Setup Your Solo 401k Today

A Solo 401k plan is easy to set up, flexible, and can be funded with tax-deductible contributions up to $67,500, about 10X higher than an IRA. 2022 is the Year to Take Your Maximum Tax Savings. Setting up a Solo 401k is a powerful tax planning tool. Solo 401ks are fully compliant with all IRS rules. With Nabers Group, you can immediately begin investing in what you want. You are also ready to take full advantage of the 2022 tax benefits that come with your Solo 401k!

Take your retirement future into your full control. You worked hard for your money, and you deserve to control where its invested and grow as much as you want. Save big on taxes and invest with freedom using a Solo 401k.

Your financial freedom is waiting!

What Is A Solo 401k

Simply put a Solo 401k is a retirement plan designed for solopreneurs, independent contractors, freelancers, and small business owners. A Solo 401k is also known as an individual 401k, Uni-K, Solo K, or even a one-participant retirement plan. Thats because theres usually just one person in the plan . If your spouse works in your small business with you, they can participate in your Solo 401k too.

Traditional 401k plans are set up by companies so their employees can save for retirement. A Solo 401k works similarly, but the structure of the 401k is made to be the perfect size for your small business. If youre a freelancer, independent contractor, or running an S-corp and paying yourself a W-2 wage, you are eligible. You play multiple roles in your small business. You are both employer and employee. In essence, this lets you contribute way more than any other retirement plan. Contributions are tax-deductible or Roth . The amount of money you can contribute to a Solo 401k is directly tied to your self employment business earnings.

What Are My Responsibilities To Properly Maintain My Individual 401k

You are responsible for submitting the salary deferral and profit sharing contributions by their required deadlines. If you have a loan, you are required to make the loan repayments according to the terms of the loan amortization schedule or risk a loan default. When the total assets in your plan reach $250,000, the IRS requires that IRS Form 5500 is completed and submitted to them annually.

Also Check: How Do You Know If You Have A 401k Plan

Find Out When And How To File Irs Form 550 For Your Solo 401 Plan

A solo 401 ) is a 401 retirement plan designed specifically for self-employed people with one-owner businesses. It covers only you . You can set up a solo 401 whether your business is incorporated or a sole proprietorship. Partners in a partnership can also establish these plans for themselves. Solo 401s are a great retirement option for self-employed people because the money you contribute each year is tax deductible, and you can make substantial annual deductible contributions: as much as 20% of your net profit from self-employment plus an annual deferral contribution of up to $18,000 , up to an annual maximum of $53,000 . Plus you can add an additional $6,000 annual catch-up contribution if you’re over 50 years of age.

You can set up a solo 401 plan at most banks, brokerage houses, mutual funds, and other financial institutions and invest the money in a variety of ways. You must adopt a written plan and set up a trust or custodial account with your plan provider to invest your funds. Financial institutions that offer solo 401 plans have preapproved ready-made plans that you can use.

If your solo 401 is worth more than $250,000, you can have your plan administrator or CPA make the required filing. However, they will ordinarily charge you for this serviceoften as much as $200. You can easily do this very simple tax filing yourself and save the money.

There are two ways to file:

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours a year in your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

Recommended Reading: What Is The Best 401k Investment Option

Traditional 401 Vs Roth 401

When 401 plans became available in 1978, companies and their employees had just one choice: the traditional 401. Then in 2006, Roth 401s arrived. Roths are named for former U.S. Senator William Roth of Delaware, the primary sponsor of the 1997 legislation that made the Roth IRA possible.

While Roth 401s were a little slow to catch on, many employers now offer them. So the first decision employees often have to make is between a Roth and a traditional .

As a general rule, employees who expect to be in a lower after they retire might want to opt for a traditional 401 and take advantage of the immediate tax break.

On the other hand, employees who expect to be in a higher bracket after retiring might opt for the Roth so that they can avoid taxes on their savings later. Also importantespecially if the Roth has years to growis that there is no tax on withdrawals, which means that all the money the contributions earn over decades of being in the account is tax-free.

As a practical matter, the Roth reduces your immediate spending power more than a traditional 401 plan. That matters if your budget is tight.

Since no one can predict what tax rates will be decades from now, neither type of 401 is a sure thing. For that reason, many financial advisors suggest that people hedge their bets, putting some of their money into each.

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $20,500 in 2022.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Don’t Miss: How To Withdraw From 401k Fidelity

Can My Spouse Contribute To The Individual 401k

Yes. If a spouse is employed by the business and is on the payroll and receives a W-2 then they are eligible to contribute to an Individual 401k. Owner and spouse businesses are one of the biggest beneficiaries of the Individual 401k because with sufficient income they can potentially contribute $122,000 total based on the 2022 limits.

For Real Estate Investors

Like the Self-Directed IRA LLC structure, the Solo 401 Plan offers participants the ability to invest in real estate tax-free. That means, all income and gains you generate from your investments will flow back to the 401 Plan without tax.

In the case of an IRA using non-recourse debt to finance a real estate purchase, income or gains from the investment typically will trigger a penalty tax.

This is known as the Unrelated Debt Financed Income tax. UDFI is a type of unrelated business taxable income which, if triggered, can subject the IRA to close to a 40% tax for 2022. However, a 401 Plan using non-recourse financing for a real estate investment is exempt from the UDFI tax.

Also Check: Is Roth Better Than 401k

What Is A Solo 401 And Who Should Open One

Modified date: Jun. 2, 2022

People with full-time jobs at big companies often have access to an employer-sponsored 401 retirement account. If youre self-employed, you have to figure out retirement all on your own. There are a handful of ways to manage your retirement, but one of the absolute best is with a Solo 401 account.

Solo 401 accounts give you generous limits, a huge range of investment options, and often come with no recurring fees. If you are looking to save for retirement while self-employed, read on to find out why a Solo 401 is the first place you should start.

Whats Ahead:

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2021, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $104,000 but less than $124,000 for a married couple filing a joint return or a qualifying widow,

- More than $65,000 but less than $75,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Recommended Reading: What Age Must You Start Withdrawing From 401k

Contributing To Both A Traditional And A Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

What Are The Potential Tax Benefits Of A Solo 401

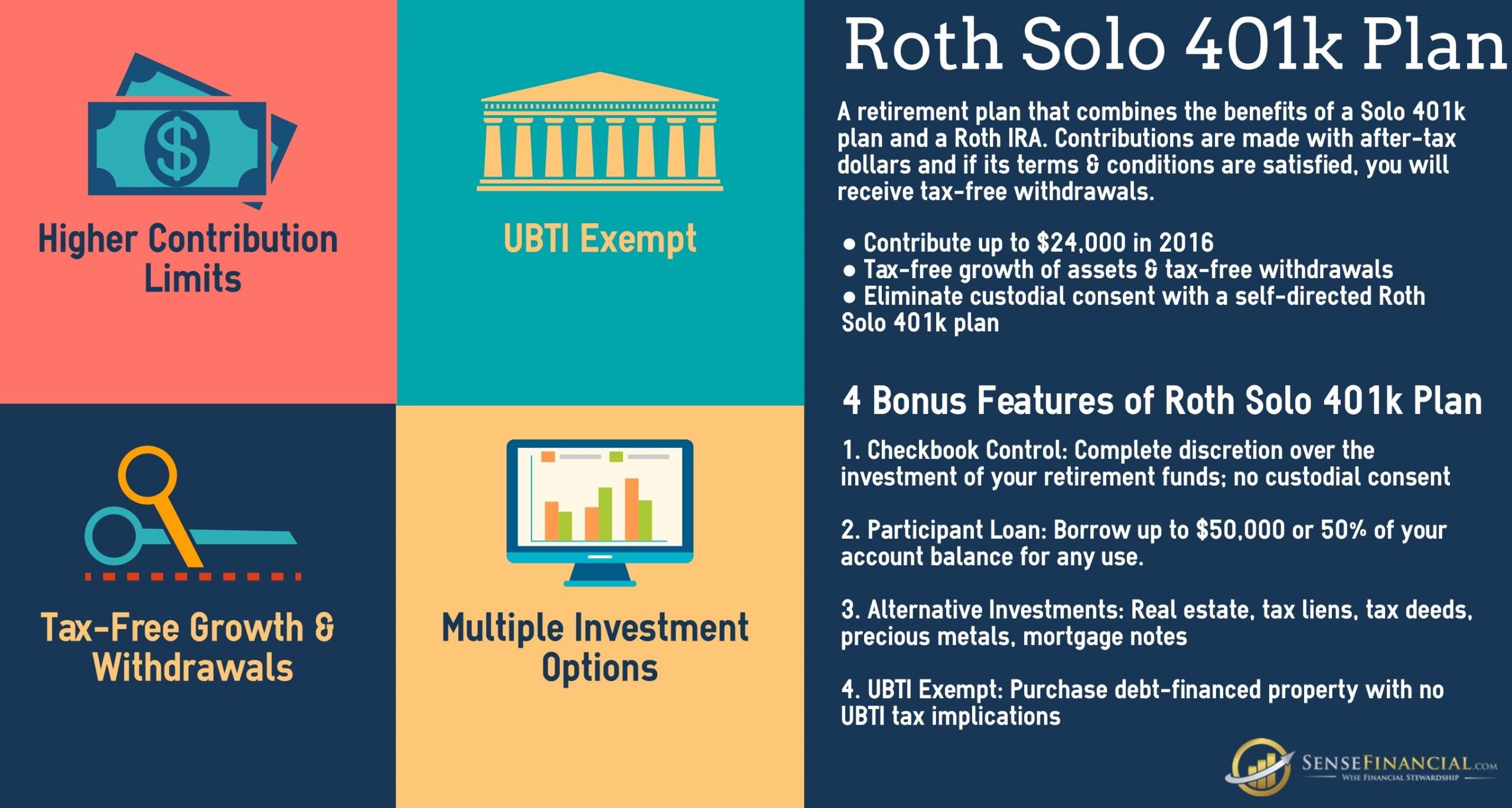

One of the potential benefits of a Solo 401 is the flexibility to choose when you want to deal with your tax obligation. In a Solo 401 plan all contributions you make as the “employer” will be tax-deductible to your business with any earnings growing tax-deferred until withdrawn. But for contributions you make as an “employee” you have more flexibility. Typically, your employee “deferral” contributions reduce your personal taxable income for the year and can grow tax-deferred, with distributions in retirement taxed as ordinary income. Or you can make some or all of your employee deferral contributions as a Roth Solo 401 plan contribution. These Roth Solo 401 employee contributions do not reduce your current taxable income, but your distributions in retirement are usually tax-free. Generally speaking, there are tax penalties for withdrawals from a Solo 401 before 59 1/2 so be sure to know the specifics of your plan.

You May Like: How Much You Should Contribute To 401k

How Do You Set Up A Self

It is easy to set up a self-employed 401 plan with many 401 administrators. You can also open a solo 401 online. To set one up, you will need an Employer Identification Number , which you can get from the IRS. You also need to complete a plan adoption agreement and an account application. Self-employed 401s are easy to administer and attract low maintenance fees because they involve only one or two people.

Before choosing a plan administrator, it is important to compare their fees before you sign up. You may also want to choose an administrator that allows you to invest your retirement savings into a broad range of assets including mutual funds, ETFs, CDs, stocks, and bonds. Other features to look for include 24-hour multi-channel support, investment advisory, low fees, and positive customer reviews. Once youve completed the paperwork, and the plan becomes active, the only thing you have to do is to set contribution levels and choose investments.

Self-employed 401 plans have no annual minimum contribution requirements. In good years, you can make the maximum contributions and reduce your savings when the cash flow is low. But once you have up to $250,000 in the account, you must file IRS Form 5500-EZ to report the financial status of your solo retirement plan to the tax authorities.

How To Open A Sep Ira

Nearly all brokerage firms offer SEP IRAs, and in most cases they can be opened online. A formal written agreement is required, known as IRS Form 5305-SEP, but the brokerage will usually take care of that. Opening fees and annual fees are often zero.

You can benefit from SEP IRA tax breaks for a given tax year by opening your account by your annual tax filing deadline, which is usually in mid April.

When opening an account, be sure to note minimum investment requirements and investment options. While SEP IRAs usually have a broader range of choices than 401 accounts, the choices are more limited than those available in a standard brokerage account.

Recommended Reading: When Can I Withdraw From My 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

Claiming The Solo 401k Contribution Deduction:

Roth solo 401k and voluntary after-tax contributions are not tax deductible, but pretax solo 401k contributions are deductible. Claiming the pretax contribution deduction is driven by the type of self-employed business sponsoring the solo 401k plan. See the following chart to determine where to claim pretax solo 401k contributions.

Don’t Miss: How 401k Works After Retirement

Allocating Employee Contributions Question:

In short yes. It is important to first understand the total contribution limit to a solo 401k cannot exceed $58,000 for 2021, not counting the catch-up contributions for those age 50 and over. The contributions made to the Roth solo 401k designated account will reduce the amount of contributions that you can make to the pretax solo 401k designated account. Only employee contribution may be made to the Roth solo 401k therefore, if you make the full $19,500 employee contribution to the Roth solo 401k for 2021, then you wont be able to make any employee contribution to the pretax solo 401k because you will have exhausted the full $19,500 employee contribution on the Roth solo 401k. Note that you can also split up the $19,500 employee contribution between both the pretax solo 401k and Roth solo 401k designated accounts. Lastly, you also have an additional $6,500 of catch-up contributions to work with if you are age 50 or older in 2021 since the catch-up contribution falls under the employee contribution umbrella and can thus be allocate between the Roth solo 401k and the pretax solo 401k designated account.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

You May Like: Can You Rollover A 401k Into A Traditional Ira

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.