Next Steps To Figuring Out How Much To Put In Your 401

If youre unsure about how much you can afford to contribute to your 401, check out our paycheck impact tool that can help you calculate an exact number based off your salary and employer match options. If your employer doesnt offer a 401 matching plan, dont fret. There are still many ways you can save for retirement.

This website contains hyperlinks to other websites that are not associated with this site. Such unassociated websites may contain links to other unassociated sites as well. We make no endorsement, expressed or implied, about any of these linked sites, are not responsible for materials posted or activities that occur on such linked sites, and do not review content or advertisements posted on or activities occurring on these linked sites.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employers plan. Amounts that are retained in a former employers 401 plan or transferred to another employers plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Dont Miss: How Do I Invest In My 401k

Don’t Miss: Can I Roll A 401k Into A Roth Ira

The Rules You Need To Knowplus A Pitfall You’ll Want To Avoid

Do you have a 401 plan through work? You can still contribute to a Roth IRA and/or traditional IRA as long as you meet the IRA’s eligibility requirements.

You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contribute. In 2022, you can contribute up to $6,000, or $7,000 with a catch-up contribution for those 50 and over. In 2023, those amounts go up to $6,500 and $7,500.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But adding an IRA to your retirement mix after that can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement. Here are the rules you’ll need to know.

How To Invest In Your 401

Starting a new job? Heres a beginners manual to understanding 401s.

Editors note: This article originally ran on Jul. 24, 2020.

This month marks a significant milestone for my family as my oldest child, who graduated from college in May, begins his first full-time job, which gives him access to a 401 for the very first time.

Read Also: Can I Rollover Solo 401k To Ira

How To Invest 401 Money

Youll also need to decide how to invest your 401 money. One option, which most 401 plans offer, is target-date funds. You pick a fund with a calendar year closest to your desired retirement year the fund automatically shifts its asset allocation, from growth to income, as your target date gets nearer.

These funds also have model portfolios you can choose from and online tools to help you assess how much risk you want to take. You can also decide which fund choices would match up best with your desired level of risk.

Additional Roth 401 Rules

Roth 401 contributions must be made by the end of the calendar year, meaning the 2022 contribution deadline is Dec. 31, 2022. However, you have a bit more time with Roth IRA contributionsyou must make them by tax day.

Five years must pass from your first contribution before you can withdraw from your Roth 401 tax-free, and you must also be at least 59½ years old. At age 72, you must take minimum distributions from your Roth 401 but not from a Roth IRA.

Recommended Reading: Can I Use 401k For Real Estate Investment

What Kind Of Investments Are In A 401

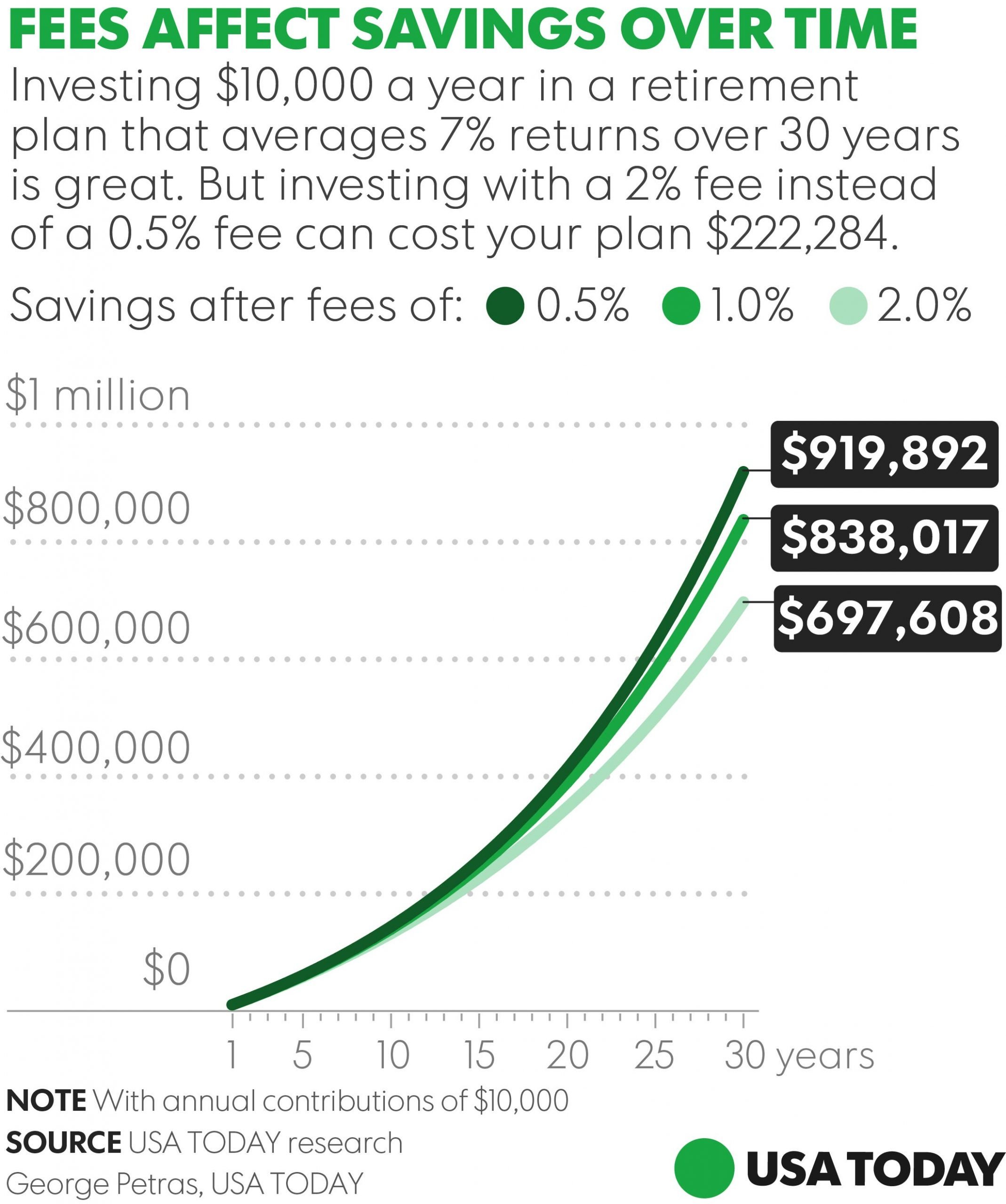

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Calculator: How 401 Contributions Affect Your Paycheck

? If you have a 401 at work, thats a great start. Increasing your 401 contributions today may greatly improve your retirement outlook. Use our 401 contribution calculator below to see how that extra money could affect your paycheck and your future.

Why Use a 401 for Retirement Savings?

Tax-deferred contributions and earnings. With a traditional 401, you wont pay taxes on contributions or earnings until you withdraw the money.

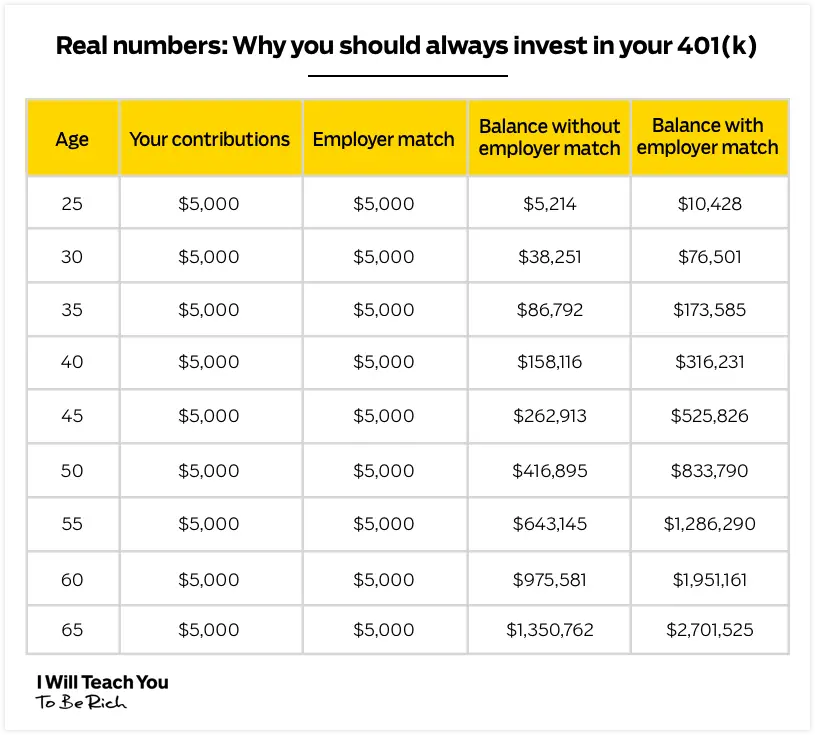

Employer match. Many employers match contributions to your account up to a maximum amount. For instance, if you deposit 4% of your salary into your 401, your employer may add the same amount to your account. If you dont contribute at least the match amount, you could miss out on this additional money.

Can You Afford to Contribute More to Your 401?

This calculator shows how increasing your 401 contributions would affect your paycheck. It also shows how much your retirement savings may grow with that increase. You may be surprised at how .

How to Use the 401 Contribution Calculator

To get started, youll need your most recent pay statement. It shows how much youre getting paid and how much youre contributing now, as well as other deduction information.

This calculator uses the latest withholding schedules, rules and rates .

Get Started

You May Like: Is It Better To Contribute To 401k Or Roth 401k

How Much Should You Save For Retirement

To start, invest 15% of your gross income into retirement savings accounts like a Roth 401 and Roth IRA. Spread your money evenly across four types of mutual fundsgrowth and income, growth, aggressive growth, and internationalinside of those retirement accounts.

And listen, we know youre eager to start saving money for your retirement future . . . but if youre still getting out of debt or need to get a solid emergency fund in place, now is not the time to save for retirement. Your income is your number one wealth-building tool, and you cant take full advantage of it if its tied up in credit card or student loan payments.

So lets say youre out of debt with a fully funded emergency fund and you have an annual salary of $75,000. That means your goal is to save $11,250 each year for retirement. Where do you start? Lets walk through it step-by-step.

S To Take Now To Improve Your Retirement Readiness

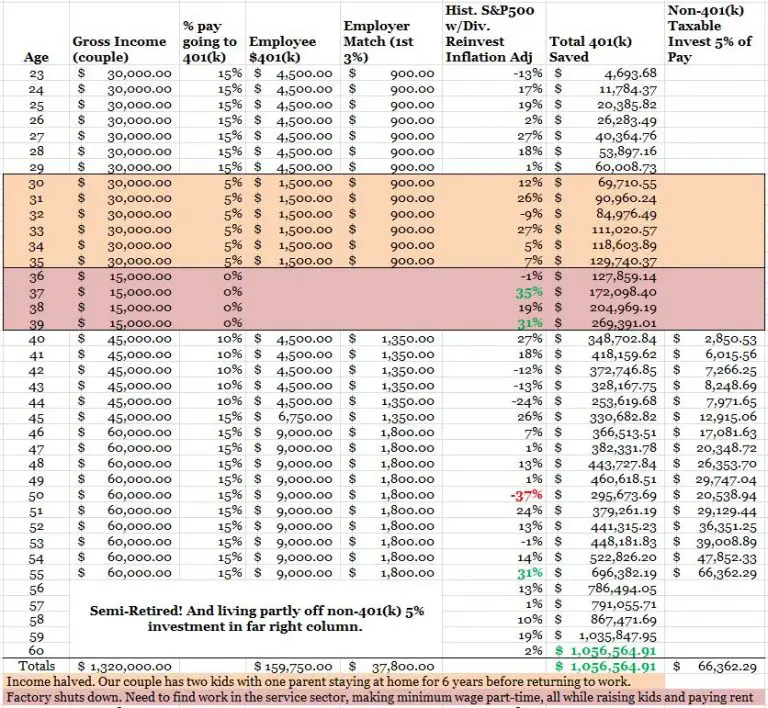

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

Read Also: Can I Transfer From 401k To Ira

Should You Ever Touch Your 401k

Many financial advisors advise against withdrawing from retirement accounts early in order to pay off debts. The money in a 401 or IRA is meant for retirement, not to pay off loans.

Enter your info below and get the PDF for free today and start the extra money you need to make your retirement goals come true.

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Also Check: Is 401k Rollover To Ira Taxable

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Comparing 2022 And 2023 Limits

The chart below provides a breakdown of how the rules and limits for defined-contribution plans , 403, and most 457 plans are changing for 2023 vs. 2022.

| Defined Contribution Plan Limits | |

|---|---|

| $150,000 | +$15,000 |

* The catch-up contribution limit for participants age 50 or older is available to those turning 50 at any time during the year. For instance, if you were born on New Year’s Eve, it applies.

Read Also: What Percentage Should I Put In My 401k

Why Contribute To A 401

A 401 is an investment plan sponsored by your employer to help you save for retirement.

If you work for a tax-exempt or non-profit organization, or a state or local municipal government, you may be offered a 403 or 457 plan, respectively which share some common features with 401 plans but there are also differences, so be sure to understand the details before you invest.

The main advantages of 401 plans include:

Can I Max Out 401k And Ira In Same Year

Noncumulative Limits The limits on 401 plan contributions and IRA contributions do not overlap. As a result, you can contribute fully to both types of plans in the same year as long as you meet the different eligibility requirements.

How much can I contribute to my 401k and IRA in 2021? 16 For 2021, the combined 401 contribution limits between you and employer-linked funds are as follows: $58,000 if youre under 50 $64,500 if youre 50 or older 100% of your salary if it is less than the dollar limit.

Don’t Miss: How To Cash Out On 401k

What Is A Good 401k Balance At Age 60

How much should I have in my 401? A general rule of thumb is to save six to eight times your salary by age 60, although more conservative estimates may be higher. The truth is that your retirement savings plan depends on your personal goals and financial situation.

What is the average 401K balance for a 65 year old?

Many workers in the US retire by age 65. Vanguard data shows that the average 401 balance at retirement is $255,151, while the median balance is $82,297.

How much should a 60 year old have saved for retirement?

A general rule of thumb for retirement savings by age 60 is to aim to save around seven to eight times your current salary. This means that someone earning $75,000 a year would ideally have between $525,000 and $600,000 in retirement savings at that age. If youre not there yet, youre not alone.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401k contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Also Check: Can You Use 401k For Investment Property

Read Also: How Do I Track My 401k

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a catch-up contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Dont Miss: When Can I Set Up A Solo 401k

Build Your Emergency Fund

You want to save as much as you can for retirement, but you shouldnt put all of your savings toward retirement. You should always have enough cash reserves to cover necessary expenses like food and rent. Its also a good idea to create an emergency fund.

An emergency fund will protect you from unexpected expenses or difficult financial situations. What would you do if you lost your job or didnt have a regular salary for a month? What if a family member got sick and you had medical bills to pay? A strong emergency fund allows you to get through tough times. Withdrawing money from your retirement accounts should be an absolute last resort. Just as importantly, an emergency fund will ease your mind by providing a sense of security. Its always nice to know that you have a backup plan in case something goes wrong.

Again, there is no perfect answer for how much you should have in an emergency fund. It depends on your situation. In general though, you want enough to cover at least a few months of expenses. That may sound like a lot if currently have no emergency fund, but you can build your fund over time by adding a little each week or month.

Recommended Reading: How To Find Out How Much 401k I Have