Do Not Panic When The 401 Loses Value

We have already talked about this in brief, but it does not hurt to emphasize the essence of not freaking out when the figures in your 401 are not looking very attractive. It is not fun to check your 401 balance just to see that you have lost several thousand dollars in a couple of months.

What you do not want to do is panic and make rash decisions. It beats logic to start taking money out of your account since you already paid a price for your assets. If they lose their value and you sell, you have simply sold your assets for a loss. The best strategy is actually to keep investing so that you can reap in the long term.

Choose Your Asset Mix Carefully

Itâs essential to think about your asset mix, which simply means the different types of investments that go into your portfolio. For example, investing in stocks may help you grow your retirement fund faster, but if they drop substantially, you could also see plenty of losses. Thats why its essential to choose your asset mix wisely and make sure there are different types of investments in your portfolio.

Some tips about how to choose assets are:

Invest more in stocks when youre young.

When deciding how to allocate your funds, a general rule of thumb is that the younger you are, the more you can invest in stocks. This is because stocks offer much higher returns than other assets and have always shown a historical tendency to go up. However, they can also crash the hardest, which is unacceptable for someone who is reaching retirement age.

However, if youre young, you can afford to take on more risk and even some temporary losses because its almost a certainty that stocks will end up climbing again in the future. If you keep a long-term mindset, youre bound to end up winning in the end.

As you get older, choose safer investments.

Investing in low-cost index funds will provide you with an average return without taking on too much risk. But if you really want to reduce risk as much as possible, investing in bonds or bond funds rather than stocks or stock funds is the way to go.

Should I Stop Contributing To My 401

Research has shown that consistent investing pays off over time. For instance, Charles Schwab looked at five different investing styles, ranging from trying to time the market to keeping everything in cash. The best performing strategy was the investor who managed to perfectly time the market an impossibility for most investors, as noted above.

After that, the most effective strategy was one where an investor socked away money at the start of the year, followed by an approach called “dollar-cost averaging,” or investing a set amount of money on a regular basis, such as monthly or with each paycheck. In other words, how most people invest in their 401s.

The worst performer? The investor who stuck with cash, Schwab found.

“I am a big believer in the adage that time in the market is more important than timing the market, and that means that any time you can set aside money to invest is a good time,” Richardson noted. “If you have the ability to put more toward your 401 or other retirement accounts, this is as good a time as any.”

Don’t Miss: How To Roll Over 401k To Roth Ira

Understand How Your Portfolio Is Impacted

The key to understanding how your stock portfolio may be impacted is to use the right tools to analyze your current holdings and enable you to perform the proper research to enable your investing strategy.

For example, if your current portfolio is already very defensive and has a low correlation with the current market direction, you may not need to take aggressive action.

Portfolio analytics and stock research are the keys to long-term successful investing. You need a tool that can provide:

- Detailed Company Financials

- Dividend History and Estimates

- Value Investing Metrics: Fair Value and Margin of Safety

- Portfolio Analytics

- Portfolio Rebalancing Tools

- Stock Correlation Reporting

Stock Rover is our recommended Stock Screening, Research, and Portfolio Management tool, winning our Best Stock Market Software Review and our Best Stock Screener Review.

Stock Rover can perform detailed portfolio analytics and assessment and help with rebalancing your portfolio. It can also connect to your broker and even help you create a Warren Buffett Value Investing Portfolio or a stable Dividend & Income Portfolio.

Read the Stock Rover Review or get Stock Rover for Free.

Making Sure Your Funds Are Allocated Correctly For Your Goals

When it comes to protecting your 401k from a stock market crash, one of the most important things is making sure your funds are allocated correctly to mitigate risk.

This means that your money is invested in a way that aligns with your specific goals, but also has safeguards in place against economic downturns.

For example, if youre saving for retirement, youll want to invest in stocks and bonds so that your money has the potential to grow over time.

If youre saving for college, youll want to invest in funds that are less risky so your money wont be as vulnerable if the stock market crashes.

Its important to talk with your financial advisor to make sure your funds are allocated correctly for your specific goals for your retirement portfolio.

They can help you come up with a plan that fits your needs

You May Like: How To Pull From Your 401k

Is It Good To Invest When The Market Crashes

You will continue to make the same type of investment contributions in even hard economic times if you have automated your investments by contributing a certain percentage in monthly installments. As a result of stock market drops, you are more likely to get your money back, while when stocks go up, your shares profit.

What Is A Stock Market Crash

A stock market crash is the sudden and simultaneous decline of stock value, with prices falling more than 20%. The impact is often unpredictable and follows after a major event that causes economic disturbances. While this is the incentive, the crash gains full force with impulsive stock selling due to panic and fear.

The stock market is exceptionally unpredictable, and price drops are just as regular as a price surge. But a crashing market is not the same as a declining one, also called a bear market.

While the first one has dramatic price plunges, a bear market occurs when stock prices fall over an extended period, characterized by pessimistic investor sentiment.

Since 1928, there have been over 20 bear markets in the U.S., but only several stock market crashes. Following the COVID-19 pandemic, 2020 saw the latest stock market crash, lasting from February 20 to April 7.

The crash had significant consequences on the economy, affecting the retirement plans of many Americans.

In precaution of another impact, many are now looking for ways to protect their savings.

Read Also: How To Transfer 401k From Charles Schwab To Fidelity

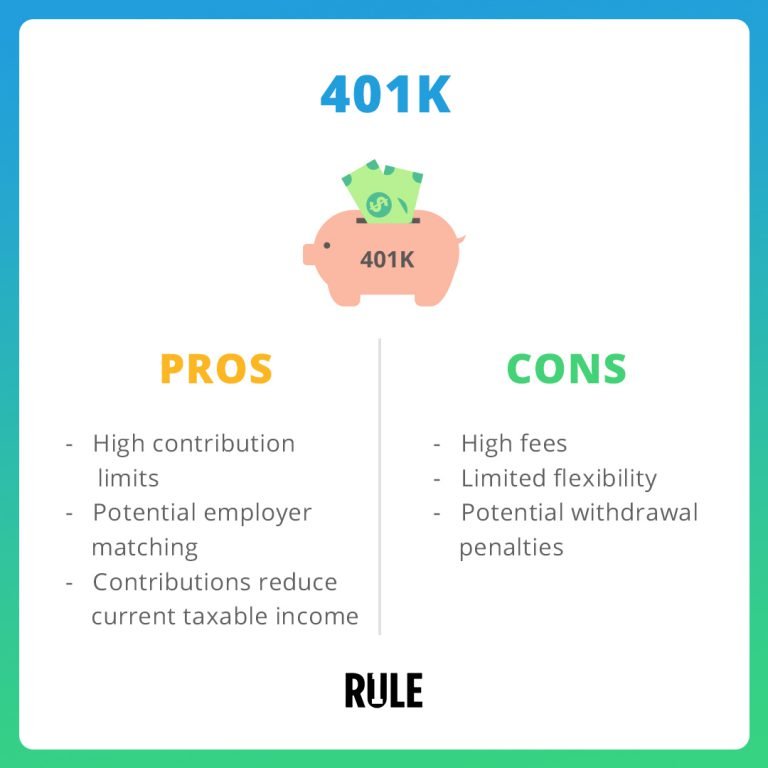

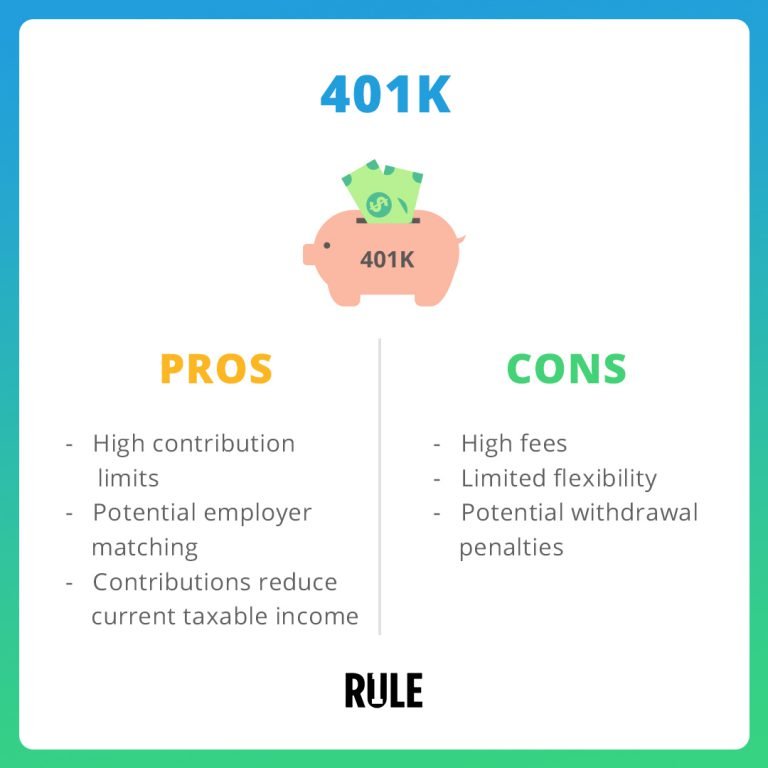

The Problem With A 401k

Now, Im not the biggest fan of 401ks for a couple of reasons.

For one, they afford you practically ZERO control over your investments.

If you do have any sort of control over where your money goes, its usually limited to which fund to choose from. Funds are baskets of stocks that typically dont even beat the market when it comes to returns. Plus, they normally have high fees, which means you not only make less than you would make if you invested on your own but youre also charged a fee on your investments.

The problem is that you cant invest in individual stocks through a 401k, and as Rule #1 investors know, investing in individual stocks of incredible companies is the best way to make returns on your money.

So, thats my beef with 401ks. They restrict the type of investments you can make so you miss out on the opportunity to choose investments that are more profitable. However, that doesnt mean they are bad. A 401k has its benefits too.

Recommended Reading: How Much Do I Need To Contribute To My 401k

Continue Contributing To Your 401 And Other Retirement Accounts

Steadily contributing to your 401 is another way to protect it from future market volatility. Cutting back on your contributions during a downturn may cost you the opportunity to invest in assets at discount prices. Meanwhile, maintaining your 401 contributions during a period of growth when your investments have exceeded expectations is equally important. The temptation to scale back your contributions may creep in. However, staying the course can bolster your retirement savings and help you weather future volatility.

Recommended Reading: Can You Transfer A 401k Into An Ira

Try To Contribute Enough To Earn The Full Employer Match

One of the keys to building a robust retirement fund is to save as consistently as possible even during market downturns. Market crashes are actually fantastic opportunities to invest more, because you can get more bang for your buck when stock prices are lower.

Matching 401 contributions from your employer can help your money go further, so it’s wise to take full advantage of them. After all, those matching contributions are essentially free money, and if you’re not saving at least enough to earn the full match, you’re leaving money on the table.

Diversification& Prudent Asset Allocation

One of the key factors to consider as you start investing for your retirement years is how you will allocate your funds to various assets. As an investor, you should understand that stocks are quite risky, hence are more likely to offer higher rewards than other assets. Bonds are, on the other hand, safer investments, but also have lesser returns.

You can aim at having a diversified 401 of mutual funds that comprise stocks, bonds, as well as cash, in order to protect the funds in your account, in the event an economic downturn occurs. The amount of money you allocate to each asset is in part dependent on how close you are to your retirement years. If you are a few years away from laying down your tools of work, it is a good idea to keep off the risky assets.

In contrast, those who are still in their 20s can create an investment portfolio that is heavily weighted in the more risky assets such as stocks. This is because they have enough time to fix whatever errors they might make during their investment journey, which is a luxury that those nearing their retirement years are not accorded.

How exactly does one decide on the percentage of their funds that should be allocated to stocks vs. bonds? A common rule is usually to subtract ones age from 110. The result you get is the percentage of your wealth that should be allocated to stocks. The more risk-tolerant investors can opt to subtract their age from 120, while the risk-averse ones can subtract their age from 100.

You May Like: Can An Individual Open A 401k Account

Frequently Asked Questions On How To Protect Your 401 From A Market Crash

1. What can I invest in a 401?

The most common investment option offered in todays 401 plans is mutual funds. There has, however, been a rise in the number of 401 plans offering exchange-traded funds . ETFs and mutual funds contain a wide variety of securities. Typically, individuals cannot invest in individual stocks, such as Amazon or Facebook, but are required to select one or several mutual funds or ETFs.

2. What is diversification?

Diversification refers to the spreading of your investments around so that the risk exposure to a single type of asset is limited. This is a strategy designed to help minimize the volatility of ones portfolio over time. It also reduces the probability that one bad event will take out your entire portfolio.

3. What is a market crash?

A market crash is a sudden and dramatic decline in the prices of stocks in the entire stock market, a process that often results in the significant loss of paper wealth. Most crashes are usually a result of panic selling and other unforeseen factors. Generally speaking, a market crash occurs under the conditions listed below:

- A prolonged bullish market

- Excessive economic optimism

- Situations in which price-earnings ratios exceed the long-term averages

- The extensive use of leverage/margin debt by the market participants

Some other factors that may trigger a market crash include:

- A change in federal laws

- Natural disasters occurring in the economically productive zones

- Large corporate hacks

Should I Cash Out My 401 If The Market Crashes

No. If you cash out your 401 plan you will have to pay the deferred income tax liability on all of the contributions and gains in the account at that time. Moreover, if you are under age 59.5, you will be hit with a 10% early withdrawal penalty, making it an even less attractive option. Instead, it is recommended to keep investing as the market dips and stick with your strategic plan.

Don’t Miss: How To Get A Loan From My 401k

Shift Your Asset Allocations As You Near Retirement

So weâve covered the different investment options, how time is your best strategy to weather the stock market storms, and what to do if the stock market does crash. But the absolute best way to protect your 401 from a stock market crash is to limit your risk from one the closer you get to retirement.

Obviously, no one can predict when the next stock market crash will be. So the next best option is to limit the effects of one on your 401 when you donât have as much time to recover before retirement.

If youâre invested in a target-date fund, your investments should already be reallocated to less risky funds, like bonds, the closer you get to 65. If youâre invested in index funds or mutual funds, youâll need to move your money to safer investments yourself. As mentioned earlier, if your 401 provides an online portal, itâs easy to reallocate your assets to lean more towards bonds. If not, your planâs custodian will be able to facilitate moving your money to other investments within the plan.

If your plan doesnât provide investment options that donât satisfy your goals, you can roll over your 401 to an IRA at an outside institution. These investment institutions like Fidelity have seemingly endless investment options to choose from within their IRAs.

What Is A 401

The 401 is an employer-sponsored, tax-deferred investment plan specially designed for retirement. Its a particular type of investment account that an employer opens on behalf of their employees to deposit a portion of each employees salary and sometimes another voluntary contribution to match that of the employee.

There are two types of 401s, the traditional 401 and the Roth 401. In the first case, contributions are made pre-income tax, and your taxes will be deferred until you withdraw your money during retirement. The Roth 401, on the other hand, allows you to make post-tax contributions, so you wont have to pay any more taxes in the future.

Recommended Reading: How To Check How Much Money Is In My 401k

The Different Investing Options

The 401 is a popular retirement plan because it offers many investment opportunities. Unlike an IRA, the 401 is employer-sponsored and has excellent tax benefits. Plus, it allows employees to add more money to their savings and cash out their 401 before retirement.

There are two types of 401s, traditional and Roth.

The main difference is that the first is pre-tax, while Roth 401 is a post-tax savings account. After deciding between the two, savers can choose how they invest their money. But the many possibilities sometimes make it challenging to select the best one.

The best investing option largely depends on several factors, including individual preferences, retirement goals, age, and risk tolerance.

Knowing the different types of investments is essential so that savers know where to put 401 before the market crashes.

Currently, the most common 401 investment option is a mutual fund that can range from very conservative to aggressive. And some of the most popular choices are stock, bond, and target-date funds.

Is The Stock Market Crashing

Stock market crashes are only clearly identifiable in hindsight, but many investors have worried about a crash in 2022. Throughout the year, the markets have been experiencing extreme volatility over concerns about rising inflation, interest rates and global geopolitical uncertainty.

While investors found some relief mid-summer, by the end of August, worries of a sustained downturn resumed, as the S& P 500 and Dow both fell more than 4%.

Although history can tell us how long crashes, stock market corrections and bear markets typically last, no one gets a calendar notice announcing the time, nature and projected magnitude of future dips.

» Learn more: What is a bear market and how should I invest during one?

Recommended Reading: When Can I Take 401k

Should You Keep Contributing To Your 401

The more practical thing to do is to keep contributing to 401s for the duration of the employment or as long as the employees have the means to do it.

There are several reasons why.

Primarily to regain profit. During a bear market or a crash, instead of backing down, savers can take advantage of buying low and then selling high with the help of a professional 401.

Another good reason to keep contributing to 401 is when employers offer to match their employees 401 contributions. That adds free money to retirement savings. So, the larger this contribution is, the longer the 401 will last.

Finally, regular 401 contributions get the best use of the double tax deduction. Employees get a tax decrease for each paycheck contribution and get the advantage of growing their retirement money tax-free before a withdrawal.