Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well-known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our review’s best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with about $7.2 trillion under management.

Read our full Vanguard review.

Best For Real Estate: Rocket Dollar

Rocket Dollar

Rocket Dollar allows you to invest in anything you can pay for with a checkbook. That means you can invest in real estate and other non-traditional assets while enjoying the tax advantages of a solo 401 account.

-

Checkbook control allows you to invest in real estate and other alternatives

-

Support for 401 loans and Roth contributions

-

Option for upgraded account that includes free wire transfers, checks, tax form filing, and other features

-

Basic accounts require $15 monthly fee and $360 setup fee

-

Premium accounts require a $30 monthly fee and $600 setup fee

If you dont want the limitations of traditional financial markets, you may want to consider Rocket Dollar. Instead of stocks, ETFs, mutual funds, and bonds, Rocket Dollar accounts give you the control to buy any asset with your solo 401 that the IRS allows. That can include rental properties, fix-and-flip real estate, or land that you think will appreciate in value. You can invest outside of real estate as well, such as private investments in a startup or precious metals, however, Rocket Dollar’s flexibility makes it the solo 401 that’s best for real estate.

Solo 401 Withdrawals In Retirement

Withdrawals from your solo 401 after age 59 ½ incur no penalties, though income taxes depend on which type of account you have.

If you have a Roth solo 401, withdrawals are tax-free if made at least five years after the first contribution to the account. If you have a traditional solo 401, you pay income taxes on withdrawals based on your current tax bracket.

With a solo 401, you eventually are required to begin taking withdrawals from your account, known as required minimum distributions . You can avoid RMDs requirements by rolling a Roth solo 401 into a Roth IRA, which does not have mandatory RMDs.

For Solo 401s, you must take your first RMD by April 1 of the year after you turn 72. In subsequent years, RMDs must be taken by Dec. 31 of the relevant year.

Don’t Miss: How To Use 401k To Purchase A Home

Vanguard Solo 401 Costs

Vanguard is very straightforward with its Solo 401 costs. There are no account maintenance fees or trading costs, which is a big plus. Solo 401 plans cost just $20 per year for each fund thats used in the plan. These fees can be waived for account holders who have at least $50,000 in Vanguard accounts.

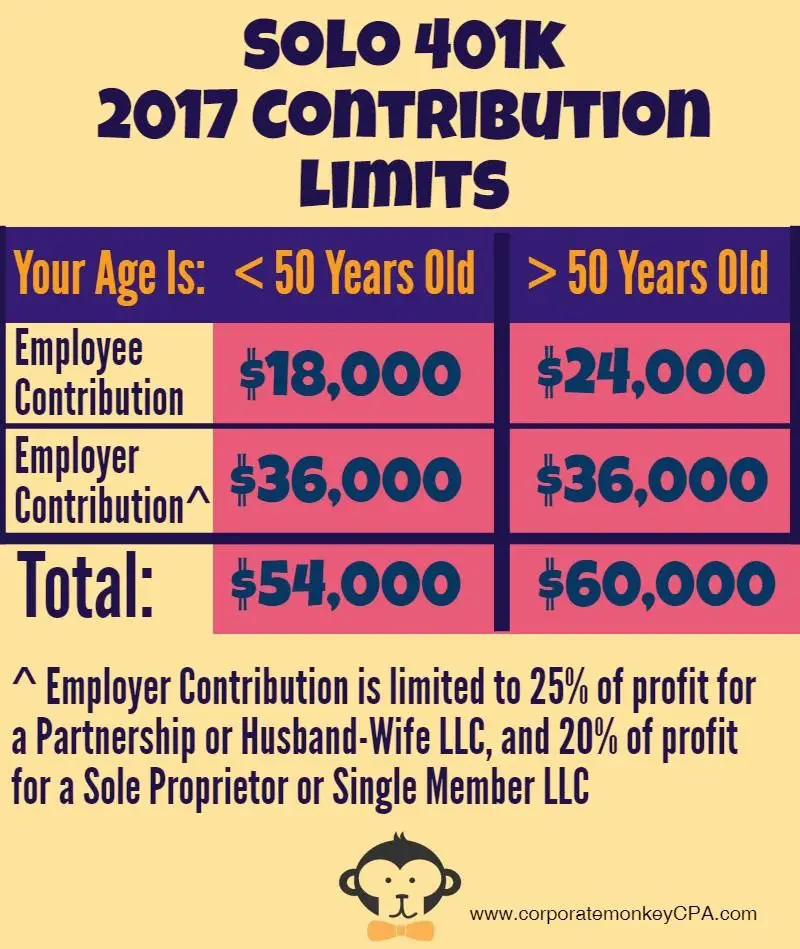

Roth Solo 401k Contribution Limits

Along with higher contribution limits, frequent increases in the contribution limits are another reason the Roth Solo 401k is superior to the Roth IRA. In November 2021, the IRS announced changes to 401k plans for 2022 allowing employees under the age of 50 to contribute up to $20,500 per year to their Solo 401k, an increase of $1,000 from 2021. The catch-up contribution for employees age 50 and older is $6,500, for a total contribution limit of $27,000. The combined total employer and employee contributions cannot exceed $61,000 for the year, and $67,500 for employees age 50 and older.

On the other hand, 2022 traditional and Roth IRA contribution limits remain unchanged at $6,000 per year, with an additional $1,000 per year catch-up contribution for those age 50 and older.

You May Like: How To Withdraw 401k From Old Job

Alternatives To A Solo 401

If you arent sure if a Solo 401 plan is right for you, you may want to consider a different type of retirement benefit account. Simplified employee pension individual retirement accounts and traditional IRAs both offer some tax benefits and, as IRAs, they avoid the administrative costs that can come with some 401 plans.

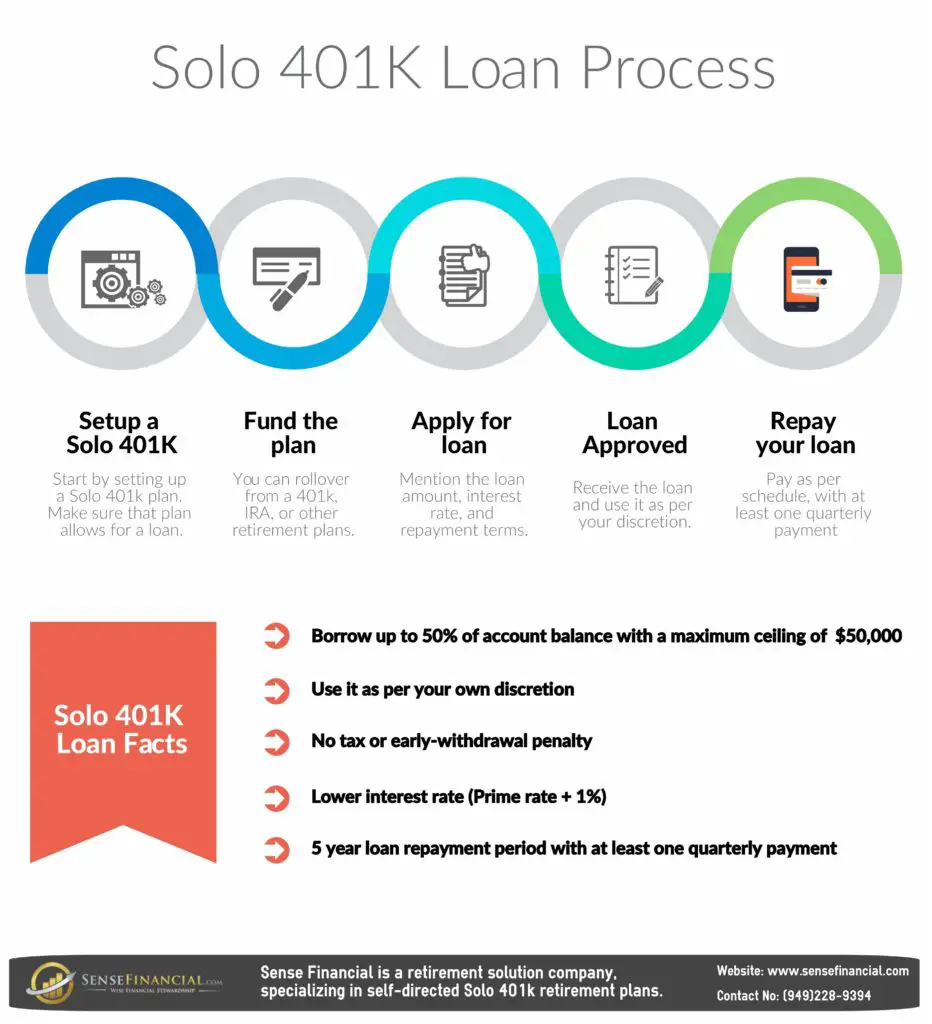

You Can Take A Loan From Your Solo 401

Most solo 401 providers let account owners take out 401 loans from their accounts. With a Solo 401, you can borrow up to the lesser of 50% of the plan value or $50,000. You must pay back the loan in five years or lessunless its used to buy a primary residence, in which case you have up to 30 years.

Just because youre borrowing from yourself doesnt mean it wont cost you. Youre required to pay your account interest comparable to what youd pay for a similar non-401 loan. Youll also miss out on potential returns that money would have earned if it had stayed invested.

While you will eventually earn what you borrow back, plus interest, that interest rate may be less than the returns the money would have earned if you had left it untouched and invested in the stock market.

Also Check: Can I Use My 401k To Pay Student Loans

Why Not A Sep Ira

The short answer is that the individual 401k is a newer and better option in almost every way:

Many people are able to put more into the 401k account every year , and the i401k also allows access to the features well talk about below like Roth contributions, 401k loans, and catch-up contributions for those above the age of 50.

The 401k is also often the better choice because it allows you to also take advantage of the Backdoor Roth IRA . Pre-tax money in another IRA runs afoul of the pro-rata rule, which means using a Simple IRA or SEP IRA prevents you from truly maximizing your tax-advantaged retirement space.

The main benefit of the SEP-IRA is that it can be expanded to make retirement accounts for employees should your business grow in the future.

For someone like me, choosing the Individual 401k is a no-brainer.

Can I Have Both A Roth Ira And A Roth Solo 401k

The short answer is YES, you can have both a Roth IRA and a Roth Solo 401k. However, depending on your income level, having both might not be the best answer. Not only are the contribution limits much higher with a Roth Solo 401k but the Roth IRA has an income cap.

In 2021, to be eligible for a Roth IRA, single filers must have a modified adjusted gross income below $140,000, and married couples filing jointly must make less than $208,000. The income limits do not apply to Roth Solo 401k contributions.

Another huge benefit of the Roth Solo 401k plan is that it allows tax-free access to retirement funds via the participant loan feature. Neither traditional nor Roth IRAs allow participant loans.

Recommended Reading: How To Transfer My 401k To An Ira

Compare The Best 401 Plan Providers

| Company | |||

|---|---|---|---|

| Defined contribution plans, defined benefit plans, non-qualified plans, combination plans, 457 plans, 403 plans | |||

| ADP | Not disclosed | Monthly: $160 plus $4 per participant, plus 0.10% of eligible plan assets or $20.83, whichever is greater | 401, Roth 401 |

| Solo 401, SEP IRA, SIMPLE IRA, traditional and Roth 401s | |||

| Betterment | Monthly: $42 to $125 flat fee plus $5 to $6 per plan participant | Traditional and Roth 401s | |

| One-time setup fee plus annual fees based on number of participants | Solo 401, SEP IRA, SIMPLE IRA, traditional and Roth 401s |

How To Start A Solo 401

Follow the steps below if you’re interested in opening up a solo 401.

Once you’ve done these four things, you may begin choosing your investments and making regular contributions to your account. You can also roll over funds from other retirement accounts in your name if you choose.

You must make your solo 401 employee contributions by Dec. 31, but you have until the tax filing deadline for the year — usually April 15 of the following year — to make your employer contribution.

One last thing to note is that if you have $250,000 or more in your solo 401 by the end of the year, you’re required to submit a Form 5500-EZ information return to the IRS with your taxes for that year so you don’t run into trouble with the federal government.

Read Also: How To Calculate 401k Match

What Happens If You Hire Employees

A solo 401k is an appropriate plan for a person who works for himself or who has a spouse or business partner involved in the company. It is not suitable for a company with employees.

If you have a solo 401k and hire workers, you will be required to switch your solo 401k to a traditional 401k plan. Doing this can come with hefty administrative costs and rules.

You may want to explore a SEP-IRA if you think youll hire workers in the future. A SIMPLE IRA, which allows for employee contributions, is also an option.

What Is A Solo 401 Plan

Lets take a minute to familiarize everyone about just what a Solo 401 plan is. Its a traditional 401 thats tailored for the self-employed individual or owner-only business operators. Basically, if you work for yourself in some capacity, you can open a Solo 401 plan, also referred to as an Individual 401 or Self-Employed 401. A Solo 401 offers high contribution limits of $61,000 for 2022 annually, which makes it better than other self-employed plans. You can invest in anything not disallowed by the IRS, such as many collectibles and life insurance. If the provider allows for it, you can also borrow money from the plan or make designated Roth contributions.

Now that you know what a Solo 401 plan is and who can open one, lets talk about the benefits of it.

*You must pay the loan back over a five-year period at least quarterly at the minimum prime interest rate. However, you do have the option of selecting a higher interest rate.

You May Like: What Is The Best 401k Rollover Option

Is A Solo 401k Worth It

One of the few positives to come out of the isolation imposed by the pandemic is a powerful desire for more control over our lives. Many of us learned that we could work very well at home alone. That we dont need nearly the amount of supervision that others thought was necessary. In fact, this is carrying over into todays workplace by people choosing not to return to the corporate office or other controlling workspaces. People found that they can do the job just fine on their own thank you!

Maybe its not only about control. Many people are refusing to return to minimum wage and low-paying jobs that have no future. It all adds up to empowering people to take full control of their lives. For many, it means becoming self-employed whether that is full-time or part-time. Both versions can lead to a very wealthy retirement through a Solo 401k that is fully self-controlled and far away from corporate bosses and Wall Street greed.

Contribution Limits In A One

The business owner wears two hats in a 401 plan: employee and employer. Contributions can be made to the plan in both capacities. The owner can contribute both:

- Elective deferrals up to 100% of compensation up to the annual contribution limit:

- $22,500 in 2023 , or $30,000 in 2023 if age 50 or over plus

If youve exceeded the limit for elective deferrals in your 401 plan, find out how to correct this mistake.

Total contributions to a participants account, not counting catch-up contributions for those age 50 and over, cannot exceed $66,000 for 2023 .

Example: Ben, age 51, earned $50,000 in W-2 wages from his S Corporation in 2020. He deferred $19,500 in regular elective deferrals plus $6,500 in catch-up contributions to the 401 plan. His business contributed 25% of his compensation to the plan, $12,500. Total contributions to the plan for 2020 were $38,500. This is the maximum that can be contributed to the plan for Ben for 2019.

A business owner who is also employed by a second company and participating in its 401 plan should bear in mind that his limits on elective deferrals are by person, not by plan. He must consider the limit for all elective deferrals he makes during a year.

Don’t Miss: How To Track Down Old 401k Accounts

Vanguard: Best Overall Solo 401 Provider

|

Investment Options: |

| Visit Vanguard |

Why We Like Vanguard: Vanguard is an extremely reputable company, offering low-cost investment choices for its customers. As the largest mutual fund company in the world, Vanguard provides simple, straightforward plans with access to professionally managed funds. Vanguard provides clients with generous cost savings for Solo 401 plans.

Vanguard doesnt provide active administration of Solo 401 plans, only providing participants with details that are needed for business and personal tax filing.

Best Solo 401ks For Multiple Accounts Or Employer Matching Betterment Retirement Account

Betterment is a Robo-advisor, so you can set it and forget it. You dont need to worry about rebalancing your portfolio or monitoring the market: Betterment will do all that for you automatically. It also has no account minimums or account fees, which makes this solo 401k option very affordable.

Betterment offers a variety of investment options beyond stocks and bondsincluding real estate and alternative investments like goldas well as personalized advice from financial experts based on your goals, risk tolerance, and other personal factors.

Once they have those details, theyll be able to recommend the specific funds that make sense for you.

Also Check: How Much Interest Does 401k Earn

Quality Of Options Provided

When deciding on a company that offers a solo 401 account, examine what features will be provided. For example, some companies allow people to open either a Roth account or a Traditional account. This freedom lets customers use either pre-tax or after-tax amounts to fund their accounts depending on personal needs. However, certain companies only allow individuals to open Traditional accounts. Some companies provide services such as the ability to take out loans from a solo 401 account. In general, its not recommended to take out a loan or to withdraw funds early, but the option of such services could prove useful for different individuals.

Reputable And Experienced Solo 401k Provider

As a reputable Solo 401k provider, we offer a full-service Self-Directed Solo 401k plan at a fair price for investing in equities and alternative investments such as real estate, cryptocurrency, promissory notes, tax liens, private company shares, precious metals and tax deeds. Our self-directed solo 401k also allows for solo 401k loans.

Read Also: How To Roll Your 401k From Previous Employer

Best Solo 401ks Overall Self

A self-directed 401k is the best option if you want complete control over your investments. It allows you to invest your money in various assets such as stocks, bonds, mutual funds, ETFs, real estate, and alternative investments.

The self-directed solo 401k allows you to invest in various investment vehicles, including mutual funds and exchange-traded funds .

Moreover, it allows you to invest in alternative investments like real estate through a self-directed IRA LLC or an IRA trust.

How Do 401 Plans Work For Small Businesses

A 401 is a retirement account that employers provide. Employees can put part of their paycheck into the account, and employers also can deposit money into these accounts to help employees save for retirement. Theyre a good benefit to use to attract and retain talent and offer extra compensation to employees.They also offer a tax deduction to the sponsoring business.

You May Like: How Do You Get Your 401k When You Retire

Have Your Ein Available

An EIN stands for an employer identification number, and you need one to open a solo 401. It is like a Social Security number for a business. The number can be obtained from the IRS online. Its possible to open a business using your personal Social Security number, but you will likely need to obtain an EIN to open a solo 401 account.

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts. But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

For example, if youre rolling over $100,000 and youre in the 22% tax bracket, that means you have to come up with $22,000 cash to cover the taxes. Dont pull that money out of the investment itself!

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and how you can be prepared for it.

You May Like: How Much Can I Take From 401k For Home Purchase

Don’t Miss: How To Start A 401k For Small Business