Top Contribution Method: Max Your 401k Percentage

If you want maximum funding for your 401k plan, then determining the contribution percentage is straightforward, even without a 401k max contribution calculator. The maximum contribution per year is age based and changes depending on whether youre age 50 and over, or whether youre under the age of 50, as set forth below. To calculate the correct percentage to contribute, divide the annual limit by the number of total yearly paychecks. The result should then be divided by your gross salary per paycheck to learn the contribution percentage.

Recommended Reading: Where To Put 401k After Retirement

How Much Should Be In Your 401 At 30

Modified date: Jun. 1, 2022

How much should be in your 401 at 30, 40, 50, etc? What about other retirement accounts? These are good questions.

Ill try to answer them in this article, but I should warn you: Personal finance is personal.

The more you can contribute to your 401, and the sooner you can start, the better. But everybodys situation is different. Dont beat yourself up if you feel behind in the retirement game remember, you cant change yesterday but you can take action today and change tomorrow.

Whats Ahead:

How Can I Protect My 401 From A Stock Market Crash

Although there is no way to perfectly protect your investments from a financial downturn, there are solid strategies you can take to hedge against a major crash. These include keeping a diverse portfolio, not panicking about a stock market crash when dips happen in the market, and consistently funding your 401 over time.

Also Check: How Much Do I Need In My 401k To Retire

What Is A Good Rate Of Return On A 401

How you define a good rate of return depends on your investment goals. Average 401 returns typically range between 5% and 10%, depending on market conditions and risk profile. If you’re playing catch-up, you may want higher returns. If you have a long way until retirement and a low tolerance for risk, you might be comfortable with a lower return.

Maximum 401 Contribution Limits

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Don’t Miss: How To Draw Money From 401k

Choosing Investments Within A Plan

Generally, 401 plans offer several options in which to invest contributions. Such options generally include mutual funds that may invest in stocks for growth, bonds for income, or money market investments for protection of principal. This flexibility may help lower investment risk by diversifying a portfolio amongst different types of classes, manager styles, investment styles, and economic sectors.

Millennials Are Contributing Less Than Recommended

Xavier Epps, Founder & CEO of XNE Financial Advising

Ideally, if you have a 401, you should contribute 15-20 percent of your gross income into it. However, Millennials are contributing about 7.3 percent of their paychecks to retirement savings plans, according to Fidelity. Millennials are either a couple of years into their careers or still at their beginning stages. They face student debt, credit card, and low wages from either being underpaid or working part-time to pick up skills to use later in an established career.

There is no concrete number to how much one should contribute to his/her 401 in early career days, but one should look into their lifestyle and spending habits. Budgeting is key to savings. Budget for essentials such as rent, utilities, loan/credit payments, groceries, transportation, and anything else that you need. Include in your essentials contributions to your 401, and appropriately allocate a percentage of your income to your savings.

Recommended Reading: Is Rolling Over 401k To Ira Taxable

Contributions: How Much Is Enough

Please fill out all required fields

Email addresses provided will be used only to let the recipient know who sent the web content. The information will not be used for any other purpose by Securian Financial.

Thank you for sharing

Your message has been sent.

When you land your first full-time job, chances are your employer will offer you the chance to contribute to a 401. Should you participate? And, if so, how much should you contribute?

If youre lucky enough to work for a company that offers a 401, most financial experts will recommend that you participate in the plan and that you do so as soon as possible. Heres why.

These Accounts Can Be A Great Way To Save For Retirement While Giving You A Tax Break Now But Beware Of The Fees Plan Providers Charge For 401s

When you start a job at a mid-sized or larger private employer, chances are you will be offered a 401 account as a way to save for retirement. These tax-advantaged plans allow you to put money aside through payroll deductions. Since its inception 40 years ago, the 401 has become the retirement plan of choice for most employers, largely replacing traditional pension plans.

To encourage employees across the company to get started saving money, many companies offer match programs: basically, if you save some money in your 401, your employers will give you additional money to put in that account.

Read on for 10 things you need to know about these powerfulretirement plans.

Don’t Miss: How To Use Money From 401k

How To Calculate A 401 Annual Return

When you invest a lump sum of money, calculating the average annual return is simple. But since you make regular contributions to your 401, you can’t just take the ending balance and divide it by the starting balance.

If you’re calculating your return for a one-year period:

- Take the ending balance and subtract any contributions you made over the past year.

- Divide by the starting balance from one year ago.

- Subtract 1 and multiply the result by 100. That will tell you the percentage total return.

If you’ve used a period other than a year, there’s more math involved. Take the number you got from dividing the adjusted ending balance by the starting balance and then use an exponential calculation as follows:

- For a two-year period, you’ll need to take the square root. On a calculator, use the power key to raise the number to the 1/2 power. For a three-year period, you’d raise it to the 1/3 power, and so on.

- Then take the final answer, subtract 1, and multiply the result by 100. What’s left is the average annual return.

The longer the period you’re measuring and the more contributions you’ve made, the less accurate this simple calculation will be. A more appropriate calculation is the time-weighted return, which measures actual investment portfolio performance regardless of deposits or withdrawals.

Less Than 25 Years Old

- Average 401 balance: $6,718

- Median 401 balance: $2,240

- Contribution rate: 8.1%

Although many people younger than 25 years old are new to the workforce or are not in a job where a 401 plan is offered, their average 401 balance increased 23 percent in 2020 compared to 2019, and 49 percent of those who are eligible for a 401 plan are participating in it. This indicates that this generation is indeed planning for retirement early on.

Recommended Reading: How To Find Where Your 401k Is

Develop Other Sources Of Income

Think about other ways you can secure sources of income in retirement outside of collecting Social Security and withdrawing from your 401k. This will not only prevent you from having all your retirement eggs in one basket, but it is also something to consider if your 401k balance is lower than youd like. Where can you invest and how can you optimize your portfolio for greater returns? Consider other ways you can supplement your retirement income, and speak to your financial advisor about what solutions could work for you.

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time you’ve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Here’s the average amount people have saved for retirement by age group, according to Vanguard’s data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Don’t Miss: Can I Roll Over My 401k To An Ira

Why Contribute To A 401

A 401 is an investment plan sponsored by your employer to help you save for retirement.

If you work for a tax-exempt or non-profit organization, or a state or local municipal government, you may be offered a 403 or 457 plan, respectively which share some common features with 401 plans but there are also differences, so be sure to understand the details before you invest.

The main advantages of 401 plans include:

Start Lower And Increase Later

If you find that you cant contribute as much as you think you will need because of your living expenses or debts, figure out what you can contribute. Start by making a budget.

Think about increasing your contributions later on, consider doing so when you get a raise, a promotion, or on a set periodic basis. The important thing is to start saving as early as possible. And if circumstances change, you can update your contribution rate at any time.

Read Also: Can I Get My 401k If I Quit

Use Target Date Funds To Retire On Your Terms

Target date funds are geared toward people who plan to retire at a certain timethe term “target date” means your targeted retirement year. These funds help you maintain diversification in your portfolio by spreading your 401 money across multiple asset classes, including large-company stocks, small-company stocks, emerging-markets stocks, real estate stocks, and bonds.

Youll know your 401 provider offers a target-date fund if you see a calendar year in the name of the fund, such as T. Rowe Price’s Retirement 2030 Fund.

Target date funds make long-term investing easy. Decide the approximate year you expect to retire, then pick the fund with the date closest to your target retirement date. For example, if you plan to retire at about age 60, and that will be around the year 2030, pick a target-date fund with the year “2030” in its name. Once you pick your target-date fund, it runs on auto-pilot, so there is nothing else you need to do but keep contributing to your 401.

Basics Of 401 Allocation

When you allocate your 401, you can decide where the money you contribute to the account will go by directing it into investments of your choice.

At a minimum, consider investments for your 401 that contain the mix of assets you want to hold in your portfolio in the percentages that meet your retirement goals and suit your tolerance for risk.

Read Also: Is 401k A Good Investment

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

You Can Choose From A Selection Of Funds In Your 401

In a 401, your employer will select the investment choices available to employees. You, as the employee, can then decide how to allocate your contribution among those available options. If you dont make a selection for your contribution, your money will go to a default choice, likely a money-market fund or a target-date fund.

Most plans will offer actively managed domestic and international stock funds and domestic bond funds, plus a money-market fund. Many plans also offer low-cost index funds. .)

Increasingly popular on the 401 menu: target-date funds, which nearly 70% of plans offer. Over time, this breed of fund typically shifts from a stock-heavy portfolio to a more conservative, bond-heavy portfolio by its target date.

You May Like: What Happens To 401k When You Leave Your Job

Aim To Invest As Much As Possible In Your 401 And Other Retirement Accounts

A 401 can be a convenient and simple way to save for retirement, although you have other options, including traditional IRAs and Roth IRAs.

You should be investing in these retirement plans throughout your career with the goal of amassing a nest egg large enough to meet your needs. If you aren’t hitting your investment targets, consider carefully reviewing your budget to find more opportunities to save. As you earn salary increases, you may also want to save those raises in your 401 rather than spending the extra income since this can make it easier to hit your savings targets.

When Does The Year End For A 401 Match

In terms of IRS contribution limits, the year resets on January 1. Any contributions and matches made during the year count toward your total contribution limit for the year. It’s referred to as a calendar year. Your employer might choose to deposit its match each time you withhold your contribution from your paycheck, or it may deposit it at less frequent intervals, say, quarterly or yearly.

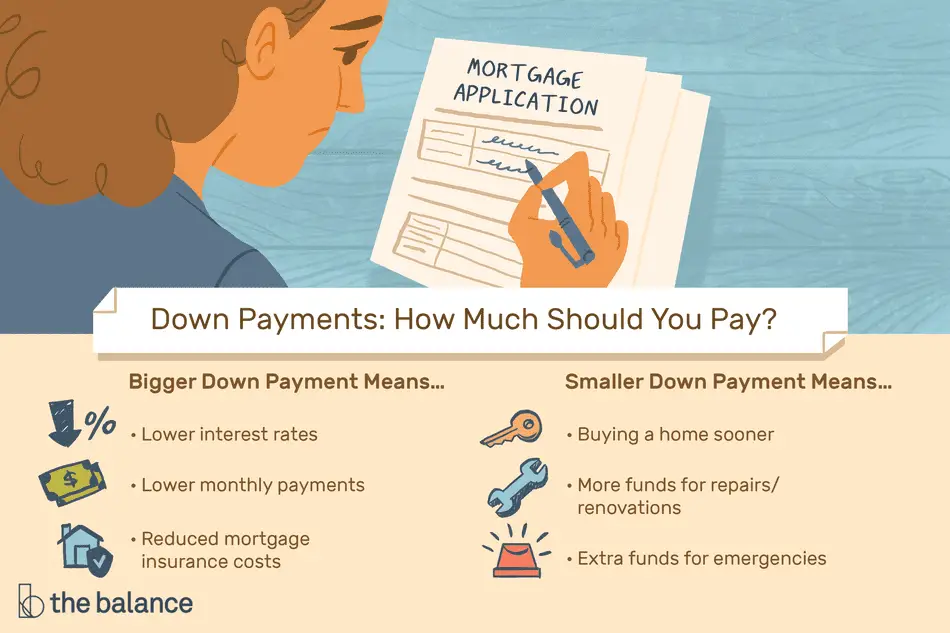

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

Read Also: How To Get Your 401k

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

Don’t Miss: How Can I Get My 401k Money Without Penalty

It Never Hurts To Save More

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, Past returns are no guarantee of future performance? Thats why. Its true that the annual average return of the S& P 500 between 1928 and 2014 was 10%. But that doesnt mean well get that average return over the next 86 years.

Jack Bogle, the father of index funds and founder of Vanguard, says that investors should plan on lower returns in the coming decade and other commenters suggest lower yields even beyond that.

We have no way of knowing what future returns will bethey could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

How Much Could Your 401 Grow

The earlier you start investing in your 401, the easier it is to build a hefty balance thanks to compound earnings.

When you invest money, your investments earn money for you. This can be reinvested so you then have a larger pool of assets earning returns. Your money can grow exponentially. That’s why Albert Einstein was famously quoted as describing compound interest as the “eighth wonder of the world.”

The chart below shows how much $1,000 invested in your 401 could turn into by age 67, depending on when you make your $1,000 investment and assuming an 8% average annual rate of return.

Table by author.| $354,569 | $195,076 |

Higher earners need more money saved for retirement because, in most cases, they are used to a higher standard of living. They will need their retirement investment accounts to produce sufficient funds to maintain their lifestyle after their paychecks stop.

Many workers contribute a set percentage of income to their 401, such as 10%. With this percentage-based approach, higher earners inevitably invest more for retirement each year than their lower-earning counterparts.

You May Like: How Do You Get Your 401k When You Retire