Are There Any Exceptions For Getting 401 Cash Early Without Penalty

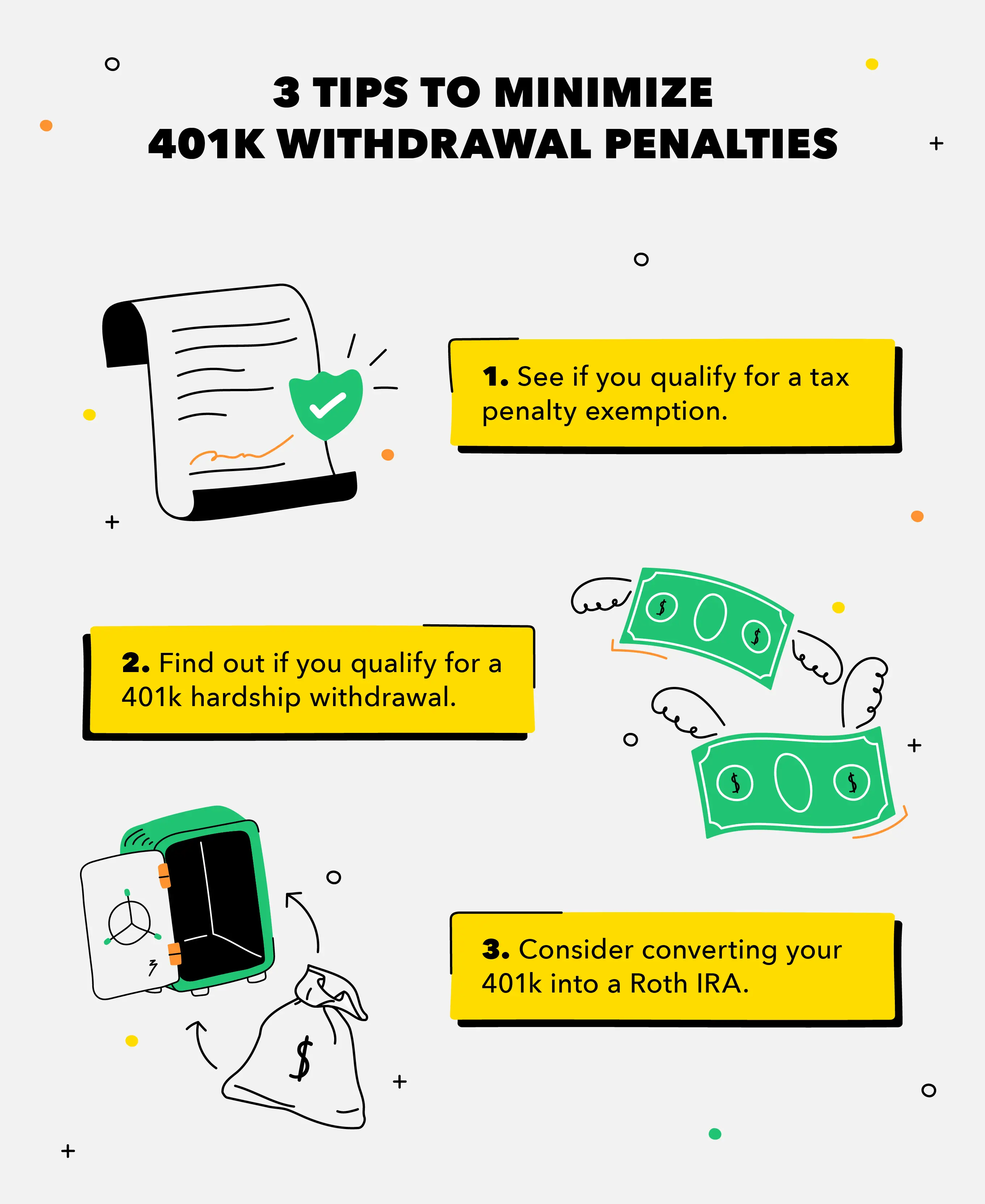

You can cash out a 401 before age 59.5 without paying the 10 percent penalty if:

- You become completely and permanently disabled.

- You incur medical expenses that exceed 7.5% of your gross adjustable income.

- You are court-ordered to give funds to a former spouse or dependent.

In some cases, 401 cash with the 10 percent penalty is the best option. The purchase of a primary residence, higher education tuition, preventing eviction, out-of-pocket medical expenses, or a severe financial hardship can cause you to need the funds sooner rather than later.

Reset Your Automatic 401k Contributions

When was the last time you reviewed your 401k? It may be time to check in and make sure your retirement savings goals are still on track. Is the amount you originally set to contribute each paycheck still the correct amount to help you reach those goals?

With the increase in contribution limits this year, it may be worth reviewing your budget to see if you can up your contribution amount to max out your 401k. If you dont have automatic payroll contributions set up, you could set them up.

Its generally easier to save money when its automatically deducted a person is less likely to spend the cash when it never hits their checking account in the first place.

If youre able to max out the full 401 limit but fear the sting of a large decrease in take-home pay, consider a gradual increase such as 1%how often you increase it will depend on your plan rules as well as your budget.

You Lose Thousands In Potential Growth

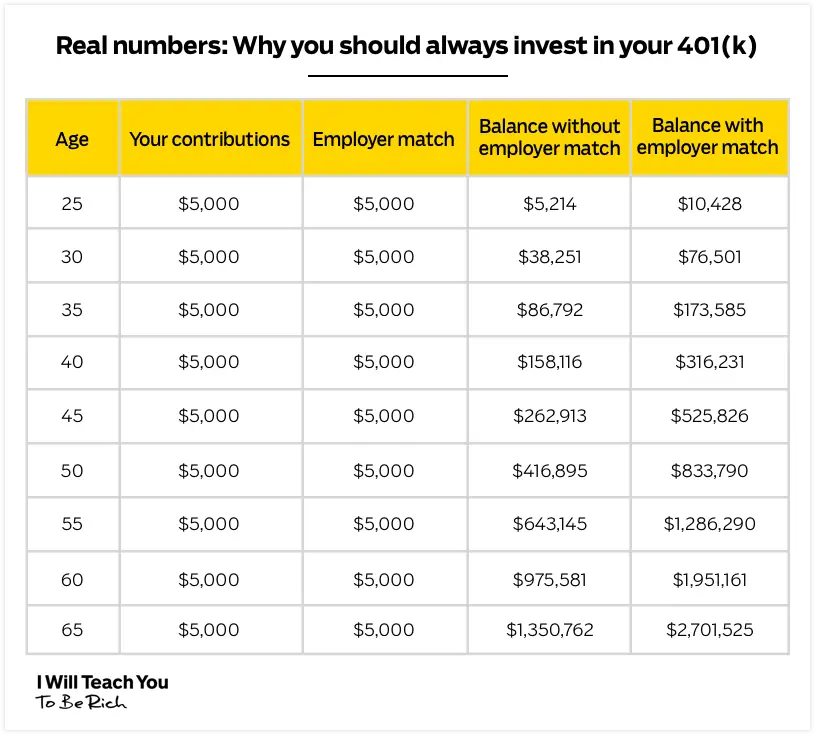

Even if youre not deterred by tax penalties, think twice before you sabotage your long-term retirement savings goals. When you withdraw money early, youll miss out on potential future savings growth because you wont gain the perks of compound interest. Compounding is the snowball effect resulting from your savings generating more earnings not only on your principal investment but also on your accrued interest.

Also, if you make a 401k early withdrawal while the market is down, youre doing yourself a disservice because youll be leaving thousands on the table. Its unlikely youll fully recover the lost years of compound interest you would have benefited from. You might need to get creative with a passive income stream to help support you later in life.

Recommended Reading: Can You Rollover A 401k To Another 401 K

Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

You May Need To Take Money Out Of A 401 Heres What You Need To Know

401s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but it also enforces certain rules to discourage you from taking distributions before retirement. In some cases, breaking those rules and taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes youll owe on withdrawn funds.

Lets look at all the approved ways you can take money out of a 401 and look into the penalties youll incur if your early distributions dont fall within one of those exceptions.

Also Check: Should You Always Rollover Your 401k

You May Like: How To Cash Out On 401k

Withdrawing Money Early From Your 401

The method and process of withdrawing money from your 401 will depend on your employer, and which type of withdrawal you choose. As noted above, the decision to remove funds early from a retirement plan should not be made lightly, as it can come with financial penalties attached. However, should you wish to proceed, the process is as follows.

Step 1: Check with your human resources department to see if the option to withdraw funds early is available. Not every employer allows you to cash in a 401 before retirement. If they do, be sure to check the fine print contained in plan documents to determine what type of withdrawals are available, and which you are eligible for.

Step 2: Contact your 401 plan provider and request that they send you the information and paperwork needed to cash out your plan, which should be promptly completed. Select providers may be able to facilitate these requests online or via phone as well.

Step 3: Obtain any necessary signatures from plan administrators or HR representatives at your former employer affirming that you have filed the necessary paperwork, executed the option to cash in your 401 early, and are authorized to proceed with doing so. Note that depending on the size of the company, this may take some time, and you may need to follow up directly with corporate representatives or plan administrators at regular intervals.

How Long Will Your Money Last In Early Retirement

Although early retirement is a dream for many, there are two main obstacles that can get in the way. First, the earlier you retire, the less time you have to build up your savings. Second, and perhaps more importantly, the longer your retirement lasts, the more youre going to have to stretch out your savings.

Important: 7 Surprisingly Easy Ways To Reach Your Retirement Goals

Whereas someone retiring at 70 may only need 15-20 years of savings, an early retiree who stops working at 40 might need their nest egg to last a whopping 40-50 years, or perhaps even longer.

To paint these numbers in black and white, heres a look at how long varying amounts of savings will last if you retire at age 62, age 55 or age 40. This analysis assumes an annual investment return of 5% and yearly withdrawals starting at $54,132 the average annual income of a full-time earner as of Q2 2022 increasing by 3% per year to keep up with inflation. Lets examine the scenarios.

Don’t Miss: How Much Should Go Into 401k

Roll Over Your 401 To A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Recommended Reading: Which Is Better A Roth Ira Or A 401k

When Does A 401k Early Withdrawal Make Sense

In certain cases, it actually might be strategic to move forward with 401k early withdrawal. For example, it could be smart to cash out some of your 401k to pay off a loan with a high-interest rate, like 1820 percent. You might be better off using alternative methods to pay off debt such as acquiring a 401k loan rather than actually withdrawing the money.

Always weigh the cost of interest against tax penalties before making your decision. Some 401k plans do allow for penalty-free early withdrawals due to a layoff, major medical expenses, home-related costs, college tuition, and more. Regardless of your strategy to withdraw with the least penalties, your retirement savings are still taking a significant hit.

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Recommended Reading: How To Start 401k Solo

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Impact Of Inflation On Pensions And Savings

The amount you get from public pensions, like the Old Age Security pension and Canada Pension Plan, is protected against inflation. This means as the cost of living goes up, the value of your benefit goes up as well.

Not all employer pensions are protected against inflation. Ask your pension administrator or employer whether your pension is protected against inflation.

Personal savings and investments, such as mutual funds or guaranteed investment certificates , are usually not directly protected against inflation. Your savings need to grow by at least the rate of inflation. If not, the amount of things your savings can buy in the future will be less than what they can buy now.

For example, something bought for $100 in 2002 would cost $129.92 in 2016. If your income isnt protected against inflation, you may have a hard time maintaining your lifestyle in retirement as the cost of goods and services increases.

Also Check: What Is The Penalty For Taking Money Out Of 401k

You May Like: How To Collect Your 401k

Substantially Equal Period Payments

Substantially equal period payments SEPPs) can also be a good option to rely on when you need to cash out some money from your 401, but without paying the penalty fee. These withdrawals cannot be done if you are still working for the employer that sponsors your 401 plan, but if you get the funds out through an IRA, then you can make these withdrawals at any time you want.

If you need money in the short term, the SEPP may not be an ideal choice to go for. Once you start making payments for this kind of withdrawal, you can expect to have to pay for at least five years on it, or until you hit 59 and a half whichever comes first.

If you dont make these payments, the penalty for early withdrawal will apply, and youll also be asked to pay interest on the deferred penalties over the past couple of tax years.

There are two exceptions to this rule. The first exception is when the taxpayer dies, allowing for beneficiary withdrawals. The second exception is when the taxpayer becomes disabled permanently.

The withdrawal and payments will be calculated through methods approved by the IRS. You may get fixed annuitization, fixed amortization, or required minimum distribution. Each will allow you to withdraw different amounts, so you can choose just the one you need.

How Do You Cash Out Your Old 401

Cashing out your 401 after leaving a job is an easy process with only a few steps:

Important note: Your 401 plan administrator will likely withhold 20% of the withdrawal amount for federal income tax. This is to ensure the IRS receives its share of your withdrawal. Procedure may vary here, so ask about tax withholdings when you contact the plan administrator.

You May Like: When Can I Start My 401k

Retirement Funds Don’t Have To Be Off

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

For those who invest in their 401 plan, the traditional thinking is to wait until retirement before taking distributions or withdrawals from the account. If you take funds out too early, or before the age of 59½, the Internal Revenue Service could charge you with a 10% early withdrawal penalty plus income taxes.

However, life events can happen, which might put you in a position where you need to tap into your retirement funds earlier than expected. The good news is that there are a few ways to withdraw from your 401 early without incurring a penalty from the IRS.

What Happens To My 401 If I Quit My Job

When you leave a job, you have several options for what to do with your 401.

You can cash it out, leave it with your old employer, or roll it into an IRA. Each option has different tax implications, so choosing the one thats best for your situation is important.

If you cash out your 401, youll have to pay taxes on the amount you withdraw. You may also be subject to a 10% early withdrawal penalty if youre younger than 59 1/2. If you decide to leave your 401 with your old employer, youll still be subject to taxes and penalties if you withdraw the money before retirement. However, leaving your money in a 401 can be a good way to keep it invested and grow over time.

Rolling over your 401 into an IRA is another option. With an IRA, youll have more control over how your money is invested. And, if you roll over your 401 into a Roth IRA, your withdrawals in retirement will be tax-free. Talk to a financial advisor to find out which option is best for you.

- You can keep your 401 with your former employer or transfer it to a new employers plan.

- You can also convert your 401 into an Individual Retirement Account via a 401 rollover.

- Another choice is to withdraw your 401, which may result in a penalty and taxes on the entire amount.

Also Check: How Do I Access My 401k From A Previous Employer