Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

When To Take A Penalty Free 401k Withdrawal

Penalty-Free 401K Withdrawal Rules. A penalty-free withdrawal allows you to withdraw money before age 59-1/2 without paying a 10% penalty. It does not, however, mean tax-free. You will still have to pay taxes at ordinary income-tax rates. You may qualify to take a penalty-free withdrawal if you take a distribution before age 59-1/2 and meet any

How is a 401k withdrawal different from a loan?

Being aware of the 401K withdrawal rules can save you from making costly mistakes. A 401K withdrawal is different from a 401K loan, which has its own set of rules and restrictions. There are four main types of 401K withdrawals: Here are the rules for each of these four kinds of 401K withdrawals:

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Read Also: Where To Move 401k Money

How Do I Get My 401k Statements

If you are a employee of a company with a 401k plan, you will likely receive a statement in your mail each year summarizing the companys financial position and plan results. This statement may also include a schedule of company income and expenses.

The statement is an important document because it gives you an overview of your companys financial situation and helps you plan for future years. It is also a good way to understand your companys overall financial performance.

If you do not receive a statement each year, you can contact your companys HR department to get a statement mailed to you.

Related Topics

Contact Your Old Employer

When you cant locate an old 401, your prior employer is the first entity you should contact. Reach out to human resources and they should be able to point you in the right direction.

Be prepared to provide the dates you worked for them, your full name and your Social Security number.

Note that if there was more than $5,000 in your 401, your funds are likely to still be in your old workplaces account. If your balance was $1,000 or less, however, its possible that your employer sent a check for the total amount to your last known address.

Recommended Reading: How Soon Can I Get My 401k After I Quit

How Do I Find My Unclaimed 401k Benefits

There are a few simple steps you can take in order to find out if you are owed any 401k benefits. First, you should check with your employer to see if they have any records of who has contributed to your account. If so, you can check to see how much money you have left in your account, and if any money has been taken from your account, you can file a claim with the IRS.If you have any questions or concerns about your 401k account, or if you feel like you may have been overpaid or misspelled contributions, you can reach out to our team of experts at accountancy firm, Grant Thornton LLP.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: How To Take A Loan On My 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How Long Will It Take For My Check To Come In The Mail

You are here: Check orders received before 1pm EST will be mailed the same day theyre submitted, Monday to Friday. Typical USPS priority delivery times are between 4-6 business days.

Can a 55 year old withdraw from a 401k plan?

Most 401 plans do not allow regular withdrawals at age 55 while you are still working for the company.

Don’t Miss: What Is A Good Investment Mix For 401k

How To Check My 401k

Do you want to learn how to check your 401k? If so, you have come to the right place! This weblog will discuss how to view your account balance, review your investment choices, and more. We will also offer tips on how to stay on top of your retirement savings. So whether you are just starting out or are nearing retirement, read on for helpful advice on checking your 401k!

What Happens To Money Left In An Old 401

If youve ever had a 401 account with an employer and lost track of it after youve left youre not alone.

We estimate that there are over 25 million orphaned 401 accounts just like yours. These are accounts tied to former employers that continue to have money in them, but are not actively being monitored or used.

At Capitalize, we help people find these old, orphaned 401 accounts and consolidate them into a new retirement account for free. This helps them better keep track of their retirement savings over time.

The money youve put away in a 401 account remains yours even after youve left that job. Most of the time its still at the same financial institution that managed it while you had it. This financial institution is known as a 401 provider. Its a company engaged by your former employer to hold and manage your 401 assets. You can see a full list of 401 providers here.

Some of the time, though, your money has been transferred to a new institution. That generally happens in one of three cases:

- Your former employer changes their 401 provider when this happens your 401 account will be transferred over to the new institution.

- Your former employer is acquired by another company when this happens your account usually gets transferred to the 401 provider used by the acquiring company.

- Your account balance was under $5,000 and was transferred to an IRA at a different institution this is known as a forced rollover and is allowed by some 401 plans.

Recommended Reading: How Do I Get 401k Money Out

Account Balance Vs Vested Balance

Why Is the Vested Balance Lower?

If your vested balance is lower than your account balance, you are not yet 100% vested in all balances. You may have matching funds or profit-sharing dollars in your account, but you have not met the service requirements to be fully vested. To get those numbers to match, you need to be 100% vested, which may require that you keep working at the same employer.

How Much Do I Get?

When you are not fully vested, you receive less than your full account balance. For example, if you quit your job and youre 40% vested, you would only get your vested balance as a rollover or cash-out payment. However, its crucial to verify your exact vesting percentage with your plans administratoras you read through statements and find information online, you might get inaccurate information .

How Do I Find Out If I Have Retirement Money

You can track down your pension at pbgc.gov/search-all. Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money.

How do I find out if I have any unclaimed money?

How to find

How do I find out if I have a retirement account?

The simplest and most direct way to check up on an old 401 plan is to contact the human resources department or the 401 administrator at the company where you used to work. Be prepared to state your dates of employment and Social Security number so that plan records can be checked.

How do I pull money out of my 401k?

Wait Until Youre 59½ By age 59½ , you will be eligible to begin withdrawing money from your 401 without having to pay a penalty tax. Youll simply need to contact your plan administrator or log into your account online and request a withdrawal.

What proof do I need for a 401k hardship withdrawal?

Documentation of the hardship application or request including your review and/or approval of the request. Financial information or documentation that substantiates the employees immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

Read Also: What Investment Is Better Than 401k

How To Check Your 401

First things first, how do you even check your 401 account online? Start by going to the website of your 401 provider. If youre not sure who your 401 provider is, go onto your employer intranet and it should be listed under a HR resources section. Once youre on their website, if you get stuck hit forgot username. If youve never set up an online profile this process will alert you to that pretty quickly. Itll take a couple of steps to get your username and password retrieved / set up. Once you have this bookmark the page and save your username / password either through a password manager or somewhere you can reference later.

How To Find Old 401 Accounts

E. NapoletanoEditorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Billions of dollars are left behind in forgotten 401 plans in the United States. Thats a massive amount of unclaimed property just waiting to be returned to its right fully owners. So if youre looking to find old 401 accounts, youve come to the right place. Well help you track them down in four different ways.

Read Also: Should You Roll Over Your 401k

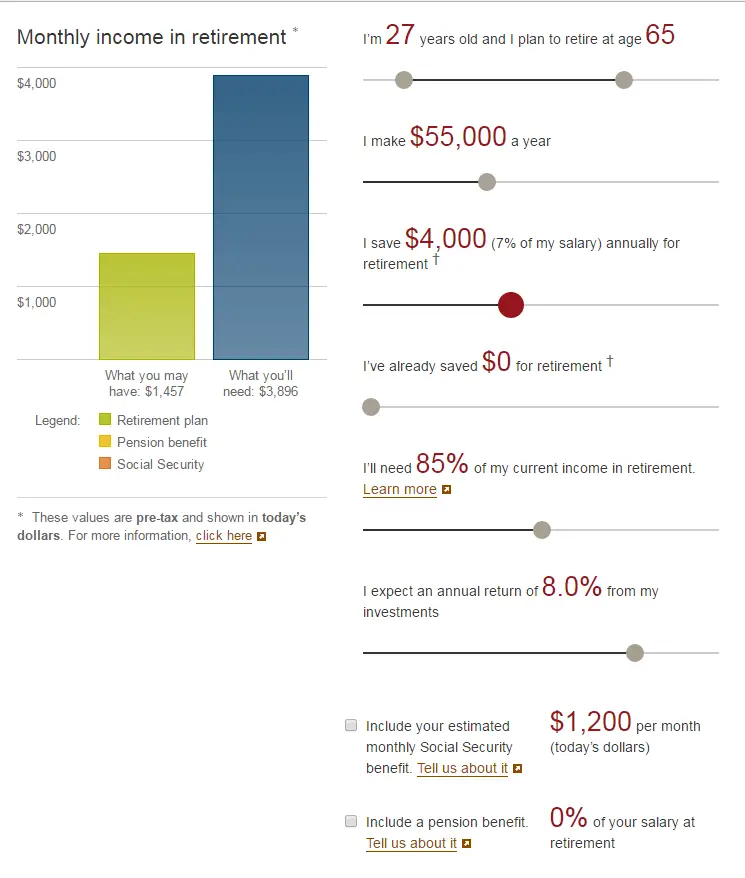

Check If Your Yearly 401 Contribution Goals Are On Track

In the summary tab online there should be a contribution box that tells you the percentage of youre salary youre contributing, your contributions this year and your employer contributions this year.

At minimum, always make sure you contribute enough to get your 401 employee match. This is free money that requires no additional effort. Additionally, consider contributing the maximum amount for tax benefits. Confirm if you are on track to get your company match. Are you halfway to your yearly contribution goals? If you want to contribute the maximum for tax benefits , have you contributed at least $9,500 this year?

If your 401 contribution goals arent on track identify what the gap is between where you are now and your yearly goal, how long it takes contribution changes to go through for your plan and how many paychecks will the new amount be withdrawn from. Then, figure out how much you need to increase your contribution per paycheck.

Transfer Funds To An Ira

Another way to protect your retirement funds is to transfer them into an individual retirement account . Like the process above, you can transfer funds from your 401 to an IRA via direct or indirect rollovers. If you dont already have an IRA, you can open one online or through the brokerage of your choice.

While 401s often offer higher permitted contributions and employer-matched contributions, IRAs typically offer more investment options.

Before opening a new account, check out our IRA guide to find out which type is best for you.

Don’t Miss: Can You Rollover A 401k Into A Simple Ira

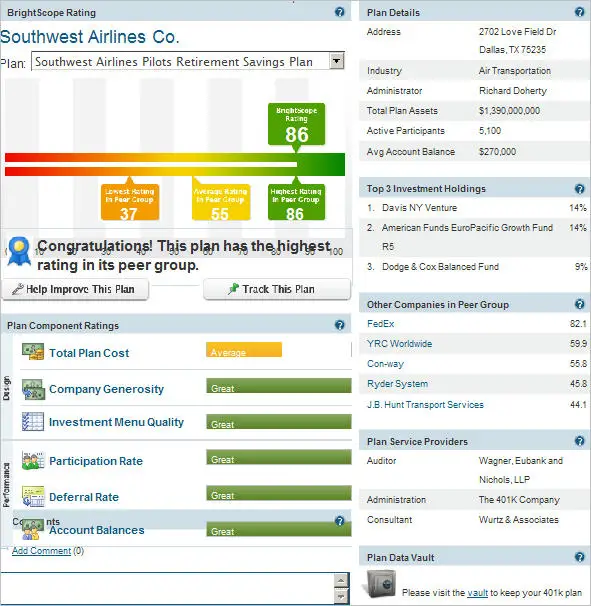

Are 401k Plan Documents Public

The Employee Benefits Security Administration makes available through its Public Disclosure Room certain employee benefit plan documents and other materials required by the Employee Retirement Income Security Act of 1974 .

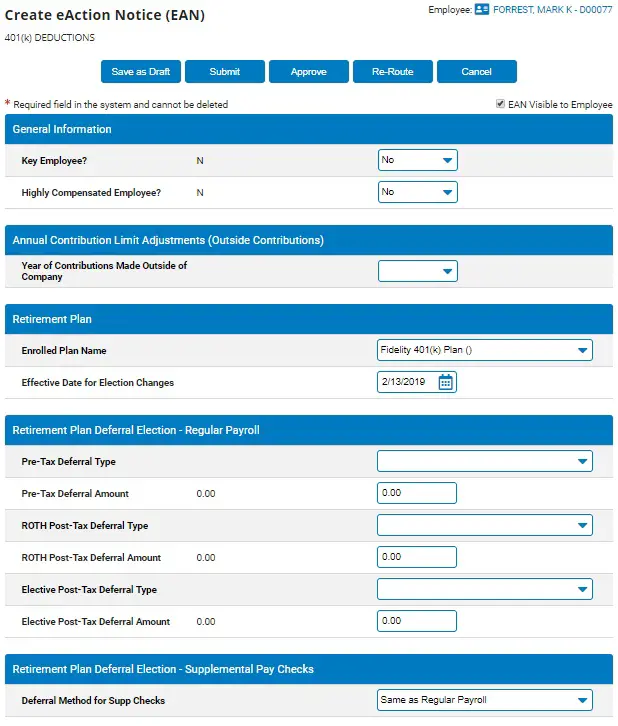

Where can I find my 401k statement?

Your 401k retirement plan statement is now available online! To view or print your statement, just log into www.principal.com/retirement/statements to view account information.

How To Request A Copy Of Plan Documents

State youre making the request under Internal Revenue Code Section 6104. Identify the name, address, Employer Identification Number of the organization and the plan number . Identify the documents youre requesting .

Where can I get a copy of my EP determination letter?

You can get a copy of your original determination letter for your retirement plan or request a correction to the letter by mail or fax. We dont accept telephone or email requests. Do not submit a copy of your original EP determination letter application with your request.

Read Also: Is An Ira Better Than 401k

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

You Have Four Main Options For An Old 401 Thats Tied To A Former Employer

At Capitalize we help our users move their legacy 401 account into an IRA. Dont worry if you dont already have one our online rollover process guides you through your different IRA options and helps you pick one thats right for you.

Read Also: Do You Pay Taxes On 401k Rollover To Roth Ira