Consider Contributing To Your Workplace Savings Plan To The Maximum Allowed

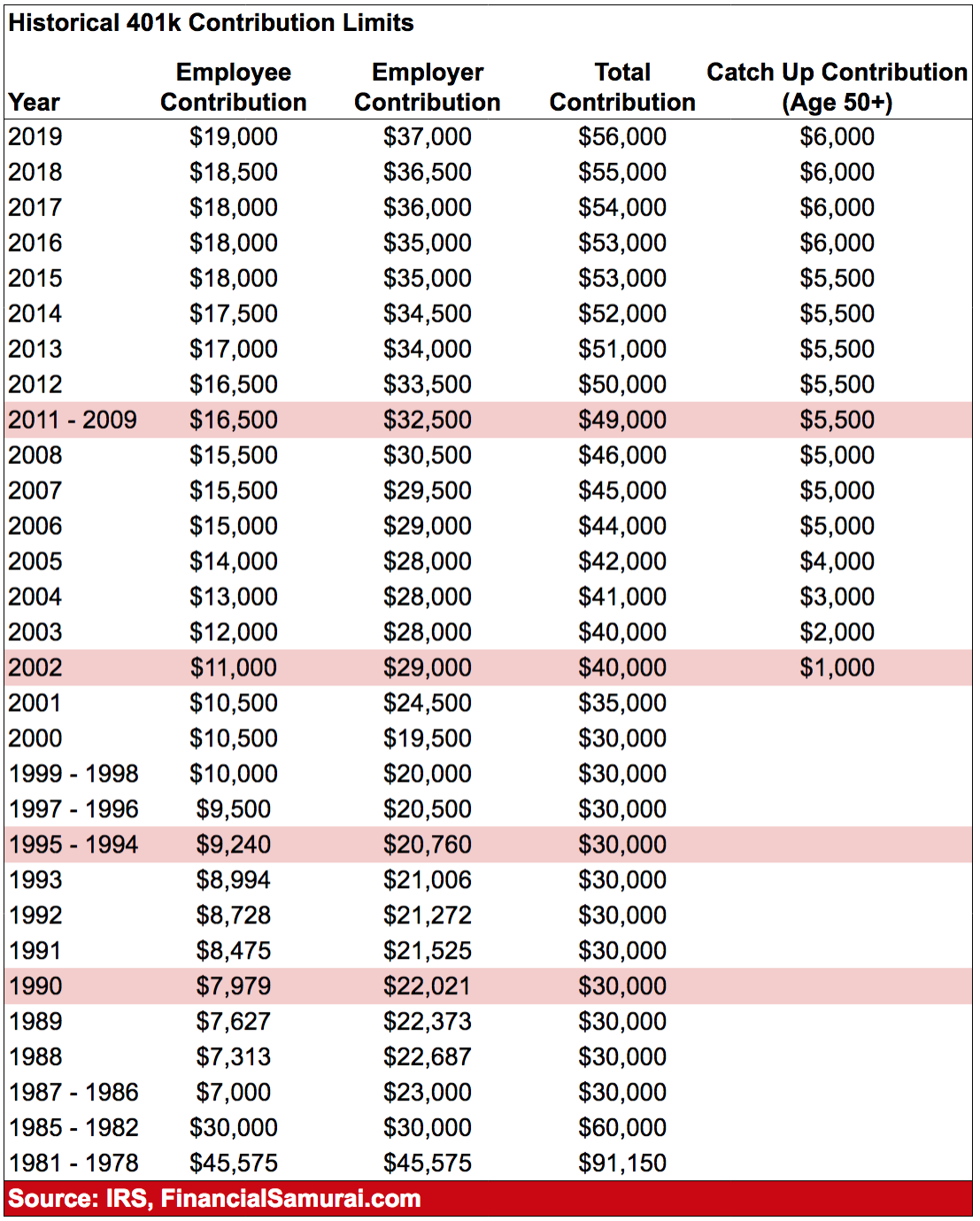

If you’ve contributed up to the employer match, you may be ready to save more for retirement. Consider maxing out your 401. For 2022, 401 contributions are $20,500 or $27,000 .

Because of the gender pay gap, women are often earning lessso basing contributions on a percentage of earnings means contributions could be lower. That’s one reason why it might make sense to aim for the maximum allowed. If you can’t afford to go up to the maximum yet, Fidelity believes in aiming for 15% of your pre-tax salary . If you can’t afford the 15%, figure out what you can afford, then you can always increase it whenever you get a raise or promotion.

FAQ:What if my employer has a profit-sharing program that goes into my 401? There is a limit to how much you and your employer can contribute in total into your retirement accounts each year. If, for example, your employer has a profit-sharing program which gives you significant 401 contributions, it could be possible for your personal yearly maximum to be lower than $20,500/$27,000. That’s because your employer will have used some of the combined total.

How Much Should I Contribute To My 401

But you dont need to limit contributions to the amount required to get the match. In 2022, employee contribution limits for a 401 plan are set at $20,500, up from $19,500 in 2021. In traditional 401 plans, you can defer income taxes on the amount you contribute each year. For example, if you earn $80,000 a year and contribute $20,500, your taxable earnings for the 2022 tax year would be $59,500.

The more you can contribute early on in your career, the better off you will be when retirement time comes.

Are Your 401 Contributions Keeping Up With Your Salary

You may still be a few decades away from retirement, but its never too soon to ramp up your savings for your life as a retiree. And one of the best ways to do so is to increase your contributions to your 401or whatever retirement account you have access towhenever your salary goes up.

This year, you may even see a bigger boost to your salary. U.S. employers expect to give an average 3.4% raise to their workers in 2022, according to a survey from Willis Towers Watson, a risk management and insurance brokerage company. Of course, your salary increase may be less or more than this amount. Either way, a good strategy is to put at least some of that salary boost to work in your 401.

Why is it so important to put in as much as you can to your 401? Lets review the key benefits of this plan:

Tax advantages By contributing pretax dollars to your 401, you can lower your taxable income, and your money can grow on a tax-deferred basis. If you contribute to a Roth 401, you put in after-tax dollars, so you dont get an immediate reduction in your taxes, but your earnings growth and distributions in retirement are generally tax free.

Employer match If your employer offers a match, you can think of it as almost a bonus in pay. Matching amounts vary among employers. They are commonly structured as 50 cents on the dollar or a dollar-for-dollar match, usually for 3% to 6% of an employees salary.

Also Check: Can You Leave Your 401k At Your Old Job

Make Sure You Contribute At Least This Much

Deciding how much to save in your 401 shouldn’t take an advanced degree in mathematics.

At a minimum, you should contribute as much as your employer will match to your 401. If you’re able to put away even more for retirement, you can contribute up to $19,500, or $26,000 if you’re older than 50, in 2021 .

There are a few other considerations to take into account before plowing all that money into your 401, but here’s all you need to know.

How To Maximize Your 401 Match

U.S. News & World Report – 02/11/2020

Many companies offer a 401 match to employees who save for retirement, but it’s not always easy to qualify for the match and take it with you when you leave the job. There might be waiting periods before you are eligible for a 401 match and vesting schedules that prevent you from keeping the match if you don’t stay at that job for a specific period of time.

How Does 401 Matching Work?

Some companies contribute to a 401 plan on behalf of employees regardless of whether the worker saves in the plan, while other firms offer to make a contribution to the 401 plan only if the employee also saves some of his or her own money in the plan. The exact amount of a 401 match varies by employer, but it is often 50 cents or $1 for each dollar the employee contributes. There is also often a cap on the amount the employer will match, such as 6% of pay. A 401 match does not count against the employee’s 401 contribution limit for tax deduction purposes, but it is subject to a different IRS annual limit.

Here’s how to take advantage of 401 matching contributions:

– Find a job with a good 401 match.

– Set up automatic 401 withholding.

– Watch out for 401 waiting periods.

– Follow the 401 match rules.

– Don’t stick with the 401 default contribution.

– Pay attention to the 401 vesting schedule.

Find a Job With a Good 401 Match

Set Up Automatic 401 Withholding

Watch Out for 401 Waiting Periods

Follow the 401 Match Rules

919308.1.0

Recommended Reading: How Do I Get My 401k Early

How To Maximize Your Retirement Portfolio With These Top

Believe it or not, seniors fear running out of cash more than they fear dying.

And unfortunately, even retirees who have built a nest egg have good reason to be concerned – with the traditional approaches to retirement planning, income may no longer cover expenses. That means retirees are dipping into principal to make ends meet, setting up a race against time between dwindling investment balances and longer lifespans.

The tried-and-true retirement investing approach of yesterday doesn’t work today.

For many years, bonds or other fixed-income assets could produce the yield needed to provide solid income for retirement needs. However, these yields have dwindled over time: 10-year Treasury bond rates in the late 1990s were around 6.50%, but today, that rate is a thing of the past, with a slim likelihood of rates making a comeback in the foreseeable future.

While this yield reduction may not seem drastic, it adds up: for a $1 million investment in 10-year Treasuries, the rate drop means a difference in yield of more than $1 million.

Today’s retirees are getting hit hard by reduced bond yields – and the Social Security picture isn’t too rosy either. Right now and for the near future, Social Security benefits are still being paid, but it has been estimated that the Social Security funds will be depleted as soon as 2035.

Invest in Dividend Stocks

Look for stocks that have paid steady, increasing dividends for years , and have not cut their dividends even during recessions.

Start Taking Less Risk

You can also invest in the stock market with your own brokerage account, but as you near retirement, most financial planners recommend taking less risk in your investments. Quicken lets you see what youre holding in your mutual funds and set target allocations across your entire portfolio, helping you make informed decisions.**

Also Check: How Much Do I Need In A 401k To Retire

Get That Match And Make The Most Of Your 401k Contributions In 2022

While most employers will not contribute large amounts of money to your 401k on your behalf, quite a few will contribute some money to your account. In fact, about 50% of employers will match your 401k contributions up to a median of 3.5%. What this means is that up to 3.5% of your salary, as much as you contribute your employer will also put into your account for you.

If you want to maximize your 401k contributions for 2022, you need to be investing at least enough to get that match. This is free money for you. If you contribute nothing else to your 401k, at least put enough in to get your employers match.

Different employers will match in different ways, though. Youll need to be aware of how your employer matches your contributions in order to make the best of it. For example, if your employer provides a lump sum contribution at the end of the year, you can contribute to your 401k in any way you want and still get that match. You could contribute up to the maximum allowed amount at the beginning of the year, and still get all that matching money from your employer.

Ways To Maximize Your 401

We offer some ideas to help you save more for retirement.

Fidelitys retirement savings report highlighted many positive trends, showing that investors are upping their saving game. How do you stack up? Lets break down five of the report’s findings to see where you stand, and more importantly, what you can do to improve.

1. Automatically Enrolled? Evaluate Your Investments and Savings Rate Fidelity found that a record level 35% of employers now use automatic enrollment for their 401 plan. Automatic enrollment means a company diverts a certain percentage of an employees pretax salary into a retirement plan, meaning its opt-out, not opt-in.

Auto-enrollment is an effective behavioral nudge. Fidelity found that 88.3% of workers participated in auto-enrollment plans while only 52.3% did when the feature wasnt an option. Thats 36 more people per 100.

If you are auto-enrolled in your companys retirement plan, stay enrolled. The sooner you start saving, the better. Plus, you wont get used to seeing the money in your paycheck if its been allocated to retirement savings all along.

Here are some other things you can do if you’re auto-enrolled: Evaluate your investment portfolio. Is it appropriate for your level of risk, and are your funds relatively inexpensive? Next, check the contribution percentage your employer set up for you. If its on the lower end, like 3%, consider raising it.

Also Check: Why Is A 401k Good

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

Withdrawing From Your 401

You cant withdraw money from your 401 before a certain age without incurring a financial penalty .

The age when you can begin withdrawing is 59-1/2 for most people, 55 in some exceptional cases .

Even though you arent paying taxes on your contributions now, you will pay them eventually, as you withdraw money during retirement.

You May Like: How To Withdraw From 401k After Age 60

Fund Types Offered In 401s

Mutual funds are the most common investment option offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording. Here is a list of the types of fund strategies you might find:

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

Read Also: How Do You Get Your 401k When You Retire

Move Money From Other Accounts

Money for IRA contributions doesnt have to come from your checking account and this months budget. The same benefits are available if you transfer money from a brokerage or savings account.

If youre worried about squeezing your monthly budget, consider moving money from an alternate account to your checking instead.

You can only contribute cash to a retirement plan, however. Other assets, like stocks, are not considered regular contributions.

Just remember to keep all your financial objectives in mind before moving money to a retirement account.

Where To Invest After Maxing Out Your 401

If you have maxed out your 401, there are other types of tax-advantaged accounts you may be interested in investing in. These include the following:

- Traditional or Roth IRAs: These accounts have a lower contribution limit than a 401. There are income limits for making deductible IRA contributions or for investing in a Roth IRA, but they provide more flexibility in what you invest in. Also, Roth IRAs allow you to invest with after-tax dollars and take tax-free withdrawals, which could provide more tax savings than a 401 if you expect your tax rate to be higher in retirement.

- Health savings accounts: These are open only to individuals with qualifying high-deductible health insurance plans. You contribute with pre-tax funds, money grows tax-free, and withdrawals for qualifying health expenditures are also tax-free. These are the only accounts offering a triple tax benefit. Seniors can also make penalty-free withdrawals for any reason after reaching age 65, but they would be taxed on those withdrawals at their ordinary tax rate.

You can invest in these accounts after maxing out your 401 if you are eligible for them. You can also choose to split your contributions between your 401 and these other types of accounts after putting enough into your 401 to get the maximum employer match — even if you haven’t yet put the full $20,500 or $27,000 into your 401 account.

Recommended Reading: How To Take A Loan On My 401k

Contribution Limits Are Increasing In 202: 3 Tips To Maximize Retirement Savings

Increased annual contribution limits for 401 and other retirement savings plans have been announced by the IRS. Contribution limits are usually increased each year by the IRS, so this comes as no surprise however, the announcement is making headlines because this increase is a record jump. Understandably, you may be wondering how this affects you and how to get the most out of your retirement savings.

What To Do After Maxing Out Your 401 Plan

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If you’ve already reached your 401 contributions limit for the year , that’s a problem. You can’t afford to fall behind in the funding-retirement game. Also, losing the contribution’s reduction in your gross income isn’t going to help your tax bill next year, either. These pointers will help you decide how to handle maxing out your contributions and hopefully avoid a large tax burden.

You May Like: How To Close A Fidelity 401k Account

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.