Review The Investment Choices

The 401 is simply a basket to hold your retirement savings. What you put into that basket is up to you, within the limits of your plan. Most plans offer 10 to 20 mutual fund choices, each of which holds a diverse range of hundreds of investments that are chosen based on how closely they hew to a particular strategy or market index .

Here again, your company may choose a default investment option to get your money working for you right away. Most likely it will be a target-date mutual fund that contains a mix of investments that automatically rebalances, reducing risk the closer you get to retirement age. Thats a fine hands-off choice as long as youre not overpaying for the convenience, which leads us to perhaps the most important task on your 401 to-do list …

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Recommended Reading: How Much Can I Contribute To My 401k Plan

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

Can Small Businesses Offer A 401 Plan

Small businesses have previously shied away from offering 401 plans for financial reasons. For years, 401s were priced for companies with many employees and was thus cost-prohibitive for small businesses, But now there are many affordable options available for small businesses. By offering a 401 plan as part of an employee compensation plan, small businesses can attract talented employees. There are some fees associated with setting up a 401 for your company, so its best to talk to 401 providers about the plan that will best suit your company.

You May Like: How Will A Loan From My 401k Affect My Taxes

When Should You Choose A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,500 a year$7,500 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing from a traditional IRA once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

How Do You Start Saving

Participating in a 401 plan through your employer is usually the easiest way to get started putting money away for the long term. Most employers who are looking for top-quality employees offer a 401 as a benefit, which helps them to retain talent.

When considering accepting a job offer, take a look at the benefits package, and especially consider the 401 and how the matching contribution works. If it’s a choice between a company that matches dollar for dollar, and a company that doesn’t, consider that matching money to be additional income. It might be worth choosing that company for just that reason.

While not all companies offer matching contributions, and some have a delayed start for matching, everyone should be contributing the maximum amount they can to a 401.

Recommended Reading: What Is The Max For 401k

If You And Your Spouse Are Each Opening A Schwab Account

If you and your spouse are each opening the new investment-only account with Schwab to get into traditional equities, then youll open the Company Retirement Account Master Account as well as participant sub-accounts .

Each participant will keep his money separate in his own Schwab participant account under the master account for the Company retirement account. Youll each have a distinct login and keep the Schwab funds separate.

Complete the Company Retirement plan application:

Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete one Participant application per spouse:

You May Like: How To Find Out How Much Is In My 401k

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

Read Also: Can I Convert My 401k Into A Roth Ira

How To Set Up 401 For A Small Business

Do companies have to offer 401?

Companies do not have to offer a 401 but it can be a cost-effective way to compete for talented people in the workforce. Around 51% of employers who offer a 401 also offer matching contributions. Companies generally choose a 50% match on 401 contributions on up to 6% of the employees pay. If you are doing a safe harbor 401, youll need to choose a specific employer matching scheme.

Why Would I Want To Open An Ira

There are a few reasons to consider opening an IRA while youre unemployed. An IRA can make it possible to keep up with your retirement savings plan so you dont fall too far behind, even if your current situation isnt ideal. You may need to save more going forward to make up for lost time if you wait until youre working again.

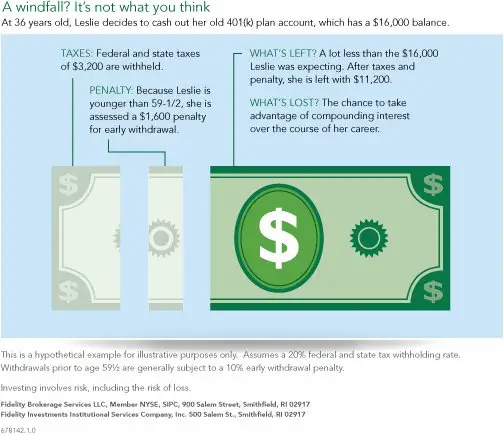

The sooner you start saving for retirement, the more youll benefit from compound interest.

If your previous employer offered a 401 plan, rolling it over into an IRA will allow you to continue to make contributions to your retirement savings and give you more control over how you invest your money.

Also Check: How Much Employer Contribute To 401k

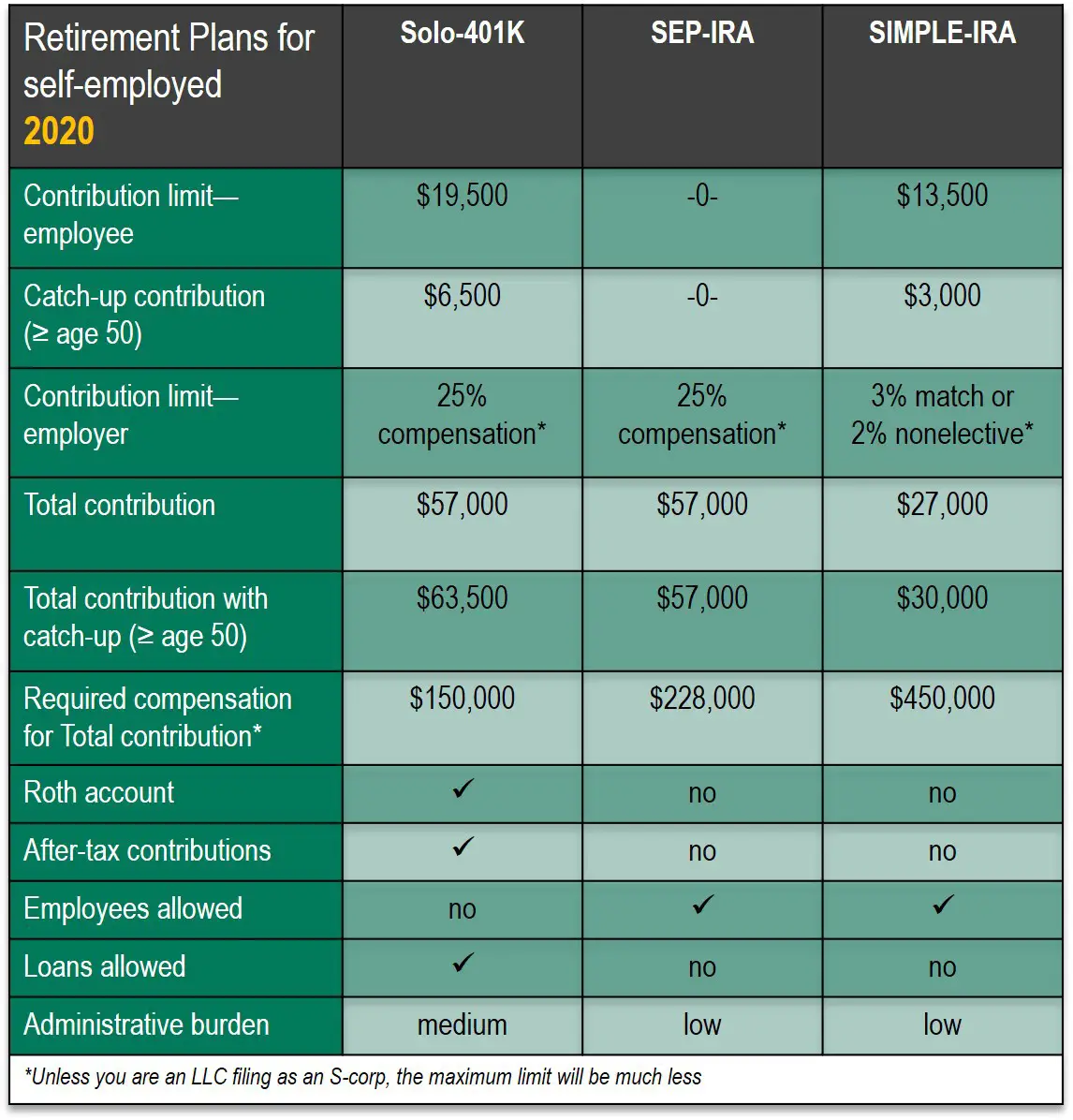

Contribution Limit As An Employer

Wearing the employer hat, you can contribute up to 25% of your compensation.

The total contribution limit for a solo 401 as both employer and employee is $61,000 for 2022, and $66,000 in 2023, or 25% of your adjusted gross income, whichever is lower.

People ages 50 and above can add an extra $6,500 a year as a catch-up contribution in 2022 and $7,500 in 2023. In other words, in 2022 you can contribute a total of $61,000 along with a $6,500 catch-up contribution if applicable for a maximum of $67,500 for the year.

You can have a solo 401 even if youre moonlighting. If you have a 401 plan at both jobs, the total employee contribution limits must be within the maximum for the year, but the employer contribution is not limited. If youre one of these lucky folks with two retirement savings plans, talk to a tax adviser to make sure you follow the IRS rules.

Recommended Reading: How To Take Out Your 401k

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeepingmake the implementation and maintenance of offering a retirement plan more affordable than ever.

Read Also: When I Leave A Job What Happens To My 401k

If You’re An Employee

You can fund a Roth 401sometimes referred to as a designated Rothif your employer offers one as part of its retirement plan options. Not all employers do, but their numbers are growing, especially among large companies. If your employer matches your contributions, or some percentage of them, that money, unlike your own Roth 401 contributions, is considered a pretax contribution and is therefore taxable when you withdraw it.

Unlike Roth IRAs, which have income limits, you can open a Roth 401 regardless of how much money you earn. Be mindful that there are contribution limits that restrict the amount of money both you and your employer can contribute to the account. For individuals, the 2022 contribution limit is $20,500, and the 2023 contribution limit is $22,500. Individuals 50 years or old may also perform a catch-up contribution of $6,500 in 2022 and $7,500 in 2023.

How Much Does It Cost To Set Up A 401k For Small Businesses

The cost of setting up a 401k generally depends on business size, plan design and the extent to which employers make contributions. Employers must also consider the administrative fees of third-party fiduciaries who help manage the plans investments. Applying for certain tax credits, however, can help offset some of these costs.

Read Also: How To Find Out How Much Is In 401k

Should You Do A Roth Solo 401k

One of the options that’s become important is allowing for a Roth solo 401k. Surprisingly, many brokerage firms currently don’t allow a Roth solo 401k, but it can be a valuable option.

When it comes to your solo 401k, it’s important to remember that you have two aspects of contributions to your plan:

Where a Roth option comes in handy is if you’re looking for tax diversification. With Roth contributions, you are using post-tax money. So, you will pay more in taxes today, but you will pay less in the future. However, if you’re putting in large profit sharing contributions into your solo 401k, then it might make sense to make Roth contributions.

The reason? It will give you tax diversification in retirement. You can choose whether you use taxable or tax free money in the future – and options are always great.

The important thing to remember here is options. You just want the options to be able to invest how you choose.

How To Start A 401k On Your Own

You have a right and a need to take control of your own retirement destination if you are a freelancer, independent contractor, are otherwise independently employed, or even if you have a side business and are still employed by someone else. Self-determination of your retirement comes with all the tax benefits associated with saving for your retirement.

Corporate work no longer offers job security. And certainly, the traditional corporate pension is not an option. You must take responsibility and control of your retirement planning. In 2016 a BNP Paribas Global Entrepreneur Report , found that millennipreneurs have started an average of 7.7 businesses, and collectively hold $5.6 billion in investable wealth. The prospering self-employed must have a tax-shelter that preserves and grows this into a wealthy retirement.

Being able to open a this account without an employer fits the needs of independent-minded people like a glove. Full control of all your retirement funds in a Solo 401k includes rolling over orphaned retirement accounts from earlier employers, accounts from previous businesses you have owned, and continuing to contribute for tax advantages that all flow into in a single consolidated account with the highest number of investment options available.

You May Like: How To Find 401k Account Number

Account Minimums & Maintenance Fees

Note: many custodians have account minimums for Donor Advised Fund charitable accounts. However, for the purposes of this article, we will ignore those accounts.

Schwab, Fidelity, and TD Ameritrade have no minimum account balance or maintenance fees for investment accounts.

Vanguard has no minimum account balance or maintenance fees if you sign up for e-delivery services. However, if you receive paper statements, then they charge an annual maintenance fee. For most account types, this fee is $20 for each account where the total Vanguard assets you have in the account are less than $10,000.

Unfortunately, E-Trade does not clearly advertise if there is a minimum account balance for their retirement accounts, but they do advertise that there is no minimum account balance for brokerage accounts.

Ongoing Considerations For Your Solo 401k

One of the great things about a solo 401k is that they are relatively easy to maintain, for the most part. Since you are technically the administrator of your own plan, you are personally required to submit required filings for the plan.

There are two ongoing paperwork requirements that you will need to stay on top of. First, if your plan has over $250,000 in assets on the last day of the plan year, you have to file a form 5500. This can be a bit complicated, but if you can fill out all of that paperwork above, you can likely handle it yourself.

You can submit the IRS Form 5500 for free, electronically here: EFAST2 Filing From The IRS.

If you don’t want to do it yourself, you’ll need your CPA to handle this for you, and they’ll likely charge a fee to do it. However, if you’re using a non-prototype plan, most of the plan providers will help you prepare the Form 5500 each year as part of your annual fee.

The second form you need to keep in mind is a 1099-R, but that form is only required if you take distributions from your 401k plan or if you roll it over, withdraw money of any kind, or change providers. This form is also relatively easy to fill out, but there is no free electronic filing for this form. You either have to pay a service to file it, or mail it in yourself.

Read Also: When Do You Have To Start Withdrawing From 401k

Who Can Have A Solo 401 Plan

You can open an individual 401 if:

-

You make self-employment income through a product or service such as working as an independent contractor, painting, or driving for ride-hailing companies.

-

You own a sole proprietorship, a limited liability company, limited partnership, S corporation or, C corporation.

-

You are the only employee in your business.

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers have shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection that their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

You May Like: How Long Does It Take To Get Your 401k Check