Wait What Exactly Does Unrelated Employers Mean

To be considered unrelated, your employers must not be part of the same entity or controlled group that owns 80% or more of another business. That means they cant work for the same parent business as:

- A sole proprietor

In the case of smaller entities such as trusts or estates with 5 or fewer individuals, the rules are the same. For a lot of docs, this will mean their W-2 income and the additional moonlighting income from another hospital will count as unrelated employers.

How Old Is A Dog To Retire From Service

Most service and working dogs, which are typically Labrador Retrievers, German Shepherds, and Golden Retrievers, are estimated to have an average working life of 8 years . Since most working dogs do not officially begin their careers until 2 years of age, they are typically retired at around 10 years of age.

Types Of Retirement Plans For Independent Contractors

There are a number of tax-advantaged independent contractor retirement plans worth considering even one that could be considered an independent contractor 401k! However, there is no one-size-fits-all solution, so its wise to weigh all of your options.

Bear in mind: Once youve set up your chosen retirement plan e.g. an IRA for independent contractors or another option youll need to select the investments that will populate your account. In other words, youll build a tax-advantaged portfolio that may include mutual funds, exchange-traded funds , target funds or other investments.

All retirement plans come with rules and restrictions. If you need additional guidance, speak with a financial planner who can answer your questions.

Read Also: How To Check If You Have A 401k

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees, commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

When Should I Contribute To My Self

So long as you have revenue, you can start contributing the employee portion up to the maximum immediately. Contribute the maximum to your self-employed 401k during the same calendar year. Its up to you whether youd like to contribute in bi-weekly, monthly, quarterly, bi-annually, or random lump sum increments.

For the employer profit sharing portion of your self-employed 401k contribution, you should probably wait until after you do your taxes to figure out your profit and loss. You can always conservatively guesstimate your employer profit sharing contribution if you dont feel the need to be exact.

Just remember the money you do contribute to your self-employed 401k cant be touched until age 59.5. You dont have to contribute the maximum if your liquidity needs are high.

Also Check: How To Divide 401k In Divorce

Who Are Your Employees

You may be thinking, Of course I know who my employees are! This seems like such a simple question, but the answer can be much more complex than it seems and has tripped-up many well-intentioned companies. In fact, employers as large as Microsoft, Coca-Cola and Time Warner have found themselves in litigation over this very issue.

To avoid the complexities, some employers simply include all workers in their benefit plans. Unfortunately, that option has a serious drawback known as the exclusive benefit rule, which mandates that plans be maintained and operated for the exclusive benefit and in the best interest of employees. By covering workers that are not employees, a plan sponsor violates this foundational rule.

Making an accurate determination is also critical for two other reasons:

- Plan Eligibility: There is quite a bit of flexibility in designing plans to include/exclude certain groups of employees, but in order to take full advantage of that flexibility, it is important to first have a solid understanding of which workers are part of the mix.

- Nondiscrimination:Properly classifying workers is an important first step to ensuring that a plan is in compliance, provides the promised benefits and does so in a manner that does not discriminate in favor of Highly Compensated Employees generally those who own more than 5% of the company or who have annual compensation exceeding $120,000 .

A Deeper Look At The Limitations And Requirements

To qualify for a SEP IRA, you must meet the following:

- Be at least 21 years old,

- Have worked at the business for three of the past five years, and

- Have earned at least $600 from the job in the past year.

Your SEP IRA contribution each year cannot exceed the lesser of 25% of your compensation or $58,000 for 2021. The maximum amount of self-employment compensation that applies for 2021 is $285,000. For self-employed individuals, the amount of compensation used for these purposes is your net earnings from self-employment less the deductible portion of self-employment tax, and the amount of your own retirement plan contribution deducted on form 1040.

For a Solo 401k plan, the 2021 limit is $19,500, plus a $6,500 catch-up contribution for those individuals over age 50. That contribution amount is up to 100% of your compensation. The employer profit-sharing contribution does not count toward this limit. However, the total contribution limit of both the employer and employee in 2021 is $58,000. If you are age 50 or older, the limit is $64,500.

Donât Miss: How Do I Cash Out My 401k Early

Also Check: What Happens To Your 401k When You Retire

A 401 For Independent Contractors

It would make sense if you thought only salaried employees could have , but freelancers can have them too.

If youre self-employed, you can open a solo 401, which has a total annual contribution limit of $66,000 for 2023 or $61,000 for 2022 .

This type of retirement account sees freelancers as having two roles as an employee and as an employer and each has different rules for contributions:

- As the employee you can contribute $22,500 in 2023 or $20,500 in 2022

- As the employer you can contribute up to 25% of compensation. The IRS walks you through how to do the calculation.

Figuring out these numbers can take a little bit of effort. Dont hesitate to reach out to a tax professional if you need some help.

Good to know: You can start withdrawing money from your solo 401, no questions asked, once you turn 59 ½. You also have to start making withdrawals, which the IRS calls , the year you turn 72 and every year afterwards. If you take money out early or dont make required withdrawals, you could pay penalties.

Differences Between 1099 And Standard Employees

One difference is that standard employees have yearly incomereported on a W-2, while 1099 employees have income reported on a 1099.However, that is not the only distinction.

Both the IRS and many states have detailed rules thatclassify workers as an employee who receives a W-2 or an independent contractorwho receives a 1099 tax form. Some of those rules include:

- The amount of control employers legally haveover how a worker can perform tasks

- How much instruction or training the workerreceives from the employer

Also Check: How To Invest 401k After Retirement

Can I Cover My Spouse Under My Owner

Although self-employed 401 plan participation is limited to the business owner, the owners spouse may participate in the plan, as long as they earn income from the business. Given that both spouses can participate, this plan offers a great opportunity for a family to significantly increase their contributions toward retirement savings.

Read Also: Where Can I Find My 401k Balance

Can You Have Employees And Open A Single

You cant have any full-time employees, but you can contract with freelancers or employ part-time employees who dont work more than 1,000 hours per year for your business. Note that not all individual 401 plans allow for part-time employees, so be sure to check with your provider before hiring employees.

You May Like: How Can You Take Out Your 401k

Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Solo 401k Contribution For 1099 What Is The Best Option

Current situation:

-I and my spouse both make max contributions to employer sponsored 401k.

-Both also have each IRA accounts and make max contribution.

-My spouse also has a small side job and makes 1099 based revenue which is more/less than $30,000 per year and the net income is mostly around $5,000 or so.

We are considering to set up solo 401k for her side job and wondering how much can be contributed for the tax deferral benefit.

According to my research, profit sharing in solo 401k seems to be the only option for the additional tax deferral/saving since she already makes a max contribution to her current 401k.

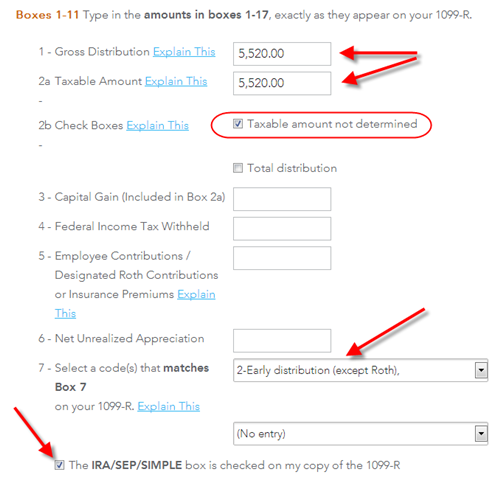

I also tried with turbo tax, simulating with the last year’s tax filing.

There is a click-box option to calculate the maximize contribution automatically in the middle of the retirement plan section, and it seems that it calculated the maximum contribution amount as the business net income less 1/2 of self-employment tax.

For example, if net income is $4,500 and 1/2 SE tax is 500, it gives $4,000 as the maximum contributable amount.

Can we open up the solo 401k account, calculate the maximum contributable amount with the turbo wax as the above when the net income and SE tax are available at the year end and contribute that amount to the profit sharing?

I also referred to the IRS website to get some idea, but I am not sure.

It looks almost similar to what Turbo tax calculated, except she doesn’t have any plan contribution rate for this.

Read Also: How Do I Check My 401k Plan

Excess Contribution Not Withdrawn By April 15

So what happens if you dont notice that youve over-contributed to one or more 401k plans until after April 15? In this situation, the excess contribution is taxed twice, once in the year when contributed and again when distributed .

Also, the earnings from the excess contribution will be taxable income for the following year. If the mistake is not corrected, then the IRS may disqualify the entire 401k plan retroactive to the beginning of year 1. This results in the employees entire 401k account balance to become income to the employee which would have massive adverse tax consequences.

But the main reason why you want to be more conservative in your self-employed 401k contribution is not the fine. Th main reason is the stress of getting an IRS audit letter in the mail. It will also take time to amend your tax returns. This process can take hours.

Id much rather miss out on contributing an extra $1,000 in my self-employd 401k than go through the torture of dealing with the IRS.

Remember, when in doubt, round down your self-employed 401k contribution amount.

Can You Have Multiple 401ks

Heres the deal. Many physicians work for multiple employers or work as an employee and either an independent contractor or a consultant. Many others have a side job of another type. Their incomes are far higher than they require for their current spending needs, but theyre behind on their savings or otherwise have a desire to maximize the amount of money they can put into retirement accounts, especially tax-deferred retirement accounts.

Obviously, these types of accounts minimize tax, maximize returns, increase asset protection, and facilitate estate planning. Who wouldnt want to get more money into them? However, most of these doctors are surprised to learn that they can have more than one 401. Thats right,

You May Like: How To Set Up 401k Contributions

Retirement Benefits For 1099 Workers

There are many retirement benefit options for the self-employed, including the simplified employee pension , 401 plans, savings incentive match plans for employees , and money purchase plans.

Contractors can also set up their own individual 401 plan2 by contributing up to 25% of their net earnings up to $66,000 for 2023. This works the same way as an employer-sponsored 401 plan.

There’s also a SIMPLE IRA plan available for contractors. Workers can set up a SIMPLE IRA between January 1 and October 1 by completing Form 5305-SIMPLE or Form 3504-SIMPLE and opening an IRA through a bank or financial institution.

Employers can contribute to a 1099 employee’s SEP or SIMPLE IRA. With a SIMPLE IRA, employers can contribute 2% of their employee’s compensation up to $305,000 or match employee contributions up to 3% of their compensation.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Also Check: How To Rollover My 401k To A New Job

Best For Account Features: E*trade

E*TRADE

E*TRADE gives you more flexibility with its solo 401 offering. E*TRADE supports both traditional individual 401 plans and Roth 401 plans. You are also able to take out a loan on your 401 balance at E*TRADE, all of which makes E*TRADE best in our review for account features.

-

Choose between traditional or Roth 401 contributions

-

Support for 401 loans

-

No recurring account fees, and commission-free stock and ETF trades

-

Now run by Morgan Stanley, meaning changes are likely

-

High fee for broker-assisted trades and some mutual fund trades

E*TRADE has a long history of supporting online investors, with its first online trade placed in 1983. It is now a subsidiary of Morgan Stanley after an acquisition that closed in October 2020. At E*TRADE, you can choose between traditional and Roth individual 401 plans, which allows you to choose between pre-tax and post-tax contributions. You can also take a 401 loan from an individual 401 account at E*TRADE.

There are no listed fees to open or keep a solo 401 account at E*TRADE. Stock and ETF trades are commission free. The brokerage also supports over 7,000 mutual funds on its no-load, no-transaction-fee list. E*TRADE supports options, futures, and fixed-income bonds and CDs, as well.

Read our full E*TRADE review.

Why Offer Benefits To 1099 Workers

The number of people who describe themselves as self-employed or contract workers is rapidly increasing year after year. According to Upwork and the Freelancer Unions annual Freelancing in America study, 57 million Americans freelance and contribute $1 trillion to the national economy. Thats approximately 5% of the U.S. GDP, which exceeds both the construction and transportation industries, ODwyer explained.

If your business uses 1099 contractors, there are some valid reasons why you should consider offering them benefits even though youre not legally obligated to do so.

Also Check: How To Close 401k Account

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: How Do I Get My 401k

Traditional Or Roth Ira

Best for: Those just starting out. If youre leaving a job to start a business, you can also roll your old 401 into an IRA.

IRA contribution limit:$6,000 in 2022 and $6,500 in 2023 .

Tax advantage: Tax deduction on contributions to a traditional IRA no immediate deduction for Roth IRA, but withdrawals in retirement are tax-free.

Employee element: None. These are individual plans. If you have employees, they can set up and contribute to their own IRAs.

How to get started: You can open an IRA at an online brokerage in a few minutes. See NerdWallet’s picks for the best IRA providers for more details.

You May Like: How To Protect My 401k From Stock Market Crash