If You Find The Money

What to do with your 401 funds when you find the account largely depends on where you find it.

If the account resides in your employer’s plan, you do have the option to leave the money and the account there — just note you can no longer contribute money to it.

To get back in the game with your sidelined 401, roll it over into an individual retirement account or a current employer’s 401 plan. That way you can put the fund money to work by investing in stocks, bonds and funds that appreciate in value and accumulate more money for your retirement, on a tax-efficient basis.

Roll It Over Into Your Current Employer’s 401

Another option is rolling the old 401 into your current employer’s 401. This can make it easier to keep track of your retirement accounts and might open up broader investment choices. But be sure you’re aware of how your current employer’s 401 works before transferring money from your old 401 into it.

Options For Cashing Out A 401 After Leaving A Job

The amount in your 401 account, including your contribution, your employers contribution, and any earnings on your investments, belongs to you and can supplement your retirement fund. The huge amount of money accumulated in your 401 account may tempt you to cash out your plan, but its in your best interest not to do so.

Leaving your account with your old employer may not a good idea. There are chances that you may forget the account after some time. You can, instead rollover to your new employer or even set up an IRA to roll 401 funds into.

Rolling over your 401 to an IRA gives you the flexibility to invest your funds the way you want. However, in some states like California, your creditors have easier access to your IRA funds than the money kept in a 401 account. If you see any potential claim or lawsuit against you, you may want to let your funds lie in a 401 account rather than transferring into an IRA.

Alternatively, if you are eligible for the 401 plan of your new employer, you may want to roll over your old 401 to your new account. No matter where you invest, always consider minimizing the risk by diversifying your portfolio. You may never want to invest a large portion of your savings in a single company, no matter how much you trust it.

Dont Miss: How To Convert 401k To A Roth Ira

Read Also: How To Roll Over 401k To Self Directed Ira

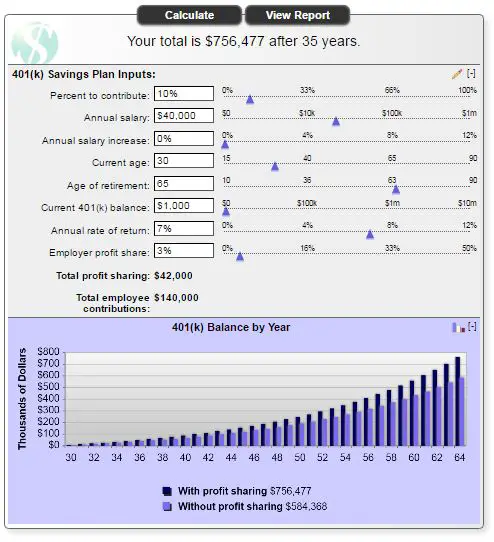

Choosing Investments In Your 401

You will usually have several investment options in your 401 plan. The plan administrator provides participants with a selection of different mutual funds, index funds and sometimes even exchange traded funds to choose from.

You get to decide how much of your 401 balance to invest in different funds. You could opt to invest 70 percent of your contributions in an equity index fund, 20 percent in a bond index fund and 10 percent in a money market mutual fund, for example.

Plans that automatically enroll workers almost always invest their contributions in what is known as a target-date fund. Thats a fund that holds a mix of stocks and bonds, with the mix determined by your current age and your target date for retirement. Generally, the younger you are, the higher the percentage of stocks. Even if you are automatically enrolled in a target-date fund, you are always free to change your investments.

Investing options available in 401 plans vary widely. You should consider consulting with a financial adviser to help you figure out the best investing strategy for you, based on your risk tolerance and long-term goals.

Contact Your Former Employer’s Hr Department

Another way to locate an old 401 is to contact your former employer’s HR department. The department should be able to tell you the name of the plan administrator along with the contact information.

If that ends up reuniting you with the old 401, you can leave the account with your former employer, roll it over into an individual retirement account , roll it over into your current employer’s 401 or cash out the account.

So, what if your former employer is no longer in business or you aren’t able to track them down? The money should be somewhere. You just need to hunt for it. One place to look is the federal government’s Abandoned Plan database.

Recommended Reading: How Do I Find If I Have A 401k

Checking With The Department Of Labor

Different types of retirement plans, including 401 plans, are required to keep certain information on file with the IRS and the Department of Labor . One key piece of information is DOL Form 5500. This form is used to collect data for employee benefit plans that are subject to federal ERISA guidelines.

So how does that help me find my 401? The Department of Labor offers a Form 5500 search tool online that you can use to locate lost 401 plans. You can search by plan name or plan sponsor. If you know either one, you can look up the plans Form 5500, which should include contact information. From there, you can reach out to the plan sponsor to track down your lost 401.

The Cons Of Leaving Your 401 Behind

Risk of Losing Track of Old 401s

Rolling over an old 401 or managing your savings during a job transition can be stressful and chaotic. Some people end up leaving behind an old account with the intention to revisit it later, only to forget about it or lose track of it as they are faced with other aspects of their job transition. This will make it difficult to put your savings to good use in a way that promotes your financial stability in the future.

As of now, if you have less than $5,000 in any old accounts, your previous employers will likely either cut you a check for the remaining balance or move the money into an IRA. Its up to you to find it, though.

Missing Out on Investment Opportunities

Do you know when you forget your old 401 accounts, you miss out on a chance for a solid investment plan? You were wise enough to set up a retirement plan to secure your financial freedom for the future. But, when you leave behind any amount of savings, it leads to loss of earning capacity.

Leaving behind money in an old retirement account also means that your savings dollars may not be invested in the most beneficial way possible for you. Staying on top of old accounts or rolling them over into your current plan can help you ensure you are investing every dollar with purpose, efficiency and your unique goals in mind.

Don’t Miss: How Soon Can I Borrow From My 401k

Convert To A Roth Ira

If your old 401 is funded with pre-tax dollars, you may decide to convert it into a Roth IRA. You will pay income taxes on the conversion amount but can make tax-free withdrawals in retirement. Despite the upfront tax hit, this conversion doesnt count against your IRA contribution limits. In addition, youre no longer subject to required minimum distributions . There are two different ways to convert your 401.

Direct Roth IRA Conversion: Your Quickest Option

The easiest way is to see if your IRA provider can directly transfer your traditional 401 balance to your Roth IRA. If you dont want to convert the entire amount, see if your 401 administrator supports two direct transfers. If so, your second transfer rolls your remaining balance into a traditional rollover IRA. These funds wont incur a tax charge until you schedule a distribution or convert them into a Roth later.

Indirect Roth IRA Conversion: The Time-Consuming Way

If you cannot make two direct transfers, you must first rollover your 401 to a traditional IRA. Then, you must wait at least 60 days before requesting a Roth conversion for your desired balance.

Tip: You may decide to keep a traditional IRA if youre nearing retirement, as a Roth conversion resets the early withdrawal clock. Unfortunately, current tax rules require waiting five years before taking penalty-free withdrawals from your new account, even if youre at least 59 ½ years old.

What You Can Do Next

To keep track of your retirement accounts, you first must know where they all are. Once you gather all your old accounts in one place and make sure they are properly balanced, its about sticking to the same investment principlesensuring your money is in diversified, low-cost fundsthat you would follow for your current company retirement plan.

For Compliance Use Only:1020356-00003-00

Read Also: How To Find Out If Deceased Had 401k

How To Find Unclaimed Retirement Benefits

Many employers offer retirement benefits, and some will even match their employees contributions. However, most people leave employers several times throughout their careers. In leaving one job and taking on another, some employees forget to take their 401 or other retirement accounts with them. If theres a chance you have unclaimed retirement benefits but arent sure how to access them, heres how to find your unclaimed retirement benefits. Keep in mind that getting help from a financial advisor might save you a great deal of time in finding that money.

You May Like: Best Retirement Homes In California

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

You May Like: Can You Have An Individual 401k

Tracking Down A Lost 401

It’s easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps that’s why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 If left unattended for too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If you’re among those with misplaced savings, here’s how to locate and retrieve them:

Roll It Over Into An Ira

You also might choose to roll over the 401 into an IRA at a financial institution. This is known as a rollover IRA. Before picking a financial institution, be sure to look into the fees and other costs associated with the IRA.

One potential advantage of a rollover IRA is that you might gain access to a wider variety of investment options than the employer-sponsored account offered. Furthermore, you’re able to take money out of the IRA before age 59½ without being charged penalties if you’re covering college expenses or if you’re buying an eligible first-time home.

You May Like: What Can You Rollover A 401k Into

Rolling Over Your 401k

If you roll over your 401k, you can do it directly from your 401k plan to your new IRA account. This way no taxes are withheld. Set up an IRA with the financial institution of your choice, and its representative will help you contact the institution that manages your 401k plan to request a direct rollover. When you do the rollover, you can choose to have a percentage of the account distributed to you in the form of a check, but this part is subject to tax and penalties. You can also withdraw cash from your IRA after you roll over funds, but youll pay taxes and the 10 percent penalty until you reach the age of 59 and six months.

Also Check: How Do I Stop My 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

You May Like: How To Direct Transfer 401k To 403b

What Can You Do With Your Old 401 Account Once You Find It

Once you’ve located your 401 account from a former employer, you have a few choices about what you do with your money.

Roll it over into your current 401: Most 401 accounts can be “rolled over,” meaning that the funds in them can be transferred to another retirement account. If your current employer offers a 401 that allows rollovers, you can shift your funds from your old account to your new one and enjoy a nice bump in your balance.

Roll it over into an IRA: If your current employer doesn’t offer a 401 plan or doesn’t allow rollovers, you can transfer the money from your old 401 into an existing or new IRA.

Pro tip: If your old 401 provider wants to roll over your funds by sending you a paper check, make sure you communicate that you want a direct rollover with a check made out to your new 401 provider or IRA institution. If the check is made out to you personally, that could trigger a required 20% withholding for taxes and potential IRS penalty.

Cash it out: You can take the funds from your forgotten 401 and turn it into money you can spend now, but you’ll pay a big penalty. The IRS will tax your distribution and charge you 10% of your 401 balance for cashing out before age 59 and six months .

Leaving it with your old employer might be a reasonable decision if you don’t like your new company’s plan, but you’ll be left with the complications of managing multiple 401s instead of one.

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Also Check: How To Withdraw Funds From 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.