Impact Of A 401 Loan Vs Hardship Withdrawal

A 401participant with a $38,000 account balance who borrows $15,000 will have $23,000 left in their account. If that same participant takes a hardship withdrawal for $15,000 instead, they would have to take out $23,810 to cover taxes and penalties, leaving only $14,190 in their account, according to a scenario developed by 401 plan sponsor Fidelity. Also, due to the time value of money and the loss of compounding opportunities, taking out $23,810 now could result in tens of thousands less at retirement, maybe even hundreds of thousands, depending on how long you could let the money compound.

Most People Have Two Options:

- A 401 loan

- A withdrawal

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Your 401 K And Income Tax

You may be wondering if your 401 k is subject to income tax. Once youve withdrawn the money from the 401 k, you need to pay tax on it. It is considered part of your taxable estate. This is why you must check the terms of your 401 k before you get any money from it. Terms like these should be clearly outlined in the plan. Withdrawing funds without understanding the implications of doing so is one common mistake that people make when changing employers in the USA. Its important to consider the other options you have.

If youre changing employers, you still have plenty of time to build up passive capital via investment and your 401 k. Youre unlikely to get much out of rushing into a decision that you arent completely ready for. Roll all of the funds out of your 401 k at once, and you might end up drowning in taxes.

Also Check: How To Transfer Rollover Ira To 401k

Find And Contact The Employer

Its very easy to find people nowadays, and a simple google search will give you details of your previous employer and even their location. Look for them and either visit the premises yourself or use a third party to carry out the initial contact. Even if the company was inherited by another company, they have a legal obligation to pay you your pension. Also, contact former employees of the company, or the union that represented you, in order to find out how you can go about the process of recovering your savings.

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Read Also: How Do I Sign Up For 401k

What Is The Maximum Annual Contribution

The maximum annual contribution is usually determined by the federal government and may increase each year depending on what they decide. What you can contribute may also be affected by your age, as those who are closer to retirement may be able to invest more in their 401 to catch up to where they feel they need to be for retirement. The maximum annual contribution should be a number your employer has easily accessible or that the 401 administration company communicates to you with its paperwork or online resources.

Also Check: How To Take Money From 401k Without Penalty

Why Take A 401 Loan

When you need cash and are having trouble getting approved for a loan, taking out a 401 loan may seem like a good idea. These loans have fairly generous repayment terms and are not contingent upon credit approval. You can apply for up to $50,000 without worrying if a bank is going to stick you with a high interest rate or decline your application.

Although a 401 loan is not ideal compared to some alternatives, it is better than others. These are some common reasons when a 401 loan makes sense:

- Need the money for the short term. If you can repay the loan in less than a year, it makes sense to avoid loan fees or higher interest rates of some loan options.

- Avoiding a payday loan. When a payday loan is your only other alternative, a 401 loan helps you avoid predatory fees and interest rates charged by payday lenders.

- Your credit score is bad. Some people have such a high debt that their credit scores are trashed. Taking out a 401 loan allows you to pay down your debt and reduce your credit utilization and improve your credit score. Once your score is higher, you might be able to qualify for better rates and terms from a traditional lender to repay your 401 loan.

- Down payment for a home. Normal 401 loans must be repaid within five years. But, when you borrow from your 401 to buy a home, you can stretch the payments out for up to 25 years.

You May Like: What Percentage Of 401k Is Required Minimum Distribution

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Plan Your Retirement With Your 401 K

If you havent already, its crucial that you start to plan your retirement as soon as possible. Financial security is a vital part of having a healthy and happy retirement. The aim of having a 401 k in the first place is that it gives you freedom from work and acts as a nest egg. You might be working hard now, but you want to be able to truly enjoy your golden years. Having the proper retirement plans in place is the easiest way to ensure this. If you start planning to retire well before the time comes, you should be in a very strong position financially.

Take the time to come up with plans for your retirement while you still have a job. These plans dont have to be concrete. All you have to do is get an idea of how your retirement may look financially. Then you can plan distributions from your 401 k, as well as any investments you may want to investigate.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Recommended Reading: Can I Withdraw 401k After Leaving Job

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

How Long Does It Take To Transfer 401 Money To The Bank

Transferring funds from a 401 account to a bank account can take seven to 10 days or more. This period includes a withdrawal processing period which can be anywhere from five days to seven days. After that, the funds will be released, and you can expect to receive the withdrawal in one or two days if you selected direct deposit or up to five days if you opt to receive a mailed check. However, this duration may vary depending on the plan custodian.

Generally, 401 funds are invested in mutual funds, which mainly comprise stocks and bonds. When you make a withdrawal request, your, and the proceeds transferred to the 401 plan administrator. Once the plan custodian receives the money, the funds are transferred to your bank account via direct deposit or mailed check.

Read Also: Can I Take Out Money From 401k To Purchase Home

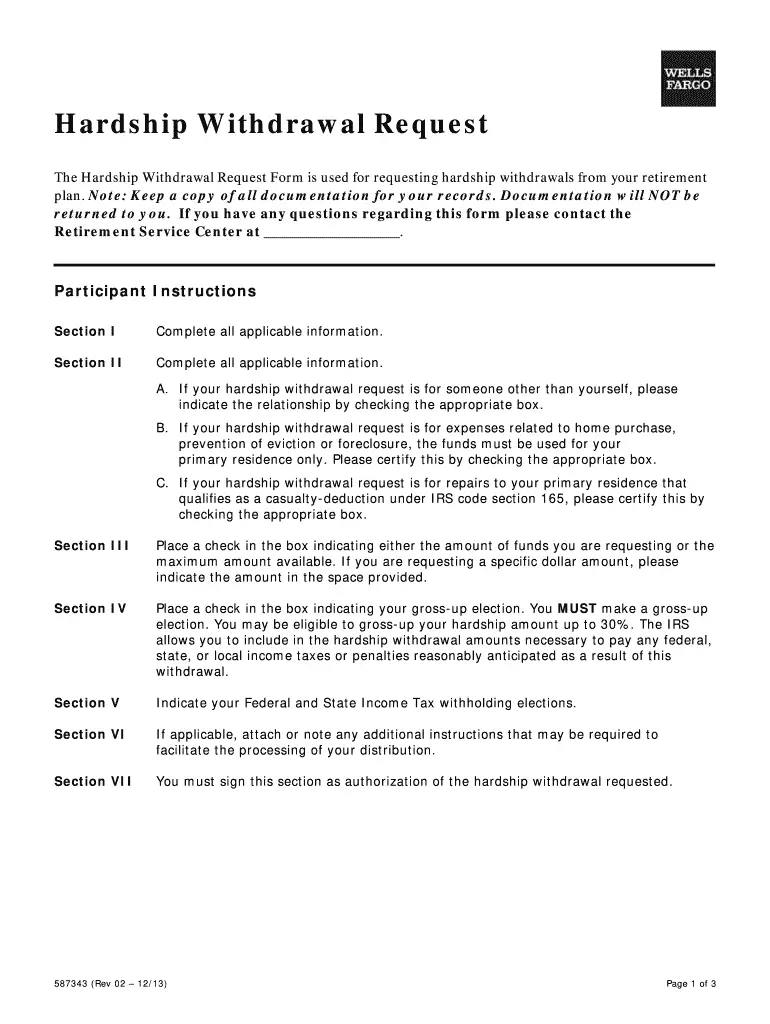

Repay A Hardship Distribution

The employee is under no obligation to repay a hardship distribution. Since the process of getting hardship money from a 401k is long and involved, the employee should start the process as soon as he or she knows that they are in financial trouble. If they wait too long, it could add to their financial difficulties.

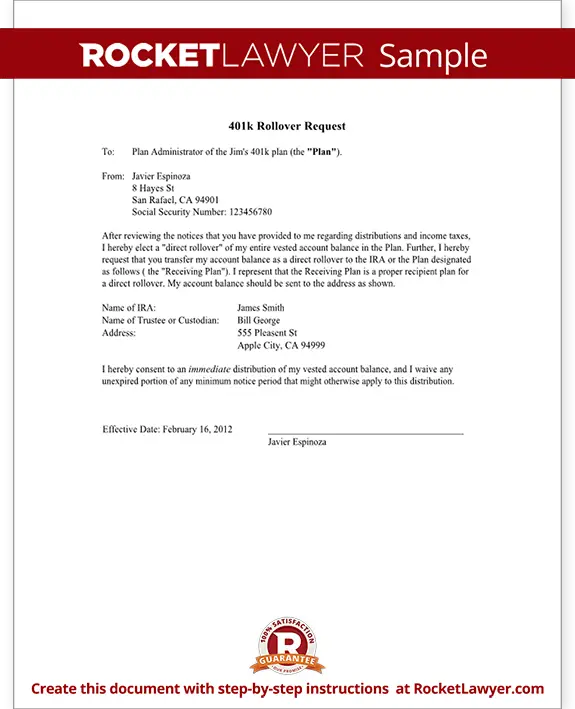

Below is a sample hardship withdrawal letter from a 401k. The writer should use a formal style and make sure it has no spelling or grammatical errors. It should be addressed to the person in charge of the companys retirement accounts.

The writer should keep copies of all communications that relate to asking for a withdrawal from the account. If there are any documents that prove or support the reason for asking for the withdrawal available, copies of those should also be enclosed with the letter.

Follow These 2 Tips To Prevent This Issue

Recommended Reading: How To Find Out If You Have A 401k Account

Recommended Reading: How To Rollover Vanguard 401k

When Changing Jobs Is This Your Best Option

When an employee leaves a job due to retirement or termination, the question about whether to roll over a 401 or other employer-sponsored plan quickly follows. A 401 plan can be left with the original plan sponsor, rolled over into a traditional or Roth IRA, distributed as a lump-sum cash payment, or transferred to the new employers 401 plan.

Each option for an old 401 has advantages and disadvantages, and there is not a single selection that works best for all employees. However, if an employee is considering the option of transferring an old 401 plan into a new employerâs 401, certain steps are necessary.

Making The Numbers Add Up

Put simply, to cash out all or part of a 401 retirement fund without being subject to penalties, you must reach the age of 59½, pass away, become disabled, or undergo some sort of financial hardship . Whatever the circumstance though, if you choose to withdraw funds early, you should prepare yourself for the possibility of funds becoming subject to income tax, and early distributions being subjected to additional fees or penalties. Be aware as well: Any funds in a 401 plan are protected in the event of bankruptcy, and creditors cannot seize them. Once removed, your money will no longer receive these protections, which may expose you to hidden expenses at a later date.

Don’t Miss: Can I Transfer Ira To 401k

What Do You Need To Know About Empower 401k Contribution

Since HUB 401 is an employer sponsored plan, all plan membership accounts will be migrated to Empower. Your HUB sponsored account will be migrated automatically and you will not be able to continue with Fidelity. However, all of your individual retirement accounts will remain with Fidelity. Will the range change?

Donât Miss: When Leaving A Job What To Do With 401k

Writing A Request Letter For A 401k Hardship Withdrawal

It is generally not allowed to withdraw money from an employer-sponsored retirement account, but there are exceptions. If the employee is faced with serious hardships that affect his or her financial situation, the Internal Revenue Service offers provision for hardship withdrawals.

Some employers do not allow such withdrawals, but if an employer does allow it, the employee must write a hardship withdrawal letter that gives the reason with details that he or she needs the money. It is recommended to include documentation that proves the case.

Don’t Miss: What Is The Max I Can Put In My 401k

If You Are Under 59 1/2

Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resort. Not only will you pay tax penalties in many cases, but youre also robbing yourself of the tremendous benefits of compound interest. This is why its so important to maintain an emergency fund to cover any short-term money needs without costing yourself extra by making a 401k early withdrawal.

However, life has a way of throwing you curveballs that might leave you with few to no other options. If you really are in a financial emergency, you can make a withdrawal in essentially the same way as a normal withdrawal. The form is filled out differently, but you can find it on Fidelitys website and request a single check or multiple scheduled payments.

If you jump the gun, though, and start making withdrawals prior to the age of 59 1/2, youve essentially broken your pact with the government to invest that money toward retirement. As such, youll pay tax penalties that can greatly reduce your nest egg before it gets to you. A 401k early withdrawal means a tax penalty of 10 percent on your withdrawal, which is on top of the normal income tax assessed on the money. If youre already earning a normal salary, your early withdrawal could easily push you into a higher tax bracket and still come with that additional penalty, making it a very pricey withdrawal.

Know: The Best Roth IRA Accounts

The Potential Tax Consequences On Retirement Plan Distributions

Apart from my own rollover, and according to the IRS, there are three permitted methods for doing a rollover of any kind:

Also Check: How To Do A Direct 401k Rollover

Don’t Miss: What Happens To My 401k If I Get Fired

Make Retirement Your Own Merrill Lynch

Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America Corporation. Trust, fiduciary and investment management services are provided by Bank of America, N.A. and its agents, Member FDIC, or U.S. Trust Company of Delaware.

Recommended Reading: How To Cash In Your 401k Early

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

You May Like: How Much Will My 401k Grow If I Stop Contributing

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

Also Check: How To Move 401k To Ira Without Penalty