Take A Home Equity Loan

If you own a home, you can consider going with a home equity loan instead. Youll need at least 20% equity to secure the loan. The average interest rate on these loans is around 5.33%, which is much better than the rates on other forms of financing . You should also note that there are no tax deductions unless youre reinvesting the loan into your home.

Read Also: What Is A 401k Vs Roth Ira

Roth Withdrawals Of Contributions

There are two main kinds of retirement accounts: traditional and Roth.

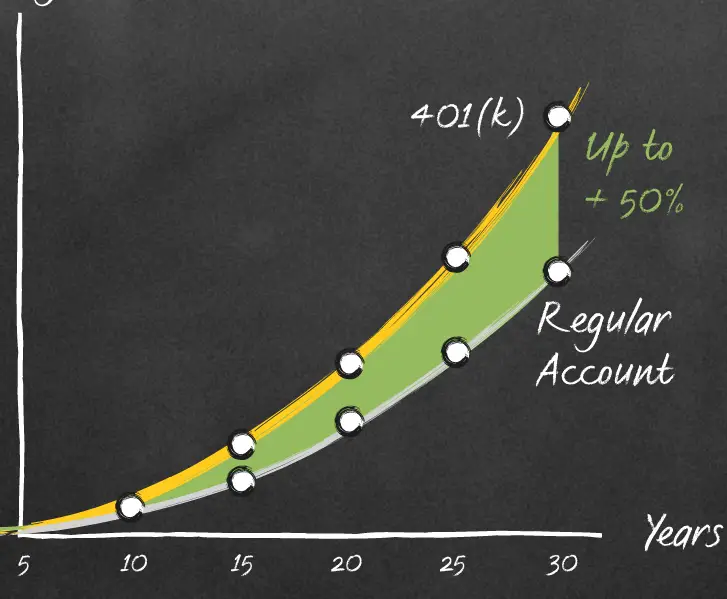

- With a traditional 401 or IRA, your contributions are PRE-tax, taking a deduction on the amount contributed. Earnings grow tax-deferred. However, you are subject to taxation on withdrawal, regardless if it was contributed or appreciated dollars.

- When you contribute to a Roth account, you put in AFTER-tax dollars. This means you must pay taxes on the money youd like to contribute . The good news? Earnings are tax-free and all qualified withdrawals are tax-free. You may be subject to taxation on earnings if you withdraw before age 59.5 and dont meet certain criteria.

- Many people convert funds from a regular to a Roth account in order to minimize taxes on future gains. Learn more about Roth conversions.

In addition to tax-free gains, another advantage of Roth accounts is that you are free to make penalty-free withdrawals on the amount of funds you contributed to a Roth IRA at any time so long as the money has been held in the account for five years. This is because youve already paid Uncle Sam his cut before the money entered the account.

If you are planning an early retirement, it may behoove you to plan early and convert funds that can be withdrawn.

You can model these conversions in the NewRetirement Planner.

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

Recommended Reading: How To Withdraw From 401k After Age 60

Understanding 401 Early Withdrawals

If an account holder takes withdrawals from their 401 before age 59½, they may incur penalties in the form of additional taxes. The additional tax for taking an early withdrawal from a tax-advantaged retirement account is 10% on top of any applicable income taxes.

The 10% early withdrawal tax may be waived if the account owner withdraws 401 funds in order to pay for certain qualified expenses, however.

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

Read Also: How Much Do You Have To Withdraw From 401k

Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Other Alternatives To Taking A Hardship Withdrawal Or Loan From Your 401

- Temporarily stop contributing to your employers 401 to free up some additional cash each pay period. Be sure to start contributing again as soon as you can, since foregoing the employer match can be extremely costly in the long run.

- Transfer higher interest rate credit card balances to a lower rate card to free up some cash or take advantage of a new credit card offer with a low interest rate for purchases .

- Take out a home equity line of credit, home equity loan or personal loan.

- Borrow from your whole life or universal life insurance policy some permanent life insurance policies allow you to access funds on a tax-advantaged basis through a loan or withdrawal, generally taken after your first policy anniversary.

- Take on a second job to temporarily increase cash flow or tap into family or community resources, such as a non-profit credit counseling service, if debt is a big issue.

- Downsize to reduce expenses, get a roommate and/or sell unneeded items.

Read Also: How To Protect Your 401k In A Divorce

Make Smart Use Of Your Assets

Look at potential income sources. You might consider generating income from your home, for example, with a home equity line of credit . Perhaps you can downsize your residence. If you sell and receive a substantial amount of money, consider using it to purchase a bond ladder or a period-certain annuity that can provide regular income until you start taking Social Security.

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, youll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Don’t Miss: How Do I See How Much Is In My 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

career counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Read Also: Can You Transfer Money From 401k To Roth Ira

Option : Leave It Where It Is

You dont have to move the money out of your old 401 if you dont want to. You wont ever lose the funds provided you dont lose track of your old account again. But this option is usually the least desirable.

For one, its more difficult to manage your retirement savings when theyre spread out over many accounts. You also get stuck paying whatever your old 401s fees were, and these can be higher than what youd pay if you moved your money to an individual retirement account, for example.

But if you like your plans investment options and the fees arent too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you dont forget.

Also Check: How To Recover 401k From Old Job

Making A Hardship Withdrawal

Depending on the terms of your plan, however, you may be eligible to take early distributions from your 401 without incurring a penalty, as long as you meet certain criteria. This type of penalty-free withdrawal is called a hardship distribution, and it requires that you have an immediate and heavy financial burden that you otherwise couldn’t afford to pay.

The practical necessity of the expense is taken into account, as are your other assets, such as savings or investment account balances and cash-value insurance policies, as well as the possible availability of other financing sources.

What qualifies as “hardship”? Certainly not discretionary expenses like buying a new boat or getting a nose job. Instead, think along the lines of the following:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

The home-buying expenses part is a bit of a gray area. But generally, it qualifies if the money is for a down payment or for closing costs.

You May Like: Who Is The Plan Administrator For 401k

Do You Pay Taxes On 401k After Age 65

Tax on a 401k Withdrawal after 65 Miscellaneous Whatever you take from your 401k account is a taxable income, as would a regular regular payment when you contributed to the 401k, your contributions were pre-tax, and so you are taxed on retirees.

How old can you get your 401k without paying taxes? After you turn 59, you can withdraw your money without having to pay an early retirement penalty. You can choose a traditional plan or Roth 401 . The traditional 401 offers deferred tax savings, but you still have to pay taxes when you take the money.

If Youre Still Working For The Company

Most 401 plans dont allow regular withdrawals at age 55 while youre still working for the company. A regular withdrawal is defined as one thats not subject to penalties and doesnt require you to qualify based on special circumstances.

You might be able to take a 401 loan or qualify for a hardship withdrawal rather than take a regular withdrawal if your 401 plan allows these options. Not all 401 plans are required to offer loans or hardship withdrawals, however.

You can check with your plan administrator to see if they have a special provision that allows for something called an in-service distribution.

Also Check: How Can I Get Money From My 401k

How Do I Avoid Tax Penalty On 401k Withdrawal

Heres how to avoid 401 charges and penalties:

- Avoid the penalty of early withdrawal 401 .

- Shop for funds at low cost.

- Read your 401 rate statement.

- Do not leave a job before dressing in the 401 plan.

- Drag your 401 directly to a new account.

- Compare 401 loans with other loan options.

How do I avoid imposition if I cash in on my 401k? If you keep $ 1000 to $ 5000 or more when you leave your job, you can transfer the funds to a new retirement plan without paying taxes. Other options you can use to avoid paying taxes include taking out a 401 loan instead of a 401 withdrawal, charity donation, or Roth contribution.

How The Rule Of 55 Works

The rule of 55 affects how and when you can access your retirement savings. If you are between ages 55 and 59 1/2 and get laid off or fired or quit your job, the IRS rule of 55 lets you pull money out of your 401 or 403 plan without penalty. It applies to workers who leave their jobs anytime during or after the year of their 55th birthday.

There is a slight catch. The Rule of 55 only applies to assets in your current 401 or 403. Thats the one you invested in while you were at the job you leave at age 55 or older.

Money in a former 401 or 403, is not covered. You would have to wait until age 59 1/2 to begin withdrawing funds from those accounts without paying the 10% penalty.

There is a strategy to use if you know you will be leaving the job. You can get penalty-free access to plans from former employers if you roll them into your current 401 or 403. Once that is done, you can leave your current job before age 59 1/2 and withdraw the money using the Rule of 55.

The rule of 55 does not apply to individual retirement accounts . If you were to move assets into a rollover IRA upon leaving your job, you would not be eligible for early withdrawal with no penalty.

You May Like: How Much Does A 401k Cost A Small Business

How 401 Plans Work

A 401 plan allows employees to contribute pre-tax earnings toward retirement. Contributions are often invested in mutual funds or company stock and grow tax-free until retirement, when distributions are treated as taxable income. Normally, workers cannot access 401 funds until they are 59½. Early withdrawals are subject to a 10% penalty, in addition to being taxed as ordinary income.

Some plans allow for a 401 hardship withdrawal. These distributions can be taken due to an “immediate and heavy financial need.” Individuals taking a hardship distribution may be subject to the 10% early withdrawal penalty, as well as taxes.

How A 401 Loan Works

Given all the drawbacks of early withdrawals, you might consider borrowing from your 401 instead.

In general, you can borrow up to $50,000 or 50% of your vested account on a tax-free basis if you repay the loan within five years. That said, if you leave your job, you may be expected to pay off the loan in a short period of time. A 401 loan can be a better option than an early withdrawal for a couple of reasons:

- You won’t owe taxes or a penalty on the amount you borrow unless you violate the loan limits and repayment rules.

- If you repay the loan on time, you won’t miss out on years of growth like you would with a withdrawal.

- The interest you pay on a 401 loan can go back into your 401.

That said, some 401 loan plans don’t let you contribute to retirement while you have an outstanding balance. Additionally, the money you use to pay back the loan is already after-tax income. This money will be taxed again once you take it out after you’ve retired.

Note: Not all companies offer 401 loans. Don’t assume you can take one before checking with your plan’s administrator.

Also Check: Can You Use 401k To Pay Taxes

Do I Have To Pay Taxes On My 401k Withdrawal In 2020

401 Tax Rates Your 401 deductions will be taxed as income. There is no separate 401 withdrawal tax. Any money you withdraw from your 401 will be considered as income and will be taxed as such, in addition to any other source of taxable income you receive.

Are 401k withdrawals taxed in 2020?

Traditional 401 deductions are taxed at an individuals current income tax rate. In general, Roth 401 withdrawals are not taxable if the account has been opened for at least five years and the account holder is 59½ or older. Employer matching contributions to a Roth 401 are subject to income tax.

Is the cares Act still in effect for 401k 2021?

However, the CARES Act allows you to distribute your retirement tax over three years 2020, 2021 and 2022. If you refund some or all of the distribution to your account, the IRS will consider this amount as a rollover and not subject to income tax.

Dont Miss: How To Roll Over 401k To New Employer Vanguard

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

Recommended Reading: Can You Rollover A 401k Into A 403b