How Does A 401 Work When You Retire

Over the course of your working years, you diligently contribute to your 401 in preparation for retirement. But what happens once you actually get there? In short, itâs time to switch from saving your money to generating income with your savings.

So how does a 401 work when you retire? For starters, it can be an essential source of income when you exit the workforce. But before you start withdrawing money from your 401, itâs a good idea to build a plan to create your retirement income. Hereâs what you can expect from your 401 when you retire.

Which States Do Not Tax Your 401k When You Retire

Alaska, Alabama, Hawaii, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, and Wyoming do not tax 401 plans when you retire.

SoFis Relay tool offers users the ability to connect both in-house accounts and external accounts using Plaid, Incs service. When you use the service to connect an account, you authorize SoFi to obtain account information from any external accounts as set forth in SoFis Terms of Use. SoFi assumes no responsibility for the timeliness, accuracy, deletion, non-delivery or failure to store any user data, loss of user data, communications, or personalization settings. You shall confirm the accuracy of Plaid data through sources independent of SoFi. The credit score provided to you is a Vantage Score® based on TransUnion data.

Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.

SORL0522041

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most people would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your old 401k from your previous employer to an individual retirement account or to a new 401k plan set up with your new employer.

When you roll over the funds all of the funds to a qualifying IRA or 401k account, you do not have to pay taxes on the transfer. You will receive a 1099 stating that the funds changed accounts. Again, this is not taxable income. The tax form is for information purposes and includes a code that identifies it to the IRS as non-taxable.

A much less popular option is to cash out your 401k. This comes with massive penalties, income tax, and an additional 10% withholding fee. Keep reading for details on those penalties.

You May Like: Can I Roll My 401k To A Roth Ira

Leaving Work With An Unpaid Loan

Suppose you take a plan loan and then lose your job. You will have to repay the loan in full. If you don’t, the full unpaid loan balance will be considered a taxable distribution, and you could also face a 10% federal tax penalty on the unpaid balance if you are under age 59½. While this scenario is an accurate description of tax law, it doesn’t always reflect reality.

At retirement or separation from employment, many people often choose to take part of their 401 money as a taxable distribution, especially if they are cash-strapped. Having an unpaid loan balance has similar tax consequences to making this choice. Most plans do not require plan distributions at retirement or separation from service.

People who want to avoid negative tax consequences can tap other sources to repay their 401 loans before taking a distribution. If they do so, the full plan balance can qualify for a tax-advantaged transfer or rollover. If an unpaid loan balance is included in the participant’s taxable income and the loan is subsequently repaid, the 10% penalty does not apply.

The more serious problem is to take 401 loans while working without having the intent or ability to repay them on schedule. In this case, the unpaid loan balance is treated similarly to a hardship withdrawal, with negative tax consequences and perhaps also an unfavorable impact on plan participation rights.

You Can Get Around The 401 Restrictions

Not to get too complicated, but there are also exceptions to some of the above restrictions that let you withdraw your 401 money penalty-free. For example, if youre buying a house or a couple of other things, you can withdraw money penalty-free. But for all intents and purposes, this is money youre putting away for 30 years.

Also Check: Can You Roll Your 401k Into A Roth Ira

Similar Employer Sponsored Retirement Plans

If you are employed by a public school, state college, religious organization, non-profit or another tax-exempt organization, you may be allowed to participate in a 403 plan. If you are a state or local government employee , you may be eligible to participate in a 457 plan.

These types of plans are generally similar to a 401 in terms of contribution limits and investment opportunities.

Understanding Your 401 A Beginners Guide

A 401 is a type of retirement account. If you work for a company, chances are you already have a 401 offered to you.

Heres how a 401 works: You put pre-tax money into the account, meaning you havent paid taxes on it yet.

Lets look at why thats important. In regular, taxable investing accounts, you pay taxes on your income and then invest it. So for every $100 you make, you might actually only be able to invest $85 of it. 15% goes to the tax man.

A 401 is different. You can invest the entire $100 and let it grow for about 30 years until retirement. That extra ~15% turns out to make a huge difference as it gets compounded more and more.

Recommended Reading: What Happens To Your 401k When You Quit Your Job

What Is A 401 And How Does It Work

A 401k is a tax-advantaged retirement savings account that an employer sponsors. Employees can choose to have a certain percentage of their paycheck deposited into their 401k account, and the money is then invested in various securities, including stocks, bonds, and mutual funds.

If you are an employee, you may be able to contribute to a 401 plan through payroll deductions. The money is deducted from your paycheck before taxes are taken out, so you end up paying less in taxes.

For example, if you earn $50,000 per year and contribute $5000 to your 401, your taxable income would be $45,000. The contribution limit for 401 plans is $18,500 per year , and you can usually start withdrawing the money when you reach age 59½.

Do I Qualify For 401 Employer Match

Your eligibility for employer 401 matching depends entirely on your employer. Not all employers offer a match program. According to statistics from the Bureau of Labor Statistics in 2015 around 51% of companies with a 401 offer some sort of match.

Its important not to assume your employer has automatically enrolled you for contribution matches. Be sure to ask when your matches will take effect. If youre unsure whether your employer offers a match program at all, dont be afraid to ask your boss or human resources representative about the company policy. Be sure to ask about the guaranteed match amount and what the match limits are.

Some firms may also have a vesting period for their contributions. This means that while the company may match 5% of your contributions, those contributions arent permanently yours until youve been at the company for a predetermined amount of time. If you leave before that time is up, you lose that money from your account.

Vesting schedules vary. Some companies have no vesting period, meaning all matching contributions are yours right away. Others have a vesting cliff at which point all of your matching contributions become permanently yours. Others have a schedule where a certain amount of your vested matches say 20% become permanently yours each year.

Read Also: How Do You Roll A 401k Into Another

Indexed Universal Life Insurance

Indexed universal life insurance is a type of permanent life insurance that can also be used for retirement savings. With indexed universal life insurance, you contribute to the policy over time. The money in the policy then grows based on the performance of an index, such as the S& P 500. In addition, you can take tax-free withdrawals from the policy starting at age 59½, and the death benefit is paid to your beneficiaries tax-free.

Many types of retirement savings plans are available, so be sure to do your research to find the best one for you. A 401 plan is an excellent option for many people, but other options are available if a 401 doesnt fit your needs. Be sure to talk to a financial advisor to get more information about your retirement savings options.

Summary Of 401 Advantages: There Are A Lot

Weve covered the advantages of a 401 account: You get to put pre-tax money to work . Your company might offer an insanely lucrative 401 match, which you must take. And its not that hard to set upyour company does most of the work. In fact, you can instruct them to automatically withdraw a certain amount from every paycheck. Dont worry about switching jobs if you leave your company later, you can take your 401 with you. And be aggressive with how much you contribute to your 401 because every dollar you invest now is worth many more times that in the future.

Image from firsthandfunds.com

Recommended Reading: Which Is Better 401k Or Ira

How Does The Public Employee Pension System Work In Maryland

The good news is, as a Maryland state employee, you have access to your pension as well, on top of your social security benefits.

That means that full-time and part-time employees in Maryland, working a minimum of 500 hours per year, participate in the Maryland State Retirement and Pension System. It requires a mandatory contribution of your income for all employees enrolled. Your specific city, county, or state will then contribute an additional amount, depending on your specific pension program.

You are fully vested, meaning you will receive full retirement benefits, calculated based on your weekly hours and your time spent working for the state after you have been employed full time by the State of Maryland for at least 10 years of service.

You can also retire early, at the age of 60, after 15 years of service, and receive your full pension.

It might be a good idea to wait until 65, however, as you will be contributing more to both your pension and your social security, which means you can collect more, for longer.

About The Authortrue Tamplin Bsc Cepf

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website, view his author profile on , or check out his speaker profile on the CFA Institute website.

You May Like: How Do I Get 401k Money Out

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½. With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions .

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Recommended Reading: How To Choose Fidelity 401k Investments

Transfer Your 401 To An Ira

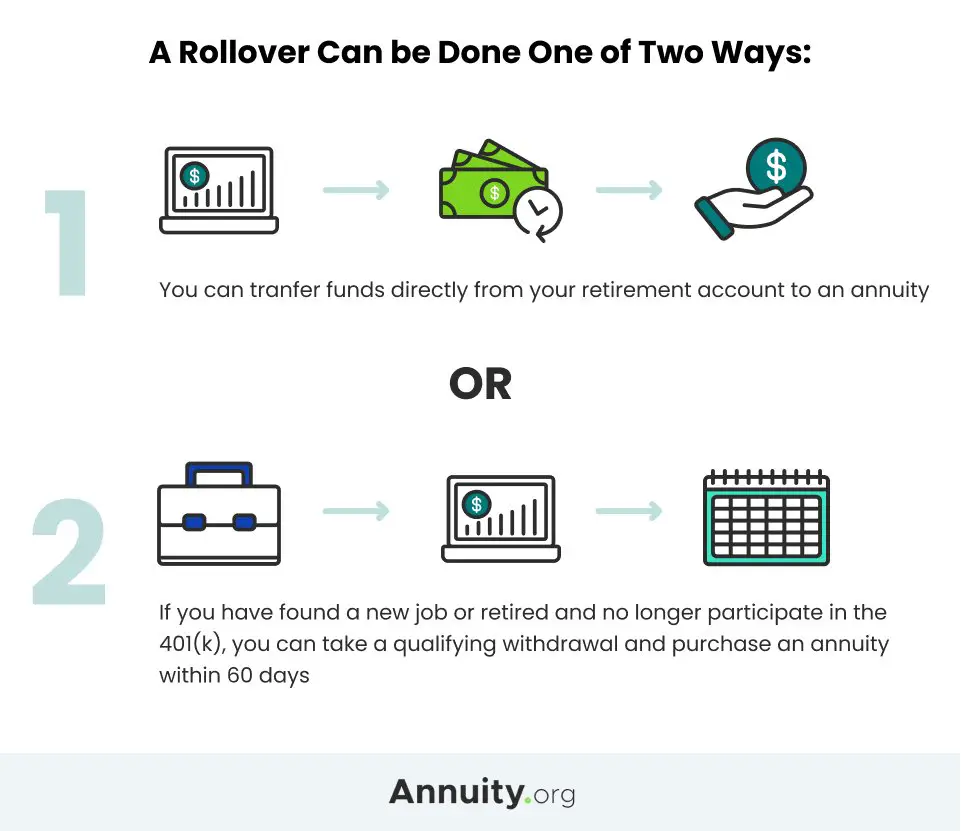

After you retire, you may transfer the money in your 401 to another qualified retirement plan, such as an individual retirement account . This may be a good idea if you’re looking for more investment options. To transfer your 401 to an IRA, you can request either a direct rollover or a 60-day rollover.

- Direct Rollover: You can request that your employer transfer your 401 assets directly to the investment company that manages your IRA. A direct rollover is a tax- and penalty-free transfer.

- 60-day Rollover: If a distribution from your 401 is paid directly to you, you have 60 days to deposit all or a portion of it into your IRA. Taxes are withheld from the distribution, which means you’ll have to come up with additional money to roll over the full amount of the distribution.

MORE When Could a 401 Rollover to IRA Make Sense?

Matching Contributions And Vesting

Some employers grant 401 matching contributions that vest over time. Under a vesting schedule, you gradually take ownership of your employers matching contributions over the course of several years. If you remain with the company for the entire vesting period, you are said to be fully vested in your 401 account.

Employers impose a vesting schedule to incentivize employees to remain with the company.

For example, imagine that 50% of your employers matching contributions vest after youve worked for the company for two years, and you become fully vested after three years. If you were to leave the company and take a new job after two years, you would pass up owning half of the matching contributions pledged by your employer.

Keep in mind, however, that you always maintain full ownership of contributions you have made to your 401. Vesting only involves the employers matching contributions.

Don’t Miss: How To Figure Out Employer Match 401k

What To Do About Your Retirement Accounts Today

I want you to spend the weekend getting educated about 401s and Roth IRAs. On Monday, I want you to open up your retirement accounts and start funding them. Call your HR department and get your 401 squared away. Call a few discount-brokerage firms to get a Roth account, too. Dont worry about where to invest your money just yet. Take it one step at a time and just open your accounts.

Oh yeah, and one more thing: I already anticipate 1 billion comments debating fiscal policy, the effectiveness of Roth IRAs vs. 401 vs. Keogh plans vs. SEP IRAs vs. Simple IRAs, and other crap. Please dont waste your time on this minutiae. The problem is not debating the tiny details. The problem is that most people dont have retirement accounts. The problem is that most people dont fund it as regularly as they should, even though $100/month makes a big difference. And the problem is that most people dont open retirement accounts early enough.

So let the fools debate. For you, just get your accounts open.

Rules Of A : Contributions And Limits

The IRS regulations that govern 401 plans also specify how much an individual can contribute to a plan per year. These restrictions are designed to prevent abuse of these plans by highly compensated employees and encourage early retirement planning. These contribution limits are adjusted periodically for inflation, and updated numbers are published on the IRS website.

- $14,000 per year in elective deferrals for a SIMPLE 401

- $20,500 per year in elective deferrals for traditional 401 and safe harbor plans

- $3,000 per year in catch-up contributions for a SIMPLE 401 if the employee contributing to the plan is age 50 or older

- $6,500 per year in catch-up contributions for traditional 401 and safe harbor plans if the employee contributing to the plan is age 50 or older

- $61,000 per year in total contributions

- $67,500 per year in total contributions for employees age 50 and older

Employers can elect to match employee contributions as an additional employee benefit, but this is not required, and any employer match is subject to the total contribution limits listed above.

Read Also: Can I Roll A 401k Into A Traditional Ira

Matching Average And Contribution Limits

On average, companies that offer matching will match up to around 3% of an individual employees pay.

Regardless of your employers match, however, you should still do your best to contribute some of your pay to your 401. Not only will that lower your tax liability, it will give you a source of income once you hit retirement. Experts recommend saving between 10% and 20% of your gross salary toward retirement. The total amount can be split between your 401 and other retirement accounts you may have, or you might keep all of that in your 401. Be sure to keep yourself on track throughout the work years, checking whether youre meeting your age groups average 401 contribution numbers or not.

Also always keep in mind that the IRS does put limits on how much you can contribute to your 401 each year. For 2022, youre allowed to contribute a maximum of $20,500, up from the 2021 limit of $19,500. If youre 50 or older, you can contribute an additional $6,000 a year. However, your employers match does not count toward that 401 limit. The combination of contributions from all sources can reach up to $64,500 for 2021 and $67,500 for 2022.