Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover ChartPDF summarizes allowable rollover transactions.

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Rolling Over To A New 401

If your new employer allows immediate rollovers into its 401 plan, this move has its merits. You may be used to the ease of having a plan administrator manage your money and to the discipline of automatic payroll contributions. You can also contribute a lot more annually to a 401 than you can to an IRA.

Another reason to take this step: If you plan to continue to work after age 72, you should be able to delay taking RMDs on funds that are in your current employer’s 401 plan, including that roll over money from your previous account. Remember that RMDs began at 70½ prior to the new law.

The benefits should be similar to keeping your 401 with your previous employer. The difference is that you will be able to make further investments in the new plan and receive company matches as long as you remain in your new job.

But you should make sure your new plan is excellent. If the investment options are limited or have high fees, or there’s no company match, the new 401 may not be the best move.

If your new employer is more of a young, entrepreneurial outfit, the company may offer a Simplified Employee Pension IRA or SIMPLE IRAqualified workplace plans that are geared toward small businesses plans). The Internal Revenue Service does allow rollovers of 401s to these, but there may be waiting periods and other conditions.

You May Like: Can You Use Your 401k To Invest In Real Estate

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

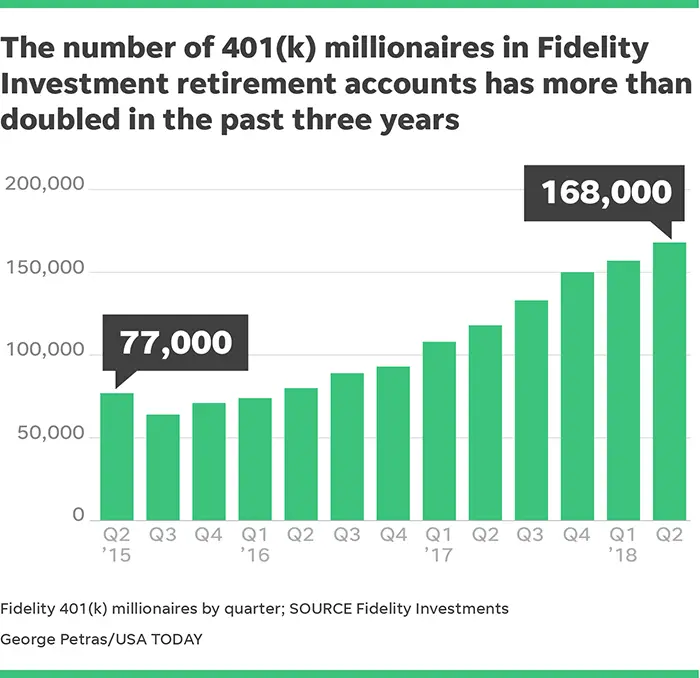

Don’t Miss: How To Rollover 401k Into Fidelity

How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

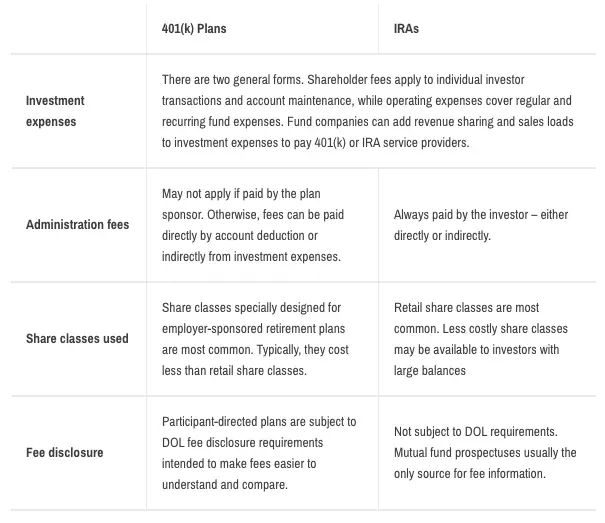

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

Also Check: Should You Convert Your 401k To A Roth Ira

You’ll Have A Broader Mix Of Investment Options

When your money is in your employer’s 401 plan, you can only invest in the assets that plan makes available. This could be a limited range of funds, which may have high fees or not be well-suited to your investment goals. This narrow range of choices isn’t the ideal investment strategy for most people.

“The more investment options you have, the more likely you are to make better decisions,” the Ramsey Solutions blog reads. “Thats why Dave likes to say if you have two bad options in front of you, go look for better ones!”

Rolling over a 401 into an IRA — instead of leaving the money with your old employer or moving it into your new employer’s plan — opens up the door to many more investments than a 401 would offer. You can find those better investments Ramsey was talking about.

In fact, when you pick a brokerage firm for your IRA, you can select from a wide range of financial institutions that offer access to lots of different kinds of investments, from stocks and bonds to mutual funds to cryptocurrencies and beyond. You will have far more choices about where to put your money and can pick the investments that are right for you.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Recommended Reading: Can You Use Your 401k To Pay Off Debt

How Many 401k Rollovers Per Year

The IRS imposes certain restrictions on the number of times you can rollover 401s and IRAs. Find out how many times you can rollover 401 per year.

If you are looking for greater flexibility with your retirement money, you could consider rolling over your 401. The IRS allows 401 participants to move the retirement money from one retirement account to another. You can rollover your 401 funds to a new 401 or an IRA. However, 401 rollovers are subject to certain restrictions that participants must observe.

There is no limit on the number of 401 rollovers you can do. You can rollover a 401 to another 401 or IRA multiple times per year without breaking the once-per-year IRS rollover rules. The once-per-year IRS rule only applies to the 60-day IRA rollovers. You can only rollover the 60-day IRA rollover once per year, but there is no limit on direct trustee-to-trustee IRA rollovers.

Roll Over Your 401 To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, principal at wealth management firm Homrich Berg.

Recommended Reading: How Much Can Be Put In 401k Per Year

What Is A Gold Ira Rollover

As a potential investor, you must first decide whether to invest in physical gold, gold provider stock, a gold growth fund, or an exchange-traded gold fund. Real gold, gold coins, or bullion investments must meet the IRS’s purity requirements, and the gold must be stored with an IRS-approved trustee and cannot be kept at home.

Transferring retirement assets to a gold IRA is more complex and expensive. You’ll have to open up a self-directed IRA to be able to invest in a broader range of assets. Then you’ll need to choose a custodian to assist you in setting up and managing your self-directed accounts. The custodian you choose must be able to store actual gold for you and must be approved by federal and state regulators to provide asset custody services.

After that, the physical gold is obtained through a broker. The trustee may have an established relationship with brokers and can refer you to them. Choosing a broker is critical since the broker is in charge of picking gold that meets the federal government’s inclusion standards in an IRA. At a minimum, you want your broker to have the following characteristics:

Rollover To A Traditional Ira

Transferring funds between a traditional 401 and a traditional IRA or between a Roth 401 and a Roth IRA is relatively straightforward. In many cases, you can do a direct rollover, also called a trustee-to-trustee transfer. This involves your 401 provider wiring funds directly to your new IRA provider. Alternatively, your 401 provider may send you a check that you then deposit into your new IRA.

Look out for any taxes your provider may have preemptively deducted. You shouldnât owe any taxes or penalties as long as you deposit money in a tax-advantaged retirement account within 60 days.

Also Check: What Is The Best 401k Fund

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

You May Like: How Do I Take Money Out Of My Fidelity 401k

Tax Consequences Of A 401

As mentioned above, you generally wont have to pay any taxes on your 401-to-IRA rollover. The only time youll have to deal with taxes is if you have a traditional IRA and want to roll over to a Roth IRA.

One other tax consideration: You can choose to do a direct or indirect rollover. For a direct rollover, your old plan sends the money directly into your new IRA. In an indirect rollover, your old plan sends you a check with the cash and withholds 20% of your funds. These withheld funds are a taxable distribution unless you make up the difference out of pocket. Youll likely have to pay a 10% fine for the early withdrawal. This rule only applies if the check is sent directly to you, though. It doesnt matter if your old plan sends you a check to forward to your new IRA.

Recommended Reading: How To Track 401k Check

Distributions Ineligible For Rollover

Some distributions from your workplace retirement plan are ineligible to be rolled over into an IRA. For example, required minimum distributions are ineligible, as are loans and hardship withdrawals.

It’s worth noting Roth 401s have required minimum distributions, but Roth IRAs do not. Therefore, it may make sense to roll over a Roth 401 account into a Roth IRA before you face required minimum distributions.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Start a Quote

Read Also: What Happens To My 401k When I Quit My Job

Which One Do You Choose

Where are you now financially compared to where you think youll be when you tap into the funds? Answering this question may help you decide which rollover to use. If youre in a high tax bracket now and expect to need the funds before five years, a Roth IRA may not make sense. Youll pay a high tax bill upfront and then lose the anticipated benefit from tax-free growth that wont materialize.

If youre in a modest tax bracket now but expect to be in a higher one in the future, the tax cost now may be small compared with the tax savings down the road. That is, assuming you can afford to pay taxes on the rollover now.

Bear in mind that all withdrawals from a traditional IRA are subject to regular income tax plus a penalty if youre under 59½. Withdrawals from a Roth IRA of after-tax contributions are never taxed. Youll only be taxed if you withdraw earnings on the contributions before you’ve held the account for five years. These may be subject to a 10% penalty as well if youre under 59½ and dont qualify for a penalty exception.

Its not all or nothing, though. You can split your distribution between a traditional and Roth IRA, assuming the 401 plan administrator permits it. You can choose any split that works for you, such as 75% to a traditional IRA and 25% to a Roth IRA. You can also leave some assets in the plan.