Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

No Early Withdrawal Penalties

- Leverage retirement funds tax penalty-free. Normally, if you decide to pull from your pre-tax retirement funds, youâre hit with hefty tax penalties, plus an early withdrawal fee of 10 percent for those younger than 59 and ½. However, ROBS is one of the few methods that enables you to leverage retirement funds without incurring tax penalties or other fees, allowing you to put more of your money to work for you.

Invest In The Asset Of Your Choice

What is Checkbook Control?

Checkbook control allows you to invest directly in alternative assets without the need for a custodian for everyday transactions. Our Checkbook Control Model gives you the 3 C’s!

Control – YOU control all of your investment decisions.

Cost – YOU save money by avoiding asset-based fees.

Choice – YOU have the freedom to invest in various different types of assets.

“Completely BLOWN away by their customer service. From the moment I contacted them to hear about their options regarding Self Directed IRA’s, through the setup process and implementation, they’ve been amazing. Responsive, informative, and quick. I could not recommend Broad Financial more highly.”

– Sean D.

“I’ve been a long-time customer of Broad Financial and have enjoyed working with them. I feel confident that our plan is up to date and compliant. Their customer service is friendly and responsive.”

– Earl C.

“I opened an account with Broad several years ago and after talking to other investors – they’re sorry they didn’t. Broad makes things so simple and they are always there to answer questions . I cannot recommend Broad Financial highly enough.”

– Shawn Y.

You May Like: How Long Can You Contribute To A 401k

Questions About The Satisfaction Guarantee

- What fees are covered by the guarantee?

-

We’ll refund fees or commissions included in:

- What Schwab Bank fees are covered by the guarantee?

-

We’ll refund fees included in:The Schwab Bank Deposit Account Pricing Guide

- Are any fees not covered by the guarantee?

-

While the guarantee covers a wide range of fees and commissions, there are services to which it does not apply. These include accounts managed by investment advisors who are not affiliated with Schwab, such as through Schwab Advisor Network® and Managed Account Select®. The guarantee also does not apply to operating expenses charged by mutual funds and ETFs, or interest paid on margin loans.

If you have questions on whether the guarantee applies to any particular fee, please call a Schwab investment professional for assistance.

- Who should I contact if I have questions or would like to request a refund?

-

You can call a Schwab investment professional 24/7 at . Or, if you work with a Schwab Financial Consultant, you can contact your consultant.

- How long do I have to request a refund under the guarantee?

-

Refund requests must be received within 90 days of the date the fee was charged.

- How long will it take to receive my refund?

-

Funds will be credited to the account charged in approximately four weeks of a valid request.

How To Roll A 401 Into An Ira

Heres how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If youre not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Read Also: How Much Are You Penalized For Early Withdrawal Of 401k

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Use Your Ira To Start A Business Or Grow Your Business

Finance a BusinessOther Funding

Do you have a retirement plan? Chances are, you do. Retirement account owners typically have either a 401 from a current employer or an Individual Retirement Account . But did you know that you can use your IRA to start a business or grow your existing business?

This is called 401 business financing and its been increasing in popularity among aspiring and current small business owners. Essentially, 401 business financing lets you use money from your retirement plan to start a business or access more capital for your current business! And you can keep growing your retirement funds as your business grows.

Whether you have a 401 or an IRA, you should know how your retirement investment strategy can contribute to your financial success. You should also know how many dollars you have in retirement plans and how you can use them to your advantage.

But how do you know if you qualify for 401 business financing or if its the best business decision for you? Keep reading to find out. When it comes to business funding, the more you know up-front, the better!

Read Also: Can You Rollover A 401k Into An Existing Ira

What Is 401 Business Financing

401 business financing, also known as Rollovers for Business Startups , is a small business and franchise funding method. ROBS allows you to draw money from your retirement account in order to start or buy a business without incurring an early withdrawal fee or tax penalty. This is not a loan ROBS gives you access to your own money so you can build the life you want without going into debt.

How To Choose Rollover Ira Investments

- Based on the asset allocation, you can select a few low-cost index mutual funds or ETFs.

- If you were invested in a target-date fund in your 401, you could invest in a similar fund at a broker.

- If your new IRA account is opened at a robo-advisor, the computers algorithms will select and rebalance your investments based on the answers you provide to the questions on timeline and risk tolerance.

Read Also: Does A Solo 401k Need An Ein

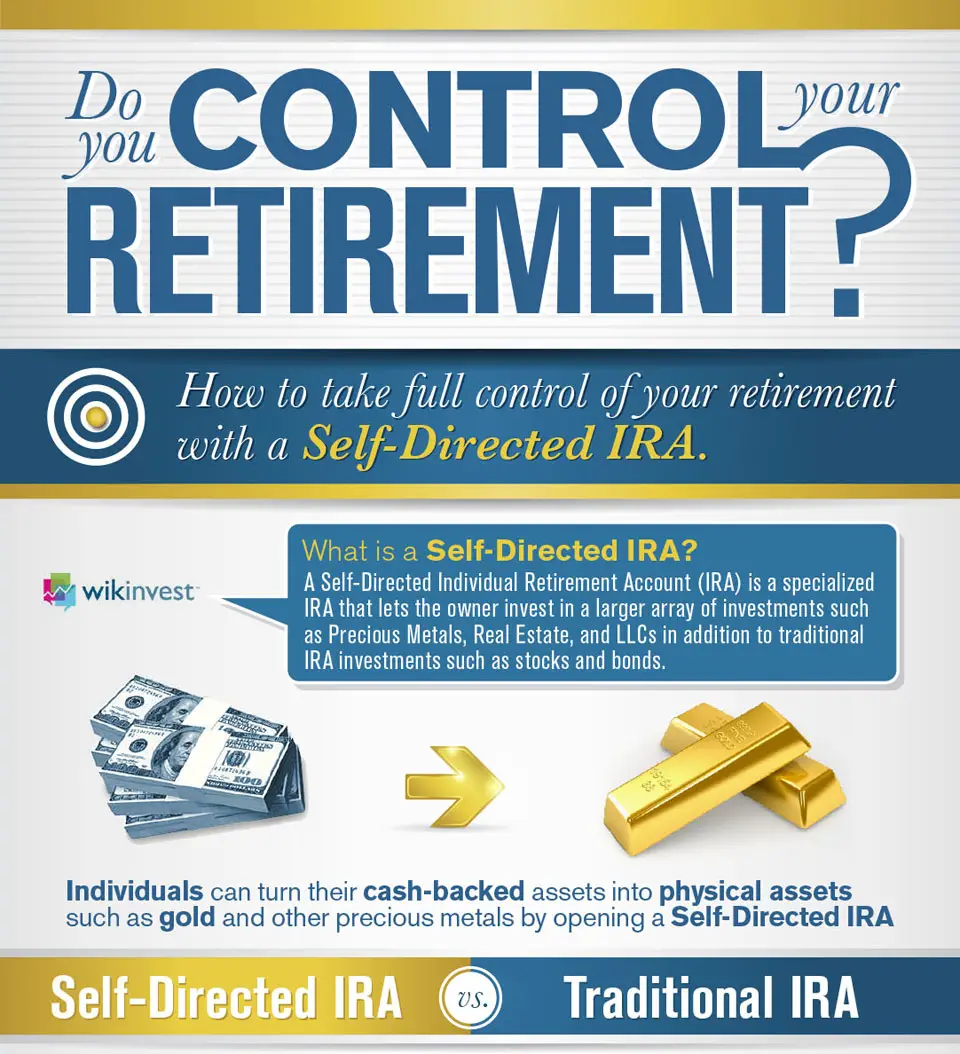

Can An Employee Roll Over A 401 Into A Self

Some 401 plans include a provision for in-service IRA rollovers.

Comstock Images/Comstock/Getty Images

Employer-sponsored 401 plans usually include investment options such as stock funds, bond funds and money market accounts. But in some instances, you may not like the options your employer offers. The good news is that you always have the option of investing your money on your own.

If you’ve already put money into your employer’s plan, you can also roll that money over into an account of your choosing. But be aware that you may experience different contribution limits with the new plan you choose.

Gain Control Of Your Self Directed Ira

Broad’s IRA LLC features unlimited free transactions with checkbook control, incredible client support, and no asset-based fees.

An IRA LLC allows you to purchase assets quickly without any transaction fees. It also offers multi-member investing and superior liability protection. The process works by setting up a specialized LLC for your IRA and then using that LLC to invest your retirement funds. An IRA LLC is most suited for assets like real estate whose upkeep and management involve numerous transactions.

Ready to start investing in your future?

Schedule a complimentary call with our IRA Specialists to learn more about Broad’s IRA LLC

You May Like: How To Roll My 401k Into A Roth Ira

How To Complete A Self

Many benefits come with self-directed IRAs, such as having the freedom to invest in whatever you want. However, you may be wondering how you can move money that you have from an older 401 or IRA. Well, its quite simple to roll over or transfer from an existing into a new SDIRA account. If you need some assistance on how to complete a self-directed IRA rollover, we are here to help. Follow our guide on how to do so below.

Examples Of Improper Uses Of Ira Funds:

- Taking a loan from the IRA. IRAs are prohibited from making loans to any party.

- Using IRA funds for a real estate purchase .

- Using IRA funds as collateral to secure a loan.

- Paying too much for IRA plan management.

Improper Uses of IRA Funds with Family Members:

- A sale, exchange, or property leasing between the IRA plan and a related family member.

- Lending money from your IRA plan to a related family member.

- Furnishing goods, services, or facilities using your IRA funds to a related family member.

- Transfer to, or use by, a related family member of the income or assets of the IRA plan.

- Act by a related family member whereby they deal with the income or assets of the IRA plan in their own interest or for their own account.

- Receipt of any benefit for their own personal account by any related family party in connection with a transaction involving the income or assets of the IRS plan.

Also Check: Can I Use 401k Money To Buy A House

How Rollovers For Business Startups Works

Chances are, you have retirement savings sitting in a 401 or similar type of retirement account. If youre also considering starting a small business venture, whether LLC or sole proprietorship, you may be surprised to find out you can use your retirement assets, or eligible 401 funds, to start or buy a business. Keep in mind you will encounter both startup costs and additional costs for marketing and other business operations. There are a variety of types of small business loans, and some can be hard to secure if you have a lower credit score or are new to business and dont have a strong track record of experience. Thats why 401 funding also known as Rollovers as Business Startups is an excellent option that allows you to tap your qualified retirement account to start your business debt-free.

Rollovers as Business Startups has paved the way for thousands of individuals to achieve their entrepreneurial dreams by using their retirement assets. The structure does have a variety of requirements and moving pieces so keep reading before you jump in. Lets look at some of the dos and donts of ROBS to help guide you through this complex transaction process so you ensure you dont end up with a financial risk that could have you paying a withdrawal penalty. When you follow all of the transaction rules, ROBS can be a smart choice for prospective business owners to utilize their qualified retirement plan funds to start a business.

Top Three Gold Ira Companies

Agusta Precious Metals is a leading gold IRA company that is based in Casper, Wyoming. The company was founded over ten years ago and has quickly risen to the top of the list of gold IRA providers. The company has been very aggressive about creating a customer-oriented process for purchasing gold and silver as part of their retirement.

GoldCo is a California-based precious metals company that has managed gold IRAs for over a decade. They have become one of the leading companies to provide Gold and Silver IRAs. The company has exceptional reviews across all of the review sites and has a perfect rating with the Better Business Bureau.

GoldCo has an extensive line of gold and silver coins that you can purchase as part of your retirement package. They work with a few IRA management companies so that you can select the account that best meets your needs. They also work with several depositories across the country for gold asset storage.

Based in Los Angeles, American Hartford has been serving clients since 2012. The company has gained in popularity because of its exceptional customer service and educational materials. American Hartford ranks highly across all review sites.

For your retirement, you can purchase gold, silver, and platinum coins and bars from American Hartford Gold. If you are a collector, you can also purchase these coins and bars for your personal use. Offers the largest selection of coins and bars in the industry.

Also Check: Can You Start A 401k Without An Employer

How Does 401 Business Financing Work

401 business financing allows you to tap into your retirement account and use that money to start or buy a business or franchise. To access your money without triggering an early withdrawal fee or tax penalty, a ROBS structure must first be put in place. The structure has multiple moving parts, each of which must meet specific requirements to stay compliant with the IRS.

Why Rollover Your 401k Into An Ira

A self-directed IRA gives you even more control over your retirement savings. One of the ways is that you can choose the company that oversees it, and you can look for a company with lower maintenance and transfer or purchase fees than what is currently offered by your employer.

You may also want to rollover into an IRA because it is easier to manage all of your retirement savings in one location. This can make it easier to make sure you have balanced your investment correctly. If you are managing multiple accounts, you may become confused at what investments are in each account. Consolidating them into an IRA just makes the entire process easier for you.

Recommended Reading: How To View My 401k Account

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Can I Roll Over A 401 403 Or Other Former Employer’s Plan Into A Self

Yes, you can move a 401 into a Self-Directed IRA! Self-Directed IRA custodians accept rollovers from qualified plans such as 401s or 403s.You’ll need to contact your current plan administrator to verify whether your account is available to be rolled into a Self-Directed IRA . In most cases, you can roll over your 401 to an SDIRA upon separation of service or retirement age . So whether it’s through retirement, termination, or quitting a job, once you’re gone, you should be able to roll over a 401.

You May Like: When Can You Take 401k Out

Tips For A Smooth Ira Rollover/transfer

- Required Documentation

Investors will require an ID copy to start an account and a current statement for the account in motion to roll over your 401 or execute an IRA Transfer to an individually-directed IRA. Before transferring the money, the self-directed IRA must be opened.

Understanding your exact form of retirement account, such as a Traditional IRA, Roth IRA, or another type, is essential when shifting your retirement savings. The type of account to which some funds can be transferred is restricted.

- Covid-19 Restrictions

Some 401 plan rules have been loosened due to the coronavirus epidemic. If your plan permits, you can transfer money to a self-directed IRA and make non-stock market investments. For further information, speak with a plan administrator.

A person with several investment accounts may merge them into one IRA to simplify management.

For instance, a worker who often changes jobs and has a pattern of leaving 401 accounts with each new employer may discover that, over time, it is challenging to keep track of the assets in all of the many plans or even to know how to access the accounts.

Rolling the previous plans into one new account outside the workplace may make sense if the new conventional IRA offers comparable or superior investment options, reduced costs, faster access, and enhanced communication.

Final Words

The most typical method of moving a 401 or other retirement investment account to another IRA is through a transfer or rollover.