Tax Consequences When Rolling A 401 Into A Roth Ira

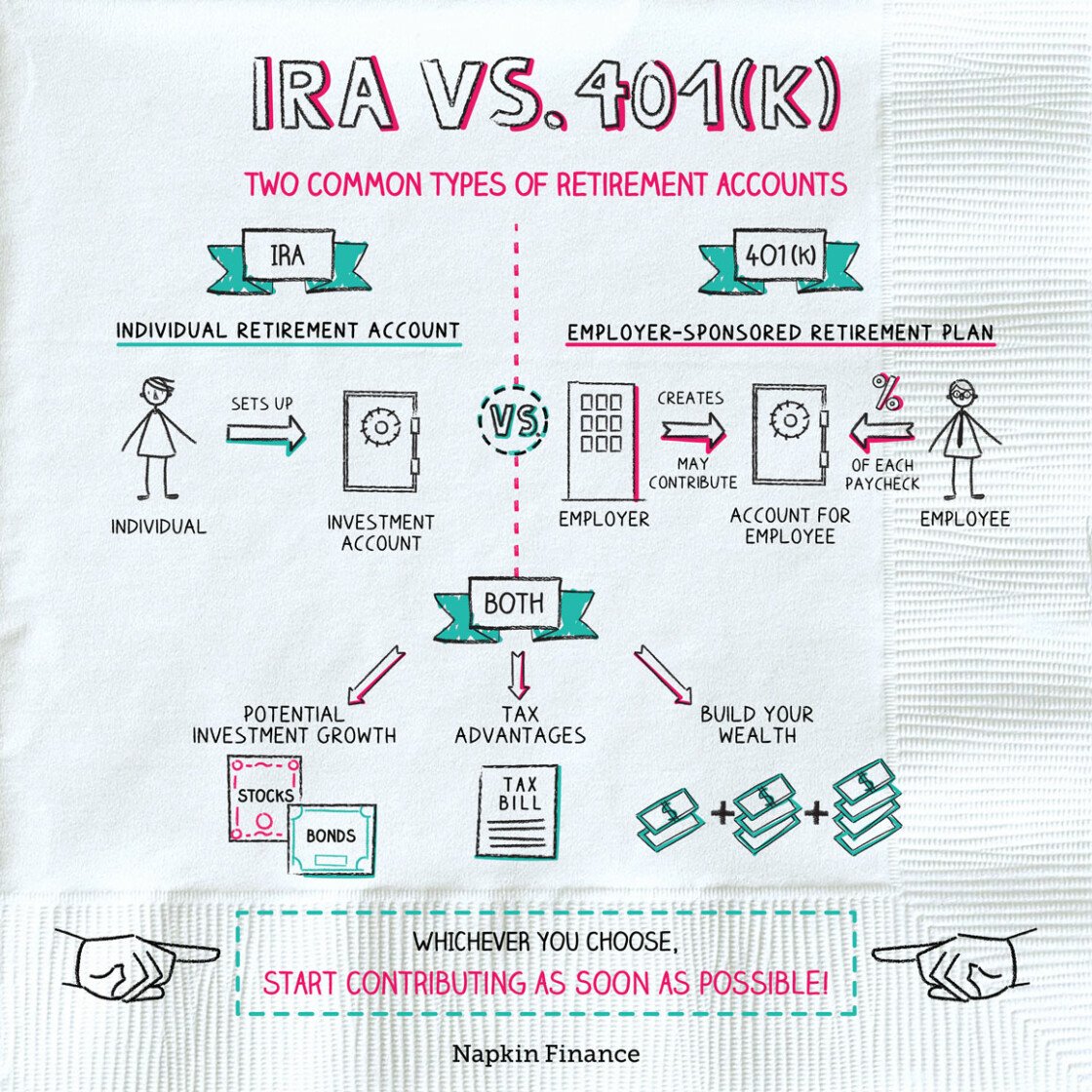

There are two main types of 401 plans available. Traditional 401 plans allow you to deposit pre-tax money into your retirement account. Youll need to pay taxes on these funds when you withdraw them.

Roth 401 plans, meanwhile, consist of after-tax money you contribute to your account. As a result, you wont owe any additional money when it comes time to withdraw. The same is true for a Roth IRA.

This means that there are tax consequences if you rollover a 401 to Roth IRA. Because a standard 401 is funded with before-tax dollars, you will need to pay taxes on those funds in order to move that money into an after-tax funded Roth IRA account.

Not everyone is eligible for a Roth IRA there are income limits to prevent high earners from avoiding tax. However, its still possible for high earners to create one, called a backdoor Roth IRA, by converting a traditional IRA to a Roth IRA.

When An Ira Is Better

An IRA could be better than a 401 if youre looking for more flexibility in your retirement planning.

Unlike a 401, with an IRA the investment world is at your fingertips, says Taylor J Kovar, Certified Financial Planner and CEO of Kovar Wealth Management. Stocks, bonds, mutual funds, and real estate are all available while with a 401, you are limited to just the funds the plan allows you to invest in.

Another reason why an IRA could be a better option is if you currently have low tax rates but anticipate higher tax rates during retirement. By contributing to a Roth IRA, youll pay your taxes upfront so your growth and withdrawals during retirement are tax-free.

Not all employers offer a 401 plan, so an IRA is one of the best alternatives to help you save for retirement on your own.

| Pros |

Dont Miss: Should I Use 401k To Pay Off Debt

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

You May Like: How To Withdraw Fidelity 401k

A Roth Ira Can Be A Great Way To Save For Retirement Since The Accounts Have No Required Minimum Distributions And You Withdraw The Money Tax

Tax-free income is a dream of every taxpayer. And if you save in a Roth account, its a reality. Roths are the youngsters of the retirement savings world. The Roth IRA, named after the late Delaware Sen. William Roth, became a savings option in 1998, followed by the Roth 401 in 2006. Creating a tax-free stream of income is a powerful retirement tool. These accounts offer big benefits, but the rules for Roths can be complex.

Here are 11 things you must know about utilizing a Roth IRA as part of your retirement planning.

Traditional Ira Vs Roth Ira

Lets say that after evaluating the advantages and disadvantages of doing a 401 rollover to an IRA, you decide to move forward with the rollover.

Now you have a second choice: traditional IRA or Roth IRA.

Lets look at both.

Traditional IRA

The traditional IRA has all the advantages and disadvantages weve discussed so far. The main advantage to doing a 401 rollover to a traditional IRA is that there are no tax consequences as a result of the rollover.

Youll move the old 401 to your traditional IRA, report it on your tax return as a full rollover, and you will not ordinary owe income tax, and no 10% early withdrawal penalty.

Youll be able to keep the money in the traditional IRA, building up tax-deferred investment income. After age 59 ½ you can begin taking withdrawals from the plan.

As you do, the amount of the withdrawals will be subject to ordinary income. If you take withdrawals before reaching 59 ½, youll not only have to pay ordinary income tax, but also the 10% early withdrawal penalty .

Beginning at age 70 ½ youll be required to begin taking RMDs, based on your life expectancy, which will be calculated for each age a withdrawal is required.

Roth IRA

If you do a rollover of a 401 to a Roth IRA, youll experience financial pain at the time of the rollover, but youll gain many benefits in the future.

Lets say youre in a combined federal and state marginal income tax rate of 30%. You do a rollover of a 401 to a Roth IRA of $100,000.

Also Check: Can You Roll Your Pension Into A 401k

Which One Do You Choose

Where are you now financially compared to where you think youll be when you tap into the funds? Answering this question may help you decide which rollover to use. If youre in a high tax bracket now and expect to need the funds before five years, a Roth IRA may not make sense. Youll pay a high tax bill upfront and then lose the anticipated benefit from tax-free growth that wont materialize.

If youre in a modest tax bracket now but expect to be in a higher one in the future, the tax cost now may be small compared with the tax savings down the road. That is, assuming you can afford to pay taxes on the rollover now.

Bear in mind that all withdrawals from a traditional IRA are subject to regular income tax plus a penalty if youre under 59½. Withdrawals from a Roth IRA of after-tax contributions are never taxed. Youll only be taxed if you withdraw earnings on the contributions before you’ve held the account for five years. These may be subject to a 10% penalty as well if youre under 59½ and dont qualify for a penalty exception.

Its not all or nothing, though. You can split your distribution between a traditional and Roth IRA, assuming the 401 plan administrator permits it. You can choose any split that works for you, such as 75% to a traditional IRA and 25% to a Roth IRA. You can also leave some assets in the plan.

Decide Between A Traditional Or Roth Ira

The type of IRA you roll your old 401 money into will depend on what kind of 401 youre transferring the money from.

In most cases, if you have a traditional 401, youll probably want to roll the money into a traditional IRA. That way, you wont have to pay any taxes on the transfer .

If you had a Roth 401, thats a different story. You could roll the money you contributed into a Roth IRA completely tax-free and continue to enjoy tax-free growth and tax-free withdrawals in retirement. But your employers contributions are treated like traditional 401 contributions . . . so that money needs to either be rolled over into a traditional IRA or you can pay the taxes to roll them into a Roth account.

Easy, right? Traditional to traditional, tax-free today. Roth to Roth, mostly tax-free today and tax-free in retirement.

Also Check: How Can I Take Money Out Of My 401k

What Happens If I Cash Out My 401

If you simply cash out your 401 account, you’ll owe income tax on the money. In addition, you’ll generally owe a 10% early withdrawal penalty if you’re under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Should You Do A 401 Rollover To An Ira

The 401 rollover to an IRA has become very popular, and for good reason. Todays retirement plans are designed to be portable, and none are more so than an IRA.

Once you complete the rollover, youll have more choices than you ever had with your 401. That will include the choice of the plan trustee, the type of investing youll do, and even the account fees youll pay.

Complete flexibility is usually a big advantage when it comes to investing, especially for retirement. And while youre managing your new rollover IRA account, youll be building a whole new 401 plan with your new employer.

Itll be the best of both worlds.

Don’t Miss: How Do I Draw From My 401k

Get Help With Your 401 Rollover

Having an investment professional in your corner, someone who can help you find the right investments to add to your portfolio and walk you through all the ins and outs of a 401 rollover, makes this process a lot easier.

Dont have an investment professional? No worries! Our SmartVestor program can get you in touch with someone in your area to help you get started.

Option : Cashing Out Your 401

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means youâll have to pay taxes on the withdrawal, and thereâs typically an additional 10% tax penalty if youâre younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If youâre considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine whatâs important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

Also Check: When To Convert 401k To Roth Ira

Recommended Reading: Do You Get Your 401k When You Quit

What To Know About Roth Iras And Roth Conversions

A Roth individual retirement account offers advantages a traditional IRA does notlike the potential for your savings to grow tax-free and not having to take required minimum distributions.

Well help you understand the benefits Roth IRAs offer, your options for including a Roth IRA in your retirement savings strategy and what to consider when evaluating your needs.

Types Of Individual Retirement Accounts

There are several types of IRAs. The Roth IRA allows you to make after-tax contributions and affords tax-free withdrawals in retirement. A traditional IRA allows you to make pre-tax contributions into a tax-deferred account, and withdrawals are subject to taxes in retirement .

Take note that after-tax and pre-tax refers to your income. When it comes to a Roth IRA, it wont be taxed because you already paid taxes on your money , and with a traditional IRA, since your money hasnt been taxed yet, you pay later.

Either way, both the traditional and Roth IRAs are independently managed. You can choose whichever financial institution youd like to manage and service your retirement account, whether its an international bank or a local investment firm. The IRA owner can choose to place the retirement savings that constitute his IRA funds into the care of a plan administrator or choose to manage their own self-directed IRA.

A self-directed IRA should not be confused with a SEP IRA, which is an IRA geared toward self-employed individuals and may or may not be under the care of an IRA custodian.

Read Also: Can A Sole Proprietor Have A 401k

Benefits Of Silver Iras

If youre invested in a traditional IRA or a 401, it may be difficult to understand the benefits of a silver IRA. Many people who have just discovered the investment find it hard to comprehend its ability to counter inflation!

I want to clear the misconceptions you have about silver IRAs with the help of my guide. Because of the current economic situation, many investors are looking for alternative investments. Silver IRAs may be the right choice for them.

Many people argue that the price of silver is volatile. While no investment offers a guaranteed upward trajectory, silvers price is less volatile than the stock market!

Another major benefit of investing in silver is its ability to be economical. Silver providers do not charge large premiums, helping you save on fees. This is why the metal is highly favorable to people who want to protect themselves from devaluation!

Are There Any Required Minimum Distributions I Must Take From The Ira Accounts After Retirement

Lets go back to Jims example once again. At age 72, Jim must start taking distributions from his Traditional IRA holdings as per amounts mandated by the IRS, based on Jims life expectancy and balance remaining.

Jim has no obligation to distribute his Roth IRA holdings. He can continue to choose the best investments to grow his money tax-free.

At Age 72:Want to retire early? A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½without the usual 10% penalty.

With a Roth conversion ladder, you shift money from a tax-deferred retirement accountsuch as a traditional IRA or 401into a Roth IRA. But unlike a standard Roth IRA conversion, you do it multiple times over several years. If done correctly, you can withdraw the converted funds with no tax or penalty long before your 59th birthday.

Recommended Reading: Can You Rollover A 401k Into An Annuity

You May Like: How To Get Funds From 401k

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs arenât linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, youâll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but letâs take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Read Also: When Can I Rollover My 401k

Read Also: What Is The Best 401k Fund

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.