Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

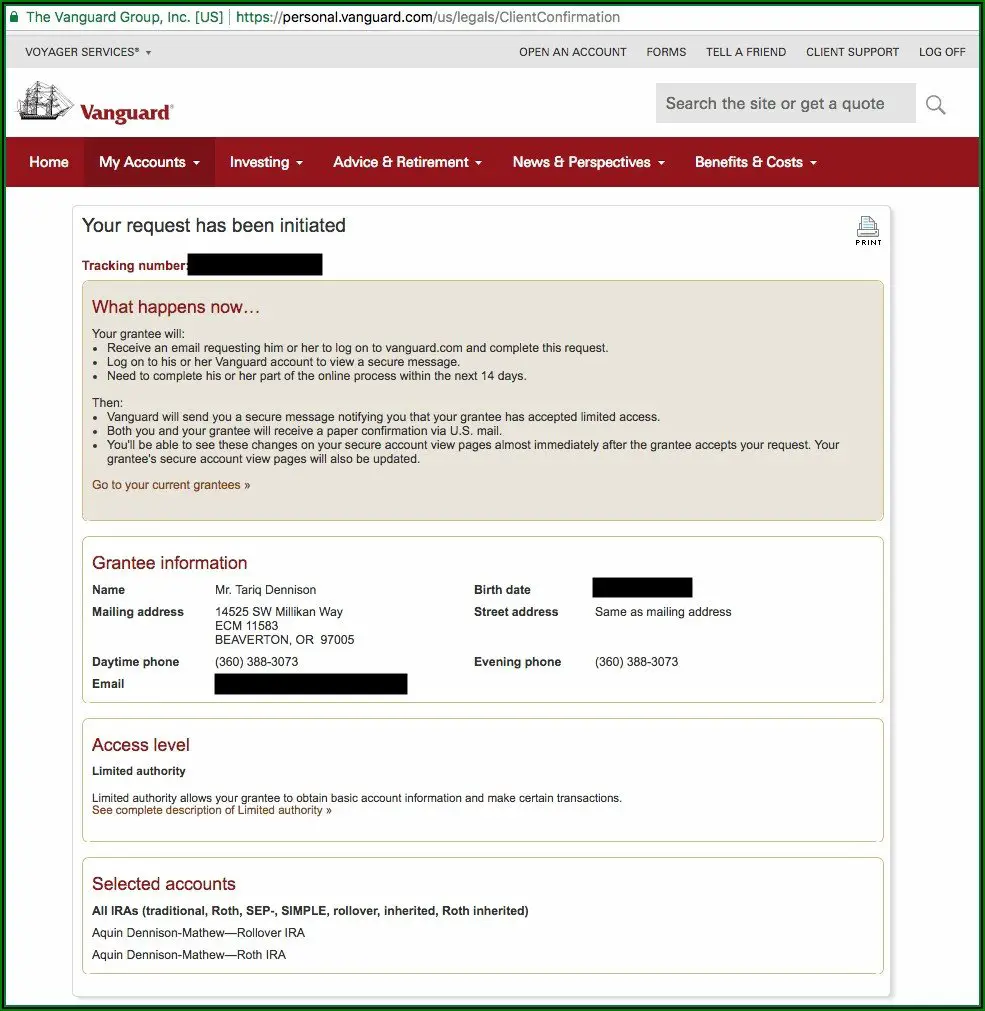

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

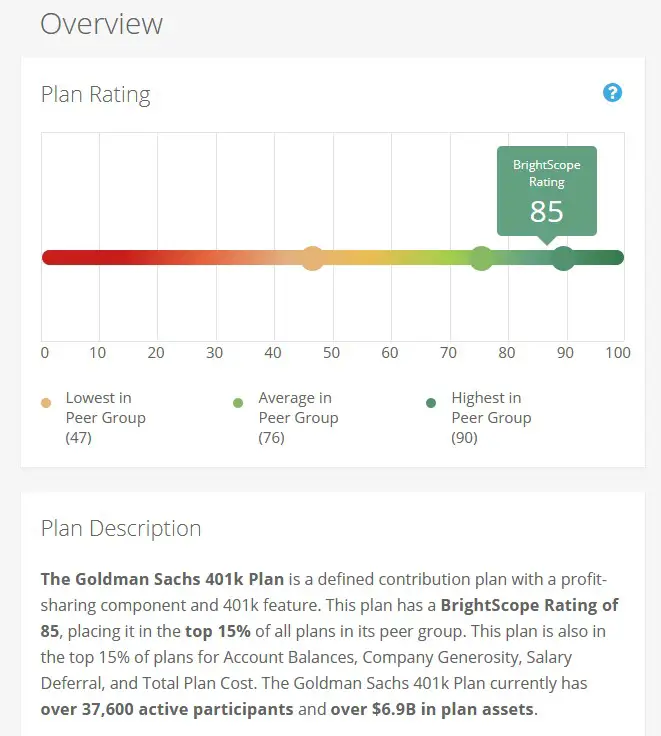

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Roll The Funds Into An Individual Retirement Account

If your new employer doesnt offer a 401 plan or you simply prefer to manage your money on your own, the money can be transferred to an IRA. Similar to rolling the funds to a new employers 401 plan, you would need to contact the administrator of your previous 401 program and ask them to disburse the funds directly to your IRA administrator.

There are important and somewhat complex rules to navigate when rolling the money into an IRA in order to avoid tax consequences. For instance, money from a Roth 401 or Roth IRA cannot be rolled into a Traditional IRA, which is an account funded by pre-tax contributions, explains Tierney. The money must be rolled into an account with the same type of tax status.

However, traditional 401 funds can be rolled into either a Roth IRA or a Traditional IRA. But here too, there are tax ramifications to be aware of.

If you roll money from a pre-tax 401 into a Roth IRA it would be a taxable event because youre converting those funds from pre-tax funds to a Roth, says Tierney. But there may be reasons that you want to do that. You may want the features of a Roth account. Or you may expect your taxes to be higher in retirement, so you want the money to be taxed at your current lower tax rate now.

You may also want to convert the money to a Roth so that you can leave the money to your heirs tax-free.

You May Like: What Is 401k Self Directed Brokerage Account

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Recommended Reading: How To View Your 401k

Recommended Reading: How Does 401k Work At Retirement

What Happens To Your 401k When You Quit Or Fired

Shawn Plummer

CEO, The Annuity Expert

If you are considering quitting your job or have been recently fired, its important to know what will happen to your 401k. What happens to your 401k when you quit? What should you do with it? Can I cash out my 401k if I quit? What if I dont have a 401k account at all? Well answer these questions and more in this guide!

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Also Check: How To Request 401k Withdrawal

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Roll It Over Into Your Current Employer’s 401

Another option is rolling the old 401 into your current employer’s 401. This can make it easier to keep track of your retirement accounts and might open up broader investment choices. But be sure you’re aware of how your current employer’s 401 works before transferring money from your old 401 into it.

Read Also: Can You Roll Your Pension Into A 401k

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

Rolling Over To An Ira

If your new employer doesnt permit rollovers, or youre not impressed with its investment options, you can roll your 401 into an IRA with any financial services firm.

Rolling over your 401 into an IRA could also allow you to build an investment strategy thats more customized than one you would get in a 401 plan. Unlike 401 plans, which typically offer a limited number of funds, IRAs offer a broad menu of investment options.

If you go that route, make sure you take advantage of resources provided to you by the financial services firm, such as information about the funds, historical fund performance and manager information, to determine the best lineup for you, says Kailyn Neat, a CFP for Bartlett Wealth Management, in Cincinnati.

Also Check: What Companies Offer The Best 401k Match

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Investing For Retirement With Sofi

When can you retire? The answer depends on how much you have saved already, including any money thats in an old 401 account or money youve got stashed in an IRA. SoFi offers both traditional and Roth IRAs to help you build wealth for the future. A traditional IRA offers the benefit of tax-deductible contributions. Meanwhile, a Roth IRA offers tax-free qualified withdrawals in retirement.

If youre ready to take the next step, learn more about investing for retirement with SoFi.

Don’t Miss: How To Start My Own 401k

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

You Could Roll It Over Into A New Or Existing Retirement Account

Then again, you might not want to leave your old 401 where it is. It could just be for your own sanity. The more investment accounts you have, the more logins you have to remember, the more tax documents you have to wait for, the more addresses and beneficiaries and email addresses you have to keep up to date.

Also, when you have all your investments in one place, its a lot easier for your advisor to help you make sure that your investment portfolio is properly diversified, and forecast whether youre on track to hit your goals, like we do for you at Ellevest.

If youre starting a new job that offers a 401 and their plan allows it , then you might be able to combine your 401s by rolling over your old one into the new one. A rollover might be a good choice especially if your new 401 has particularly low fees or unique investment options.

If you arent opening a new 401, or if you just want more choices about what kinds of things you invest in or the fees youll have to pay, then you could roll over your 401 into an IRA instead, be it one you already have or a new one altogether. Heres an article that lists out the pros and cons of rolling over into a new 401 vs an IRA.

The good news is, there arent really any wrong answers. No matter what you do with your old 401, the fact that youre thinking about the options and making a decision means youre looking out for Future You. And thats really what this is all about.

Planning to work past the age of 72?

Fees and Expenses

Read Also: Can I Borrow From My 401k To Buy Investment Property

Don’t Be Forced Out Of A 401 From Your Former Job

When you change jobs and abandon vested amounts in your 401, your former employer has to follow IRS rules and plan provisions for dealing with your account balance. Pursuant to these guidelines, the 401 plan may have a force-out provision. That means when your vested balance is less than $5,000, you can be forced to take your money out of the plan.

Your former employer is required to give you advance notice of this rule so you can decide what to do with the money. Your choices are to cash out your account and receive a check, or roll your account balance into an IRA or your new employers plan.

What happens if you fail to respond to the notice? If your vested balance is more than $1,000, your former employer must transfer the money to an IRA. For balances under $1,000, you will either get a check or your former employee will open an IRA on your behalf.

Neither outcome is optimal, according to a report by the U.S. Government Accountability Office. If you receive the money, youll owe federal income tax. When the balance is transferred to an IRA, account fees may outpace investment returns and your balance will be eroded over time.

Protecting assets you worked for and earned is always a smart move. Consult your tax professional for assistance.

What Happens To My 401 When I Leave Does It Follow Me

When you quit your job, you wont be able to contribute to that particular 401 anymore, because its tied to your employer. But the money already in the account is still yours, usually, so it can just sit in that account for as long as you want with a couple of exceptions:

-

First, if you contributed less than $5,000 to that 401 while you were with that employer, they can legally tell you, Closing time! Your money doesnt have to go home, but it cant stay here.

-

If you contributed between $1,000 and $5,000, your employer might move your money into an IRA, a move otherwise known as an involuntary cashout.

-

If you contributed less than $1,000, they might just mail you a check for that amount. If that happens, you should deposit it into another retirement account ASAP so that you dont get hit with a penalty from the IRS .

Also relevant: If you had 401 matching, be sure to check whether there was a vesting schedule attached. If so, you only get to keep the employer contributions that had fully vested as of your last day. Your employer gets to take back any unvested contributions. If there was no vesting schedule in other words, if 100% of employer contributions vested immediately then its all yours.

Recommended Reading: Can I Rollover Multiple 401k To Ira

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.