Why Should I Not Get A Roth Ira

Roth IRAs offer several key benefits, including tax-free growth, tax-free withdrawals in retirement, and no minimum distribution required. The obvious disadvantage is that youre donating post-tax money, and thats a bigger hit on your current income.

Are Roth IRAs still a good idea?

A Roth IRA or 401 makes the most sense if you believe you will earn more in retirement than you are earning now. If you expect your income to be lower in retirement than you currently are, a traditional account is likely a better bet.

What are the disadvantages of a Roth IRA?

Cons of Roth IRA

- You pay taxes up front.

- The maximum contribution is small.

- You have to set it yourself.

- There is an income limit.

- Your savings grow tax free.

- No need for the required minimum distribution.

- You can withdraw your contribution.

- You get tax diversification in retirement.

How To Open An Ira

You can open an IRA with any bank or broker. You may already have a brokerage account with Fidelity, Schwabb, or Merryl Lynch, for instance. If so, simply open an IRA via your current account. If you dont have a brokerage account yet, choose a reputable company that resonates with you and open one today.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Read Also: Can You Transfer Money From 401k To Bank Account

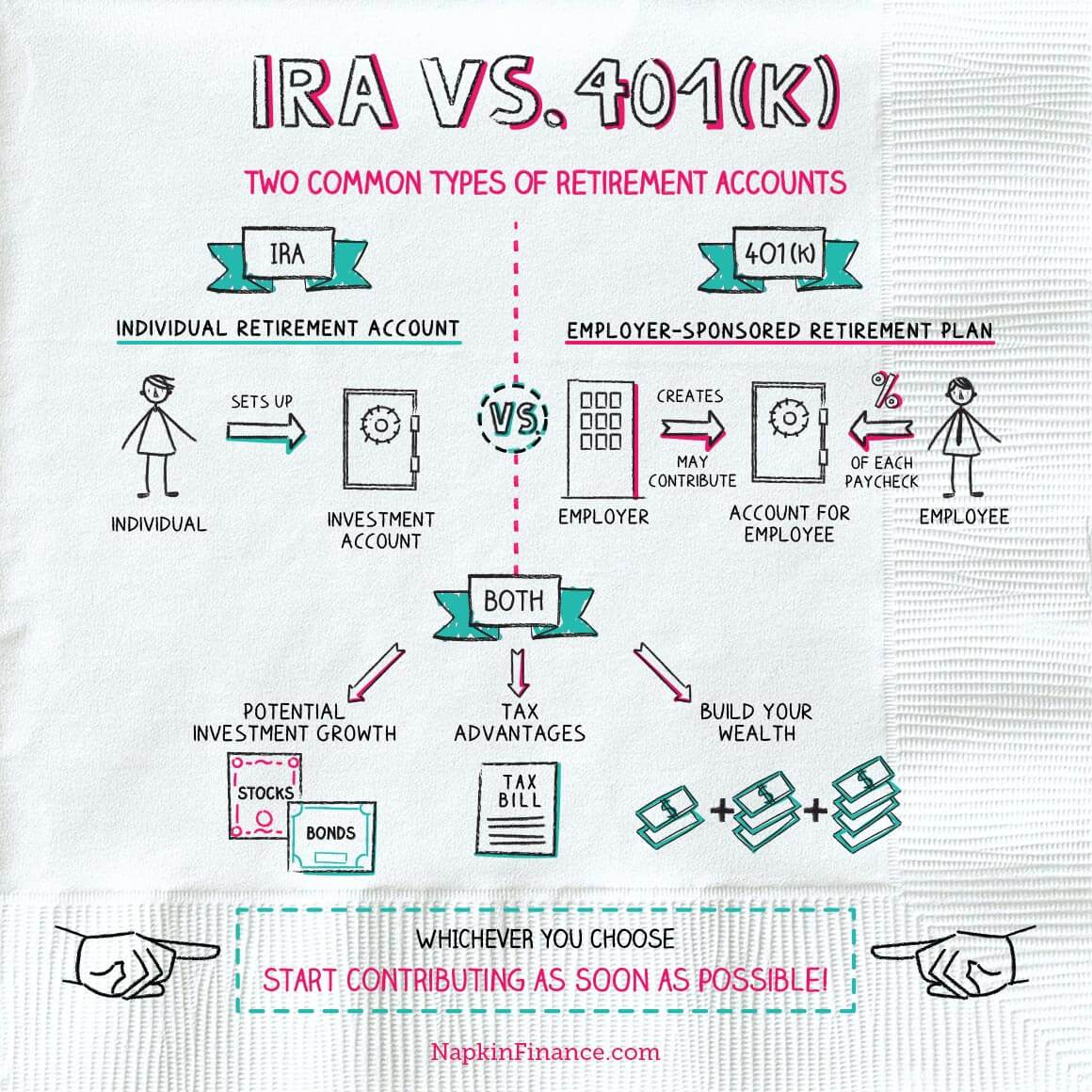

Ira Vs : The Quick Answer

Both 401s and IRAs have valuable tax benefits, and you can contribute to both at the same time. The main difference between 401s and IRAs is that employers offer 401s, but individuals open IRAs . IRAs typically offer more investments 401s allow higher annual contributions.

If the IRA vs. 401 comparison is weighing on you, heres the quick answer:

-

If your employer offers a 401 with a company match: Consider putting enough money in your 401 to get the maximum match. That match may offer a 100% return on your money, depending on the 401. For example, some employers promise a 100% match up to 3% of salary. That means, if your salary is $50,000, your employer will put in $1,500, as long as you also contribute at least $1,500. Once you get the match, then consider maxing out an IRA for the year, return to the 401 and resume contributions there.

-

If your employer doesnt offer a company match: Consider skipping the 401 at first and start with an IRA or Roth IRA. You’ll get access to a large selection of investments when you open your IRA at a broker, and you’ll avoid the administrative fees that some 401s charge. After contributing up to the IRA limit, think about funding your 401 for the pre-tax benefit it offers. Here’s how and where to open an IRA.

Are There Any Examples To Help Explain The Rollover Rules

Yes, the following examples illustrate the rollover rules.

Recommended Reading: How Much Money Do You Need In 401k To Retire

Roth 401k Vs Roth Ira: How Are They Similar

Before we look at the differences between Roth IRAs and Roth 401ks, lets look at the similarities. Heres the big one: with both of these accounts, your investments grow without the burden of taxation. This can mean a larger nest egg when you decide youre ready to retire.

Also, in most circumstances, you can withdraw money from both a Roth IRA and a Roth 401k income tax-free after you turn 59 1/2. Practically, this means favorable tax treatment in retirement, since you wont have to pay taxes on the distributions you take after you hit 59 ½.

With a Roth IRA, you can withdraw contributions penalty-free, but earnings will generally be taxed and penalties assessed on any withdrawals made before age 59½, with a few exceptions. With Roth 401ks, withdrawals before age 59½ are usually taxed and assessed a penalty, but there are ways to avoid this .

Read More:When Can I Withdraw From My 401k or IRA Penalty-Free?

What Are Roth 401 Contribution Limits

For 2022, the 401 contribution limit is $20,500. This contribution limit applies to all of your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount. And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or older, you can also pitch in an extra $6,500 as a catch-up contributionwhich increases your contribution limit to $27,000.

Don’t Miss: Can I Borrow From My 401k To Buy Investment Property

Consider Your Current And Future Tax Rates

The main thing youll want to consider when choosing between Roth and Traditional accounts is whether your tax rate will be higher or lower during retirement than your marginal rate is now, says Young. If you think your tax rate will be higher, paying taxes now with Roth contributions makes sense. If your tax rate is likely to be lower in retirement, you can use Traditional contributions to defer taxes instead. Federal tax rates are scheduled to revert to pre-2018 levels after 2025, which may make Roth contributions more attractive today. In addition, investors who expect to leave a legacy may want to consider the tax impact on their beneficiaries.

Of course, tax rates are hard to predict due to changes in the law as well as uncertainty around your future income levels.

| Contributes 6% to 401 to get full company match. Pretax savings provide $216/year more net pay. | Traditional |

*Brackets are for federal taxes, based on rates as of January 1, 2023. While rates are scheduled to revert to pre-2018 levels after 2025, those rates are not shown in this table. Income refers to gross earnings the current bracket reflects the standard deduction and potential retirement contributions. State taxes are not considered in the examples. Married status reflects joint filing.

Who Is Responsible For Keeping Track Of The Designated Roth Contributions And 5

The plan administrator is responsible for keeping track of the amount of designated Roth contributions made for each employee and the date of the first designated Roth contribution for calculating an employees 5-taxable-year period. In addition, the plan administrator of a plan directly rolling over a distribution would be required to provide the administrator of the plan accepting the eligible rollover distribution) with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis or that the distribution is a qualified distribution.

Recommended Reading: How Much Can I Contribute To Solo 401k

Should High Earners Use Roth 401k Or Traditional

Roth has also been recommended as a way to diversify the tax treatment of retirement income sources and to provide retirees with tax flexibility. Even if you end up in a lower income tax bracket when you retire, withdrawals from your traditional retirement account could potentially put you into a higher tax bracket.

Should I do all Roth or traditional 401k?

If you expect to be in a lower tax bracket in retirement, a traditional 401 may make more sense than a Roth account. But if youre in a lower tax bracket now and believe youll be in a higher tax bracket when you retire, a Roth 401 may be a better choice.

Does it make sense to have a Roth and traditional 401k?

If youve funded a traditional 401, it makes sense to add a Roth plan to the mix. Its actually worth it not to keep all your eggs in one retirement basket, even if it makes the most financial sense right now. Thats because having both plans will give you flexibility later.

Is a Roth 401k good for high earners?

Choosing an Account for the High-Income With the potential for large compound growth, along with the benefits of this non-taxable money, the Roth 401k can be a great choice for high-income earners.

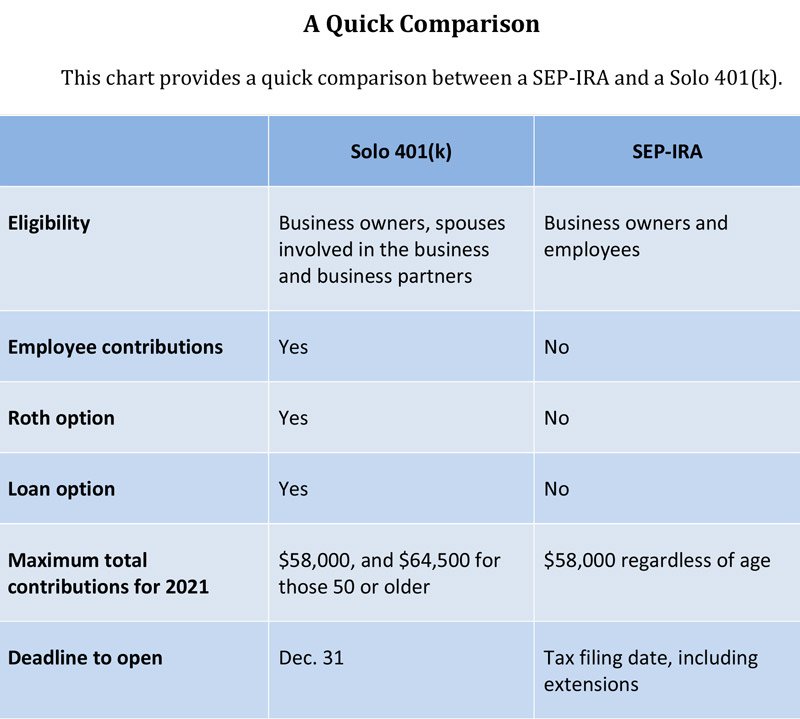

Eligibility & Contribution Limits

Your eligibility for a 401 plan simply depends on whether your employer offers them. Generally, you have to inquire a little bit more about taking advantage of an employer match program.

On the other hand, without an employers help, a Roth IRA may not prove available to everyone. For one, you have to find an institution with which to open your account. Some institutions may only accept applicants with high deposit amounts, limiting their products to more wealthy clients.

Its important to note, however, that Roth IRAs offer a solid savings option for those with lower income. This is because you fund a Roth IRA with after-tax money, making your withdrawals tax-free. This structure comes in handy for people who see themselves in a higher tax bracket in retirement.

Plus, Roth IRA rules and limitations tend to phase out higher earners. For tax year 2023, total contributions to Roth IRAs cannot exceed $6,500, or $7,500 for those over 50. Those numbers were $6,000 and $7,000 respectively in 2022. To the opposite, 401 plans have much higher contribution limits.

For tax year 2023, you can contribute up to $22,500 to your 401. For tax year 2022, the limit was $20,500. Dont forget that if your employer matches your 401 contribution, their match does not count towards that limit. Instead, you have to ensure your total annual 401 contributions do not exceed the lesser of 100% of your salary or $66,000 in 2023.

Don’t Miss: Can You Use Your 401k As Collateral For A Loan

What Is A Backdoor Roth

A backdoor Roth IRA is not an official type of individual retirement account. Instead, its the informal name for a complicated Internal Revenue Service -approved method for high-income taxpayers to fund Roths, even if their income exceeds the IRS-allowed limit for regular Roth contributions.

Is a backdoor Roth a good idea? A Backdoor Roth IRA is worth considering for your retirement savings, especially if you are on a high income. A Backdoor Roth conversion can be something to consider if: Youve made the most of other retirement savings options. Willing to leave money on Roth for at least five years

Set Up Your Roth Solo 401k Or Ira And Start Investing In Your Future

Having a Roth Solo 401k in your financial future comes with:

- Qualified distributions are tax-free .

- Both your contributions and earnings grow tax-free and are distributed tax-free.

- Enables you to pay taxes at a lower bracket rate today if you anticipate a higher tax bracket during retirement.

- Protects against the possibility that Federal, State, and Local income tax rates will rise overall.

- Increases tax diversification .

- Can be a vehicle for providing a tax-free inheritance to loved ones.

Read Also: How To Check How Much 401k I Have

Can My Employer Match My Designated Roth Contributions Must My Employer Allocate The Matching Contributions To A Designated Roth Account

Yes, your employer can make matching contributions on your designated Roth contributions. However, your employer can only allocate your designated Roth contributions to your designated Roth account. Your employer must allocate any contributions to match designated Roth contributions into a pre-tax account, just like matching contributions on traditional, pre-tax elective contributions.

So Which Is Better: A Roth Or A Traditional 401

Traditional IRAs make it easier for you to save, because youre contributing pre-tax income. If your biggest interest is saving as much money as possible, the benefits of tax-free earnings in a traditional 401 are hard to beat.

If youre a great saver, a Roth 401 might be better for you. Although youll pay taxes on your contributions, they will come out tax-free, provided you follow the rules for withdrawals at retirement. Its nice to look at your 401 balance and not have to worry about how much goes to taxes and when you have to send your checks.

More on Money

Don’t Miss: How Do I Get A Loan From My 401k

Why Is A Roth Ira Better Than A Roth 401

getty

Maybe youre better off saving your money in a Roth IRA as opposed to a Roth 401. Of course, sometimes you simply dont have a choice.

One of the key advantages of a Roth IRA vs. a Roth 401 is that everyone that earns under a certain level of income has access to establish it and fund it annually, says Daniel G. Dolan, Principal at TFB Advisors, LLC in Overland Park, Kansas. Not all employer-sponsored 401 plans offer the Roth option, so having access to the Roth IRA is critical to accumulate after-tax dollars.

Even if your company does offer a Roth option in its 401 plan, you may still prefer the Roth IRA because it features greater flexibility and customization.

One advantage that most often comes to mind is the ability to open your Roth IRA wherever you want, says Derek Amey, Partner and Advisor at StrategicPoint Investment Advisors in Providence. With the Roth 401 youre beholden to your 401 plans investment choices, which may have limited fund options and unfortunately sometimes expensive fund options. With a Roth IRA you can open it where you want to and invest your money any way that you would like, individual stocks, ETFs different mutual funds etc.

Often overlooked is the requirement to defer your salary in the 401 option with every paycheck. Sometimes you wont know how much to contribute or when to make your contribution, . If this is the case, then the Roth IRA may be more to your liking.

Are There Any Drawbacks To Using A Roth Ira Vs Roth 401k

There are no drawbacks to using a Roth IRA vs Roth 401k. However, the Solo 401k does require that you be self-employed and not have any employees. There is also the RMD difference between a traditional IRA and a Roth IRA. The Roth IRA does not require withdrawals until after the death of the owner. The traditional IRA and Solo 401k do require a first minimum distribution by April 1 of the year after you reach 72.

On the other hand, the Solo 401k does offer many superior benefits over the IRA. A Solo 401k automatically comes with a Roth Solo 401k subaccount. The Roth Solo 401k account has all the advantages of a Roth IRA with the exception that RMD is required with a Roth Solo 401k but not a Roth IRA. Importantly, the Roth Solo 401k does not have the income limit that the Roth IRA has. Other important advantages of Roth IRA vs Roth 401k are the high contribution limits for Roth 401ks, avoiding Unrelated Business Income Tax on leveraged real estate, and the ability to take loans that are tax and penalty-free.

As a business owner, you can have a Solo 401k and you can make an employee deferral just like you can with a company you work for as well as the employer contribution component. If you have a spouse that is working in your business and is employed by your business, they can also take advantage of the Solo 401k as a participant of the plan.

Recommended Reading: How Do I Know Where My 401k Is

Withdrawals In Roth Ira And Traditional Ira

| Roth IRA | Traditional IRA |

|---|---|

| Roth IRAs have no required minimum distributions while youre alive. If you die, you can pass on your IRA to an heir, who has 10 years until they have to make RMDs.Roth IRA distributions are tax-free withdrawals. However, taxpayers may pay a 10% penalty or taxes on your investment earnings on nonqualified withdrawals .Your first Roth IRA contribution must have been five years ago to make a penalty-free withdrawal. | You must begin making RMDs the year after you turn 72 . After that, you must take a yearly RMD by the end of each year.All withdrawals are subject to income tax. All withdrawals before age 59.5 are hit with an additional 10% penalty tax. |

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

You May Like: How To Move Your 401k To An Ira