How To Convert To A Roth Ira

There are plenty of reasons to consider a Roth individual retirement account rollover, which moves funds from an existing traditional IRA into a Roth IRA. Here’s a quick look at how to convert to a Roth IRA, plus considerations when deciding whether it makes sense for you.

Changes In Roth Ira Rules

The Tax Cuts and Jobs Act of 2017 made some changes to the rules governing Roth IRAs. Previously, if you converted another tax-advantaged account plan, or 403 plan) to a Roth IRA and then changed your mind, you could undo it in the form of a recharacterization.

No longer. If the conversion occurred after Oct. 15, 2018, it cannot be recharacterized back into a traditional IRA or back into its original form.

How Does A Roth In

A Roth in-plan conversion lets you take a distribution that is rollover-eligible from your 401 plan and roll it over to a Roth account in the same plan. The Roth in-plan conversion can be a valuable tax-saving strategy, if used correctly. It can also help high-income taxpayers legally avoid the contribution limits placed on income. Heres how it works.

A financial advisor could help you optimize your retirement investments to minimize your tax liability.

Don’t Miss: How Do I Roll Over My 401k To An Ira

Mega Backdoor Roth And The Pro Rata Rule

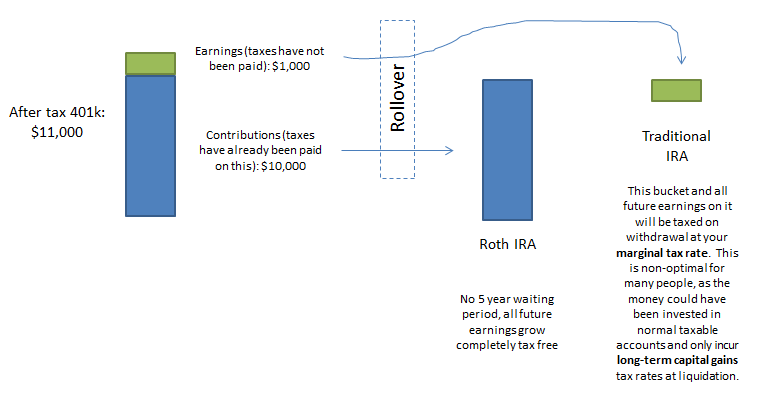

401 withdrawals are generally subject to something known as the pro rata rule. This rule says you cant exclusively withdraw pre- or post-tax contributions from your traditional 401. You must take out an amount equal to the ratio of your contribution sources.

If you had a traditional 401 balance of $100,000, and $80,000 of the balance came from pre-tax contributions and $20,000 was from post-tax, each one of your withdrawals would take out $8 of pre-tax money for every $2 for post-tax money.

For the mega backdoor Roth, the pro rata rule means you cant exclusively make an in-service withdraw of post-tax contributions if your traditional 401 balance includes a mix of pre- and post-tax money. Instead, you may need to rollover your entire 401 balance in a mega backdoor Roth maneuver. In a situation like this, its best to roll your pre-tax contributions into a traditional IRA.

If your employer tracks pre-tax and post-tax contribution amountsas well as their growthyou might be able to get around this and simply withdraw the entirety of your post-tax contributions outright.

Possible Effects Of The Proposed Build Back Better Act

The House of Representatives has passed the Build Back Better bill but it remains stalled in the Senate. As the bill is currently written, Roth in-plan conversions could be impacted. However, since the deadline for the bills enactment, December 31, 2021, has come and gone, and because the bill may be significantly changed by the Senate, its impossible to know what will happen with Roth conversions at this time. Though it is important to be mindful about legislation that could make changes to your retirement.

Don’t Miss: When Leaving A Job What To Do With 401k

Roth Ira Withdrawal Rules

Unlike traditional IRAs, there are no required minimum distributions for Roth IRAs. You can take out your Roth IRA contributions at any time, for any reason, without owing any taxes or penalties.

Withdrawals on earnings work differently. In general, you can withdraw earnings without penalties or taxes as long as youre 59½ or older and youve owned the account for at least five years. This restriction is known as the five-year rule.

Your withdrawals may be subject to taxes and a 10% penalty, depending on your age and whether you meet the requirements of the five-year rule.

If you meet the five-year rule:

- Under 59½: Earnings are subject to taxes and penalties. You may be able to avoid taxes and penalties if you use the money for a first-time home purchase or have a permanent disability. If you pass away, your beneficiary may also be able to avoid taxes on the distribution.

- 59½ or over: No taxes or penalties.

If you dont meet the five-year rule:

- Under 59½: Earnings are subject to taxes and penalties. You may be able to avoid the penalty if you use the money for specific purposes. They include first-time home purchases, qualified education expenses, unreimbursed medical expenses, and permanent disabilities. If you pass away, your beneficiary may be able to avoid penalties on the distribution.

- 59½ or over: Earnings are subject to taxes but not penalties.

Rolling Over A 401 To An Ira

If youve got a 401 with an old employer that youd like to move into your tender loving care as an IRA that youre managing instead, Capitalize is the easiest way to handle it. I have a full deep dive about the rollover process here, in case youd like to go read that first.

But lets say youve already decided youre going to roll over your 401 into an IRA if your 401 was Traditional , you may be wondering Hm, should I keep this as pre-tax money and roll it into a Traditional IRA, or should I convert it to Roth and roll it into a Roth IRA?

Read Also: Can I Borrow From My Solo 401k

Can I Pay The Taxes From My Conversion From The Retirement Funds

While it is possible, it generally does not make sense to use the retirement assets to pay the taxes. If you are under age 59 1/2, the amount distributed to pay taxes may be subject to an IRS 10% additional tax for early or pre-59 1/2 distributions . Plus, those funds would no longer be potentially growing tax-free within the Roth IRA. Its suggested you use assets outside of retirement accounts to pay any taxes resulting from the conversion.

First Some Background And A Caveat

-

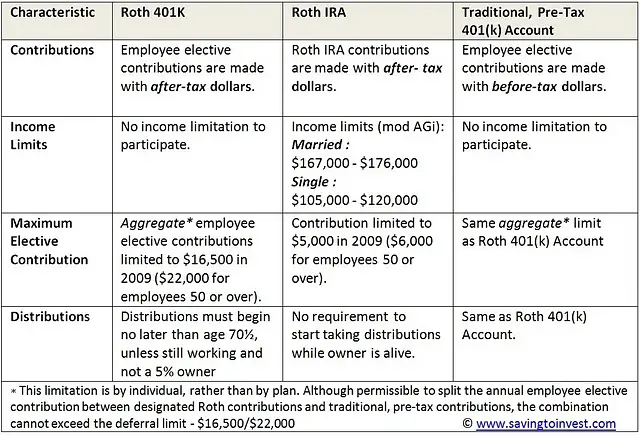

Roth and traditional IRAs: With Roth IRAs, you put in money after paying income tax on it, and then those dollars grow tax-free. But income rules restrict who can contribute to a Roth, and theres a maximum IRA contribution limit of $6,000 in 2021 and 2022 . A traditional IRA gives you an immediate tax break on your contribution, your money grows tax-deferred and you pay income tax when you pull out your money in retirement.

» Everything you need to know about Roth and traditional IRAs

-

Backdoor Roth: a strategy for people whose income is too high to be eligible for regular Roth IRA contributions. You simply roll money from a traditional IRA to a Roth. There are no income or contribution limits that is, anyone can convert any amount of money from a traditional to a Roth IRA. But you risk a hefty tax bill on the rollover if you have pretax money either contributions youve deducted or investment earnings sitting in any traditional IRAs, thanks to the IRS pro-rata rule.

» Read more about that rule in our backdoor Roth IRA guide.

» Are you on track for retirement? Run your numbers through our retirement calculator to see.

|

no promotion available at this time |

Promotioncareer counseling plus loan discounts with qualifying deposit |

Promotionof free management with a qualifying deposit |

You May Like: Is There A Cap On 401k Contributions

How Much Can I Roll Over Into A Roth Ira

A rollover is considered a balance transfer from one retirement plan to another retirement plan and does not count toward the annual Roth IRA contribution limits.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Why Would You Want To Convert A 401 Into A Roth Ira

When youre employed by a company that offers a 401 plan, its an indispensable investing tool. Many companies match some of your contributions, which is essentially free money.

However, when you leave that job, this is a great time to look at the 401 youve been given and evaluate what is working for you, says Nicole Stanley, a financial coach and founder of Arise Financial Coaching.

Here are some of the most common reasons you might want to convert your 401 into a Roth IRA:

Read Also: What Should You Do With 401k From Previous Job

Who Are Roth Iras Best For

Roth IRAs are best for those whose modified adjusted gross income is under the limit for 2021 , and for those who believe that they will be in a higher tax bracket when they retire than they are now.

Regardless, it’s always beneficial to have your retirement savings tax-diversified. Note that singles with MAGIs between $125,000 and $140,000 and $198,000 and $208,000 for those married filing jointly can make reduced contributions to a Roth IRA.

Tax diversification means having a variety of retirement accounts with the goal of maximizing withdrawals without pushing yourself into a higher tax bracket.

Here’s how it works. When you can withdraw penalty-free money from your retirement accounts starting at age 59½, you withdraw from your traditional IRA savings just up to the limit of the next tax bracket.

You can then take additional savings out of your Roth IRA, as it does not add to your taxable income because it was already taxed when it was first contributed. This lets you keep your taxable income low while being able to take a larger sum out of your retirement accounts.

Consider Converting Over A Period Of Years

Experts such as Victor advise careful planning to minimize the tax hit that comes with a conversion. Individuals could space the conversion out over many years rather than convert the full amount in one year. By doing so, they may be able to avoid jumping up to a higher tax bracket and paying more on each incremental dollar of converted money.

Also Check: Is Spouse Entitled To 401k In Divorce In Ny

What Is A Roth Ira

With a Roth IRA you can save for retirement on a tax-advantaged basis, giving you some attractive incentives to prepare for your golden years. With a Roth IRA, you deposit after-tax money, can invest in a range of assets and withdraw the money tax-free at retirement, defined as after age 59 1/2. Tax-free withdrawals are the biggest perk but the Roth IRA offers others.

If youre planning an estate, a Roth IRA can be especially valuable. You can pass down a Roth IRA, and heirs will receive some significant tax advantages, too. You can invest in a Roth IRA at any age as long as you have enough earned income to cover the contribution.

The Roth IRA also offers a lot of flexibility. There are no required minimum distributions, as you have with a traditional IRA. Plus, youre able to take out contributions at any time without penalty. If you take earnings out early, you can be hit with taxes and a 10 percent bonus penalty, however. But some situations allow you to take penalty-free withdrawals.

The withdrawal rules for a Roth conversion work somewhat differently, however. A traditional IRA or traditional 401 that has been converted to a Roth IRA will be taxed and penalized if withdrawals are taken within five years of the conversion or before age 59 1/2. However, this five-year rule does not apply if youre taking a withdrawal from a conversion after age 59 1/2. Moreover, if you make multiple Roth conversions, each is subject to its own five-year rule.

Questions And Answers About In

Recent legislation now permits plans to adopt a newly expanded Roth in-plan conversion feature. This new plan feature allows you to convert all or a portion of your pre-tax and traditional after-tax money to a Roth account within the plan.

Q: Who is eligible to make a Roth in-plan conversion?

A: All participants are eligible to convert pre-tax or traditional after-tax money to Roth within the plan.

Q: Can I recharacterize an in-plan Roth conversion?

A: No, a Roth in-plan conversion cannot be undone.

Q: What are the differences between an in-plan Roth conversion and a Roth IRA rollover?

A: See our grid to review the differences between the two.

Q: What are the benefits of a Roth conversion?

A: Roth assets, including earnings, can be withdrawn free of taxes provided that you are age 59½ or older and the account has been established for at least five years.

Tax-free withdrawals could be a significant benefit, especially if you expect to be in the same or a higher income tax bracket at the time of withdrawal than you are at the time of the conversion to Roth. That said, a Roth conversion is not for everyone.

Q: Who might benefit from a Roth in-plan conversion?

A: You might benefit from a Roth in-plan conversion if you:

- Expect your tax rate to be the same or higher in the future.

- Are interested in tax diversification .

- Plan to keep the money invested for at least five years before taking a withdrawal.

Q: Who might not benefit from a Roth in-plan conversion?

A: No.

Don’t Miss: How To Pull Money From 401k Without Penalty

Should I Roll Over My Traditional Ira Funds Into A Roth Ira

Whether you should roll funds from your current retirement account into a Roth depends entirely on your tax situation. If you are in a lower tax bracket this year than you plan to be during retirement, a rollover may make sense. For example, if you had been furloughed or laid off due to the coronavirus pandemic, that year might be a good year to consider transferring some of your retirement funds into a Roth IRA.

On the other hand, if you expect to be in a lower tax bracket during retirement, it is wise to keep your funds where they are currently. This becomes harder to plan as tax laws change and tax brackets are updated.

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

Also Check: How To Rollover Fidelity 401k To Vanguard

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

You should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

You May Like: How Does A 401k Retirement Plan Work

What Should I Do With An Old 401

You might have an old 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.