How Much You Can Withdraw

You cant just withdraw as much as you want it must be the amount necessary to satisfy the financial need. That sum can, however, include whats required to pay taxes and penalties on the withdrawal.

The recent reforms allow the maximum withdrawal to represent a larger proportion of your 401 or 403 plan. Under the old rules, you could only withdraw your own salary-deferral contributionsthe amounts you had withheld from your paycheckfrom your plan when taking a hardship withdrawal. Also, taking a hardship withdrawal meant you couldnt make new contributions to your plan for the next six months.

Under the new rules, you may, if your employer allows it, be able to withdraw your employers contributions plus any investment earnings in addition to your salary-deferral contributions. Youll also be able to keep contributing, which means youll lose less ground on saving for retirement and still be eligible to receive your employers matching contributions.

Some might argue that the ability to withdraw not just salary-deferral contributions but also employer contributions and investment returns is not an improvement to the program. Heres why.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Wait To Withdraw Until Youre At Least 595 Years Old

If all goes according to plan, you wont need your retirement savings until you leave the workforce. By age 59.5 , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax.

Youll simply need to contact your plan administrator or log into your account online and request a withdrawal. However, you will owe income taxes on the money , so a portion of each distribution should be designated to cover your tax liability. 401 withdrawals arent mandatory until April 1 of the year after you turn 72 , at which point you must take a required minimum distribution every year.

Read Also: How To Set Up 401k For Employees

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

When Should You Consider A 401 Loan

401 loans have a number of negative aspects, yet there are still times when they may be preferable to other options. As a last resort, a 401 loan might be useful if you need money for:

- Compensation of Tax Obligations. When you owe money to the Internal Revenue Service , they can claim ownership of your property by filing a tax lien. Having a tax lien on your property might make it difficult, if not impossible, to sell the home or refinance the mortgage. When a tax is not paid, the IRS can levy your assets and take them. Its the least of two evils to withdraw money from retirement to settle a tax lien or levy.

- To keep from going bankrupt. To avoid filing for bankruptcy, a 401 loan may be a viable option. You may keep your house and other valuables even after filing for bankruptcy, but your credit will take a serious hit. Your prospects of landing a job, a professional license, or a government security clearance may all take a hit even after the bankruptcy has been removed from your credit report.

- House Hunting . Some 401 plans allow you to borrow against your retirement savings for a house down payment and extend the repayment period. That lessens the hit on your salary, but doesnt get rid of the other hazards involved with payday loans.

Recommended Reading: How Much Money Can You Take Out Of Your 401k

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Read Also: Can You Transfer Your 401k

Series Of Substantially Equal Periodic Payments

This is the classic Section 72t ) method for early withdrawal exceptions to the penalty. Essentially you agree to continue taking the same amount from your plan for the greater of five years or until you reach age 59½. There are three methods of SOSEPP:

7. Required Minimum Distribution method uses the IRS RMD table to determine your Equal Payments.

8. Fixed Amortization method in this method, you calculate your Equal Payment based on one of three life expectancy tables published by the IRS.

9. Fixed Annuitization method this method uses an annuitization factor published by the IRS to determine your Equal Payments.

Section 72 provides additional methods for premature distribution exceptions which can occur before leaving employment :

10. High Unreimbursed Medical Expenses for yourself, your spouse, or your qualified dependent. If you face these expenses, you may be allowed to withdraw a limited amount without penalty.

11. Corrective Distributions of Excess Contributions under certain conditions, when excess contributions are made to an account these can be returned without penalty.

12. IRS Levy when the IRS levies an account for unpaid taxes and/or penalties, this distribution is generally not subject to penalty.

And lastly, here are a few additional ways that you can withdraw your 401k funds without penalty:

Originally by Financial Ducks In A Row, 1/20/20

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

Withdrawing After Age 595

Recommended Reading: Can You Convert A Traditional 401k To A Roth Ira

Q: Does It Make Sense To Borrow From My 401 If I Need Cash

When cash is tight, your 401 can seem like a perfectly reasonable way to make life a little easier. The money is there and its yoursso why not tap it to pay off debt or get out of some other financial jam? Or you might be tempted to use it to pay for that dream vacation you deserve to take.

Stop right there. The cash in your 401 may be calling youbut so is your financial future. The real question here: Will taking the money today jeopardize your financial security tomorrow?

Im not saying a 401 loan is always a bad idea. Sometimes, it may be your best option for handling a current cash need or an emergency. Interest rates are generally low and paperwork is minimal. But a 401 loan is just thata loan. And it needs to be paid back with interest. Yes, youre paying the interest to yourself, but you still have to come up with the money. Whats worse is that you pay yourself back with after-tax dollars that will be taxed again when you eventually withdraw the moneythats double taxation!

K Early Withdrawal Hardship Or Loan: Whats The Difference

Knowing the differences between a 401k early withdrawal, a hardship withdrawal, and a 401k loan is crucial. Due to the many obstacles to make a 401k early withdrawal, you may find you want to keep it untouched. If youre convinced you still need to use your 401k for financial assistance, consult with a trusted financial advisor to figure out the best option.

|

When Does This Apply? |

||

| Your funds are withdrawn to pay off large debts or finance large projects. | Your 401k fund is typically subject to taxes and penalties. | |

|

Hardship Withdrawal |

Youre only eligible for this type of withdrawal under circumstances such as a pandemic or natural disasters. | Withdrawals cant exceed the amount of the need and the funds are still subject to taxes and penalties. |

|

401k Loan |

The loan must be paid back to the borrowers retirement account under the plan. | The money isnt taxed if the loan meets the rules and the repayment schedule is followed. |

You May Like: How To Save For Retirement Without A 401k

How To Save For Retirement

Once youre out of debt and have your fully-funded emergency fund, youre ready to start building wealth in Baby Step 4. Youll do this by investing 15% of your gross household income into retirement accounts.

Start with your employers 401, if you have one, and invest up to the match. Then move to a Roth IRA and invest the rest of your 15%. If you max out your Roth IRA contributions and still havent reached your 15% goal, go back to your 401 and contribute more there! contributions, start by maxing out your Roth IRA.) However, if your employer offers a Roth 401 with a match and you like your investment options, things get a lot easieryou can invest your whole 15% in your workplace plan.

Theres no secret trick or magic formula when it comes to investingif you invest every month, it will add up. In fact, about 80% of millionaires consistently invested in their employer-sponsored retirement plansaka their 401.5 It may sound boring, but it works ! And if youre still not sure where to start when it comes to investing, one of our SmartVestor Pros will show you.

Scenario : Invest While Still Paying Off Debt

The average American with student loan debt has a balance of $38,792 with an interest rate of 5.8%.2,3 It typically takes someone 20 years to pay off their student loans, but it can take up to 45 years!4 For this example, well use 30 years.

So, if it took you 30 years to pay off a $38,792 loan with 5.8% interest , youd hand over $43,526 in interest alone. And if you started paying off your student loans at the age of 22, youd be in debt until youre 52!

Lets say, when you turn 30, you decide to start investing. You put that same amount of $227 toward retirement, while still paying $227 toward your debt. At age 52, you pay off your student loans and use that payment to bump up your investing to $500 each month.

With an 11% annual return, youd have a little over $1.5 million in retirement when you turn 67. Yeah, thats a lot of money, but were not done doing the math.

Also Check: How Does Rolling Over A 401k Work

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you have no need for your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

Recommended Reading: How To Change 401k Contribution On Fidelity

Given All This What Is The Best Age To Take Money Out Of Your 401

For those with no pension or other guaranteed sources of income, it often makes sense to take money out in years when you are in a low tax rate rather than waiting until age 72.

On the other hand, for those with pensions or other income sources, it often makes sense to delay and only withdraw when you are required to do so at age 72. The right age depends on many factors, and no one can recommend the best option for you without a complete analysis.

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars unlike contributions, which are made before taxes.

You May Like: How To Roll My 401k Into A Roth Ira

Read Also: How Do I Sign Up For 401k

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

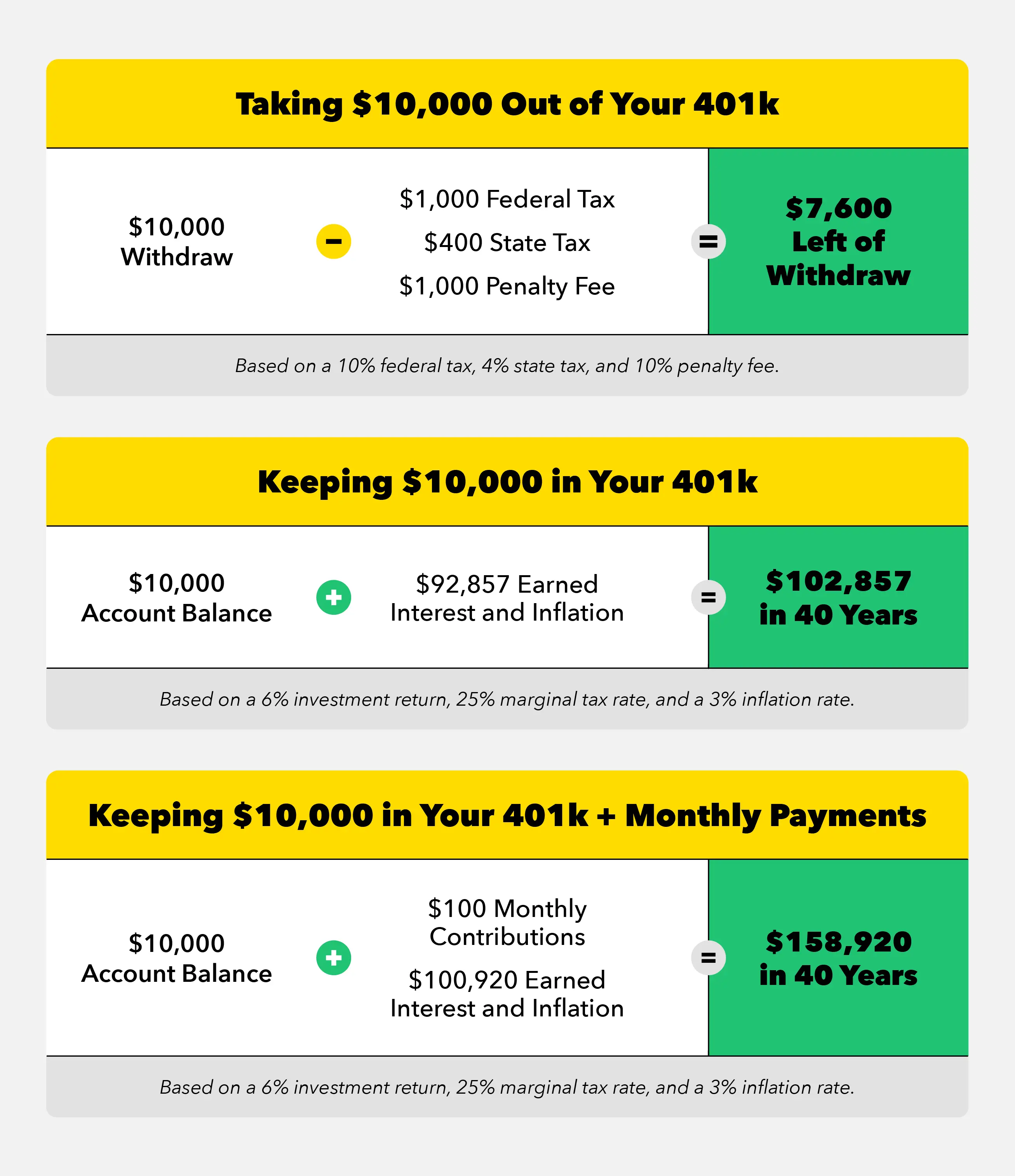

A withdrawal is a permanent hit to your retirement savings. By pulling out money early, youll miss out on the long-term growth that a larger sum of money in your 401 would have yielded.

Though you wont have to pay the money back, you will have to pay the income taxes due, along with a 10% penalty if the money does not meet the IRS rules for a hardship or an exception.

A loan against your 401 has to be paid back. If it is paid back in a timely manner, you at least wont lose much of that long-term growth in your retirement account.

Don’t Miss: How To Qualify For 401k