Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

How To Roll Over Your 401 To An Ira

The easiest and safest way to roll over your 401 into an IRA is with a direct rollover from the financial institution that manages your 401 plan to the one that will be holding your IRA. Note there are three key types of rollovers from a 401 to an IRA:

Your plan administrator can guide you through the process, and the financial institution where your money is going will usually be more than happy to assist. In many cases, your plan administrator will give you a check made out to your new IRA custodian for you to deposit there. Thus, open your new IRA first, then contract the plan administrator for of your former employer.

What Happens If I Already Took The Cash From My Account Can I Still Roll Over To An Ira Or To A New Plan

Yes, but you must do so within 60 days of receiving your distribution to keep the tax benefits. This is known as an indirect rollover.

Your employer withholds 20% of the taxable portion of your distribution for federal income taxes. State income taxes may also have been withheld.

If you replace this withholding with your own money, you can roll over the entire amount of your distribution. The IRS will apply the amount toward your tax liability for the year, and if applicable, youll get the withholding back from the IRS when you file your taxes.

If you roll over your distribution but dont replace the withholding, the amount withheld will be considered a distribution subject to taxes and possible penalties.

You can avoid this with a direct rollover, which goes straight from your old plans trustee to an IRA or your new plans trustee not through you. If the sending and receiving plan types are the same to 457 ), consider a transfer of assets, which is not a tax-reportable event.

You May Like: What Does It Mean To Rollover 401k

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roth’s that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

Though this may sound relatively simple, the five-year rule can actually be tricky, and careful consideration of how it applies to your situationand perhaps a good tax advisoris recommended.

Are There Any Examples To Help Explain The Rollover Rules

Yes, the following examples illustrate the rollover rules.

Don’t Miss: What Age Can You Collect 401k

Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes upfront before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary. Tax brackets for 2022 range from 10% to 37%, which are the same as those from 2021.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

Read Also: Why Cant I Withdraw My 401k

Relevant Uniform Ira Measures

A SIMPLE IRA can be a tax-efficient retirement plan for companies with fewer than 100 employees. The employer sets up a plan with a specific financial institution, which then manages it. Paper work is minimal, just the initial computer file of the plan and annual disclosure to employees. Start-up and maintenance costs are low, and employers do notA tax deduction from the contributions they claim.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Also Check: How Do You Get Your 401k Out

Do I Have To Take My Retirement Plan Assets When I Change Jobs

Company retirement plan rules can vary, but most follow the same basic guidelines. If your account balance is less than or equal to $1,000, your plan might cash you out. If your balance is greater than $1,000 and less than or equal to $5,000, your plan might roll over your balance into an IRA selected by your former employer. If your balance is greater than $5,000, you will generally be permitted to leave your balance in the plan however, you will not be able to contribute to the account and will be subject to any restrictions and rules of the plan.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Also Check: Can I Transfer My 401k To Another Job

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Recommended Reading: How To Use Your 401k To Invest In Real Estate

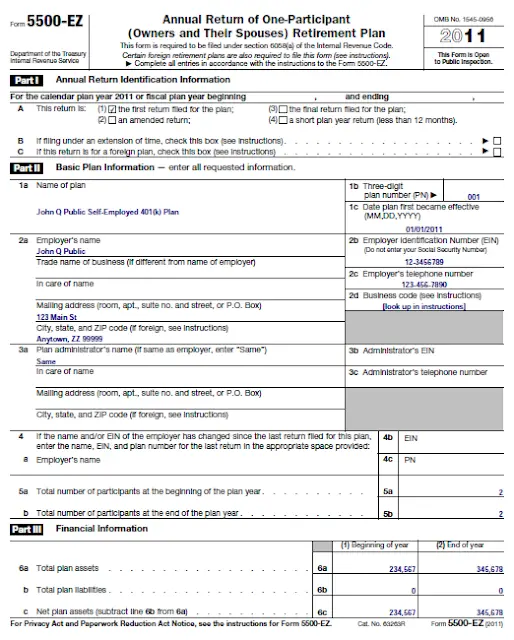

Do Employees Have Any Recordkeeping Or Reporting Obligations

An employee has no reporting obligation with designated Roth contributions in a plan. However, an employee rolling over a distribution from a designated Roth account to a Roth IRA should keep track of the amount rolled over in accordance with the instructions PDF to Form 8606, Nondeductible IRAsPDF.

What Is A Designated Roth Contribution

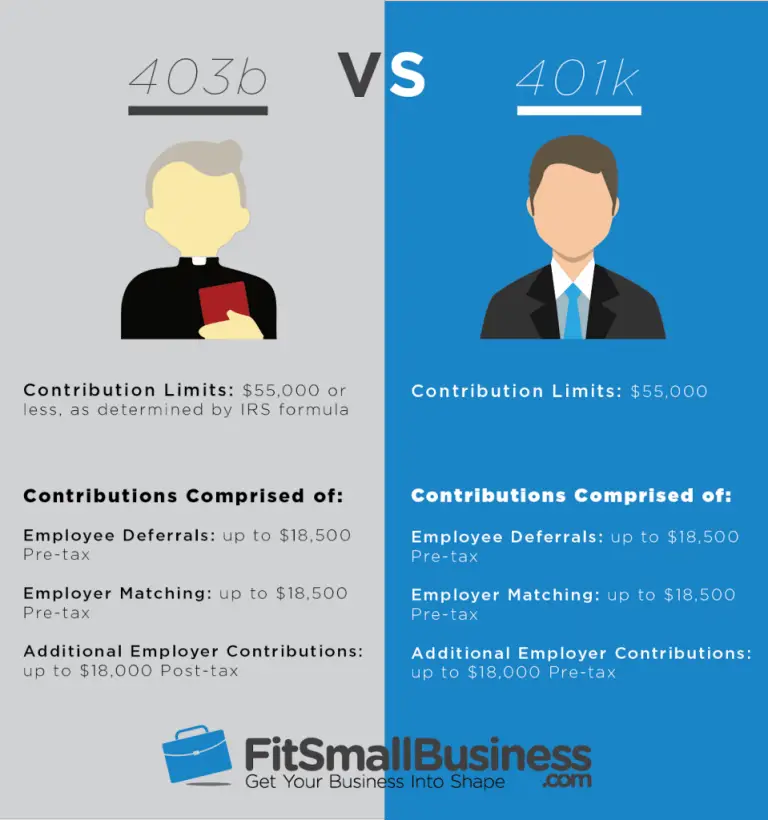

A designated Roth contribution is a type of elective deferral that employees can make to their 401, 403 or governmental 457 retirement plan.

With a designated Roth contribution, the employee irrevocably designates the deferral as an after-tax contribution that the employer must deposit into a designated Roth account. The employer includes the amount of the designated Roth contribution in the employees gross income at the time the employee would have otherwise received the amount in cash if the employee had not made the election. It is subject to all applicable wage-withholding requirements.

The law does not allow designated Roth contributions in SARSEP or SIMPLE IRA plans.

Read Also: How Early Can I Retire 401k

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

Can I Roll Over Just The After

No, you cant take a distribution of only the after-tax amounts and leave the rest in the plan. Any partial distribution from the plan must include some of the pretax amounts. Notice 2014-54 doesnt change the requirement that each plan distribution must include a proportional share of the pretax and after-tax amounts in the account. To roll over all of your after-tax contributions to a Roth IRA, you could take a full distribution , and directly roll over:

- pretax amounts to a traditional IRA or another eligible retirement plan, and

- after-tax amounts to a Roth IRA.

Also Check: How Can I Find My Lost 401k

Rolling Your Annuity Into A 401

Can you roll your annuity over into your 401? It depends.

First, your annuity would need to already be an IRA annuity. And second, your 401 plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You should check with the person in charge of your employers plan. You should also check with your annuity provider and review the contract to make sure youre able to take the funds from the annuity.

Dont Miss: Can I Convert My 401k To A Roth

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if youve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

You May Like: What Is 401k In Usa

You May Like: Can You Transfer 401k To Ira While Still Employed

The Ins And Outs Of Opening And Contributing To A Roth Ira

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

Is There A Limit On How Much I May Contribute To My Designated Roth Account

Yes, the combined amount contributed to all designated Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited ). The limit is $20,500 in 2022 , plus an additional $6,500 in 2020, 2021 and 2022 if you are age 50 or older at the end of the year. These limits may be increased in later years to reflect cost-of-living adjustments.

You May Like: Can I Move 401k To Roth Ira

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917