So How Much Is Your Match Actually Worth

If any of the above information is news to you, it might be a good idea to investigate your 401 match a little further. Talk to your company’s human resources department or your 401’s plan administrator to learn more about your company’s matching system and how to get the most out of it.

The Motley Fool has a disclosure policy.

How Do I Maximize My Employer Match

If youre not maximizing your employer match, youre in the minority. In 2018, nearly two-thirds of Vanguard plan participants received the full employer-matching contribution.

While you can contribute up to the maximum amount specified by the IRS, you can contribute less. To make the most out of your workplace retirement plan, set the minimum contribution to your plan to reach your employers maximum matching contribution.

Lets calculate what a match might look like assuming you have an annual salary of $50,000:

| Employer Match Type | |

|---|---|

| $2,000 | $4,500 |

In 2018, the average employee contribution to maximize employer match was 7.4% of their annual pay, according to Vanguard data. Your plan rules will dictate the actual contribution percentage to maximize your employer match so contact your plan administrator for more details.

What Is A Partial 401 Match

A partial 401 match is among the most common contributions made by employers. With partial matches, employers match their employees’ contributions up to a certain percent. For instance, your employer may provide a partial match of 50% of your contributions. So if you contribute $100 to your 401, your company will contribute $50.

Don’t Miss: When Can I Take Money Out Of 401k

Average 401k Match 2017

The average 401 match in 2017 was 4.5% of eligible employee compensation. A 2017 Vanguard Study titled âHow America Savesâ reported an increase in the average contributions to 4.7% up from 3.9% in 2015 and 3% during the financial crisis of 2007/08.

After the financial crisis, most companies reduced or suspended their 401 match when their earnings dropped. As revenue stabilized, employers increased their match to retain and attract the best talents, especially in competitive sectors. Most companies also introduced automatic enrollment for new hires as an inducement for employees to save for retirement.

How Much Do Companies Typically Match On 401 In 2020

Dylan Telerski / 4 Aug 2020 / Business

Getting insight into how much companies are matching on 401s in 2020 will help you know how well your employer stacks up and whether youre in the right ballpark with your contributions.

Long gone are the days where a full pension or government stipend will guarantee you a secure future. These sources of income typically comprise less than half of what you would need to live comfortably in retirement. A 401 investment account is one of the best strategies to bridge the gap and save enough money for your post-retirement years.

In addition to the contribution deducted from your paycheck, about 51% of employers offering a 401 agree to match a certain amount of employee contributions. This generous bonus is literally FREE MONEY that employers add to your retirement savings that will gain interest and compound over time to help you reach your goals faster. There is, however, one caveat to the employer match in most cases , how much you receive depends on how much you put in.

You May Like: How Much To Withdraw From 401k

Resist The Temptation To Tap Your 401

When youre contributing funds to your 401 account month after month, there will be times when the market flags and you see the value of your investments steadily decline. You may face the urge to withdraw money from the market during downturns, its essential that you resist the temptation.

Especially for young investors, its important to remind people to stay the course even when the market is volatile, said Taylor. People who are younger have time to ride out market swings.

Safe Harbor Matching Contributions

Safe harbor 401 plans are the most popular type of 401 plan used by small businesses today. They automatically pass annual ADP/ACP and top heavy tests and allow business owners to make salary deferrals up to the legal limit without the risk of corrective refunds or contributions. For a 401 plan to achieve safe harbor status, the employer must make a qualifying contribution to eligible employees.

For a matching contribution to meet safe harbor 401 requirements, it must use one of the following three formulas:

An employer may also make discretionary a matching contribution on top of these contributions and remain exempt from ADP/ACP and top heavy testing if the match meets both of the following two requirements:

- Its formula is not based on more than 6% of compensation.

- Its dollar amount doesnt exceed 4% of compensation.

Other safe harbor match requirements

You May Like: Can You Rollover A 401k Into A Roth Ira

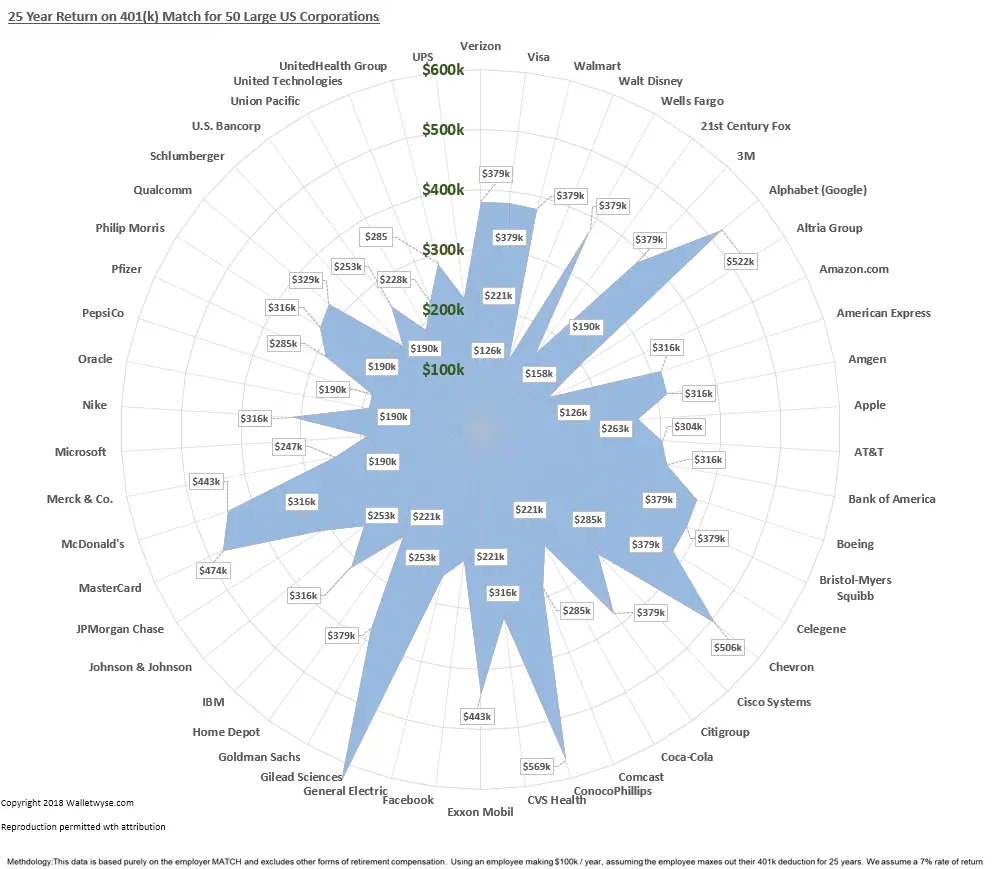

Bank Of America 401k Match

New employees are automatically enrolled into the bankâs 401 plan at 3% of the eligible pay, which increases by 1% each year until it reaches 5%. Employees can change this rate at any time.

Bank of America matches employee contributions dollar-for-dollar up to 5% of the eligible pay. However, employees must complete one year of service to get this benefit. The firm also offers an additional 2 to 3% in additional annual company contribution depending on your years of service.

Employees are 100% vested in the matched contributions at all times.

What Is A Good 401 Match

A good 401 match is usually 5% to 7% of your salary, up to a dollar-for-dollar match. For example, if you contribute 5% of your $50,000 salary, your employer will contribute 5% as well, for a total contribution of 10%. If you contributed 7%, your employer would contribute the full 7%. The 401 contribution limit for 2019 is $19,000, so if youre contributing 5%, thats $950 per year. A good 401 match can help you reach your retirement savings goals sooner. And its free money! So if your employer offers a 401 plan with a good match, take advantage of it.

Don’t Miss: How To Take Out 401k Without Penalty

Goldman Sachs 401k Match

Goldman has an automatic enrollment feature for its 401 plan that allows employees to be enrolled into the plan immediately upon hire. Employees can contribute up to 50% of their eligible pay to the plan.

For an employee to qualify for the employerâs match, he/she must have completed 12 months of service. Goldman Sachs matches 100% of the employee’s 401 contributions each pay period up to 4% of the employeeâs base pay.

Matched contributions become fully vested immediately.

Matching Contributions Are They Right For Your Plan

One of most effective ways an employer can persuade their employees to participate in a 401 plan is by matching a portion of their pre-tax or Roth 401 salary deferrals. This is unsurprising when you consider matching contributions are like a guaranteed return on salary deferrals – or free money.

Yet, despite their indisputable benefit to employees, matching contributions are not the best fit for every 401 plan. Sometimes, nonelective contributions like profit sharing which dont require employees to do anything to receive a contribution – are the better alternative. If youre a 401 plan sponsor, its important to understand your companys matching contribution options, as they can be crucial to meeting your 401 goals.

Don’t Miss: How Much Should I Put In My 401k And Roth

What Are The Benefits Of Offering A 401k To Employees

Helping employees plan for the future is a big responsibility, but it can also be very rewarding. Employers who offer a 401k may be able to:

- Attract and retain talent In addition to competitive salaries and health benefits, retirement savings plans can be a major influencer with candidates who are weighing different job offers.

- Improve retirement readiness Employees who are financially prepared for retirement can leave the workforce when the time is right, thereby creating growth opportunities for other employees and new talent.

- Take advantage of tax savings Businesses that sponsor a 401k are potentially eligible for a $500 tax credit to cover startup administration costs during the first three years of the plan. Additional tax deductions may be available if the employer matches employee contributions.

- Enhance productivity through financial wellness A retirement savings plan is one of the cornerstones of financial wellness. And when employees feel secure about their future, they tend to be less stressed and more productive at work.

Also Check: How To Pay Off 401k Loan

Safe Harbor Matching Formulas

Safe Harbors are a popular type of 401 plan that allows businesses to bypass many of the annual IRS nondiscrimination testing requirements when they agree to a standard matching formula. Any employer contributions made in a Safe Harbor plan must be fully vested for all employees.

The most common Safe Harbor 401 matching formulas are:

- 100% match on the first 3% of employee contributions, plus 50% match on the next 3-5%

- 100% match on the first 4-6% of employee contributions

- At least 3% of employee pay, regardless of employee deferrals

You May Like: Can I Invest My 401k In My Own Business

What Do Small Employers Do

-

Some dont match. According to Vanguard, 25% of 401 plans at small businesses do not provide an employer contribution. Matching is not mandatory but many employers provide this benefit because it helps with recruiting and retaining talented employees and shows theyre investing in their employees future.

-

Some match right away some have a wait. Among small businesses that offer employees a 401 match, 19% of plans provide immediate employer-matching contributions 40% require one year of service before employer-matching contributions kick in.

-

The majority offer immediate vesting: 69% of plans offered by smaller businesses provide immediate vesting for employer-matching contributions .

Do Employers Really Match Contributions To 401s

Yes. And it has been the norm for several years now. In the 18th edition of its How America Saves report, Vanguard analyzed 1,900 defined contribution retirement plans plans) representing a total of 5 million participants and found that 95% of plans provide employer contributions, up from 91% in 2013.

Employers recognize the power of a 401 as a strong tool for attracting and retaining talent. 31% of employees value an employer-sponsored 401 over a salary raise, according to a Glassdoor poll. In addition, a 401 match contribution is tax-deductible for employers. Every dollar a company contributes to employees 401 plans is tax-deductible, providing ongoing tax benefits to companies.

Read Also: How To Get My 401k Early

Don’t Miss: How Do I Cash Out My 401k After Being Fired

Matching Makes Financial Sense

401 matching makes financial sense for employers and employees alike. Employee matching is the best way for employees to maximize their retirement savings, while employers get the benefits that come with investing in their team members futures namely, tax savings and reduced employee turnover. Learn more about employee retirement plans and their features in our buyers guide.

Kimberlee Leonard contributed to the writing and reporting in this article.

What Is A Dollar

With a dollar-for-dollar 401 match, an employers contribution equals 100% of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary.

We commonly see employers offer a 3%, dollar-for-dollar match, said Taylor. They match 100% of your contributions up to 3% of your salary.

Imagine you earn $60,000 a year and contribute $1,800 annually to your 401or 3% of your income. If your employer offers a dollar-for-dollar match up to 3% of your salary, they would add an amount equal to 100% of your 401 contributions, raising your total annual contributions to $3,600.

Also Check: How To Sign Up For 401k

Whats A Typical Employer Match To A 401

Ever wondered how employers calculate matched contributions? In 2018, Vanguard administered more than 150 distinct match formulas . With 71% of plans using it, the most popular formula is the single-tier formula, such as $0.50 per dollar on up to 6% of pay. Under this single-tier formula, an employee making $60,000 per year could get up to $1,800 in employer-matched contributions.

Here are the most common employer matching formulas per the Vanguard survey:

| Match Type | |

|---|---|

| Variable formula, based on age, tenure or similar vehicles | 2% |

There are literally hundreds of matching formulas out there, so contact your 401 plan administrator regarding the rules and specifics of the matching formula used by your employer.

-

The most common matching formula among Vanguard plan holders was $0.50 per dollar on the first 6% of pay.

-

The second most popular formula for employer matching contributions is $1.00 per dollar on the first 3% of pay and $0.50 on the next 2% of pay. Under this multi-tier formula, the same worker in our previous example would receive up to $2,400 in matching contributions.

Dont Miss: How Much Can You Put In Your 401k A Year

How Does 401 Employer Matching Work

Siân Killingsworth / 14 Sep 2022 / 401 Resources

A 401 is the standard retirement plan offered by companies across the nation as part of their employment benefits package. Many of those employers also offer whats known as a matching contribution as an added benefit. Matching means that the employer contributes a specified amount to the employees retirement plan based on the employees annual contribution.

Why would an employer give money away? Well, there are three valuable benefits employers can derive from small business 401 matching:

- Increased employee retention and morale

- The ability to attract and retain top talent

- Significant company tax incentives

Also Check: Can You Transfer 401k To Ira While Still Employed

How Much Should You Match 401 Contributions

Employers 401 match amounts vary widely. However, all contribution limits and withdrawal regulations must comply with the standards of the Employee Retirement Income Security Act. Otherwise, you can set your 401 contribution rates however you please.

There are two especially common methods for determining how much money you should contribute to your employees retirement accounts:

- As a percentage of an employees wages: Some employers will match all employee contributions up to a contribution limit equal to a percentage of an employees wages. For example, if you set a contribution limit of 4% of an employees income and the employee makes $50,000 per year, you will contribute at most $2,000 over the course of the plan year. Note that if your employee contributes less than $2,000 to their retirement account, you have to match only that amount, not the full $2,000.

- As a percentage of an employees contributions: Other employers will match a percentage of contributions instead. For example, if you choose to match 40% of your employees contributions with the same 4% contribution limit as in the prior scenario, then for an employee with a $50,000 annual salary, your employer contribution limit isnt $2,000 over the course of the plan year. Instead, its $800 .

Did you know?:Self-employed 401 plans may not offer employer matching, but they still allow independent contractors and sole proprietors to save for their retirement.

Can I Afford It

Offering a retirement plan with a match may be less expensive than you think: With modern providers, a 401 for an entire company may cost less than a single employees health insurance. Companies that offer some level of matching are likely to stand out among similar businesses that do not offer this benefit, giving a boost to recruitment and retention initiatives.

Also Check: Can I Start My Own 401k Plan

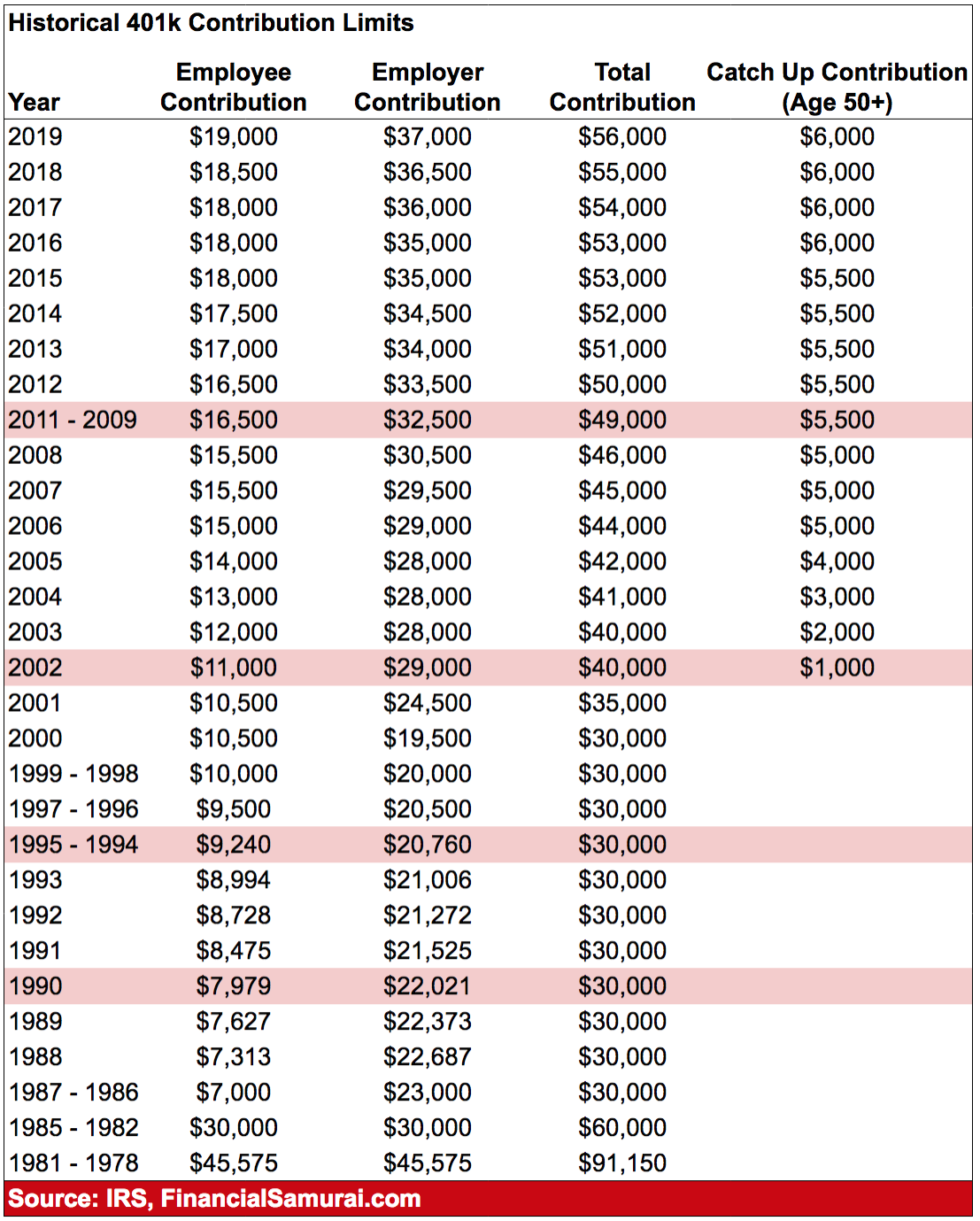

Are There Rules For 401 Matches

Employees can make pre-tax contributions to a 401 plan up to the $20,500 maximum for 2022 . Employer contributions may lead to a total contribution in excess of $20,500* that is, theyre outside the annual contribution limit applied to employees.

An employer is typically the one to set rules around their maximum contributions. Its largely driven by the matching formula and rules that the employer lays out.

One more caveat to know here: If the employee is also the employer, e.g., if they are self-employed, then an employee can contribute up to $57,000 for 2020 *, or 100% of their compensation, whichever is less.

*$20,500 if theyre under age 50 $27,000 is the annual contribution limit for employees if the employee is age 50 or older. $57,000 is the total if youre under age 50. If youre age 50 or older, the $6,500 catch-up contribution can be added on top.

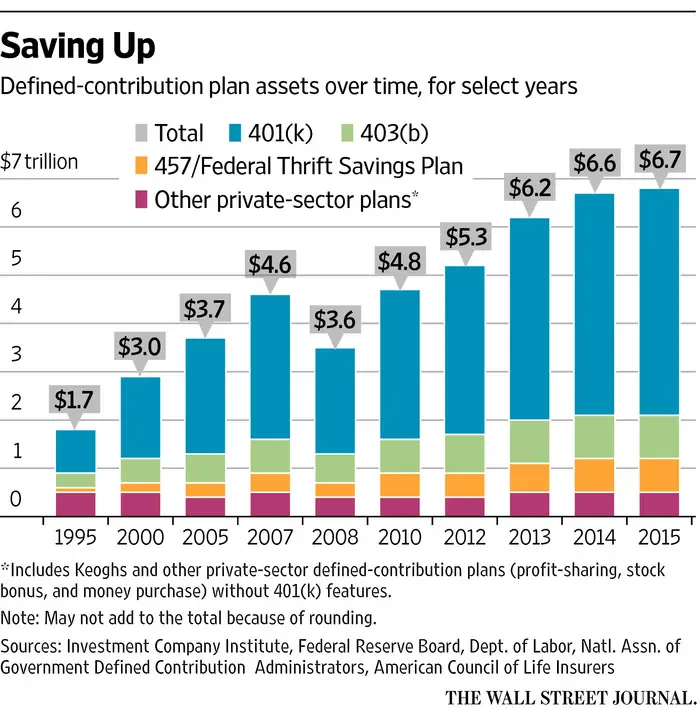

What Is 401k Matching

For most employees, a defined contribution plan is one of the primary benefits offered by their employer, with a 401k being the standard employer-sponsored retirement plan used by for-profit businesses. Employer matching of your 401k contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Similarly, some employers use 403b or 457b plans. While there are some minor differences between these plans, they are generally treated in a similar manner, and they usually have the same maximum contribution limits.

The type of plan is based on the type of entity:

- 403b plans are used by tax-exempt groups, such as schools or hospitals.

- 457b plans are for government workers, although there are some non-governmental organizations that also qualify to use these plans.

Whether youre on your first job or are thinking about retirement, here are a few considerations to keep in mind when offered an employer match to your 401k contributions.

You May Like: Where Can I Move My 401k Without Penalty