Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people often get tripped up.

Heres what you need to know about investing your 401.

You May Like: Can I Take My 401k If I Quit

These Trends Won’t Fade Away And Some Of The Companies That Are Positioned To Ride Them Should Be Big Winners

Momentum traders sometimes say, “The trend is your friend — until it ends.” The idea is that you can make money from short-term trends in stocks and other assets, but those trends don’t always last long.

However, long-term investors can profit from some ongoing macro trends that aren’t directly connected with asset prices. And these trends are likely to persist for decades. Here are five unstoppable trends to invest $5,000 in for 2023.

Why Your Employer Doesn’t Offer A 401

The most common reason an employer doesn’t offer a 401 is that most of their jobs are entry-level or part-time. The average worker in these positions is either very young or living paycheck to paycheck, so saving for retirement is difficult most would pick getting more money upfront instead of a retirement plan anyway.

There are other reasons why your employer might not offer a plan. An employer might not have the experience or time to create an individually designed plan or have a go-to financial or trust institution. In these cases, plenty of employers make the decision not to offer benefits rather than spend time and money chasing a good sponsor.

For 2022, the 401 contribution limit is $20,500 , with a $6,500 catch-up contribution for those 50 or older .

Read Also: How Long Will My 401k Last In Retirement

Options When Employment Ends

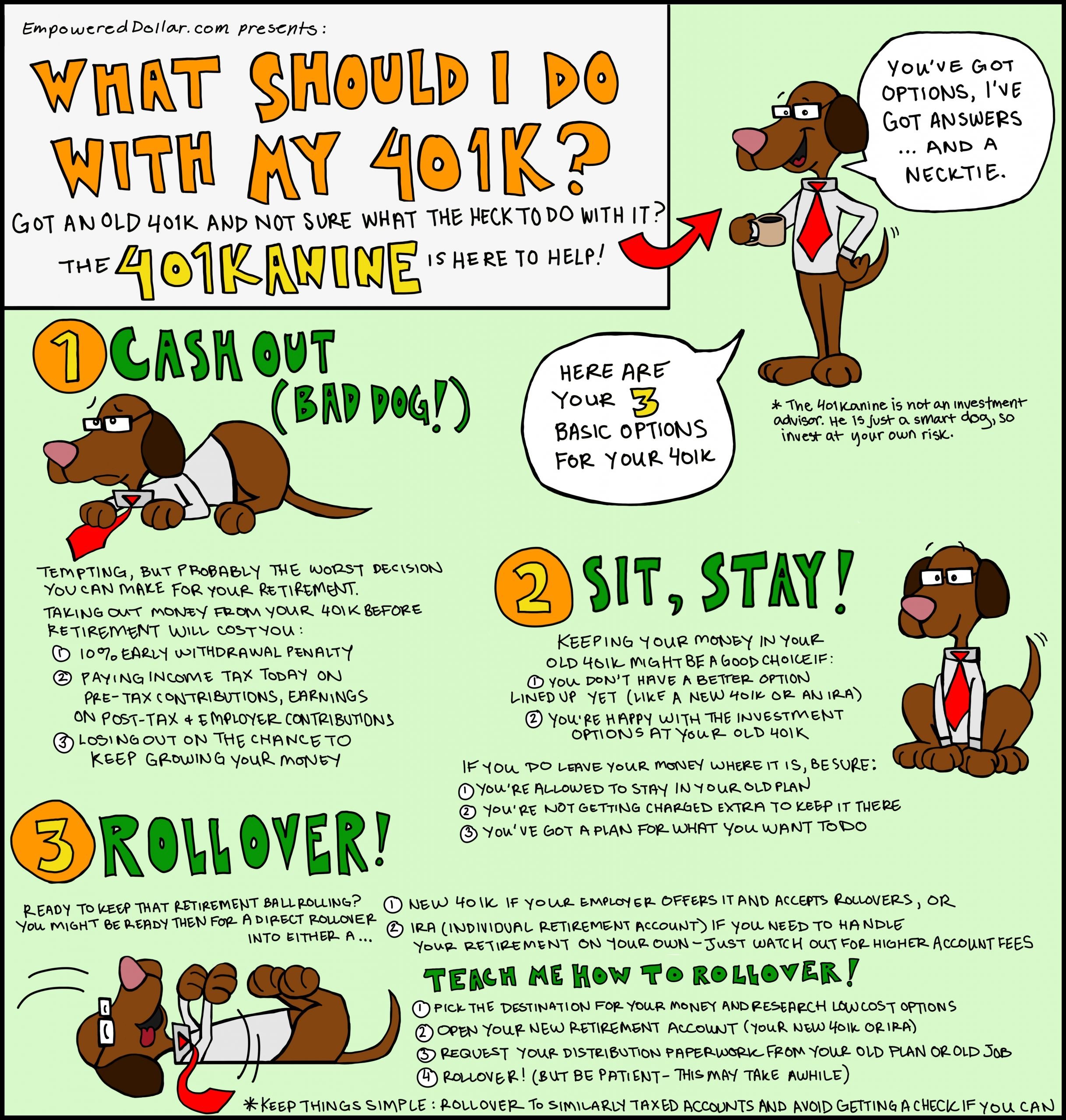

There are a number of options an employee can take when leaving the job:

- Roll over to an IRA Rolling 401 assets to an IRA can allow participants to keep the same tax benefits, avoid penalties, choose from a wide range of investment options and, with a Roth IRA, avoid having to take distributions before theyre needed.

- Stay in the old plan Participants may be able to remain in the plan and keep the same benefits, although fees may increase and they wont be able to make contributions.

- Move to a new plan If the participants new employer accepts rollovers, participants can keep the tax benefits while consolidating their retirement plan money.

- Cash out Participants will owe applicable taxes and, if not yet age 59½ , an additional 10% early distribution tax. However, cashing out does give you cash in hand, which may make sense if you need money to take care of current needs.

To learn more about your options, contact your financial professional.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Is A Rollover From A 401k To An Ira Taxable

Ways To Save $500 A Month In 2023

Did you know that if you save $500 each month, youll end the year with $6,000 in savings? This substantial amount of money can be put toward IRA contributions, paying off credit card debt or other outstanding debt, or tucking it away in an emergency fund.

Find Out: 3 Easy Tips to Turn Your Credit Woes Into Wows

Saving an extra $500 each month, if youre not accustomed to doing it, can be tricky to put into practice. Even if youre not used to saving this much, you can still achieve this savings goal. Mallory Micetich, home expert at Angi, joins GOBankingRates to share her tips for successfully saving $500 each month. Heres how to get started on this savings goal in 2023.

Mistake #: Getting Out Of The Market After A Downturn

When the market takes a big hit, you may be tempted to pull out all the stocks in your retirement portfolio. If you do, youll miss the gains if the market turns around. You want to keep a good mix of asset classes in your portfolio: stocks, bonds, and cash. And once a year, you should rebalance to keep your asset allocation on track.

Don’t Miss: How Can I Borrow Money From My 401k

When Should You Avoid Maxing Out Your 401

Of course, not all people are in a position to add $20,500 a year to a retirement plan. If you earn $50,000 a year, that $20,500 represents 41% of your total incomeâsome of which you may need to meet your living expenses. Itâs okay that you may not have the excess cash flow needed to make this happen. Each year brings a new enrollment period, so you can always choose to increase your contribution over time if your financial situation improves.

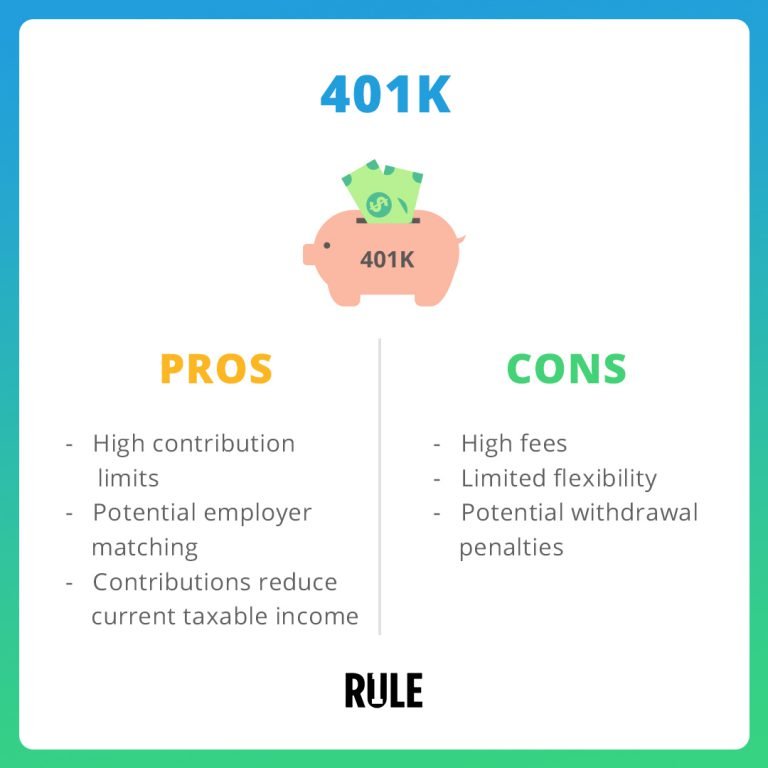

There are other reasons to think about maxing out 401 contributions. Employer-sponsored plans come in many forms, but most are managed by outside investment firms with their own rate and package options. Your retirement plan at work may have a great track record with a history of steady growth, or it may be more modest. You may be able to have some say in whether your money is invested aggressively or cautiously, or you may have only one option.

Its possible that your plan charges high fees. You can usually find these details in your summary plan description and annual report. You should think about all these factors when you sign up and decide how much of your earnings will be put toward your plan each pay period.

Lastly, your 401 is only one of many potential retirement vehicles. You can always opt out of your company plan and save for retirement in an independent fund, like an IRA through your bank or credit union.

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

Don’t Miss: How To Borrow From My 401k

Why You Dont Have To Be Afraid Of A Stock Market Crash

As I mentioned earlier, a stock market crash can be a golden opportunity to buy great companies at great prices and make incredible returns.

Even Warren Buffett has said its best to look at market fluctuations as your friend rather than your enemy.

You can do this both in your 401k, or self-directed retirement account, and in a money market account. Keep in mind, you wont be able to buy individual stocks when theyre on sale in your 401k, but you can still take advantage of the low prices and buy when others are running in fear.

Here are a few more tips to help you navigate a stock market crash:

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a target retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

Most people arent interested in researching selecting funds for their 401, Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. Target date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise youre essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

Don’t Miss: Can You Invest Your 401k In Crypto

Achieve A Better Life Accounts/529a

These tax-advantaged accounts are a form of special needs trust for individuals disabled before age 26 .

ABLE accounts allow individuals and families to contribute up t0 $15,000 a year with a lifetime total contribution of $100,000 without impacting certain means-tested federal/state aid benefits like Supplemental Social Security , Supplemental Nutrition Assistance Program , and Medicaid.

Contributions are not federally tax-deductible, but distributions of investment earnings are federally tax-free if used for qualified disability expenses.

These qualified expenses are written pretty broadly and may include education, housing, transportation, employment training and support, personal support services, health care expenses, and other expenses that help improve health, independence, and/or quality of life for the designated disabled beneficiary.

ABLE accounts were designed from 529 College Savings Accounts and are sometimes also called 529A accounts. There are about 40 states that offer them and each has its own cost structure, investment options, and rules. You can open an ABLE account in any state that accepts outside residents into their program.

ABLE contributions may also be eligible for the Saver’s Credit, which is a type of tax credit that can reduce your tax bill. You can learn more about ABLE accounts at ABLE NRC.

Consider A Health Savings Account

Another option to consider is a health savings account . If you have an HSA-eligible health plan, these accounts offer a number of benefits, including a tax deduction, tax-free growth potential, and tax-free withdrawals to pay for qualified medical expenseseither now or in retirement.*

After age 65, if you dont need the money for health care costs, you can take withdrawals from the account penalty-free. But, similar to a traditional IRA, taxes on contributions and earnings will be due.

- For more information, read on Fidelity.com: How can an HSA benefit you?

Recommended Reading: Is A 401k Worth It Anymore

Clean With A Damp White Cloth

If you need to clean your handbag, Kelly said use warm water and a small amount of mild soap on a white cloth to wipe down the handbag.

I recommend using clear Dawn dishwashing soap and cleaning along the grain, said Kelly. Be sure the cloth is just damp to not saturate the handbag.

After cleaning, Kelly said its very important the handbag dries completely. Once it is completely dry, you may store it after use.

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Don’t Miss: How Do I Start A Solo 401k

Tips On Saving For Retirement

-

A financial advisor can help you create a savings plan that works with your budget. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

-

Seeing how your savings can grow over time can help motivate you to save even more. SmartAssets free 401 Calculator, which takes into account your age, income and rate of return, will estimate how much your savings will be worth by the time you retire. Give it a try today.

What If You Dont Have A 401

That advice to save money in your 401 assumes you have a 401 in the first place. And 41% of Millennials dont have access to such a plan through their employer.

This puts the burden of funding your own retirement even more squarely on your own shoulders, since you cant double your savings through a benefit like an employer match.

But dont get discouraged or think you dont have any options. There are still plenty of ways to save for retirement outside of a 401 .

Heres what else you can do to build your nest egg even if the common refrain to save in a 401 just doesnt apply to you.

Also Check: How To Fill Out 401k Enrollment Form