What Is A Withdrawal Buckets Strategy

With the buckets strategy, you withdraw assets from three buckets, or separate types of accounts holding your assets.

Under this strategy, the first bucket holds some percentage of your savings in cash: often three-to-five years of living expenses. The second holds mostly fixed income securities. The third bucket contains your remaining investments in equities. As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets.

Potential advantages: This approach allows your savings to continue to grow over time. Through constant review of your funding, you also benefit from a sense of control over your assets.

Potential disadvantages: This approach is more time-consuming.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Recommended Reading: How To Transfer 401k From Old Job

Don’t Miss: How To Search For An Old 401k

The History Of The 401

The first 401 retirement plan was founded in the 1970s by employees of the Kodak corporation. You remember them: the guys who made all of those old-style cameras and film?

So, in the early 1970s, according to Wikipedia, a group of high-earning Kodak employees went to Congress. They wanted Congress to pass a law stating they could invest part of their salary into the stock market and have that money be exempt from income taxes.

This law eventually morphed into what we now know as the 401. Todays 401 is used by individuals all over the world as a way to save for retirement.

Disadvantages Of Closing Your 401k

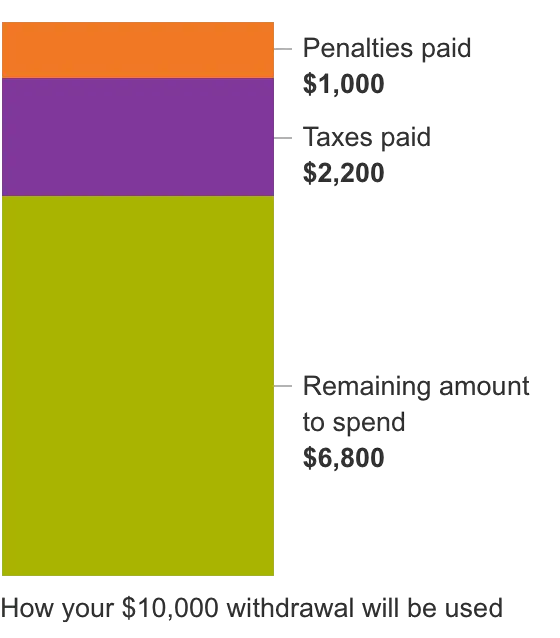

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Don’t Miss: How Much Can You Invest In 401k

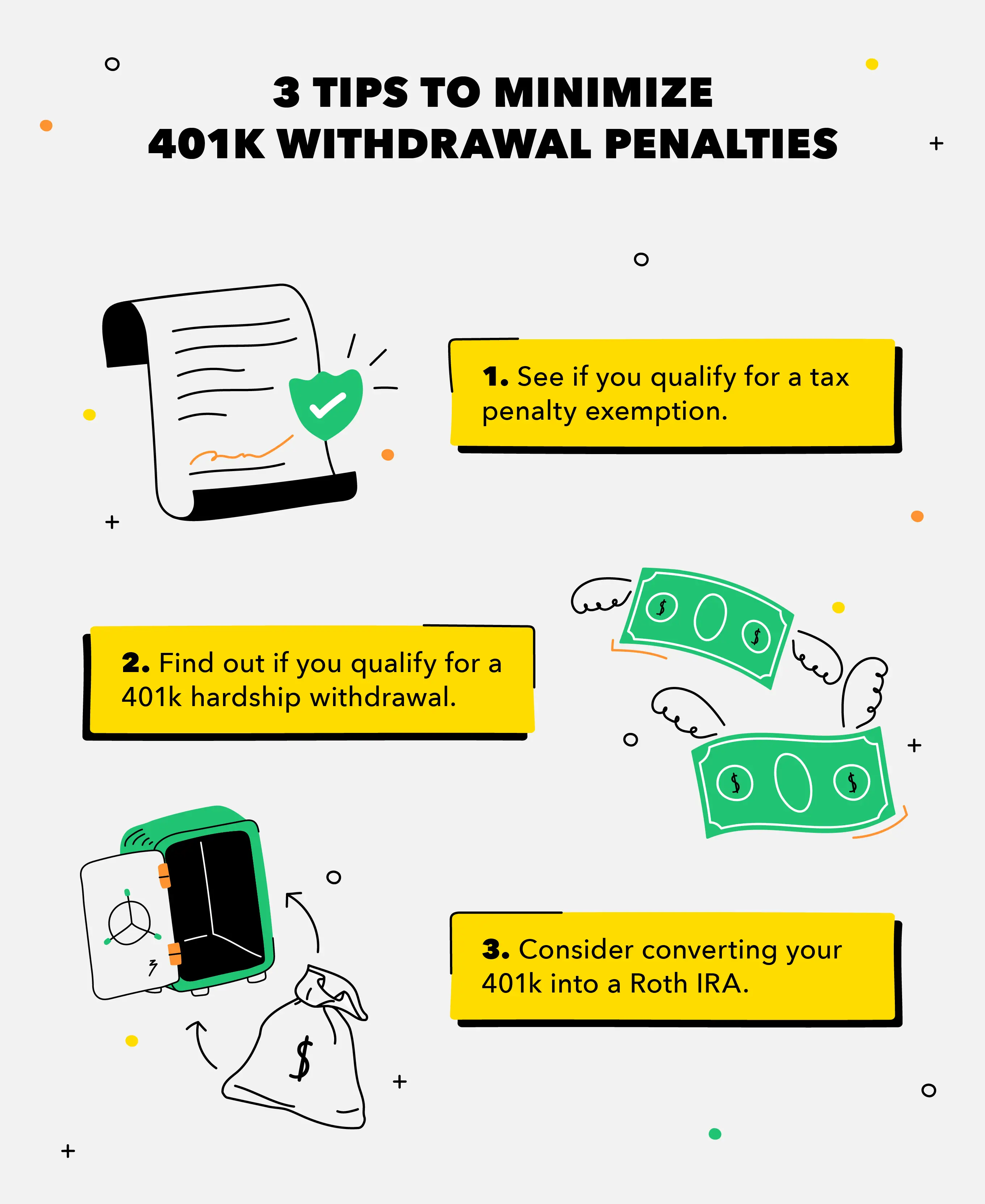

How Do I Avoid Tax Penalty On 401k Withdrawal

Heres how to avoid 401 charges and penalties:

- Avoid the penalty of early withdrawal 401 .

- Shop for funds at low cost.

- Read your 401 rate statement.

- Do not leave a job before dressing in the 401 plan.

- Drag your 401 directly to a new account.

- Compare 401 loans with other loan options.

How do I avoid imposition if I cash in on my 401k? If you keep $ 1000 to $ 5000 or more when you leave your job, you can transfer the funds to a new retirement plan without paying taxes. Other options you can use to avoid paying taxes include taking out a 401 loan instead of a 401 withdrawal, charity donation, or Roth contribution.

How Does A 401k Plan Work

The money in your 401k plan can be used to help you pay for things like retirement, a new home, or a childs education.

When you enroll in a 401k plan, youll choose how much money you want to contribute from each paycheck. This money is then taken out of your paycheck before taxes are taken out.

This means that youll pay less in taxes now, and youll have more money saved for retirement. The money in your 401k plan is invested in a variety of different investments, such as stocks, bonds, and mutual funds.

These investments can grow over time, and the money can be used when you retire. When you retire, you can choose to take the money out of your 401k plan in a lump sum, or you can choose to have it paid out to you over time.

If you choose to have it paid out over time, youll pay taxes on the money as you receive it. If you have a 401k plan through your job, you may also have the option to take out a loan against your 401k.

This can be a good option if you need money for a down payment on a house or an emergency expense. Youll need to pay the loan back with interest, but it can be a good way to access the money youve saved.

A 401k plan is a great way to save for retirement. The money you contribute is invested and can grow over time.

And you may be able to take out a loan against your 401k if you need the money for something important.

Also Check: Can You Transfer 401k To Roth Ira

Rmd Rules For 401 Plans

RMD rules required that workers begin taking RMDs by April 1 of the year after the accountholder turned 70 1/2.

RMDs must be taken not just from 401 plans but from other retirement plans including different types of IRAs. These include SEP and Simple IRAs, as well as from 403s, 457s, profit-sharing plans, and other defined contribution plans. The amount of your RMD is based on your account balance and life expectancy.

The IRS provides worksheets and tables to calculate RMDs. If you do not take your RMD, youll face a 50% penalty on whatever amount you fail to withdraw. So if youre looking at a $5,000 RMD and you dont remove any money from your 401, youll lose $2,500.

Recommended Reading: Who Can Open A Solo 401k

How To Avoid Paying Taxes And Penalties

Despite the fact that it’s funded with after-tax dollars, a Roth 401 account is not immune to taxes and potential penalties if you don’t know how rules surrounding withdrawals. Understanding the requirements will keep you from losing part of your retirement savings or scrambling to pay an unforeseen tax penalty. These taxes and penalties are one more reason to avoid making withdrawals for any reason but a serious emergency. Here’s what you need to know to keep your retirement funds safe.

Recommended Reading: Is Rolling Over 401k To Ira Taxable

How Much Tax Do I Pay On An Early 401 Withdrawal

The money will be taxed as regular income. Thats from 10% to 37%, depending on your total taxable income. In most cases, that money will be due for the tax year in which you take the distribution.

The exception is for withdrawals taken for expenses related to the coronavirus pandemic. In response to the coronavirus pandemic, account owners have been given three years to pay the taxes they owe on distributions taken for economic hardships related to COVID-19.

Can I Take A Withdrawal Before I Terminate Employment

In general, you cant take a 401 withdrawal from your account until one of the following events occurs:

- You die, become disabled, or otherwise terminate employment

However, a 401 plan can also permit withdrawals while you are still employed. These in-service withdrawals are subject to the following conditions:

- 401 deferrals , safe harbor contributions, QNECs and QMACs cant be distributed until age 59.5

- Non-safe harbor employer match and profit sharing contributions can be distributed at any age.

- Employee rollover and voluntary contributions can be distributed at any time.

- 401 deferrals , non-safe harbor contributions, rollovers and voluntary contributions can be withdrawn in a hardship distribution at any time.

To find the in-service withdrawal rules applicable to our 401 plan, check your plans Summary Plan Description .

Recommended Reading: How To Invest My 401k In Stocks

Planning Out The Timing Of Your Withdrawals

The timing of your early withdrawals is important, says Dave Lowell, certified financial planner and founder of Up Your Money Game.

If you were employed for most of the year and had a relatively high income, then it makes sense to not withdraw money under the rule of 55 in that calendar year, since it will add to your total income for the year and possibly result in you moving to a higher marginal tax bracket, Lowell says.

The better strategy in that scenario may be to use other savings or take withdrawals from after-tax investments until the next calendar rolls around. This may result in your taxable income being much lower.

Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Depending on your tax situation, both Luber and Whitney say it also might make sense to take a portion of your 401 and do a Roth IRA conversion. However, its important to review the tax consequences of a move like this with a tax professional.

Keep in mind that any money converted to an IRA would make the funds ineligible for the rule of 55 and prevent penalty-free access for five years under Roth conversion rules. That said, moving funds into a Roth IRA allows you to benefit from years of valuable tax-free investment growth.

Before you leave your job, make sure you look at all your accounts and assets and review the potential tax consequences, Whitney says. Then decide what is likely to work best for you.

Looking For A Financial Advisor?

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

Recommended Reading: How Do I Get A 401k Plan

What Are The Tax Benefits Of Delaying Or Speeding Up 401 Withdrawals

Depending on your individual situation, it might benefit you to start withdrawing 401 monies right away at age 59 ½. Or, you may be better off waiting until youre age 70 ½.

Each persons financial situation is different. Therefore, youll want to talk to a tax expert to find out whats best for you.

Depending on how much you have saved in the various investment vehicles, how much you have saved in non-retirement vehicles and on many other factors, the right withdrawal time can vary.

So be sure to consult with financial experts to determine what the best method for funding your retirement might be. Companies like Blooom specialize in helping people like you manage your 401 plan in a way that is best for your individual situation.

Worried that you arent saving enough to fund your retirement? Consider the tips below for saving more.

Which Is Right For You

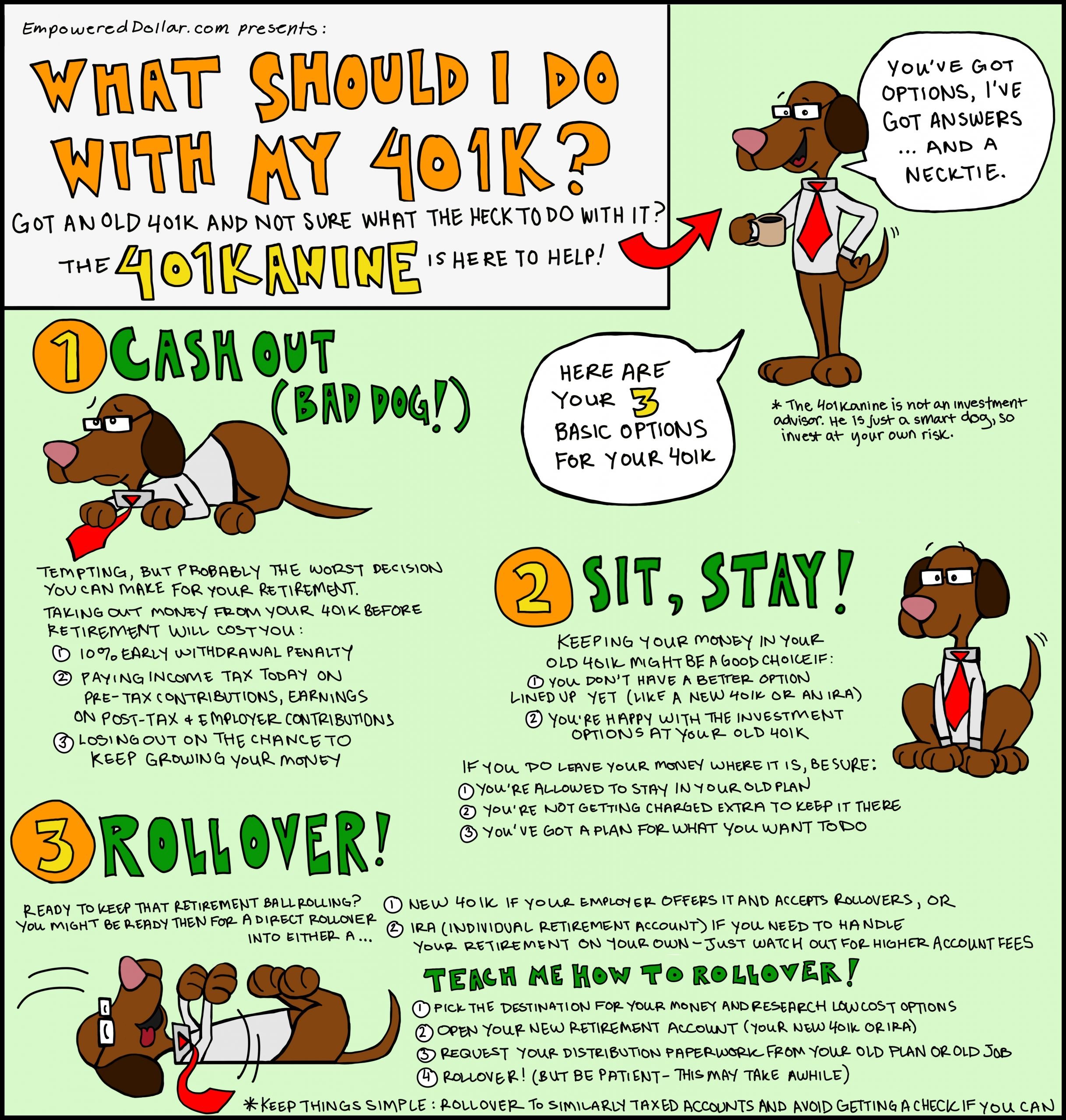

For many, 401 loans are a better option than early withdrawals. After all, as long as you pay the money back during the required time period, you won’t have to pay taxes on the amount withdrawn. Plus, the interest you’ll pay is added to your own retirement account balance.

However, there are several reasons to think twice before taking out a 401 loan.

For example, if you left your job in December of 2022 and had a $2,000 outstanding balance on your loan, you would have until to repay $2,000 in full.

- If you’re not able to repay the loan, your employer will treat the unpaid balance as a distribution.

- Typically, it will be considered taxable income and subject to the 10% early withdrawal penalty.

Ideally, you want to leave your 401 alone until retirement. However, if you find yourself in a really tough spot, borrowing from your 401 might be a better option than simply cashing out your balance. Just make sure you understand the potential consequences and do what you can to repay the balance quickly so you can start rebuilding your retirement nest egg.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Also Check: How To Find My 401k Account Number

Can You Collect Social Security And A Pension At The Same Time

Can I collect Social Security and a pension? Yes. There is nothing that precludes you from getting both a pension and Social Security benefits. … If your pension is from what Social Security calls covered employment, in which you paid Social Security payroll taxes, it has no effect on your benefits.

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Don’t Miss: How To Use 401k To Invest

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

Will My Credit Score Be Impacted If I Withdraw Early

Withdrawing funds from your 401 early won’t impact your credit directly since the credit bureaus don’t track activity on your retirement accounts.

Making an early withdrawal can indirectly affect your credit when you use the money to pay down outstanding debt. It may seem like an easy way to ease a debt burden or boost your credit, but in most cases, this shouldn’t be the only reason to withdraw funds from your 401. Such a move should only be considered in a financial emergency when you have exhausted all other options.

You May Like: Why Should I Roll Over My 401k

How Is The Amount Of The Required Minimum Distribution Calculated

Generally, a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that the IRS publishes in Tables in Publication 590-B, Distributions from Individual Retirement Arrangements . Choose the life expectancy table to use based on your situation.

Joint and Last Survivor Table II

It Can Be Done But Do It Only As A Last Resort

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

If your employer allows it, its possible to get money out of a 401 plan before age 59½. Taking that route is not always advisable, though, as early withdrawals deplete retirement savings permanently and, minus a few exceptions, carry a 10% penalty and a substantial income tax bill.

If you have no better alternatives and decide to proceed, youll need to get in touch with your human resources department. Theyll give you some paperwork to fill out and then ask you to provide some documentation. Once thats done, you should eventually receive a check with the requested funds.

Recommended Reading: When Can I Access My 401k Without Penalty

What Types Of Retirement Plans Require Minimum Distributions

The RMD rules apply to all employer sponsored retirement plans, including

profit-sharing plans, 401 plans, 403 plans, and 457 plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules also apply to Roth 401 accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.