Alternatives To Borrowing From Your 401

Most experts agree that borrowing from your future self should be a last resort. If you find yourself in a bind, consider these alternatives:

Tap into your emergency fund. If you have an emergency fund built, tapping into those savings may be a better long-term strategy than taking on more debt and paying steep interest charges over time. As long as you make a plan for how youll replace the money so that your emergency fund can cover any unexpected expenses down the line.

See if you can use your home equity to your advantage. A home-equity loan allows you to borrow against the market value of your house and receive a lump-sum payment in return. These loans charge higher interest rates than traditional mortgage loans, but lower rates than other types of debt like credit cards. The catch: a home equity loan puts your home at risk if you fail to repay your loan, so this option should be explored cautiously.

Consider a 0% APR credit card. Dont let high APRs steer you away from getting a new credit card. Some credit cards offer interest-free introductory periods. Depending on how much you need to borrow, you could benefit from this kind of offer and repay the amount you owe before interest on your balance accrues.

If you are going to borrow from your 401, its crucial that you have a clear goal for that money and a clear plan for how youll replenish those funds and cover the cost of any penalties or taxes imposed on the amount borrowed.

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars, unlike contributions, which are made before taxes.

Why Choose A Plan

There are many options for setting up a Solo 401K account, but Vanguard offers a great option for side hustlers and those that own their own business.

Vanguard doesnt charge a setup fee for the account, but they do have some limitations. For example, you cant take a loan on your money, no matter the balance. The only way you could access your funds early is with a hardship withdrawal before the age of 59 ½, but you must qualify for it. This is also consistent with an owner-only plan.

Vanguard does charge some trading fees, but they are minimal and some are avoidable. Most commonly, investors pay a $20 per fund annual fee. If you have several funds, youll pay the fee for every fund you have, which can take away from your profits, so keep that in mind when choosing your investments.

Don’t Miss: How Do I Find Out Who My 401k Is With

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companyâs 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employerâs 401 plan.

Fidelity And/or Vanguard To Tiaa

Transfer funds from Fidelity and/or Vanguard fund into a TIAA fund

Read Also: How Much Money Do I Have In My 401k

Is It Better To Take A Lump Sum Pension Or Monthly Payments

If you take a lump sum available to about a quarter of private-industry employees covered by a pension you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.

How To Roll Over A 401

Perhaps youâve left your job but still have a 401 or Roth 401 with your former employer youâre retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employerâs plan, cash out your 401, initiate a 401 rollover into a new employerâs plan, or rollover into an IRA .

You May Like: Should I Transfer 401k From Previous Employer

What Is A 401 Loan

A 401 loan is a loan you take out from your own 401 account. They work like normal loansâyou pay origination fees and interestâonly youâre borrowing money from yourself. According to Vanguard, 78% of 401 plans permit participants to take out 401 loans, and about 13% of plan participants have an outstanding 401 loan.

If you need money, you might consider taking a loan from your 401 if:

⢠You want a lower interest rate. 401 loans still charge interest. But the amount you pay may be less than on a loan you take out with someone else. 401 loan interest rates are based on the prime rate, an interest rate adapted from Federal Reserve loaning guidelines. 401 loans will normally be a percentage point or two above this rate, which may be lower than the rate you could get at a bank.

⢠Youâd prefer to pay interest to yourself. No one likes paying banks and credit card companies interest. While youâre still on the hook for interest payments with a 401 loan, you get to pay it back to yourself instead of someone else.

⢠You want looser credit requirements. If your credit score prevents you from getting the best rates on loans, you may opt for a 401 loan. Depending on your employer, you may not even need a credit check to borrow from your 401.

You might want to avoid a 401 loan if:

How Do I Close Out A 401k Account

Closing a 401 account can take a significant bite out of the balance.

If you leave an employer where you have a 401 plan, you might want to close out that 401 account. Sometimes you can let the money stay in that old 401, but people often want to completely cut their ties with the company and consolidate financial accounts for easier record keeping. You can reduce your liability for taxes and penalties by rolling these accounts into new tax-deferred accounts.

Read Also: How Can I Apply For 401k

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

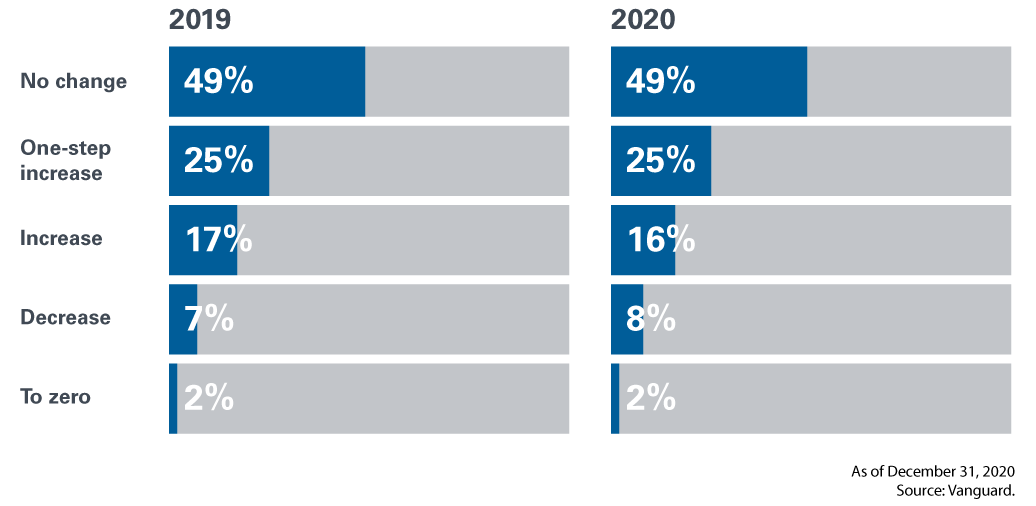

Vanguard Says Workers Are Tapping Retirement Money Early Recommends These Better Options

Workers are prematurely tapping their retirement savings, a sign that households are coming under increased financial pressure, a troubling development that’s likely to get worse if the U.S. economy falls into recession in the coming months.

According to the recent Vanguard Investor Expectations Survey, “Investors are feeling more pessimistic about the short-term outlook for financial markets and more of them are having to tap their retirement savings for cash,” based on October 2022 data drawn from 5 million workplace retirement accounts managed by the mutual fund giant.

For help strategizing for retirement and avoiding early withdrawals, consider matching with a vetted financial advisor for free.

The number of hardship withdrawals from retirement plans managed by Vanguard has risen to the highest level since 2004, according to Vanguard, with 0.5% of workers taking money out for an emergency. The total of 250,000 hardship withdrawals is worse than during the COVID-19 lockdowns and during the great recession of 2008 and 2009. The withdrawals are allowed only for what the IRS calls “an immediate and heavy financial need” that often needs to be documented.

Another sign of financial pressure among workers is the increase in people take loans against their 401 accounts, which surged during the great recession to more than 1%. As of October, Vanguard reported 0.9% of plan participants taking out loans.

How to Avoid Early Retirement Account Withdrawals

Bottom Line

Also Check: How Much Can One Contribute To 401k

Will A 401 Loan Affect My Credit

Taking out a 401 loan has no direct impact on your credit scores.

- You don’t need a credit check to qualify for a 401 loan, so taking one out doesn’t trigger a hard inquiry and result in a temporary dip in credit scores.

- Payments on 401 loans are not tracked by the national credit bureaus , so they do not appear in your credit reports and cannot factor into credit score calculations. If you miss a payment or even default on the loan, your credit scores will not change.

Note, however, that the extra tax and penalty expenses that come with a 401 loan default can make it difficult to pay your credit bills, which can jeopardize your credit standing indirectly.

New & Outstanding Disaster Loans:

- Loan payment dates that are due between the disaster event date and ending 180 days after the disaster period may be delayed.

- Loan repayments may be delayed for one year , with the loans term extended by the period of the delay.

- Loan balances will continue to accrue interest during this delayed timeframe.

- The max 5-year loan term is disregarded for outstanding loans deferring payment for 1 year.

Don’t Miss: How Much Is Taxed On 401k Early Withdrawal

The Potential Tax Consequences On Retirement Plan Distributions

Apart from my own rollover, and according to the IRS, there are three permitted methods for doing a rollover of any kind:

Also Check: How To Do A Direct 401k Rollover

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, youll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

You May Like: Can You Get Your 401k If You Quit Your Job

Don’t Miss: Who Can Open A 401k

If You Take A 401 Loan You’ll Pay Interest To Yourself

When you borrow against your 401, you have to pay interest on your loan. The good news is that you’ll be paying that interest to yourself. Your plan administrator will determine the interest rate, which is usually based on the current prime rate.

The bad news is that you will pay interest on your 401 loan with after-tax dollars. When you take money out as a retiree, you are still taxed on the distributions at your ordinary income tax rate. This means the money is effectively taxed twice — once when you earn it before using it to pay back your loan and then again when the withdrawal is made.

The interest you pay yourself is generally also below what you would earn if you had left your money invested.

What States Do Not Tax Tsp Withdrawals

While most states tax TSP distributions, these 12 do not: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Illinois, Mississippi and Pennsylvania.

What state does not impose your 401k? Some of the states that do not impose 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania and Tennessee. You can save a lot of money if you live in these states, since your retirement income will be tax-free.

You May Like: Where Do I Go To Withdraw My 401k

Read Also: How Will A Loan From My 401k Affect My Taxes

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal arent interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isnt required.

- Theres no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isnt taxed initially, and theres no penalty. If you cant pay it back within the specified time frame, the outstanding balance is taxed and youll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

Can You Use A 401 To Buy A House

The short answer is yes, since it is your money. While there are no restrictions against using the funds in your account for anything you want, withdrawing funds from a 401 before age 59½ will incur a 10% early withdrawal penalty, as well as taxes. So, while it is possible to tap your 401 in lieu of a mortgage loan, it would end up being a very expensive source of funds, not to mention being disruptive to your retirement savings.

Don’t Miss: Should I Let Fidelity Manage My 401k

How Long Does It Take To Get A 401 Loan Direct Deposit

Knowing how long it takes to get a 401 loan direct deposit can help you decide whether a 401 loan is the best option for your current situation.

A well-funded retirement account can be a safety net in times of emergencies. Ideally, you donât want to tap into your retirement funds. However, in desperate times, a 401 can act as an emergency fund by taking out a 401 loan. Knowing how long it takes to get a 401 loan and have the funds direct deposited into your account can help you plan ahead should you ever need one.

The 401 loan process can anywhere from a day if you do it online to a few weeks if done manually. Once completed, it may take two or three days for a direct deposit to reach your account.

Before relying on a 401 loan to fund an emergency or any other large purchase you may need it for, there are many things to keep in mind.

Can I Use My 401 To Buy A House

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, it shouldnt be your first choice. There are some factors and drawbacks that you might want to consider before using your 401 to buy a house.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Read Also: Can I Use 401k To Pay Taxes

Contact Your 401 Provider

Youre making great progress. You know where your 401 is and you have an IRA at Fidelity to transfer your money into. The next step is to initiate your rollover by contacting your 401 provider.

Often, the easiest way to do this is by phone. Your 401 providers phone number should be visible on an old account statement.

In order for your call to go smoothly, follow these tips: