Can I Rollover My 401k To An Ira Without Leaving My Job

Most people roll over 401 savings into an IRA when they change jobs or retire. But, the majority of 401 plans allow employees to roll over funds while they are still working. A 401 rollover into an IRA may offer the opportunity for more control, more diversified investments and flexible beneficiary options.

If You Follow The Rules You Can Avoid Taxes And Penalties

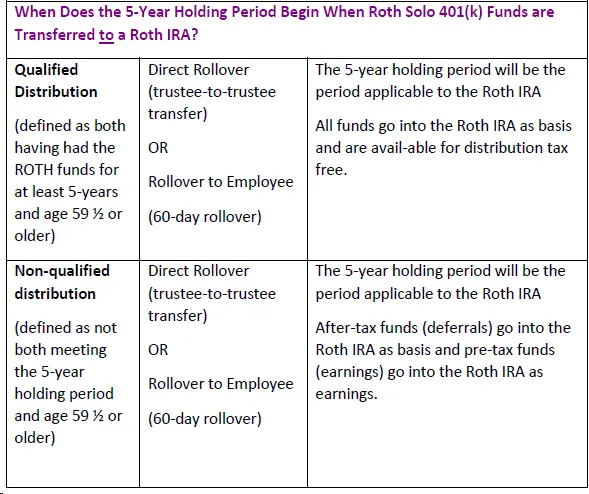

If you have a Roth IRA and want to transfer your account to a new custodian, taxes and penalties can be avoided if you follow some relatively simple rules. To start, don’t close out your old account before finding and making arrangements with a new custodian. That would result in receiving a distribution and could subject you to those taxes and penalties, particularly if you are younger than age 59½ or the Roth account has not been open for five years or more.

Among the options to accomplish the switch from one Roth account to a new one is by a direct transfer, which is the safest way.

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Recommended Reading: What Is An Ira Vs 401k

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Read Also: What Happens To My 401k After I Leave My Job

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover, and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

K To Rollover Ira To Roth Ira Tax Payment Options

I have taken part of my 401K and transferred part of it to a Roth IRA and Rollover IRA. I would like to convert the Rollover IRA to a different Roth IRA.This will result in tax liabilities from the conversion process. I believe that the Rollover IRA custodian will offer the option to use some of the funds in the Rollover to pay for tax liabilities . I would not prefer to do this as it lowers the Roth IRA growth potential. However the advantage is that I do not have to mess around with estimated taxes and Vanguard handles the tax payment.

Could I let the Vanguard custodian take out the tax funds and then within 60 days after the conversion date replace the funds taken out to cover taxes by adding cash back in taken from my personal after tax savings ?

Would the income limit imposed on ROTH IRA contributions limit the amount I can replace the tax money taken out or would the added cash to make up for taxes just be considered as part of the original Rollover IRA ?

The biggest restriction is that you can only replace the IRA funds once every 12 months. So you cant do a quarterly conversion, have Vanguard withhold some money, then replace that money within 60 days. Well, you can do it once. Then you have to wait a year to do it again. The other three quarters would be out of luck.

Peter

Hi @math999man,

If you do a Trustee-to-Trustee transfer, you can do multiple conversions in a year if you chose to. The one-per-year applies ONLY to having the check mailed to you.

Also Check: What Are The Benefits Of A 401k Plan

Roll Over Your 401 To A Traditional Ira

If you’re switching jobs or retiring, rolling over your 401 to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are tax-deferred1 retirement accounts.

- Pros

-

- Your money can continue to grow tax-deferred.1

- You may have access to investment choices that are not available in your former employer’s 401 or a new employer’s plan.

- You may be able to consolidate several retirement accounts into a single IRA to simplify management.

- Your IRA provider may offer additional services, such as investing tools and guidance.

- Cons

-

- You can’t borrow against an IRA as you can with a 401.

- Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a 401.

- Some investments that are offered in a 401 plan may not be offered in an IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

- Whether or not you’re still working at age 72 RMDs are required from Traditional IRAs.

Question 5 Of : Can You Convert 401 To Roth After Retirement

Also Check: How To Max Out 401k Calculator

Question 4 Of : Can I Roll My 401 Into A Roth Ira Without Penalty

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but a few examples may offer food for thought.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Note: Some public safety workers can avoid early withdrawal penalties from a retirement plan as early as age 50. If you worked for a federal, state, or local government, be sure to explore your options.

Depending on state laws, money in IRAs might be treated differently, and a 401 might offer more protection . Federal law often applies to ERISA-covered 401 plans, while state laws cover IRAs. However, there is some federal protection for IRAs in bankruptcy. When you owe federal tax debts or assets are due to an ex-spouse, protection is usually limited.

Roth Conversions

Fees and Expenses

Read Also: How To Borrow Against 401k Fidelity

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

How Long Does A Roth Ira Transfer Take

How long a Roth IRA transfer takes varies depending on your situation, brokers, and how you complete the transfer. A direct transfer can take a week or two. If you use the 60-day rollover rule, it typically takes longer, but should not take longer than 60 days.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Read Also: Is 401k Required By Law In California

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

What If I Leave My Job

A Roth IRA plan is not tied to your job, so its yours alone, no matter who you decide to work for. In fact, many self-employed individuals contribute to a Roth IRA for their retirement plan.

If you have a 401 and your employer matches a portion of the contribution, they may restrict the amount of money they put in. For example, they might require you to stay at your job for a certain period of time before you can keep the funds they set aside in the account.

Generally, when you leave your job, all money that you put into either fund is yours. Youll need to roll the balances from your employers plan to an IRA you will now manage.

Don’t Miss: How To Get Money Out Of 401k Without Penalty

Open Your Rollover Ira In 3 Easy Steps Were Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bankî, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Donât Miss: How To Access An Old 401k Account