Are There Exceptions To The 10% Early Withdrawal Penalty

If youre under 59½ when you cash out of your plan, you may also be subject to a 10% early withdrawal penalty. Certain exceptions include:

- If youre 55 or older when you leave your job.

- Distributions due to death, disability and certain medical expenses.

- You take the distribution as part of substantially equal payments over your lifetime.

Ask your financial professional for more information about these and other exceptions.

Read Also: Should I Open A 401k

What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

Also Check: How Much Does A Solo 401k Cost

Look Out For Your Check In The Mail And Deposit Into Your New Account

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Also Check: Can You Withdraw From 401k To Buy A House

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

You May Like: How To Transfer Your 401k To Another Company

How To Roll Over A 401

Perhaps youve left your job but still have a 401 or Roth 401 with your former employer youre retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employers plan, cash out your 401, initiate a 401 rollover into a new employers plan, or rollover into an IRA .

Recommended Reading: How Can I Use 401k To Buy A House

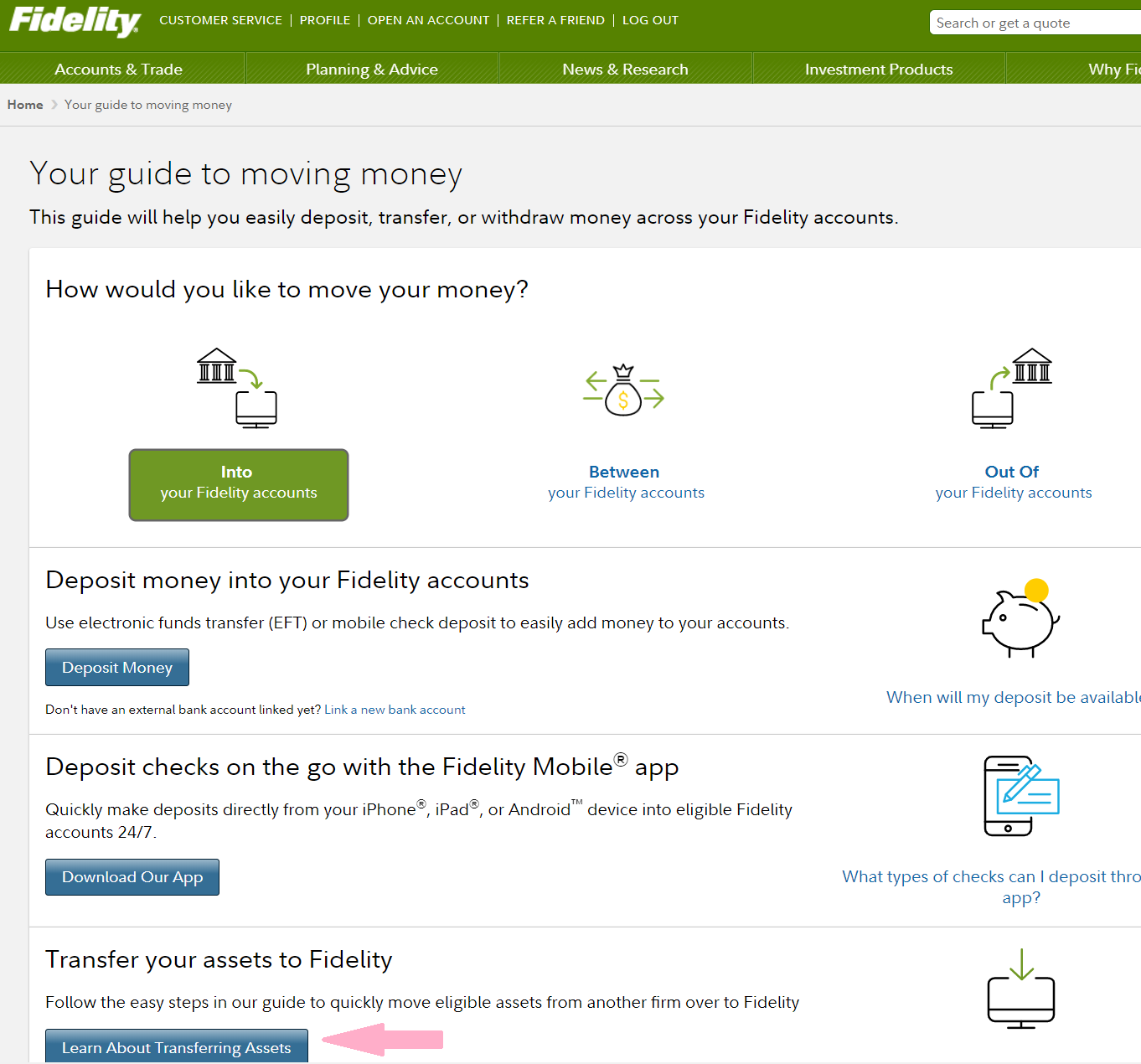

Contact Fidelity And Ask For A Direct Rollover

Reach out to a Fidelity representative about beginning your rollover. The company has a set procedure to follow for rollovers.

Be very sure, though, to emphasize that you want a direct rollover, meaning youre moving the funds directly from one retirement account to another. No taxes will be withheld from the transfer amount, according to the IRS.

Also Check: How Do You Roll A 401k Into An Ira

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

Don’t Miss: What Is The Difference Between 401k And 403b

Option : Cashing Out Your 401

While withdrawing your money is an option, in most circumstances, it means those funds will not be there when you need them in retirement. In addition, cashing out your 401 generally means youll have to pay taxes on the withdrawal, and theres typically an additional 10% tax penalty if youre younger than 59½, unless you left your employer in the calendar year you turned 55 or older.

Net unrealized appreciation: special considerations for employer stockIf you own stock in your former employer and that stock has increased in value from your original investment, you may be able to receive special tax treatment on these securities. This is referred to as net unrealized appreciation . If you roll the employer stock into a traditional or Roth IRA or move it to your new employers plan, the ability to use the NUA strategy is lost. NUA rules are complex. If youre considering NUA, we suggest consulting with a tax professional prior to making any decisions on distributions from your existing plan.

Should I roll over my 401?The decision about whether to roll over your 401 is dependent on your individual situation. A financial advisor will work with you to help identify your goals and determine whats important to you. By understanding your investment personality, he or she will be able to advise if rolling over your 401 is the best option for you.

What If My Check Gets Misplaced Or Lost In The Mail

This unfortunately does happen every once in a while, but dont worry your money hasnt disappeared. If your check doesnt arrive then youll have to call your 401 provider again and ask them to issue a new one. Theyll place a stop on the first one, and nobody will be able to cash the first check since its generally made out to you or your IRA provider and will always stipulate that its for the benefit of or FBO, your name.

STEP 5

Recommended Reading: How Can I Use My 401k To Pay Off Debt

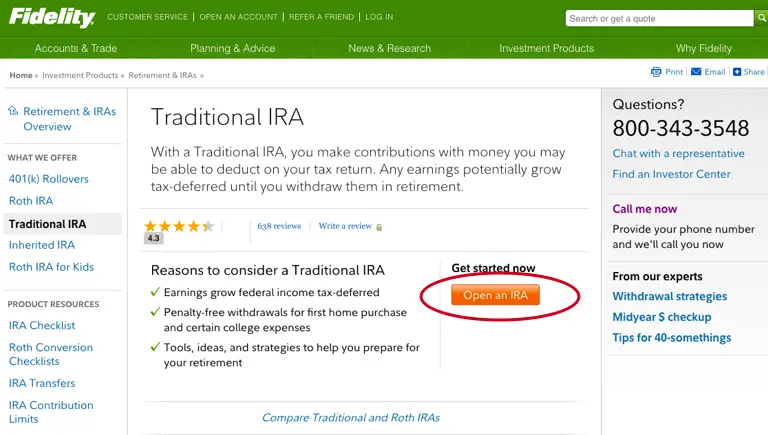

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguards advisor-assisted, automated investing account has Fidelitys equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

Vanguard Vs Fidelity: Online And Mobile Experience

Both brokerages have robust online and mobile experiences. So while each firm has features and investments that favor specific types of clients, the quality of their tools and platforms are unquestionably strong.

Vanguards trading platform and apps are fairly basic, in keeping with the general aesthetic of the company. You can do everything you need to do as a low-level investor make trades, buy mutual funds and check your performance. The platforms dont have all the bells and whistles an experienced investor might want, but for someone who just wants to manage a few basic investments, it works.

Fidelity, on the other hand, has a more complicated and extensive online and mobile experience. While this may be a bit overwhelming for someone without a ton of investing experience, if you have been trading for awhile, Fidelity may help you take your investing game to the next level.

In April 2021, Vanguards mobile app has a major variance in its satisfaction level among users. For the Apple version, users rate it at 4.7 stars out of 5 across over 167,000 reviews. But on the Google Play store, Android users rate it at just 2.2 stars out of 5 across more than 5,350 reviews. The brokerage is releasing a new app called Vanguard Beacon, though, and it promises to have more features and tools for clients.

Also Check: How To Recover 401k From Old Job

Read Also: How To Grow Your 401k Faster

Investing The Money In Your Ira

Once the money is rolled over into your new IRA account, select your investments.

-

Index funds: You can put index funds in your IRA, which is a fund that aims to mirror the performance of a market index such as the S& P 500.

-

ETFs: These investments often make sense for many people because theyre a basket of assets, such as stocks or bonds, that can be bought and sold during market trading hours. ETFs are a good way to diversify a portfolio.

-

Stocks: Individual stocks are also an investment option for IRA accounts.

-

Mutual funds: These are investments that combine money from investors to buy stocks, bonds, and other assets. Mutual funds are another way to create diversification in your portfolio.

-

Real estate: You can hold real estate in your IRA, but you’ll need to do so by means of a self-directed IRA.

-

Cryptocurrency: Bitcoin, Litecoin and Ethereum are all examples of alternative investments you can choose.

-

Target-date funds: 401s often allocate money into target-date funds, which buy shares of other mutual funds with the goal of shifting investments automatically over time as you approach a specific date, such as retirement. If you like that approach, you probably can find a similar target-date fund for your IRA at an online broker.

Those who would rather automate the investing process can use a robo-advisor for this. When you open a new account at a robo-advisor, that robo-advisors algorithms usually will select your investments based on questions you answer.

How To Roll A 401 Into An Ira

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.

Also Check: How To Save Without 401k

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Also Check: How Often Can I Change My 401k Investments Fidelity

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

You May Like: How Much To Invest In 401k To Be A Millionaire

If I Choose A Direct Rollover To An Ira Or A New Plan Will I Receive Any Kind Of Confirmation

You will receive a Form 1099-R from your old plans provider indicating you initiated a direct rollover. Since there is no federal income tax withheld, your entire balance will be rolled over and youll continue benefiting from the tax advantages. If you roll over your money into an IRA, you will receive a Form 5498 and an account confirmation from the IRA trustee or custodian. If you roll over your money into a new plan, ask your employer if you will receive confirmation.

Also Check: How To Open A 401k Plan

Transferring Dividend Stocks From Td Ameritrade To Fidelity

My retirement accounts are now completely transferred from Vanguard to Fidelity. But I still have additional taxable accounts with TD Ameritrade and the no-fee broker, M1 Finance. These two accounts are the focus of my .

At this stage, I am planning to transfer the TD Ameritrade account to Fidelity when Im ready.

My TD Ameritrade dividend growth portfolio has also grown to a six-figure account. But Im not an active trader. I buy stocks and collect dividends. Then I reinvest the dividends into more dividend-paying stocks. Ive almost always been happy with them.

I dont need a fancy trading platform. My priority now is to simplify my life a bit. Fidelity is an equally capable online brokerage for my needs, so it makes sense to move my money there.

Fidelity charges $4.95 per stock trade while TD Ameritrade charges $6.95 is now commission-free as of October 2019!

The only hesitation I have is the cost basis data on record at TD Ameritrade. When I transferred my decades-old DRIPs , I had to update the cost basis from my records. Since these were DRIPs, there were dozens of transactions for each.

Im afraid that when I transfer my holdings, the cost basis will not be transferred correctly or at all. Ive seen this screwed up many times. I will back up my cost basis very carefully in case I have to resubmit the data.

Read Also: Can You Take Out Your 401k To Buy A House

You May Like: How Does A 401k Make Money

You May Have Accumulated

There are many factors to keep in mind when considering a 401 rollover, including where you’re at in your career, your current financial status, and your tax and investment preferences. You should consider all of your options before making a decision, and can use the information provided here to help. If you decide a rollover is right for you, contact a Schwab Rollover Consultant at .

Contact Your 401 Provider

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips:

Recommended Reading: How To Find Out If I Have An Old 401k