How To Decide Which Rollover Is Right For You

When you leave an employer for non-retirement reasons, for a new job, or just to be on your own, you have four options for your 401 plan:

Let’s look at each of these strategies to determine which is the best option for you.

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

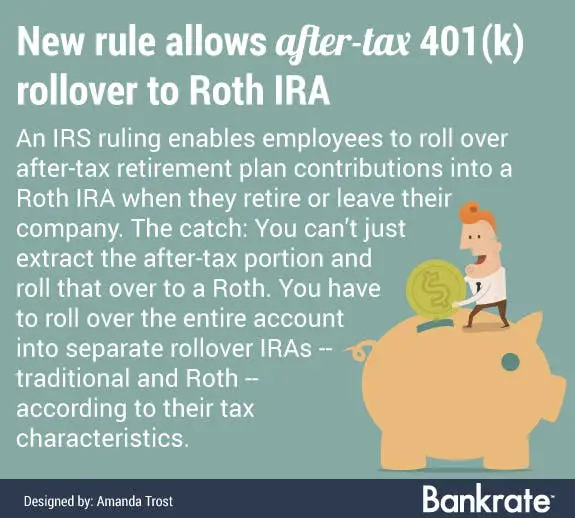

Roth Conversions

Recommended Reading: Can I Take Money Out Of My Fidelity 401k

What Are The Benefits Of A Roth Individual Retirement Account

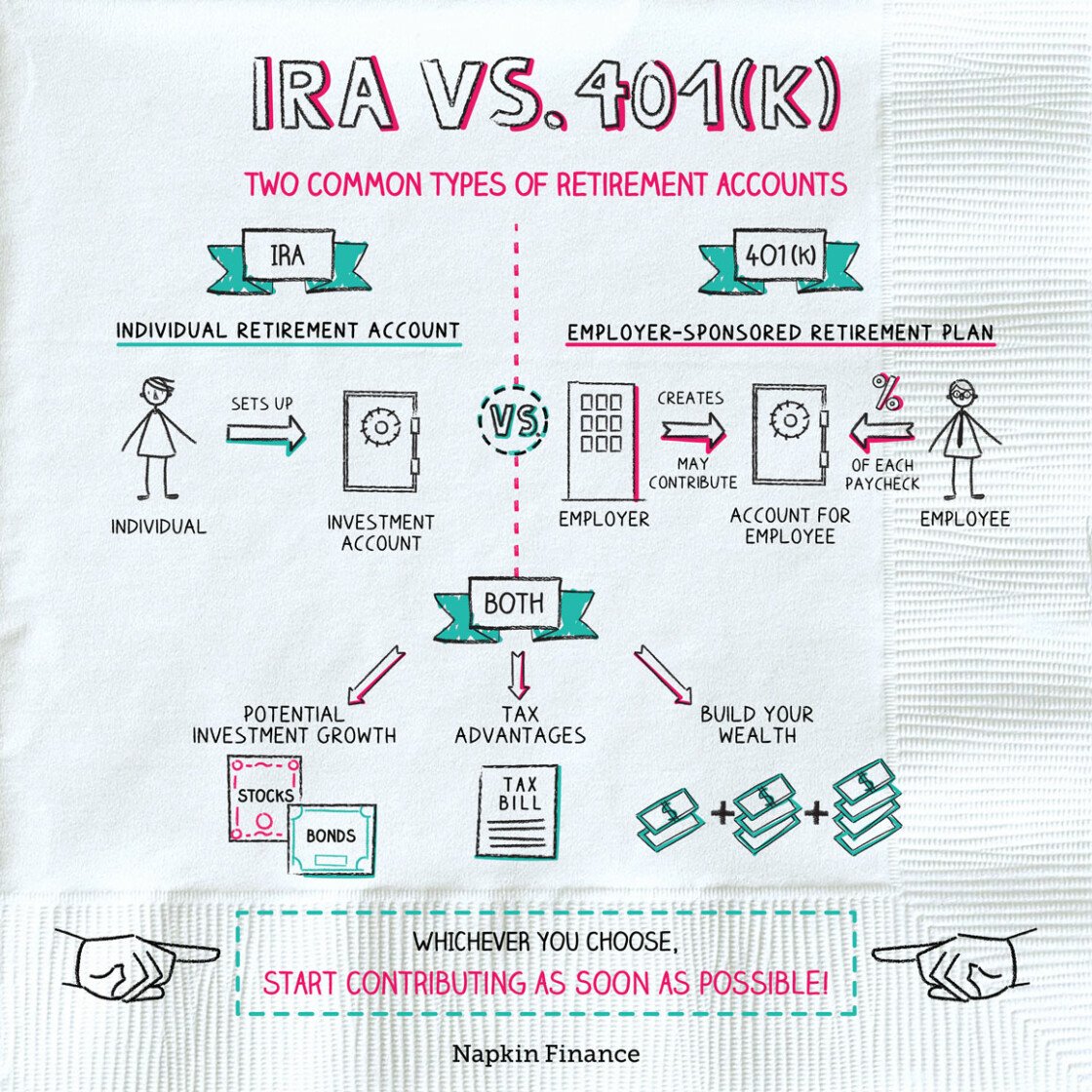

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time during the contributed tax year, regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

Recommended Reading: Is There A Limit On Employer 401k Match

How To Convert A Simple Ira To Aroth Ira

To convert a simple IRA to a Roth IRA, you should first contact theplan administrator for the simple IRA to make certain that you have passed thetwo-year limitations period. Plan administrators use different dates tocalculate when you have met the requirements of the rule.

You do not want to try to complete a simple IRA rollover to a Roth IRAbefore that date. If you do, the IRS will count the amount that you contributeto your Roth IRA as a distribution. This means that you will have to count theentire amount that you transfer as ordinary income that could throw you into ahigher tax bracket. You also may exceed the annual contribution limits for aRoth IRA. Finally, if you are under age 59 1/2, you will have to pay a 25percent penalty.

Once you have satisfied the two-year rule, the answer to can youconvert a simple IRA to a Roth becomes easier. You can open a Roth IRA accountand then fill out paperwork with the administrator of your simple IRA thatinstructs the plan to send acheck directly to your new Roth plan. You do not want the plan to send acheck to you directly because it might be counted as a distribution, subjectingyou to a penalty.

Read Also: How To Find My 401k Money

How Is The Ira Tax Credit Changing

The new law will repeal and replace the IRA tax credit, also known as the “Saver’s Credit.” Instead of a nonrefundable tax credit, those who qualify for the Saver’s Credit will receive a federal matching contribution to a retirement account. This change in tax law will start with the 2027 tax year.

Congress also amended the IRS laws for retirement account rollovers from 529 plans, which are tax-advantaged savings accounts for higher education. Currently, any money withdrawn from a 529 plan that’s not used for education is subject to a 10% federal penalty.

Beneficiaries of 529 college savings accounts will be allowed to roll over up to $35,000 total in their lifetime from a 529 plan into a Roth IRA. The Roth IRA will still be subject to annual contribution limits, and the 529 account must have been open for at least 15 years.

You May Like: Can I Put My 401k Into An Ira

Disadvantages Of A 401 Rollover Into An Ira

Rolling over a 401 into an IRA does have some disadvantages, so youll have to weigh these against the advantages.

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense notto roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt notto defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell it , your taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment. The usual more-than-one-year holding period requirement for capital gain treatment does not apply if you dont defer tax on the NUA when the stock is distributed to you.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.

Also Check: How To Take Your 401k With You

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

What Are The New Rules For Required Minimum Distributions Or Rmds In 2023

Currently, Americans must start receiving required minimum distributions from their 401 and IRA accounts starting at age 72 . The Secure 2.0 Act of 2022 raises the age for RMDs to 73, starting on Jan. 1, 2023, and then further to 75, starting on Jan. 1, 2033.

The new rules also reduce the penalty for failing to take RMDs. The previously steep 50% excise penalty will be reduced to 25%, and lowered further to 10% if the error is corrected “in a timely manner.” The penalty reductions take effect immediately, now that Biden has signed the law.

Also Check: How To Use 401k For Business

Which Types Of Distributions Can I Roll Over

IRAs: You can roll over all or part of any distribution from your IRA except:

Retirement plans: You can roll over all or part of any distribution of your retirement plan account except:

Distributions that can be rolled over are called “eligible rollover distributions.” Of course, to get a distribution from a retirement plan, you have to meet the plans conditions for a distribution, such as termination of employment.

Delay Required Mandatory Distributions

Workers with traditional IRAs and 401s both face the same reality when it comes to taking mandatory distributions. The IRS requires that you begin taking distributions by April 1 of the year following your 72nd birthday. However, you may delay taking RMDs from your 401 if youre still working and own less than 5% of the company that sponsors the plan.

Don’t Miss: Can I Get A 401k

Simple Ira Contribution Limits

For 2021, the SIMPLE IRA contribution limits are $13,500 or $16,500 for people who are age 50 and older. For 2022, the SIMPLE IRA contribution limits rise to $14,000 or $17,000 for people 50 or older.

If you want to contribute more than that amount, you can also invest up to an additional $6,000 in a traditional or Roth IRA. You cannot, however, max out both a SIMPLE IRA and another employer-sponsored retirement plan, like a 401.

The annual total for both SIMPLE IRA contributions and 401 contributions cant be more than $19,500 for 2021 . In 2022, this increases to $20,500 . Because an employer cannot offer both a 401 and a SIMPLE IRA, this scenario would only occur if you changed employers during one year, your employer changed your plan mid-year or you had multiple jobs with retirement benefits.

How To Start An Ira For Your New College Graduate Because Even Gen Z Needs To Save For Retirement

Roth IRA or regular IRA? Starting a retirement account for your new grad is a great idea, but there are lots of things to consider as you set it up.

Also, she needs to figure out how she would pay the tax bill on the conversion. Converting a regular retirement account to a Roth can make sense if someone expects to be in a higher tax bracket later, but the math starts to fall apart if the retirement account itself has to be raided to pay the tax.

Your daughter should consult a tax pro who can review her situation and provide personalized advice.

Recommended Reading: How Much Is The Max You Can Contribute To 401k

Plan To Roth Ira Rollovers

To help alleviate parents fears about over-funding 529 college savings accounts, the Act enables penalty-free rollovers from 529 college savings plans to Roth IRAs, with limitations:

- The lifetime rollover limit is $35,000

- Annual rollover limit is pegged to the yearly IRA contribution limit, which includes contributions made to any IRA. In addition, the amount rolled over plus annual IRA contributions cannot exceed the designated beneficiarys earned income for the year.

- The individual must be the designated beneficiary of the 529 plan and move funds to a Roth IRA in their name

- The 529 account must have been opened for at least 15 years

- Contributions and earnings made within the last 5 years are not eligible for rollover

- Amount rolled over is tax-free and penalty-free

This one of the most significant changes in the Secure Act 2.0 as it is an entirely new rule. Potential planning opportunities exist, though further guidance from the IRS is needed.

For example, does the 15-year account seasoning period reset when a new beneficiary is named? If the lifetime limit only applies to the beneficiary doing the rollover, not the 529 account, the same account could accommodate multiple rollovers. As there are currently no limits on naming new beneficiaries, their age, etc. So its clear there may be some new planning opportunities on the horizon.

The ability to do 529 plan to Roth IRA rollovers goes into effect January 2024.

Its Your Money And Your Choice

When it comes to what to do, there are advantages and disadvantages to all options so theres no one right answer for all. You need to review your options and choose whats best for you and your retirement. Retirement savings is one of the most important and long-lasting investment decisions youll ever make. If youre not sure what to do, you always have the option of talking to an advisor. Whether you need a bit of advice or a comprehensive financial plan, a Certified Financial Planner can help guide you in the right direction.

Don’t Miss: How Much Do Companies Match 401k

Protection From Stock Market Downturns

You will not lose money due to market downturns in a fixed annuity or fixed index annuity. If the markets have a down year, you earn zero interest. In exchange for this protection, you are limited on the upside you can get each year, unlike an individual stock through a mutual fund.

A variable annuity will provide unlimited upside potential without protection from volatile market conditions. However, adding a Guaranteed Lifetime Withdrawal Benefit can protect the annuitant from running out of money due to a stock market crash.

K To Gold Ira Rollover Guide

Due to its economic importance, gold is a valuable metal and a common choice for people looking to protect their investments. Given the current situation, consider converting your retirement account to gold. Even so, you might think about other gold investment options.

Weve got your back, though! This 401k to Gold Rollover Guide will be helpful if thats the case. To finish the procedure, adhere to these steps.

Recommended Reading: Can I Rollover Ira To 401k

How Much Can I Roll Over If Taxes Were Withheld From My Distribution

If you have not elected a direct rollover, in the case of a distribution from a retirement plan, or you have not elected out of withholding in the case of a distribution from an IRA, your plan administrator or IRA trustee will withhold taxes from your distribution. If you later roll the distribution over within 60 days, you must use other funds to make up for the amount withheld.

Example: Jordan, age 42, received a $10,000 eligible rollover distribution from her 401 plan. Her employer withheld $2,000 from her distribution.

If you roll over the full amount of any eligible rollover distribution you receive :

- Your entire distribution would be tax-free, and

- You would avoid the 10% additional tax on early distributions.

How Do I Complete A Rollover

Don’t Miss: How To Transfer 401k Between Jobs

Old Uncashed Insurance Policies

Dear Liz: What advice can you provide to people when they stumble on old life insurance policies that may never have been cashed in?

Answer: My siblings and I have personal experience with this after coming across two policies in our late fathers papers. We learned one policy had indeed been cashed in, but the second purchased in the 1930s, with a face value of $5,000 was still in effect.

You typically can use a search engine to determine if the insurer is still in business or if it has changed its name or merged with another company. If youre having trouble tracking down the company, contact the insurance regulator in the state where the insurer was originally located.

Once you have the current insurer name and contact information, you can call and ask if the policy is still in force. If the policy has value, the insurer can instruct you how to make a claim.

Is identity theft insurance worth the expense? What do identity theft protection companies such as LifeLock and Aura do? Heres what to consider.