The High Cost Of Hardship Withdrawals

So what’s the best way to have money for unexpected expenses? Build an emergency fund. You can tap into that without incurring early withdrawal penalties.

Generally, you should have enough cash to cover three to six months of living expenses in case of an emergency, like being laid off from work.

If saving that much money seems daunting, start small. Aim to build a fund of at least $500 and go from there. Be sure to build your savings back up when you take money out of the account. Don’t forget to take advantage of the power of compound interest.

How Much Can I Withdraw From My Ira At Age 60

At age 60, a Roth IRA owner is free to withdraw the entire balance tax-free or to leave it in place for his heirs. Contact the trustee managing your IRA about making a withdrawal.

How are distributions from a tax qualified retirement account treated for tax purposes?

Your contributions are tax-free, but your distributions arent. With a 401, for example, withdrawals you make from the account are all taxable income. If you start withdrawing before age 59 1/2, you pay a 10 percent tax penalty on top of the regular tax.

When to take a lump sum retirement distribution?

When deciding whether to transfer the money into another qualified retirement plan, taking a lump-sum distribution is usually one of a few choices: a rollover, a partial distribution, or keeping the benefit in the current account for as long as the plan or account custodian allows.

Whats Next For Monetary Policy In 2023

Inflation looks like its finally peaked. Consumer prices in November rose 7.1 percent from a year ago, down from 7.7 percent in October. Even excluding food and energy, prices rose at a slower pace than the previous month, giving the Fed more confidence that their rapid rate hikes are starting to do their job and wrestle price increases.

Thats not to say the Fed is close to declaring victory. Those price gains are still more than three times the Feds 2 percent target, and data suggests they could be sticky for a while. A measure of households rent costs, for example, has jumped by the most since July 1982, with shelter now becoming the largest contributor to overall inflation, according to the Department of Labor.

A promising sign, Powell has said he expects new lease prices to eventually start falling in 2023, but price pressures in another category are threatening to take its place.

Services from health care to haircuts rose 6.8 percent in November from a year ago, and wage growth tied to an ongoing shortfall of 3.5 million workers could keep those price gains from cooling anytime soon. The share of working-age individuals in the labor force is down 1.3 percentage points since the start of the pandemic and fell in November for the third straight month.

Also Check: How To Manage 401k In Retirement

Who Gets The Interest Payments From A 401 Loan

You get the interest you pay on the 401 loans, since you are essentially lending money to yourself. Keep in mind that the interest payments are made with after-tax dollars. That’s a downside to 401 loans, because those after-tax dollars will be taxed again when they’re taken out as a 401 withdrawal in retirement.

What Is A 401k Plan Loan

A 401k plan loan is one of a few ways you can borrow money from your 401k early without incurring a penalty.

While 401k plan loans will vary depending on which plan your company offers, a few rules are constant:

- The maximum amount you can take from your 401k is 50% of the vested account amount.

- You may borrow no more than $50,000.

- If 50% of your vested account amount is less than $50,000, you can withdraw up to $10,000.

- You must repay the loan within five years.

Youre borrowing the money from your future self when you take a 401k loan and your future self is going to want that money back with interest.

Thats because when you take the money out, its no longer compounding and accruing interest. This means you will lose the gains on any amount you borrow. The interest rate is there to compensate for the loss in gains.

Now lets take a look at how to borrow from your 401k.

You May Like: How Do I Close My 401k

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Read Also: How Often Can I Change My 401k Investments Fidelity

How A 401 Loan Works

The tax code allows for 401 retirement plan savers to borrow a portion of their funds. The terms of the loan are outlined in the tax code, and the loan features offered by any 401 plan must be designed within certain criteria.

You may borrow the lesser of $50,000 or 50% of your plan account value.

A loan has a maximum term of 5 years. If you plan on using the loan to purchase a primary residence, this term can be longer.

Loan interest is set at one percentage point above the prime lending rate as of the start of the loan. Loan payments must be made on a straight-line amortized basis, with payments made at least quarterly.

Each participant in the plan is treated individually. If both you and your spouse have savings in your Solo 401, you may each take out your own loan.

You may take up to 3 loans at any time, as long as you dont exceed your borrowing limit. There is no pre-payment penalty.

If you fail to repay the loan or miss making quarterly payments, then the balance of the loan is treated as a taxable distribution to you. If youre under age 59 ½, a 10% penalty for early distribution will also apply.

Also Check: How To Open Your Own 401k

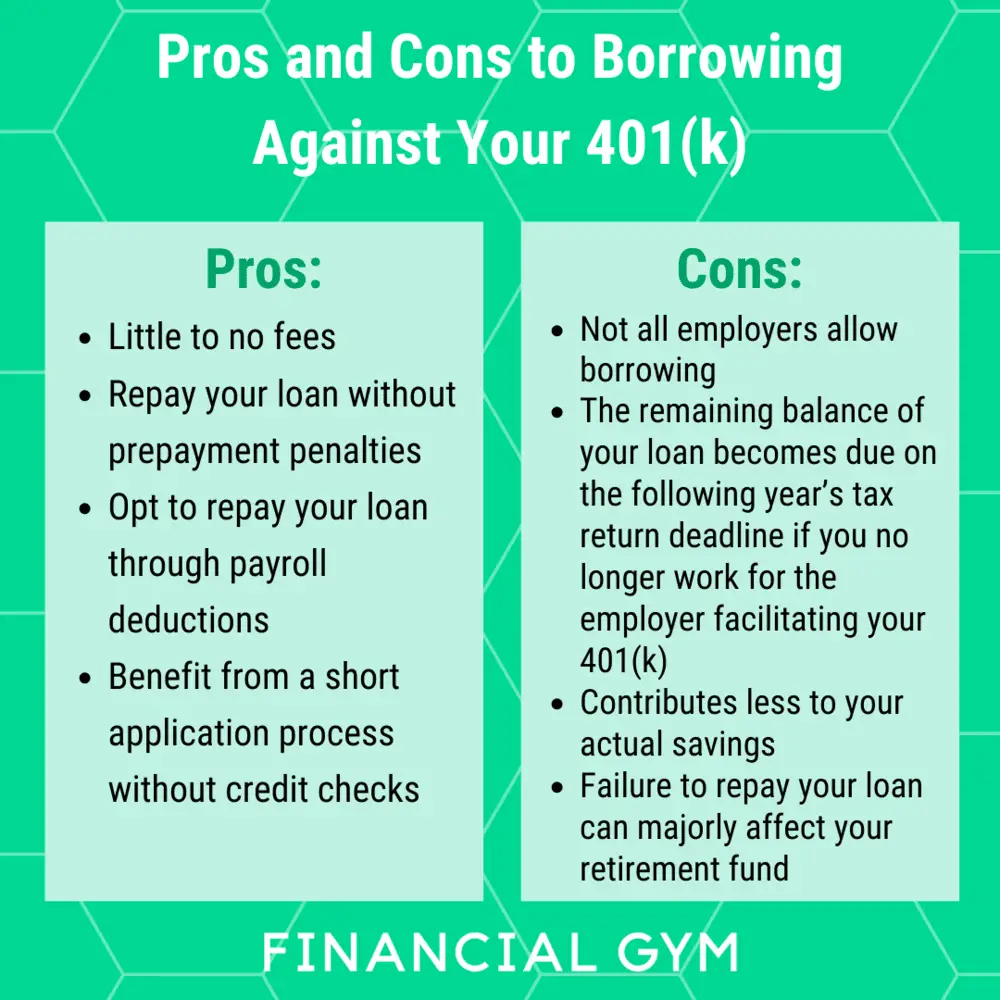

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

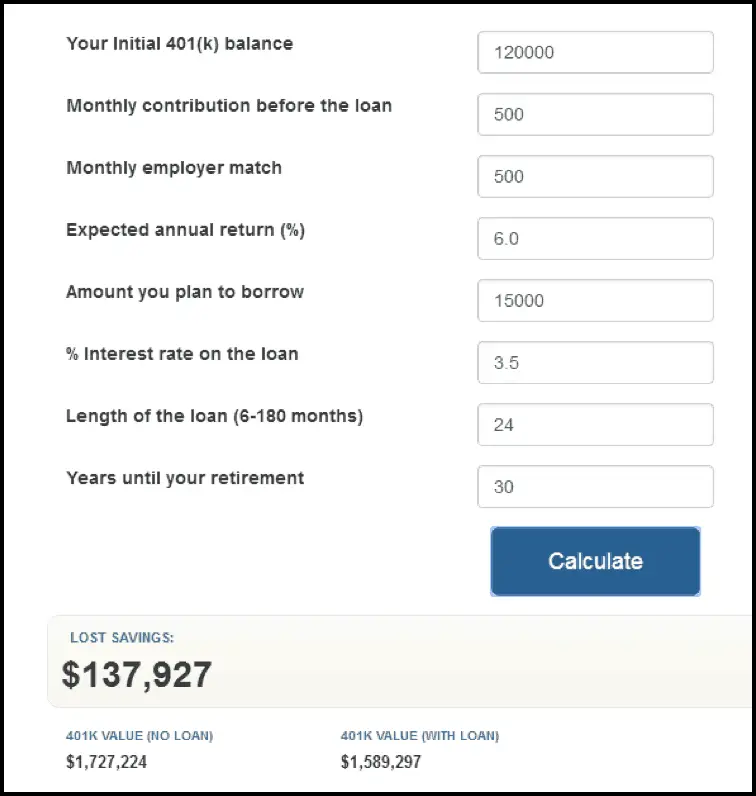

Long-term impact of taking $15,000 from a $38,000 account balance

Find Out If Your Plan Allows Loans

Many 401 plans allow you to borrow against them, but not all. The first thing you need to do is contact your plan administrator to find out if a loan is possible. You should be able to get a copy of the Summary Plan Description, which will give you the details. Even if your plan does allow loans, there may be special conditions regarding loan limitations. While there are legal parameters for 401 loans, each plan is different and can actually be stricter than the general laws. So get the facts before you start mentally spending the money.

Recommended Reading: How To Become A 401k Advisor

Do Lenders Look At 401k

Despite the fact that if you withdraw 401k for house loan is a new monthly obligation, lenders dont count that obligation against you when analyzing your financial statements and debt-to-income ratio because the payment is not seen the same way as another regular loan. This is just like a car payment or student loan payment! Therefore, if your debt-to-income ratio is already high, you dont need to worry that your 401k home down payment will push you over the edge, nor will it downgrade your credit score.

However, the lender will deduct the available balance of your 401k loan by the amount of money you borrowed. Therefore, you might need to think twice before borrowing from your retirement savings if you are short on cash reserves. Some loan types require two months of housing payment reserves after closing.

Recommended Reading: How To Start Withdrawing From 401k

If You Default On Your 401 Loan Youll Owe A Penalty

If you do not pay your 401 loan back as required, the defaulted loan is considered a withdrawal or distribution and thus is subject to a 10% penalty applicable to early withdrawals made before age 59 1/2. Thats potentially a huge cost, especially when you also consider the loss of the potential gains your money would have made had you left it invested.

You May Like: Do I Need To Rollover My 401k To New Employer

You Miss Out On Compounding Interest

Finally, you miss out compounding returns. Even if you dont default, you miss out on up to five years of potential gains. If you take your loans out during a market downtown, you lock in losses and miss out on the gains from a recovery. When you start contributing again, you might be buying at a higher price, reducing your ability to enjoy future gains. There is no making up for time in the market.

How Long Do You Have To Repay A 401 Loan

Generally, you have up to five years to repay a 401 loan, although the term may be up to 25 years if youre using the money to buy your principal residence. IRS guidance says that loans should be repaid in substantially equal payments that include principal and interest and that are paid at least quarterly. Your plan may also allow you to repay your loan through payroll deductions.

The interest rate youll pay on the loan is typically determined by the plan administrator based on the current prime rate, but it and the repayment schedule should be similar to what you might expect to receive from a bank loan. Also, the interest isnt paid to a lender since youre borrowing your own money, the interest you pay is added to your own 401 account.

Also Check: How To Properly Invest In 401k

What Did Muhammad Do After He Retired

His retirement did not last long. Ali had grown used to a very lavish and lifestyle and within a few years his fortune had dwindled. So in 1980 Ali returned to the ring, battling Larry Holmes for the World Boxing Council title with a guaranteed purse of $8 million. Holmes won a technical knockout in the eleventh round.

Avoid Taxes And Penalties

While hardship withdrawals from a 401 get taxed as ordinary income and come with a 10% early withdrawal penalty, loans dont suffer the same fate. Youll generally avoid taxes and penalties if you borrow from your 401.

One exception is if you default on your loan. In that case, youll pay the penalty and taxes if youre under the age of 59 ½.

Don’t Miss: What Is 401k Rollover To Ira

What Are The Disadvantages Of Withdrawing Money From Your 401 In Cases Of Hardship

- Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred.

- Hardship withdrawals are generally subject to federal income tax. A 10 percent federal penalty tax may also apply if you’re under age 59½. contributions, only the portion of the withdrawal representing earnings will be subject to tax and penalties.)

- You may not be able to contribute to your 401 plan for six months following a hardship distribution.

Using Your 401 Funds To Buy A Home Has Pros And Cons

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

If you need cash for a down payment for a home, and you have a 401 retirement plan, you might be wondering if you can use these funds.

Typically when you withdraw funds from a 401 before age 59½, you incur a 10% penalty. You can use your 401 toward buying a house and avoid this fee. However, a 401 withdrawal for a home purchase may not be best for some buyers because of the opportunity cost.

Learn how to tap your 401 to buy a home and more about some alternatives for funding a home purchase, such as using a mortgage program or saving up cash.

Recommended Reading: Should I Roll My 401k Into A Roth Ira

How To Borrow Money From A 401

There are two ways that you can borrow money from a 401 retirement account.

Both of these options will impact your long-term ability to grow your money and save for retirement, so be aware of the downfalls. Taking money out of your 401 reduces the principal balance, which also impacts the amount of interest it can earn.

Depending on when you are planning to retire, this can can have a serious impact on your total savings at retirement. in some situations, though, it can make sense to use that money to pay off other debt.

Also Check: Can I Borrow From My 401k For A House

How Is 401k Loan Interest Paid

You’ll have to pay the money back with interest. The good news is, the interest is credited to your 401k account, not to your employer, so you are paying the money back to yourself. Paying the loan back comes right out of your paycheck too. So keep in mind this will lower your take home pay until the loan is paid back.

You May Like: How To Invest 401k In Stocks

Average American Is Losing $34k And Everything Else On Bidens Watch

The second worrisome switch is that Biden makes ESG funds eligible to be the default fund when a worker doesnt choose one. The Trump administration banned that. Bidens rule will push more workers unwittingly into these funds.

Bidens doing an end run around democracy, trying to change corporate America without having to pass laws in Congress. Companies need investment capital. The more 401 money is controlled by ESG funds, the more pressure can be put on companies to adopt the ESG agenda climate change, diversity and unionization whether they like it or not. Bidens buddies on Wall Street will do the financial arm-twisting.

Democrats invented ballot harvesting. Now theyre on to 401 harvesting.

Bidens rule eventually will be challenged in court and probably struck down. The Labor Department characterizes it as a mere clarification of the 1974 law Congress enacted the Employee Retirement Income Security Act that requires 401 retirement-plan sponsors to act solely in the interest of savers. In truth, the new rule reverses ERISA. The Labor Department is trying to do what only Congress has the power to do.

In the meantime, employees should avoid getting stuck in an ESG plan unless theyre willing to sacrifice their retirement to advance a left-wing political agenda. Elon Musk nailed it, tweeting: ESG is the devil.

Betsy McCaughey is a former lieutenant governor of New York.

Twitter: @Betsy_McCaughey

Can You Borrow From Your 401 Without Penalty

Depending on what your plan allows, you could take out as much as 50% up to a maximum of $50,000, within a 12-month period. If you repay under the loan’s terms, you won’t be penalized.

But be careful: If you lose your job and don’t repay by that year’s tax deadline, the IRS considers your loan a withdrawal. That means if you’re younger than 59 ½, you may have to pay the 10% early withdrawal tax penalty.

You can also do some rough math on early withdrawal costs by using a 401 calculator.

Also Check: Can A 401k Be A Roth

When To Choose A 401 Loan

- You cant beat the price. If your 401 offers a loan at 4%, but your bank cant offer better than 8%, borrowing from your 401 could be a strong consideration.

- Speed and convenience are a priority. With no credit checks and fast access to funds, these loans can help those on tight timelines.

- Youre out of other options. If other sources of money have come up dry, your 401 loan can save the day.

How Long Do You Have To Repay The Loan

Generally, 401 loans have a repayment period of five years. However, you may be allowed a longer repayment period of up to 15 years if you are using the loan to buy your primary residence. You must make loan payments at least once every quarter.

You may be required to make loan payments through automatic payroll deductions. Sometimes, an employee may elect to repay the loan through a check, but subject to the plan administrators approval. If the request is granted, you will be responsible for making loan payments on time.

Dont Miss: How Do You Transfer 401k

Read Also: Can You Cash Out Your 401k