Should You Take A 401 Loan Or 401 Withdrawal

Some plans allow loans from 401 plans as an option to get access to the fund for virtually any purpose. Maybe you want to travel, pay your childs college tuition, put a down-payment on a new house, or cover the cost of a divorce. There are many personal reasons to consider a loan.

Generally, you can take up to 50% of the balance to a maximum of $50,000. The good news is that there is no age restriction, and there are no taxes due when you take out a loan. However, the loan must be repaid over a five-year period, with interest owed back to your account.

There is risk involved in taking out a loan. Some plans allow you to roll over a 401 when changing employers. However, in other cases, you may have to pay your outstanding loan balance in full within 60 days of leaving an employer otherwise, it will be considered a 401 withdrawal, taxed as ordinary income and subject to the 10% withdrawal penalty.

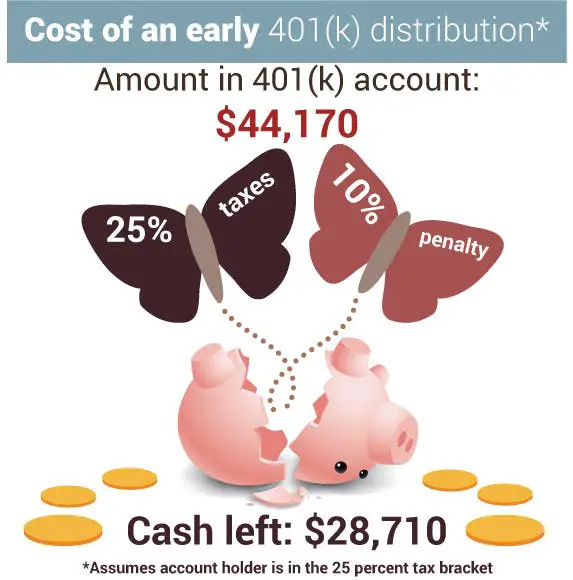

Compared to a loan, an early 401 withdrawal:

- Must have an option that allows for in-service withdrawals, which may be restricted by age or hardship.

- Will be taxed as ordinary income .

- Can be subject to a 10% penalty if youre under 59.5 .

- Will not require repayment loan).

Also Check: What Is A Good Percentage To Contribute To 401k

How To Cash In Your 401

If you want to liquidate your 401, youll usually start with your plan administrator. Again, check any documentation your HR department gave you when you set up your 401. There may also be a phone number on the statement you get on a periodic basis updating you on your balance.

What happens if youre no longer with the employer? No worries. Youll go through the same process of tracking down the plan administrator. But if your withdrawal request is due to a hardship, you will no longer have that benefit. Youll only have three options: take a distribution, roll the balance over to an IRA, or leave the money in place.

Why Does Slavic401k Reimburse All Revenue Paid By The Funds

Dont Miss: Can An Llc Have A Solo 401k

Read Also: How To Get Money From 401k To Buy A House

Withdrawing When You Retire

After you reach the age of 59 1/2, you may begin taking withdrawals from your 401. If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401 you had with that current company. If you are a public safety worker, this rule takes effect at the age of 50.

Once you reach 72, you are actually obligated to begin making required minimum distributions or RMDs.

Taking 401 Distributions In Retirement

The 401 withdrawal rules require you to begin depleting your 401 savings when you reach age 72.

At this point, you must take a required minimum distribution each year until your account is depleted. If you are still working for the employer beyond age 72, you may be able to delay required minimum distribution until you stop working if your plan allows this delay. The delay option is not available to you if you own 5% or more of the business.

You have until April 1 of the year after you turn 72 to take your first required minimum distribution. After that, you must take a minimum amount by December 31 each year. Your 401 plan administrator will tell you how much you are required to take each year.

The amount is based on your life expectancy and your account balance. If you dont take your required minimum distribution each year, you will have to pay a tax of 50% of the amount that should have been taken but was not. If you participate in more than one employer plan, you must take a required minimum distribution from each plan.

Recommended Reading: What Percentage Of 401k Is Required Minimum Distribution

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Also Check: Can I Take A Loan Out Of My 401k

What Does Rolling Over A 401 Mean

Rolling over your 401 fundamentally means moving the funds from one place to another, and it customarily happens between different places of employment.

When you leave a job for any reason, you generally have three opportunities. You can either leave your 401 with your current employer, roll over the funds to an IRA, or roll over the funds to a new employers 401 plan.

In any case, you should either be able to execute a direct or an indirect rollover. A direct rollover implies that the assets move directly from your previous 401 plan to the one at your new job. The indirect rollover transpires when you receive the funds as a distribution from your previous employer, but you have to put it into the new account within 60 days or face taxes and penalties.

Leaving your 401 with an old employer is very uncommon and has many drawbacks. If you possess less than $5,000 in savings they could force you out by presenting you a check, in which case you will have to do an indirect rollover to your next employers plan.

You also wont be able to generate contributions and take out loans, and your former employer may even add administration fees. Because of this most plan participants roll over their 401 to their new employer.

Rolling over to a different 401 plan can be done directly or indirectly and is usually the best choice.

Withdrawal Age And Early Withdrawal Rules

Once you reach age 59.5, you may withdraw money from your 401 penalty-free. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that youd owe on any type of withdrawal from a traditional 401. But in some cases, your plan may allow you to take a penalty-free early withdrawal. Well cover the 401 early withdrawal rules and alternatives to dipping into your retirement savings. We can also help you find a financial advisor who can guide you through your options based on your individual needs.

Also Check: Should I Consolidate My 401k

What Is A Roth 401 And How Does It Work

A Roth 401 is an employer-sponsored retirement savings program that uses post-tax money. That means that the government has already taxed the money you put in the account. Because its already been taxed, you dont pay taxes on withdrawals when you retire, like with a Roth IRA. However, you cant deduct contributions from your taxes like you can with a traditional 401.

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Read Also: Can Fidelity Manage My 401k

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an IRA rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

SEPP withdrawals are not the best idea if your financial need is short term. When starting SEPP payments, you must continue for a minimum of five years or until you reach age 59½, whichever comes later. Otherwise, the 10% early penalty still applies, and you will owe interest on the deferred penalties from prior tax years.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the IRS: fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

How 401 Hardship Withdrawals Work

The IRS allows anyone to take penalty-free withdrawals if they have an “immediate and heavy financial need.” You can use the money to cover your needs or those of someone else.

You may qualify for a hardship distribution if the funds go to:

- Pay for certain medical expenses

- Buy a primary residence

- Cover college tuition, fees, room, and board

- Prevent eviction or foreclosure

- Pay for burial and funeral expenses

- Make necessary home repairs after a disaster

The amount you’re able to withdraw will be limited to the amount necessary to cover the expense.

Also Check: How To Manage My Own 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

|

no promotion available at this time |

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

Read Also: Do Part Time Employees Get 401k

Don’t Miss: How Much Can An Employee Contribute To A 401k

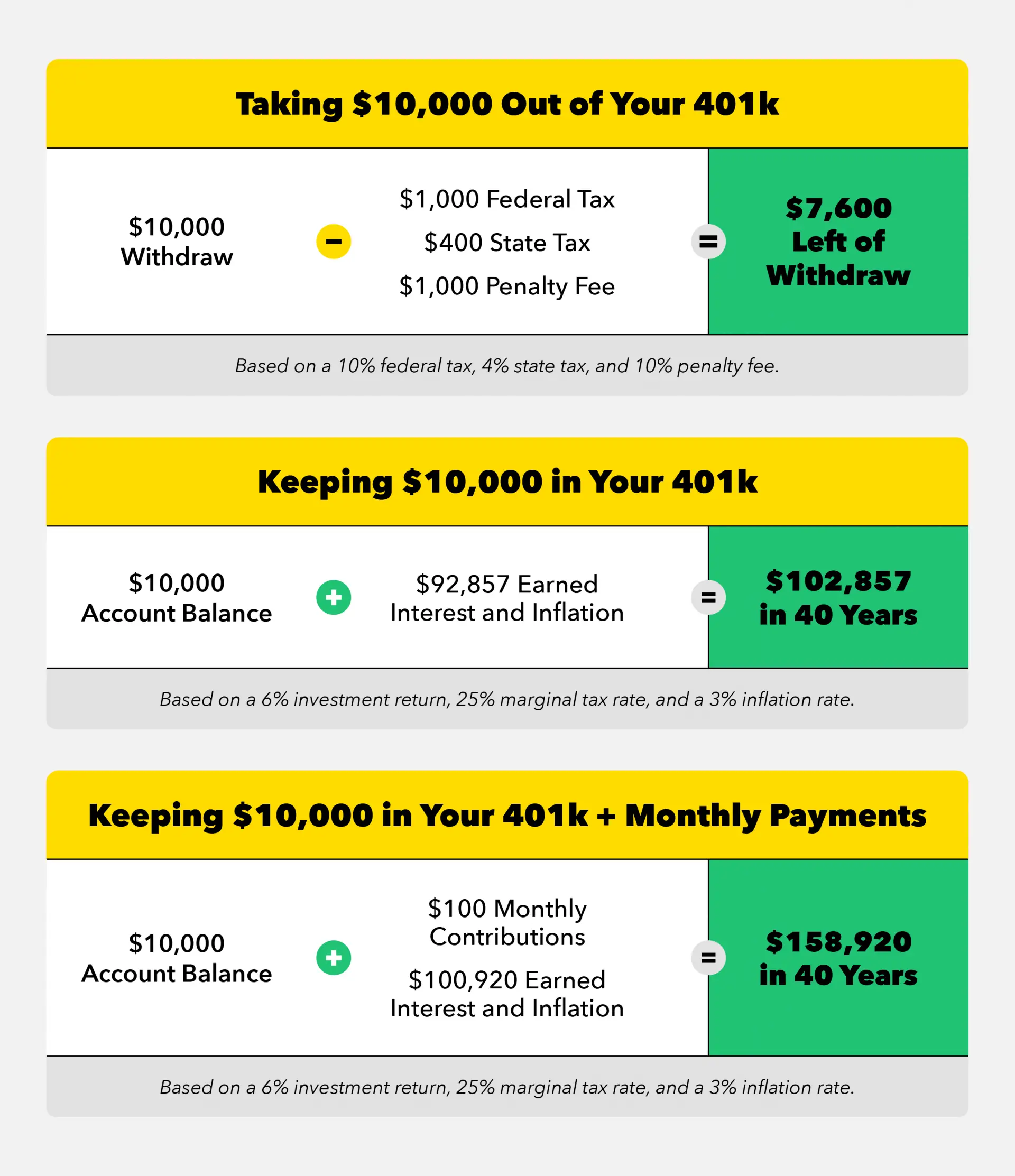

Taking A 401k Loan Might Not Be Such A Good Idea

A 401K is supposed to help you have money in retirement. When you temporarily take money out of the plan, it inhibits its ability to compound with interest or stock market growth. You may end up with less money in retirement than if you had left the money in your 401K. In addition, if you terminate your employment, youll owe a 10% penalty and income taxes on the balance unless you can pay the loan back right away. 401K loans may also have fees and the payment terms are often very inflexible. Finally, taking a 401K loan may be a sign of broader financial distress.

Also Check: When Can You Take Out 401k Without Penalty

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Don’t Miss: How Do You Borrow From 401k

Should I Convert My 401 Into A Gold Ira

If you no longer have earned income as an early retiree and can no longer contribute to my company 401, converting your 401 to a Gold IRA may be a good idea. For those of you who are transitioning to a new job, rolling over your 401k to a Gold IRA is also a good idea.

Even though a 401 may provide about 40 or so mutual fund choices provided across various sectors, countries, and asset classes, it may not be enough for what you want to do with your overall retirement plan. With a Gold IRA, youve got plenty more investment options.

If you are ready to rollover your 401 or even a Fidelity 401 to a Gold IRA, view our List of Top 10 Gold IRA Companies and see why it you should choose to work with the most trusted IRA Custodian in the industry, Regal Assets.

Do you have any questions on what is the best way to rollover your Fidelity 401 to a Gold IRA? Ask below!

Dont Miss: How Do I Start My 401k Plan

Rejecting A Buyout Offer

Buyout offers are voluntary. You may say no to the offer.

Sometimes layoffs follow buyout offers. Before rejecting a buyout offer, check to make sure youll get severance pay if you lose your job at a later date. Check if the buyout offer will give you more money and benefits than severance pay will.

If your employer is in serious financial difficulty, consider the buyout offer carefully. If the employer becomes bankrupt, it may be more difficult to get your severance pay.

There are two main types of FERS Early Retirement. One is MRA+10 Retirement which is available to anyone who is eligible. The other type of Early FERS Retirement is when your agency is going through a RIF and they offer employees a chance to take an Early Out.

On this page, well be talking about Early Outs. But click here if you want to learn more about MRA+10 FERS Early Retirement.

Recommended Reading: Can I Rollover From 401k To Roth Ira

Also Check: How To Pull Out Your 401k Early