What Is Pre Tax 401k

You fund 401s with pretax dollars, meaning your contributions are taken from your paycheck before taxes are deducted. That means that if you fund a 401, you lower the amount of income you have to pay taxes on, which can soften the blow to your take-home pay.

What is the difference between pre tax and Roth 401k?

- Traditional pre-tax 401k contributions are made without deductions for state and federal taxes. Contributions and earnings grow tax-free until they are withdrawn. At distribution, contributions and earnings are taxed at the individuals state and federal tax rates. Roth 401k contributions are after-tax contributions.

Taxes On Rolling Over A 401 Account

There are a few instances where you may want to transfer funds from an employers 401 into another account. The most common situation is when you leave an employer and want to transfer funds from your previous employer into your new employers 401, or into your own individual retirement account .

Whenever you withdraw money from a 401, you have 60 days to put the money into another tax-deferred retirement plan. If you transfer the money within 60 days, you will not have to pay any taxes or penalties on your withdrawals. You will need to say on your tax return that you made a transfer, but you wont pay anything. If you dont make the transfer within 60 days, the money you withdrew will add to your gross income and you will have to pay income tax on it. You will also pay any applicable penalties if you withdraw before age 59.5.

If you dont want to worry about missing the 60-day deadline, you can make a direct 401 rollover. This means the money goes directly from one custodian provider) to another without ever being in your hands.

Finally, note that if youre rolling over a 401 into a Roth IRA, youll need to pay the full income tax on the rolled-over amount. However, theres no 10% penalty for doing this before age 59.5.

How Is The 401 Contribution Deducted From My Paycheck

Your 401 contributions should be deducted automatically from your wages before you receive your paycheck. If the contributions aren’t being withheld from your paycheck in the amount you desire, reach out to your employer’s human resources department for information about how to update your contributions.

Recommended Reading: Can I Rollover Ira To 401k

What Is A Traditional 401

A traditional 401 is the original version of the plan and is usually referred to simply as a 401. This type of plan allows you to make contributions with pre-tax dollars so that you dont pay taxes on money you contribute. So your tax break comes today, rather than later.

In this 401, youll also enjoy deferred taxes on your investment gains. Your money is taxed only when it comes out of the account. That means you can avoid taxes on earnings, such as capital gains and dividends, until you withdraw them from the account at retirement.

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

Recommended Reading: How Much Do You Get Taxed On 401k

When The Roth 401 Is Better

Heres when the Roth is probably a better option:

Youre young and in a low tax bracket

I recommend making Roth contributions when someone is in a low bracket and expecting to later be in a higher tax bracket, says Mark Wilson, CFP and founder of MILE Wealth Management in Irvine, California. If you can pay taxes today at 12 percent to avoid paying taxes in the future at 25 percent, this is a good deal.

Wilson defines a low bracket as being taxed at the federal level of 12 percent or less. There are cases where Roths can make sense for folks in higher brackets as long as they are expecting even higher incomes in the future, says Wilson.

Youth is also a big advantage, allowing money to grow tax-free even longer.

The younger a person is, the more advantage a Roth can have for them, because they have a longer time for the money to grow, says Edward J. Snyder, CFP and founder of Oaktree Financial Advisors in Carmel, Indiana. The younger person is also more likely to be in a lower tax bracket than someone who is mid- to late-career.

You expect tax rates to rise

Even if you dont expect to earn more, you might expect tax rates across the country to increase, and such a rise could make the Roth 401 more attractive today.

Of course, theres always uncertainty in any projections, especially predicting the political winds.

You already have a traditional 401

RMDs can have an impact on the taxation of Social Security benefits and Medicare surcharges, says Greenman.

Can I Contribute To Both A 401 And A Roth 401

If you want to take advantage of the benefits of a traditional 401 and a Roth 401, you can do so. For example, you could make contributions for the first half of the year into the Roth version to take advantage of its tax-free withdrawals in retirement and use the second half of the year to get benefits from the traditional 401 plans tax breaks on contributions. Or you could alternate years, using the Roth plan one year and the traditional plan the next. Either way, your plans administrator will track and categorize your contributions appropriately for tax purposes.

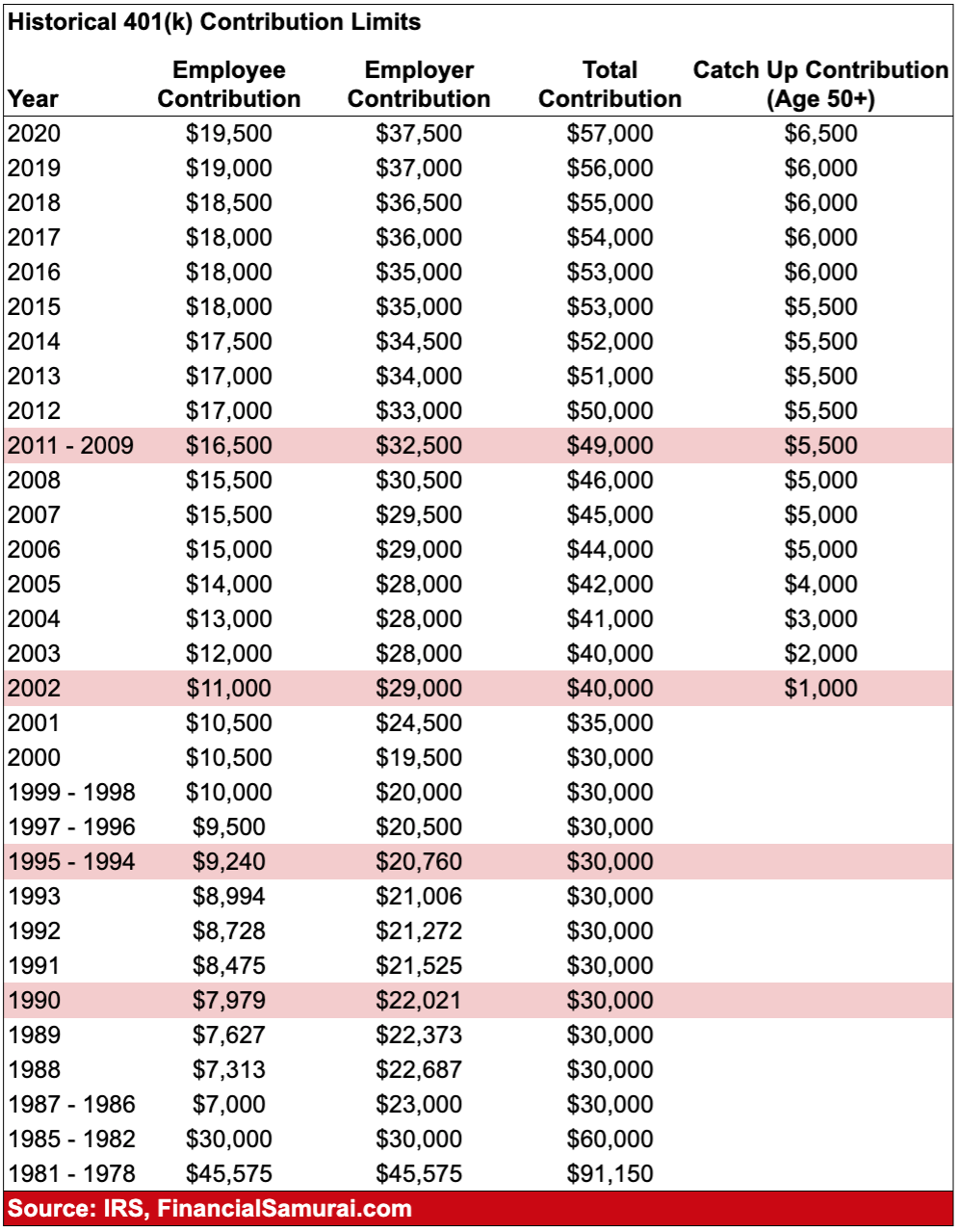

Regardless of which 401 plan you choose or if you choose both your total contributions in any single year are limited to the annual maximum That maximum does not include any employer match on your contributions, however. So the match counts as a bonus above and beyond your own personal contributions. With this employer contribution, the maximum you can put into the account is $61,000, or $67,500 for those 50 and over.

Read Also: Should I Buy An Annuity With My 401k

Roth 401 Vs : Which One Is Better

15 Min Read | Nov 1, 2022

Listen to this article

If youve read through your companys benefit package lately, you probably noticed a new option when it comes to saving for retirement: the Roth 401.

Just over the last five years, the number of plans offering a Roth 401 has skyrocketed. About 3 out of 4 workplace retirement plans now offer a Roth optionwhich is great news for you!1

Younger savers are starting to take advantage of this new option and the tax benefits that come with it. In fact, Gen Z is now the most likely group to put money in their Roth 401 at work.2

Were big fans of the Roth 401. In fact, in a showdown between a Roth 401 versus a traditional 401, wed go with Roth every single time! But lets dig into the differences between these options so you can make the best decision.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Here are some of the key differences:

Also Check: Can You Have A Roth 401k And A Roth Ira

Comparing 2022 And 2023 Limits

The chart below provides a breakdown of how the rules and limits for defined-contribution plans , 403, and most 457 plans are changing for 2023 vs. 2022.

| Defined Contribution Plan Limits | |

|---|---|

| $150,000 | +$15,000 |

* The catch-up contribution limit for participants age 50 or older is available to those turning 50 at any time during the year. For instance, if you were born on New Year’s Eve, it applies.

Are 401 K Contributions Pre Tax

This day and age, conscientious use of 401 s and other retirement accounts is essential if you want the retirement of your dreams, but why is this the case? Do they offer some sort of notable benefit over a typical savings account?

Well, the obvious advantage of using this sort of retirement account is that your employer is obliged to add to them in tandem with you, essentially offering you free money, but this isnt the only reason these accounts are so critical.

Could another be that 401 contributions are amassed, pre tax? Well, thats exactly what Im going to be discussing with you today! Lets dive right in.

Contents

Read Also: Who Is Eligible For Solo 401k

Why Is A Pre Tax Account Helpful

Okay, so weve established that a pre tax account means the money within will not be taxed until withdrawn, but whats the point? If its going to be taxed eventually, why delay the inevitable?

Well, every year that money accumulates without being taxed, youre saving a significant sum of money Its completely untouchable for your entire working life.

Yes, youll be taxed on the full amount once withdrawn, but by then youve likely enjoyed 40+ tax-free years.

The same temporary tax exemption applies to any form of contribution to the account.

For example, the building interest, capital gains, and dividends will also be free from tax until the day you withdraw the funds, but this is just the tip of the 401 iceberg!

For each pre-tax dollar that you funnel into your 401 , your taxable income is reduced in kind, and even though this means your liquid income also goes down, it decreases by a lesser degree, leading to some substantial gains over the years.

Put Contributions Into A Roth

You may be able to put your after-tax contributions into a designated Roth account to ensure tax-free withdrawals during retirement. That is, as long as you wait until age 59½ to withdraw, and you make your first contribution at least five years before then.

There are two ways you can roll after-tax contribution dollars into a Roth account:

-

In-plan conversion: If your job offers an in-plan conversion, you can convert all or some of your 401 into a Roth. You have to pay taxes on the amount you convert, but like with a Roth IRA, your withdrawals in the future would be tax-free. Some plans have an auto-convert feature that automatically converts your after-tax contributions into your Roth.

-

In-service withdrawal: If your employer offers in-service distributions or withdrawals, you can do a mega backdoor Roth. This is when you roll after-tax contributions into a Roth IRA outside of your retirement plan.

If your employer doesnt offer in-plan conversions or in-service distributions on your 401 plan, you might consider asking what your options are for withdrawing money and putting it into an IRA. Make sure to ask about the rules associated with withdrawing money from your 401 and any potential penalties.

Don’t Miss: How To Take Money Out Of My Fidelity 401k

So Which Account Should I Contribute To

If you think you are in a low tax bracket compared to your future tax bracket, then a Roth 401 might make more sense because you are paying a low tax rate on your money today. Then in retirement, you will not pay any taxes on withdrawals.

When we retire, we have to live off of our retirement accounts and Social Security. Both pre-tax 401/IRA withdrawals and Social Security are included in your taxable income during retirement. If your taxable income in retirement is significantly less than your current income, you may benefit more from a pre-tax 401.

Ideally, you will save enough to maintain the same standard of living as you have when you are working. In that case, your tax rate may stay in the same bracket. This may result in no significant benefit for you regarding either 401 account type.

There is no single correct answer for everyone. The determination is based on many unknowns like your future career earnings, how future tax rates change, how long you live in retirement, how much income you need in retirement, and many others. All of these factors will change over your lifetime. A Roth 401 may be more ideal today but in a decade the pre-tax 401 may be better.

This post cannot tell you the correct choice based on your unique life. It is written to give you the information and the considerations you need to make a more informed decision.

The future is uncertain so you will not know if you made the right decision until much later in life.

Taxes For Making An Early Withdrawal From A 401

The minimum age when you can withdraw money from a 401 is 59.5. Withdrawing money before that age results in a penalty worth 10% of the amount you withdraw. This is in addition to the federal and state income taxes you pay on this withdrawal.

There are exceptions to this early withdrawal penalty, though.

If you want to remove money from a 401 account without paying taxes, you will need to meet certain criteria. According to the IRS, you generally dont have to pay income tax or an early withdrawal penalty if you experience an immediate and heavy financial need. One situation where this may apply is when you have medical expenses that arent reimbursed by your insurance and which exceed 7.5% of your modified adjusted gross income . If this happens, you dont have to pay taxes on the money you withdraw to cover that financial need. There are also other exceptions, such as for disabled taxpayers. The IRS provides a more complete list of situations where you wont pay tax on early withdrawals.

The big caveat here is that the amount you can withdraw tax-free is exactly enough to cover the cost of this financial need. And youll still pay the full income tax on your withdrawal only the 10% penalty is waived.

Also Check: Can You Transfer Funds From One 401k To Another

Understand The Value Of An Employer Match

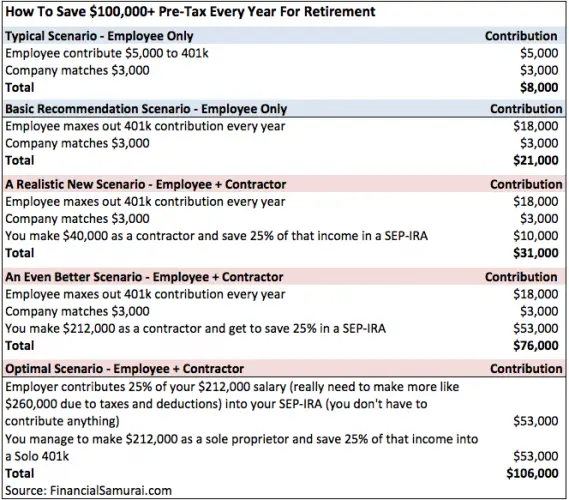

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Let’s assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, let’s assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now let’s assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employee’s salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: it’s a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. That’s because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Roth Vs Traditional 401which Is Better

Please note: This article may contain outdated information about RMDs and retirement accounts due to the SECURE Act 2.0, a law governing retirement savings from their retirement account will change from 72 to 73 beginning January 1, 2023). For more information about the SECURE Act 2.0, please read this article or speak with your financial consultant.

Please note: This article may contain outdated information about RMDs and retirement accounts due to the SECURE Act 2.0, a law governing retirement savings from their retirement account will change from 72 to 73 beginning January 1, 2023). For more information about the SECURE Act 2.0, please read this article or speak with your financial consultant.

Don’t Miss: What Percentage Of Paycheck Should Go To 401k