Can Someone Else Put Money On My Walmart Moneycard

The cheapest way for someone else to put money on your Walmart MoneyCard is for them to transfer the money from their bank to your MoneyCard using your routing and account numbers. If they cant do a bank transfer, or if you need money more quickly, they can purchase a MoneyPak at most retailers for $5.95 and deposit cash into your account that way.

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

High Unreimbursed Medical Expenses

This particular exception is similar to the hardship distributions mentioned earlier, and these medical bills might qualify you under either category. You should know that a hardship withdrawal for medical bills will not entitle you to a waiver of the 10% penalty in all cases. To qualify for a penalty-free withdrawal, the amount of the bills must be greater than 7.5% of your adjusted gross income . You must also take the distribution in the same year in which the bills were incurred. You cannot take money for estimated future bills either. The bills must be currently due for services already provided.

Also note the requirement that the bills be unreimbursed. If your insurance covers part of the bills or will reimburse you for the payments, then you cannot use money from your 401 to pay them. Likewise, the bills must be for you, your spouse, or a qualified dependent. You cannot use the money to pay bills for a parent, sibling, or any other family member. The limit to the amount of money you can withdraw for medical bills was recently removed, so you are allowed to withdraw as much as is needed to cover all the expenses.

Don’t Miss: What To Do With 401k When You Leave A Company

How Much Will I Get If I Cash Out My 401

Its worth noting for all withdrawals, that the plan administrator is required to withhold 20% of your withdrawal from a 401 for taxes, even if you expect to get a tax refund in the year you make the withdrawal.

This means if you request a $10,000 withdrawal you can expect to receive a check for only $8,000.

Important Note: Unless you have a Roth 401 plan, all withdrawals/distributions from a 401 are taxable even if there is no penalty for the withdrawal.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Recommended Reading: Can You Buy A House With 401k

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Recommended Reading: Can You Take Out Your 401k Early

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

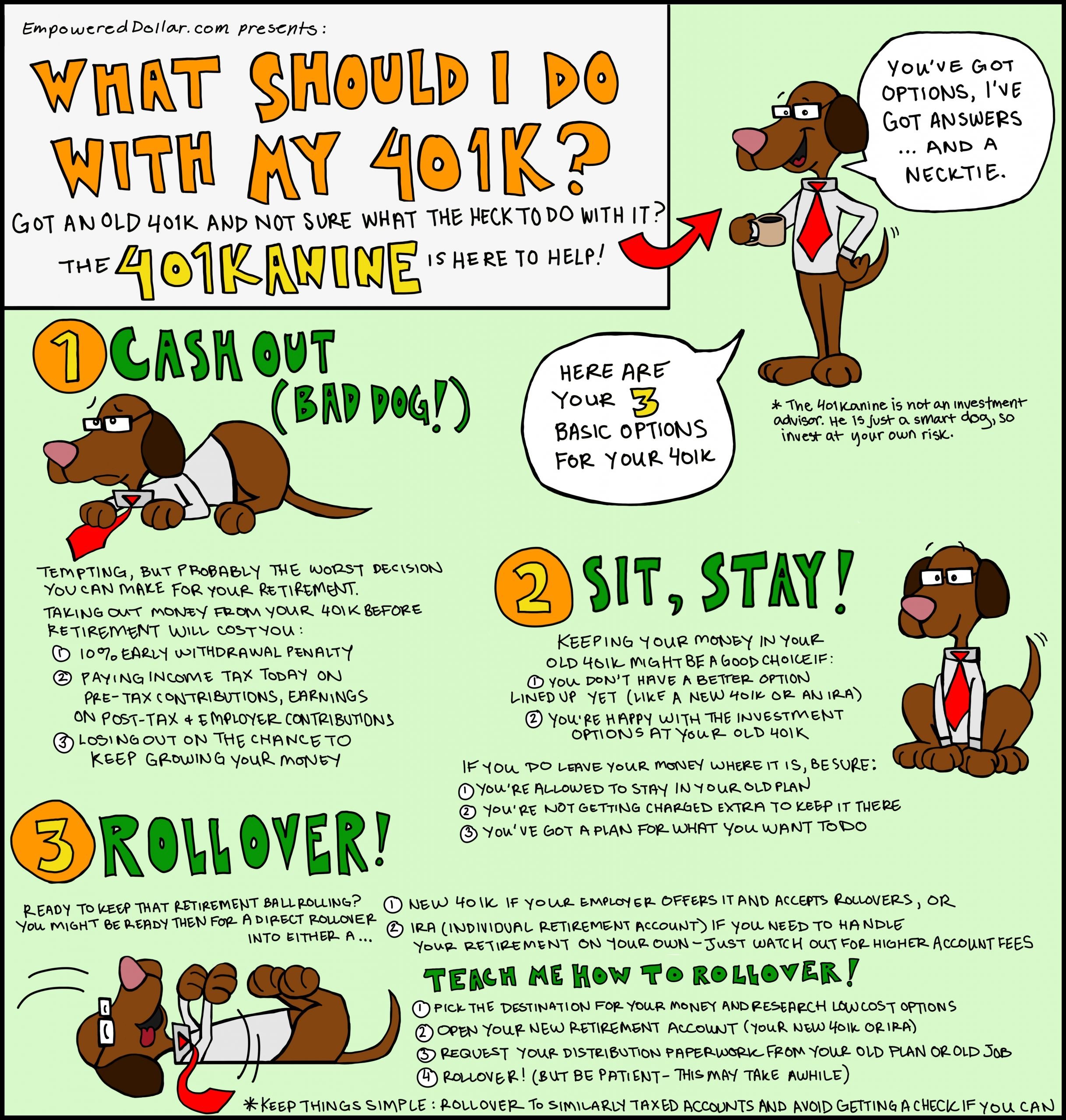

What To Do With A 401k After Leaving A Job Or Getting Laid Off Due To Coronavirus

The Coronavirus has caused the stock market to plummet, shut down many businesses and prompted many Americans to file for unemployment. The increase in jobless claims and market volatility has many Americans worried about the fate of their retirement savings.

If youve lost your job, youre not alone. Over 25 million Americans have already filed jobless claims. And that number is expected to grow.

If youve been laid off, furloughed or let go from a job like millions of other Americans, your entire financial plan may have changed overnight. For many, the switch to unemployment is becoming a reality in the wake of the coronavirus pandemic. There is a lot of uncertainty about what to do with your 401k after leaving a job or getting laid off due to Coronavirus.

When facing a job loss, its important to consider the best decision regarding your financial future. If you had a 401k with your former employer, youll need to decide what to do with the funds in the account. There are several options to consider, and each one comes with potential benefits and costs. Heres what you can do with your 401k after leaving a job or getting furloughed/laid off due to COVID-19.

Read Also: What Percentage Should I Be Putting In My 401k

Also Check: How Much Can I Rollover From 401k To Roth Ira

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

You May Like: How Much Invest In 401k

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

There Are Several Situations In Which This Could Happen

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Read Also: Can You Roll Over 401k To New Employer

Also Check: How To Get A 401k If Self Employed

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

What Are My 401 Options After Retirement

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Recommended Reading: Where Is The Best Place To Rollover My 401k

Can I Resign Immediately

How to Immediately Resign from a JobCall employer promptly. Time is of the essence, so communicate as soon as it becomes clear that a departure is imminent. State reasons for sudden leave. Since short notice goes against the grain and can sour professional relationships, it often helps to share some background information about the change.Try to give 2-weeks notice. More items

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

You May Like: How To Transfer Your 401k To Another Company

Requesting A Loan From Your 401

If you do not meet the criteria for a hardship distribution, you may still be able to borrow from your 401 before retirement, if your employer allows it. The specific terms of these loans vary among plans. However, the IRS provides some basic guidelines for loans that won’t trigger the additional 10% tax on early distributions.

Whether you can take a hardship withdrawal or a loan from your 401 is not actually up to the IRS, but to your employerthe plan sponsorand the plan administrator the plan provisions they’ve established must allow these actions and set terms for them.

For example, a loan from your traditional or Roth 401 cannot exceed the lesser of 50% of your vested account balance or $50,000. Although you may take multiple loans at different times, the $50,000 limit applies to the combined total of all outstanding loan balances.

Resist The Temptation To Cash Out Your Retirement Savings If You Are Fired Or Laid Off From A Job If You Have A 401k Roll Your Money To A New Plan So You Can Continue To Contribute And Grow Your Savings

Losing a job is a stressful experience. Adding to that stress is the decision youll have to make about what to do with your 401. The good news is that retirement plans are portable. That means you can take your nest egg with you when you leave a job. Lets look at the options available to you:

Transfer to your new companys plan. When you start a new job, you can move the money from your previous employer to your new employers retirement savings plan . Not all plans accept rollovers, so youll need to check with your new employer.

Roll over your old plan to an IRA. You can move your retirement savings from a previous employer to an IRA without paying taxes or penalties. If you roll your money over to an IRA, you can continue to save for retirement while you look for new employment or start working for yourself.

Icon is an IRA and accepts rollovers. You need to first open an Icon account and then we can help you with the process of rolling over your funds.

Dont cash out. Whatever you do, dont cash out your savings, even if you think its a small amount. Not only will you have to pay taxes and an extra 10% early withdrawal penalty, but youll also lose out on your future savings.

Don’t Miss: What Ira Should I Rollover My 401k To

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, the penalty will likely be waived if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year.

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

Also know, how do I close my Merrill Lynch account?

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If youre outside the United States, you should call 1-609-818-8900 instead.

Furthermore, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Also know, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal youll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you havent reached 59 1/2 years of age. This includes any money youve contributed and any vested contributions from your employer plus any investment profits your account has generated.

The IRS defines some criteria for a hardship withdrawal. These include:

Don’t Miss: Can You Roll A 401k Into An Existing Roth Ira