Compare Your Fees Against Other 401 Providers

Now that you know how much each service provider is charging, compare those numbers to other, similar plans to see how those plans fees stack up against yours. This is called benchmarking.

It can be hard to know how much similar plans are paying for similar services, or what similar even looks like. If your provider is doing very little for you, it might make sense that their fees are lower than the industry benchmark you find while comparing expenses. Likewise, a provider that offers an exceptionally high level of service might reasonably charge higher fees. But there is lots of grey area between those two extremes, and thats why its so important to look at as many plans as possible to get a sense for where yours sits along the spectrum of service and cost.

Ask your 401 adviser for a report from a third-party benchmarking tool for an unbiased comparison. Review at least 100 plans in the benchmark so that you can really get a good view of how your plans fees compare to comparable plans, but also so you can look at the subset where the services are very similar.

|

no promotion available at this time |

Get more smart money moves straight to your inbox

Become a NerdWallet member, and well send you tailored articles we think youll love.

Prototype Free Solo 401k Plan Providers

We’re going to start with the 5 major firms that provide Prototype Plans. These are the “free” plans that the companies advertise.

Note: Over the last few years, many of the prototype plan providers have been limiting what you can do with your Solo 401k. For example, NOT allowing Roth contributions or NOT allowing a mega backdoor Roth.

As such, I’ve personally moved to a non-prototype plan provider, and I actually recommend most people do the same.

Right now, the best free solo 401k is being offered by E*TRADE, due to the fact that they offer the most options with their plan.

Active Mutual Funds Vs Passive Index Funds

Our listing of the best Fidelity mutual funds includes actively managed and passive index funds. So whatâs the difference between active vs. passive funds?

Managers direct active mutual funds by picking assets in a never-ending attempt to outperform benchmark indexes or average market returns. Actively managed funds charge higher fees than passive index funds. Some active funds deliver consistent outperformance, but most tend to underperform their benchmarks.

Passive index funds aim to duplicate the returns and performance of a market index, such as the S& P 500 or the Russell 3000. Costs to operate the fund are lower, as management only needs to track the indexâs composition rather than research and pick investments. They tend to offer greater diversification and steadier returns.

Recommended Reading: How To Figure Out 401k Contribution

Third Party Solo 401k Providers

If you need or want a solo 401k that is a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

How is this possible? Your plan provider simply creates your plan documents that govern your 401k plan. You can then take those documents to your favorite broker , and you open a non-prototype account. These are equity-holding accounts that simply manage your equity investments. What they don’t do is any of the paperwork associated with your plan. Did you withdraw from your plan? You’re responsible for creating the 1099-R.

Some of the most popular online providers include:

Investing In You And Your Future

After one year of service American will provide you with an employer contribution to your 401 account. The amount contributed will depend on your workgroup.

Team members with prior service or who transfer to American from one of its wholly owned subsidiaries will have their prior service at the subsidiary credited towards the one-year eligibility requirement and toward the service requirement for vesting full ownership of your 401 account balance.

American will contribute 16% of your eligible compensation to your 401 account up to the IRS limits. Participation is automatic, and you will be eligible for this nonelective company contribution* after completing one year of service.

If you do not have an investment election on file, your nonelective company contributions will be made to the Target Date Fund closest to the year you will turn age 65.

You are always 100% vested in your contributions, the nonelective company contributions and any associated earnings.

*A nonelective company contribution is a contribution to your 401 account that the company makes regardless of whether you are making your own contributions.

Flight Attendants receive a nonelective company contribution*, plus you are eligible to receive matching company contributions based on your eligible compensation. You become eligible to receive the following employer contributions after completing one year of service:

TWU-designated team members

You May Like: How To Calculate 401k Match

Letter Form Fidelity Investments Regarding Ubit Question:

I recently went through the process of applying for the ability to trade options in my Fidelity account. Last week I received a letter from Fidelity saying that I will be responsible for filing IRS Form 990T.

Questions:

- Is trading options in my solo 401k allowed?

- Is it a problem if Fidelity requires margin on the account in order to trade options?

- Assuming its allowed, is the Form 990T filing something that you will do for me each year?

How Do I Find Out My 401 Fees

401 fees are listed in different places, depending on whos charging them.

-

401 provider fees: The fees charged by your companys 401 plan administrator will be listed by the administrator directlyusually on their website or in the informational material given to you when you first enroll in the plan. Like we mentioned, these fees are sometimes covered by your employer, or you might have to pay them yourself.

-

Front-end and back-end loads: You can see a specific funds front-end and back-end loads in its prospectus, which is available on the SECs website as well as on services like Morningstar. Prospectuses are always available to you before, during, and after you hold shares in the fund. No-load fundsâ are funds that charge neither a front-end nor a back-end load, but some still charge a 12b-1 fee .

-

Operating expenses: 12b-1 fees, investment management fees, and miscellaneous other annual fees are all gathered into one figure: the 401 expense ratio. This figure is expressed as a percentage of the average AUM. For example, if youve invested $10,000 in a fund with a 5% expense ratio, youll pay $500 a year in fees. In most cases, the annual gross expense ratio for 401 is the same amount as the net expense ratio. However, if there are waivers and reimbursements affecting the gross expenses, the gross expense ratio for a 401 plan may be higher.

Read Also: How To Sell 401k Stock

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

What Fees Are Included In Your 401

Many American workers believe that 401 funds charge fewer fees than individual investments, but that isnt always the case. 401 fees fall into three basic categories. The U.S. Department of Labor defines them as investment fees, plan administration fees and individual service fees. The table below compares them:

Read Also: Is Fidelity A 401k Plan Administrator

Want To Ask Your Employer For A Lower

Here at Human Interest, our HI advisory fee is on average 0.50%2, and employers can choose to cover most of that. We offer access to nearly every mutual fund and index fund on the market, including low-cost funds from Vanguard, Dimensional Fund Advisors, BlackRock, Charles Schwab, and more. In fact, the average fund fee for our model portfolios is 0.07%, for a total average fee of 0.57%. By offering lower charges than the average 401 fees, expenses, and other costs, we can help plan participants such as yourself maximize your retirement savings.

If your companys 401 provider is charging high fees or doesnt offer low-cost funds, tell your HR manager about Human Interests investment policy were committed to making retirement possible for everyone. Get in touch with our helpful representatives to find out more about our 401 services.

Article By

Anisha Sekar

Anisha Sekar has written for U.S. News and Marketwatch, and her work has been cited in Time, Marketplace, CNN and more. A personal finance enthusiast, she led NerdWallets credit and debit card business, and currently writes about everything from getting out of debt to choosing the best health insurance plan.

What Is The Range For Average 401 Fees

Typically, 401 plans cost somewhere between 1% and 2% of the plan assets, or the money saved in the account. Some outliers can see fees as high as 3.5%, but these high fees can have a significant impact on your employees ability to retire and should be avoided if at all possible.2 There are many factors which can impact the cost of a plan, from the amount of money in the plan, to the investment options you choose to include, to the level of service you receive.

You May Like: Can I Roll Over A 403b To A 401k

How Do We Review Brokers

NerdWallets comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent .

For more details about the categories considered when rating brokers and our process, read our full methodology.

*$0.00 commission applies to online U.S. equity trades and Exchange-Traded Funds in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee . Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Clearing & Custody Solutions® are subject to different commission schedules.

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

Recommended Reading: How Much Should You Put In Your 401k

Annuity Exchanges With Fidelity Investments

If you have an annuity and want to switch to Fidelity Investments, you can take advantage of the low-fee exchange process. An annuity exchange, also known as a 1035 exchange, allows for the tax-free transfer of funds held in a life insurance policy or annuity contract into a new annuity with Fidelity Investments.

You might consider exchanging annuities if:

- Your current provider charges higher fees compared to Fidelity

- You want more contemporary annuity investment options

- You have other investments with Fidelity and wish to consolidate with one brokerage

Talk with your financial adviser to see if switching your annuity from your current provider to Fidelity is right for you.

How To Buy Fidelity Annuities

Contact a Fidelity investment professional by phone or in person at a local Fidelity Investments Center. You can find the number and office locations on the website. Alternatively, you can use the online form to get in touch with a representative to discuss your financial goals and find out which Fidelity annuity would work best for you.

The account representative will talk you through the process of choosing a plan, completing a contract, and making annuity payments. Before you buy, be sure you have a clear understanding of the pros and cons of annuities to determine if its your best option for retirement savings.

Also Check: How Can You Take Money Out Of Your 401k

The Impact Of 401 Fees

401 plan fees can vary greatly, depending on the size of your employers 401 plan, the number of participants and the plan provider. One study found that large plans almost uniformly have fees below 1%. The largest plans are usually below 0.50%.

The small plan marketplace is a different story. Average fees for small plans were between 1.5% and 2%, with plenty of plans with less than $50 million in assets paying more than 2% a year in fees.

The difference in these percentage points doesn’t sound like much, but it can really add up over the years. Take these three hypothetical friends: Joe, Tyler and David each invest $100,000 in a mutual fund at age 35. Each account earns an annualized return of 8%, but the accounts charge annual fees of 1%, 2% and 3%. David paid 3% and has $432,194 in assets at age 65. Tyler paid 2% and has $574,349 for retirement. Joe paid 1% and is the big winner, with $761,225 saved for retirement.

Finding The Fees In 401s

Many workers don’t. A TD Ameritrade survey found that just 27% of investors knew how much they paid in 401 fees, and 37% didn’t realize they paid fees at all. Unfortunately, many never think to ask how much a 401 provider makes off the money you hand over to invest. Your provider takes a fee every month, and over time these fees can impact your returns. Some 95% of 401 plan participants pay fees.

These fees aren’t truly “hidden.” The U.S. Department of Labor requires 401 providers to disclose all fees in a prospectus that is given to you when you enroll in a plan, and which must be updated every year.

We know you devour these statements the minute they arrive. As the fees are no longer difficult to locate, it pays to pay attention to them. When you receive a 401 statement or prospectus, check for line items or categories such as Total Asset-Based Fees, Total Operating Expenses As a %, and Expense Ratios.

You May Like: Can You Rollover A 401k While Still Employed

Is Fidelity Right For You

Fidelity is the rare broker that’s able to serve both active traders and beginner retirement investors alike. The company brings it on every level, starting with a mutual fund selection that stacks up to any other broker and even includes free offerings. But Fidelity also offers features that matter to stock traders, including strong trading platforms, zero trade commissions and a wide range of research offerings. We can’t think of an investor who won’t be well-served by Fidelity.

How Can I Find Hidden 401k Fees

The fees aren’t actually hidden, but are in fact disclosed in the prospectus that is given to new customers when they enroll in a plan. This prospectus is updated yearly, reflecting any change in fees. Disclosing fees is not optional, and is a requirement of the U.S. Department of Labor. To check fees, look through your 401 statement or prospectus for line items such as Total Asset-Based Fees, Total Operating Expenses As a %, and Expense Ratios.

Also Check: Should I Roll My 401k Into A Roth Ira

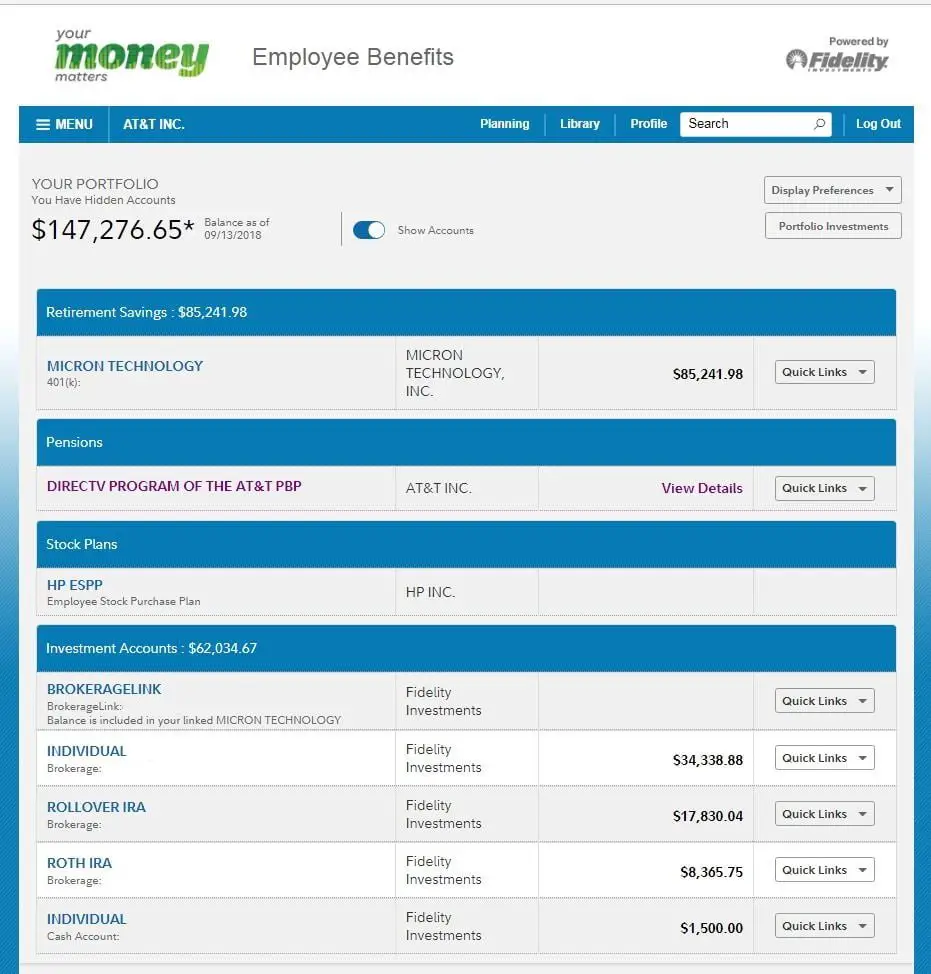

Distinguishing Account Sources Question:

Thank you for assisting me in opening the three brokerage accounts with Fidelity under your self-directed solo 401k. To recap, I now have the following 3 brokerage accounts at Fidelity:

They all have a zero balance since I just opened them, but they are not labeled accordingly. How do I distinguish them?