Compare Multiple Options Before Borrowing From Retirement Savings

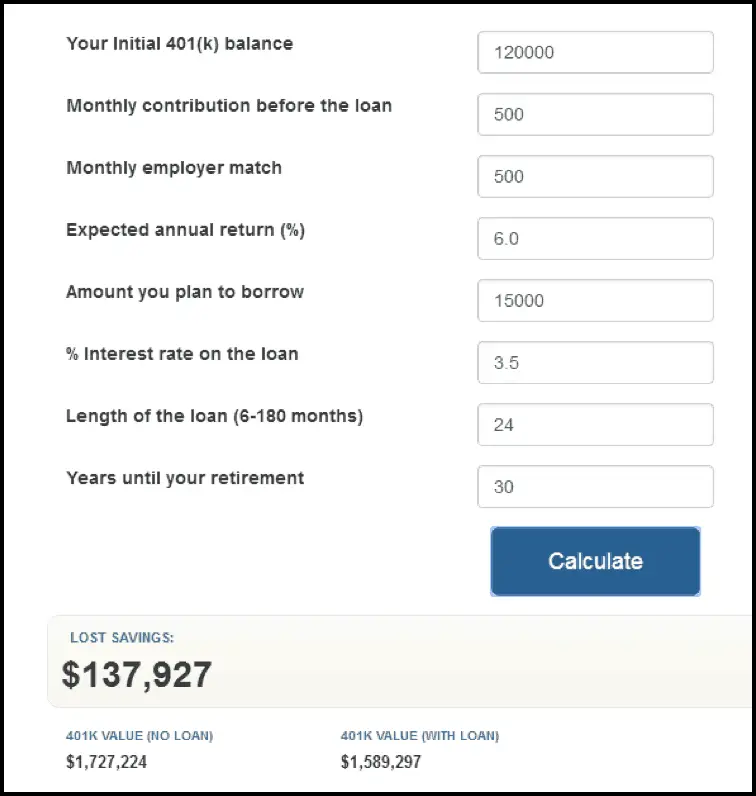

Taking a loan from your 401 is essentially borrowing from your future self. Even if you pay off your 401 loan with no issues, you could end up with less money during retirement due to the loss of compounding interest over the five years it takes you to repay the loan.

This reduction in retirement assets could become even worse if youre terminated before fully paying off the loan or unable to continue making loan payments.

This is why its important to compare all of your loan options before deciding to borrow from your retirement savings vehicle. Though the interest rate and fees might seem initially higher on a personal loan or other alternative, the cost to your future could be much lower.

Tip:

If youre struggling to get approved for a personal loan, consider applying with a cosigner. Not all lenders allow cosigners on personal loans, but some do. Even if you dont need a cosigner to qualify, having one could get you a lower interest rate than youd get on your own.

If you decide to take out a personal loan, remember to consider as many lenders as you can to find a loan that suits your needs. This is easy with Credible: You can compare your prequalified rates from multiple lenders in two minutes without affecting your credit.

Ready to find your personal loan?Credible makes it easy to find the right loan for you.

Whats The Average Interest Rate On A 401 Loan

Loan terms and rates are determined by your plan administrator your employer, in other words. The interest rates on most 401 loans is prime rate plus 1% or 2%. The prime rate as of September 2022 is 5.5%.

Since youre borrowing your own money, the interest isnt paid to a lender. Instead, the interest is paid back into your 401 account.

The Basics Of 401 Loans

Every 401 program is different, and will have its own restrictions and requirements concerning loans. You should speak with your employer, or with the head of your firm’s HR department, to learn how your retirement plan is managed and how it addresses short term lending. However, there are some basic features that are common to most programs, and a short review should give you a general idea of how 401 loans work.

Recommended Reading: How To Hide 401k In Divorce

Choose A Shorter Loan Term

Personal loan repayment terms can vary from one to several years. Generally, shorter terms come with lower interest rates, since the lenders money is at risk for a shorter period of time.

If your financial situation allows, applying for a shorter term could help you score a lower interest rate. Keep in mind the shorter term doesnt just benefit the lender by choosing a shorter repayment term, youll pay less interest over the life of the loan.

K Rules & Regulations

While most large employers set up their 401k plans to allow employees to take a loan, some smaller employers do not. Itâs important to check with the specific plan sponsor or refer to the Summary Plan Description to determine if a 401k loan is even an option.

Similarly, some plans include specific criteria for when employees are permitted to take on a 401k loan, while others are more open and allow borrowing for nearly any reason. Depending on the specific terms of the plans, it can be possible to take on multiple 401k loans. In addition, some plans require the participant to get consent from their spouse before providing a loan greater than $5,000. Other plans do not have this requirement.

Also Check: How To Pay Off 401k Loan Early

Why Not To Borrow From Your 401 Retirement Plan

While there are a few reasons that make borrowing from your 401 a good idea, this is something you should keep in mind:

Your 401 is not an emergency fund or a source of discretionary spending.

A retirement account is meant to support you through your golden years. When you find yourself faced with lifes unexpected expenses, a personal loan on the other hand could be exactly what you need to pay off debt and get back to focusing on your financial goals. Why jeopardize your retirement savings if you do not have to? If a personal loan can solve your needs, it is the better and less risky option.

Zirp Danger: Zero Interest Rate Policy Impact On Whats Ahead

Last week, 401 Specialist published Institutional Investors Both Optimistic, Pessimistic Post-Pandemic. I believe that paranoia is more appropriate than schizophrenia at this time, and that optimistic statements are gaslighting, tricking investors into ignoring current realities.

As stock markets continue their meteoric rise, optimism currently prevails, driven in large part by investor biases. But investors should consider what might spoil the party. The most likely spoiler is the termination of Zero Interest Rate Policy since rising interest rates decimate stock and bond values. The reduction in bond values is straightforward because bond prices fall when yields rise.

The impact on stock prices is more nuanced. Investment analysts estimate a fair stock value by projecting earnings and then discounting those back to today.

So, if interest rates rise, the discounted present value of future earnings declines, making a stock worth less. In fact, current low-interest rates are the common justification for high stock prices, implying that stock prices would be lower if interest rates were higher.

Also Check: Can Anyone Open A 401k

Also Check: When Can I Transfer My 401k To An Ira

Loans To An Employee That Leaves The Company

Plan sponsors may require an employee to repay the full outstanding balance of a loan if he or she terminates employment or if the plan is terminated. If the employee is unable to repay the loan, then the employer will treat it as a distribution and report it to the IRS on Form 1099-R. The employee can avoid the immediate income tax consequences by rolling over all or part of the loans outstanding balance to an IRA or eligible retirement plan by the due date for filing the Federal income tax return for the year in which the loan is treated as a distribution. This rollover is reported on Form 5498.

Loan Withdrawls: Limits Conditions & Considerations

Are You Considering Borrowing Against Your 401 Account?

We all know the importance of planning for the future, and for many people that means participating in a workplace sponsored 401. It’s frankly one of the easiest, and most effective, ways to save for your retirement. But many 401 plans can do more than just provide for your golden years. A growing number of programs allow participants to borrow against the equity in their 401s, providing low cost loans that can be a real boon in a financial emergency. Of course, borrowing from your retirement savings is never an ideal situation, but in a crisis it is an option to be considered. That being said, there are some pitfalls to avoid if you are thinking about a 401 loan, and it is important to understand the pros and cons of borrowing from your retirement fund before you get in over your head.

Recommended Reading: Does Fidelity Offer Solo 401k

Considering A Loan From Your 401 Plan

Your 401 plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your 401.

If you dont repay the loan, including interest, according to the loans terms, any unpaid amounts become a plan distribution to you. Your plan may even require you to repay the loan in full if you leave your job.

Generally, you have to include any previously untaxed amount of the distribution in your gross income in the year in which the distribution occurs. You may also have to pay an additional 10% tax on the amount of the taxable distribution, unless you:

- are at least age 59 ½, or

- qualify for another exception.

What You Should Know Before Taking A Loan From Your 401

Your 401 is your retirement nest egg. Youll need that money later in life once you have stopped working. If you need extra cash for an emergency or have trouble making ends meet, you may be tempted to tap into your 401 before retiring. After all, its your money. But withdrawing from your account before you retire may leave you with less money for your golden years. Keep these tips in mind when tapping into your 401.

Read Also: Should I Roll My Old 401k Into My New 401k

Make The Right Choice But Tread Carefully

After all other cash flow options have been exhausted including such possibilities as reducing voluntary 401 contributions or reviewing the necessity of any subscription services which are automatically charged to your credit card – ,) participants should compare plan loans to other short-term financing options. Some of the points to specifically consider include:

Does Your Credit Score Affect Your 401 Interest Rate

Your credit score does not determine the interest rate you pay on a 401 loan. Typically, your credit score does not affect your chances of getting approved for a loan, and you may be allowed to borrow from your 401 even with bad credit. Once the plan administrator sets the interest rate for 401 loans, this rate remains the same for all participants regardless of their credit scores.

Read Also: Can You Roll A 401k Into An Existing Roth Ira

How Higher Interest Rates Impact Your 401

Interest rates are a key variable for the economy and the stock and bond markets in particular. In the U.S., the Federal Reserve is the central bank that sets the federal funds rate, which influences other interest rates, to meet its mandate of promoting stable prices and maximum employment. The Federal Reserve holds regular meetings to discussand announceany changes in interest rate policy.

Interest rates can also affect your 401 plan. Knowing how this critical economic factor can affect the performance of your retirement plan can help you bolster your investment returns, and to avoid potential losses that could result from changes in interest rates.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Don’t Miss: Can You Cash Out 401k Early

Can A Loan Be Taken From An Ira

Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans that satisfy the requirements of 401, from annuity plans that satisfy the requirements of 403 or 403, and from governmental plans. Reg. Section 1.72-1, Q& A-2)

Common 401 Loan Questions

Can I borrow against my 401? Check with your plan administrator to find out if 401 loans are allowed under your employers plan rules. Keep in mind that even though youre borrowing your own retirement money, there are certain rules you must follow to avoid penalties and taxes.

How much can I borrow against my 401? You can borrow up to 50% of the vested value of your account, up to a maximum of $50,000 for individuals with $100,000 or more vested. If your account balance is less than $10,000, you will only be allowed to borrow up to $10,000.

How often can I borrow from my 401? Most employer 401 plans will only allow one loan at a time, and you must repay that loan before you can take out another one. Even if your 401 plan does allow multiple loans, the maximum loan allowances, noted above, still apply.

What are the rules for repaying my 401 loan? In order to be compliant with the 401 loan repayment rules, youll need to make regularly scheduled payments that include both principal and interest, and you must repay the loan within five years. If youre using your 401 loanto buy a primary residence for yourself, you may be able to extend the repayment period. What if I lose my job before I finish repaying the loan? If you leave or are terminated from your job before youve finished repaying the loan, you typically have 60 days to repay the outstanding loan amount.

Summary of loan allowances

Recommended Reading: How To Withdraw My 401k From Fidelity

K Loan Repayment After Leaving A Job

The biggest fear that surrounds borrowing from a 401k is what will happen if you leave the job either voluntarily or involuntarily. Before the Tax Cuts and Jobs Act, loan repayments must have been met within 60 days.

Nowadays you have until your tax returns due date for the year you left your job.

For example, if you left your job in 2020, youd have until April 15, 2021, to repay your loan .

Any outstanding loan balance not repaid on time will be seen as an early withdrawal and subject to an early withdrawal penalty.

This understandably freaks people out. Ideally, you wont borrow against your 401k if you feel that you are in danger of losing your job or you plan to leave shortly. If your job is stable, this fear is mostly unfounded.

Of course, all of us are expendable. What if you do lose your job and have to pay the money back?

Well, we dont have debtors prisoners anymore , so its not like youll be locked up. What will happen is that the IRS will classify the remaining balance as an early withdrawal, hit you with a 10% penalty on that amount, and require you pay taxes on the distribution.

Should You Use Your 401 To Buy A House

As you can see, there are a variety of drawbacks and risks involved in using a 401 to buy a house. These include:

- Missing out on making new contributions while you pay yourself back

- Having to pay penalties, fees and interest depending on the specifics of your companys 401

- Losing out on the compounding interest your money could earn if you left it in the retirement account

- Missing out on your companys match

- Finding yourself in a bind if you change jobs and have to pay your 401 back in a lump sum

Recommended Reading: How To Take My Money Out Of 401k

Pros And Cons Of Using A 401k Loan For A House

There are several good reasons to take out a 401k loan for a home purchase. It’s a low to no-cost option thanks to the fact that you’re paying interest back to yourself. Some borrowers may also like the fact that they can get a 401k loan without a credit check. These loans can also be faster and more convenient than traditional loans.

That said, there can be an opportunity cost with a 401k loan. While the interest paid goes into your account, you’re losing out on any returns you would’ve earned while invested. Depending on the state of the market, those returns might be higher than the interest you’re paying. Plus, your interest payments aren’t considered contributions, so you’re putting after-tax dollars into your 401k. It’s a good idea to contact a tax advisor before getting a 401k loan.

Leaving your employer or losing your job before you’ve paid off your 401k loan can create problems. You’ll have to repay your remaining balance by the tax due date for that year or risk defaulting.

While defaulting on your 401k loan won’t destroy your credit or get you sent to collections, it isn’t ideal. The outstanding balance is treated as a withdrawal and taxed and penalized as such. This can significantly reduce your retirement savings.

If you’re ready to buy a home, estimate your monthly payments with our mortgage calculator and feel free to reach out to our Loan Officers for guidance on todays mortgage rates.