on a central authority database.

- Method Three of three: Accessing Your Funds. Verify your identity if important.

Dont Miss: What Is The Difference Between Annuity And 401k

Also Check: How To Create A 401k