Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

How To Roll Over Your 401 To An Ira

There are many reasons why you may have decided to make a 401-to-IRA rollover. You may have left your job for a position at a new company, you may have been laid off or you may have decided to take your career in a new direction. Regardless, if youve been contributing diligently to your employer-sponsored retirement plan for a number of years, you could have a decent stash of cash in your account. If you want help managing your retirement accounts after your rollover, consider working with a financial advisor.

Don’t Miss: How Can I Get My 401k Out

Convert/move The Solo Voluntary After

While the required IRS reporting is the same whether you used a bank vs a brokerage account to hold the voluntary after-tax solo 401k funds, the conversion/movement of the funds varies by financial institution.

Bank Account:

You will work with your bank in moving/converting the funds from the Voluntary after-tax solo 401k bank account to the Roth IRA account.

Brokerage Account:

You will work with the brokerage in moving/converting the funds from the Voluntary after-tax solo 401k brokerage account to the Roth IRA account.

Fidelity:

Schwab:

Keeping Your 401 With A Former Employer

If your ex-employer allows it, you can leave your 401 money where it is. Reasons to do this include good investment options and reasonable fees with your former employers plan. Keep in mind that you may not be able to ask the plan administrator any questions, you may pay higher 401 fees as an ex-employee, and you cant make additional contributions.

Another noteworthy thing to consider is that your former employer could decide to move your old 401 account to another provider. If your balance is between $1,000 and $5,000 and your former employer wants to close your old 401 account, your former employer can, but it is required to transfer the balance to an IRA in your name and notify you in writing. For balances under $1,000, your former employer can send you a check, which you’d need to put in a retirement account within 60 days to avoid taxes and penalties.

Don’t Miss: How Much Do Companies Match 401k

How Do I Initiate A Transfer Into A Roth Ira

When Not To Transfer To An Ira

You now know some of the benefits of moving your 401 to an IRA. But control over your money isnt the only thing that matters, and you may have other priorities. Its impossible to list every potential pitfall, but here are just a few examples of when I suggest that clients might want to leave funds with their employer.

Between age 55 and 59.5

When youre at least 55 years oldbut not yet 59 1/2 years oldyou might want to leave at least some of your money in the 401 plan. 401s allow you to pull money out without penalty after age 55 . IRAs, on the other hand, require that you wait until age 59 ½ to avoid an early-withdrawal penalty of 10% on certain distributions. There are always exceptions and workarounds, but those are the basic rules. If you intend to spend your 401 savings between the ages of 55 and 59 1/2, keep this in mind before making a transfer.

Some Government Workers

If you worked for a federal, state, or local government, be sure to explore your options. Those with 457 plans can potentially avoid the early-withdrawal penalty thats commonly associated with 401 and similar plans. Plus, some public safety workers can avoid early withdrawal penalties from a retirement planincluding the TSPas early as age 50.

Roth Conversions

RMD While Working

Stable Value Offerings

Fees and Expenses

NUA Opportunities

Read Also: Where Can I Find My Fidelity 401k Account Number

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Is It Better To Roll Over A 401 To An Ira

If you like your former employers 401 plan the investment options and the expense ratios on the investments then it wont necessarily be better to roll it over into an IRA. But you may find that if you roll your 401 into an IRA, you may have more investment options. Compare expense ratios and fees to see which option is best for you.

Kaleb Paddock, a certified financial planner at Ten Talents Financial Planning in Parker, Colorado, says a typical 401 plan only has approximately 20 to 40 mutual funds available. But an IRA could give you access to thousands of exchange-traded funds and mutual funds as well as individual stocks.

Another reason might be, if you want to invest in socially responsible funds or funds that invest according to a certain set of values, those funds may not be available in your 401 or your prior employer 401, Paddock says.

But by rolling it over to one of these large custodians, youll likely be able to access funds that may be socially responsible or fit your values in some fashion and give you more options that way, he says.

Plus, rolling over your 401 to an IRA may result in you earning a brokerage account bonus, depending on the rules and restrictions that the brokerage has in place.

Don’t Miss: How To Use 401k For Investment Property

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you donât have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: Thereâs a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: Thereâs a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Can I Roll My 401 Into A Roth Ira Without Penalty

You May Like: Can I Open A Roth 401k On My Own

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

You May Like: How To Rollover Voya 401k

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

Read Also: Is It Good To Have A 401k

How To Roll A 401 Into An Ira

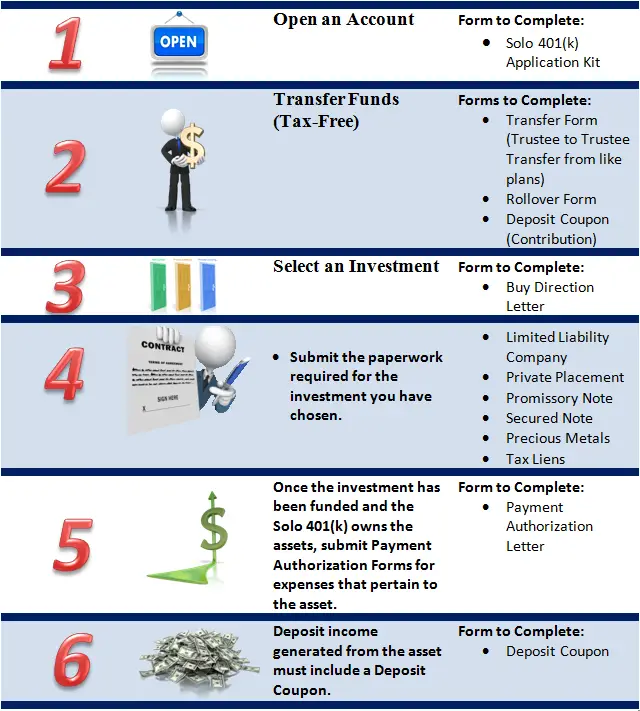

Here’s how to start and finish a 401 to IRA rollover in three steps.

1. Choose which type of IRA account to open

An IRA may offer you more investment options and lower fees than your old 401 had.

2. Open your new IRA account

You generally have two options for where to get an IRA: a robo-advisor or an online broker.

-

If you’re not interested in picking individual investments, a robo-advisor might be a good option. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, usually for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments, and has a reputation for good customer service.

» Ready to get started? Explore our picks for best IRA accounts

3. Ask your 401 plan for a direct rollover

Here are the basic instructions for a direct rollover:

Contact your former employers plan administrator, ask for a direct rollover, complete a few forms, and ask for a check or wire of your account balance to be sent to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include, and where it should be sent.