When Can I Withdraw From My401k Plan

When can I withdraw from my 401k plan?

If youre in your 20s, the answer is simple:

You can withdraw from your 401k plan whenever you want! However, there are a few things to keep in mind before you make any withdrawals.

First, youll want to make sure that you have enough money saved up in your 401k plan to cover any taxes and penalties that you may owe.

Withdrawing money from your 401k plan before youre 59 1/2 years old typically results in a 10% early withdrawal penalty, plus youll owe income taxes on the money you withdraw.

Second, youll need to decide how you want to take the money out of your 401k plan. You can either take a lump sum distribution or set up a regular withdrawal schedule.

Taking a lump sum distribution may be a good idea if you need the money for a large purchase or expense, but keep in mind that youll be responsible for paying taxes on the entire amount withdrawn.

If you set up a regular withdrawal schedule, youll be able to spread out the taxes owed on the money you withdraw.

This can be a good option if you need the money to supplement your income or if you want to make sure you dont outlive your retirement savings. Finally, youll need to decide what to do with the money once youve withdrawn it from your 401k plan.

You can leave it in a savings account, invest it in a brokerage account, or use it to purchase an annuity. Each option has its own set of pros and cons, so be sure to do your research before making a decision.

The Gist:

How Much Can You Contribute To A 401 Plan Each Year And How Does That Impact Your Taxes

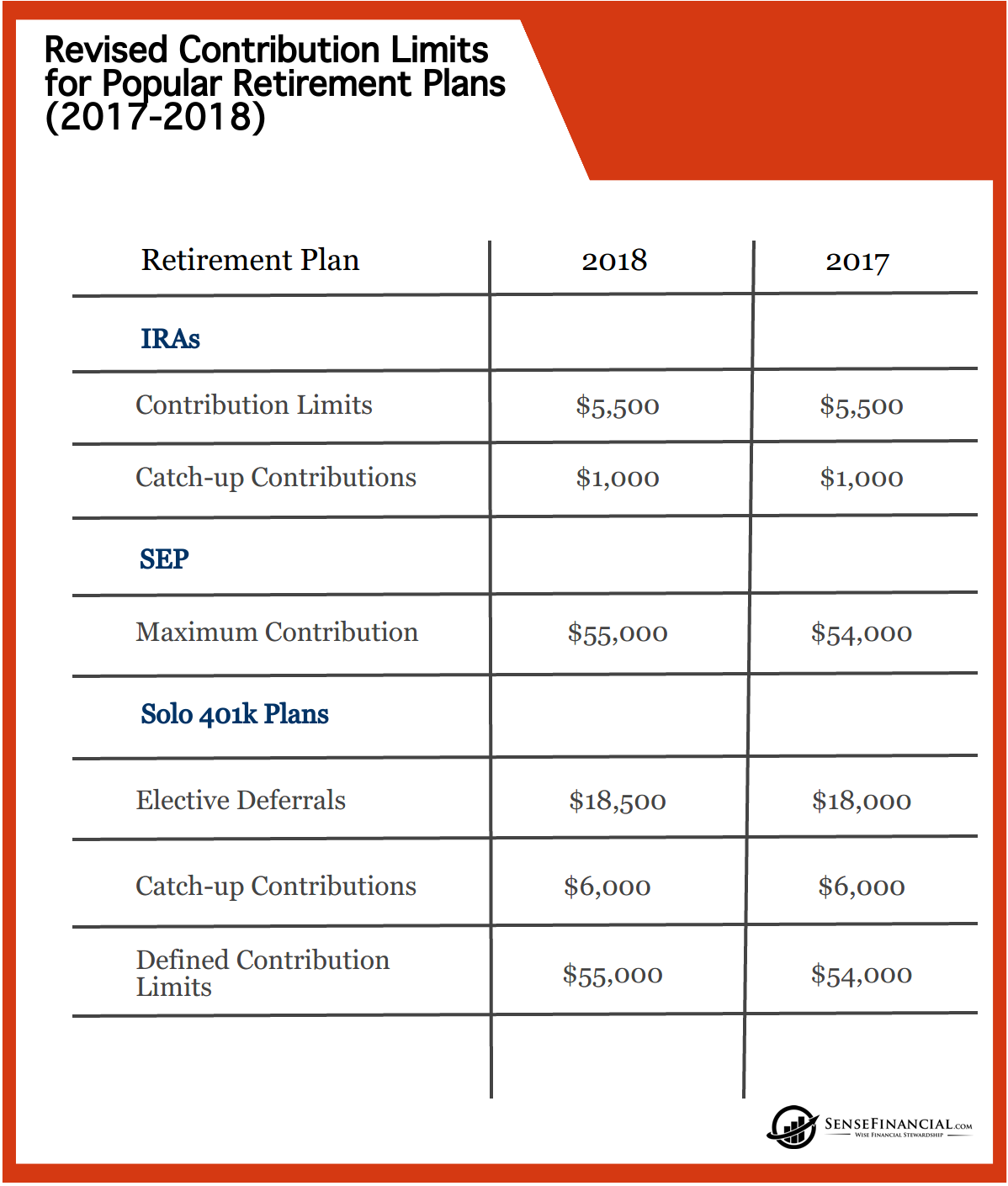

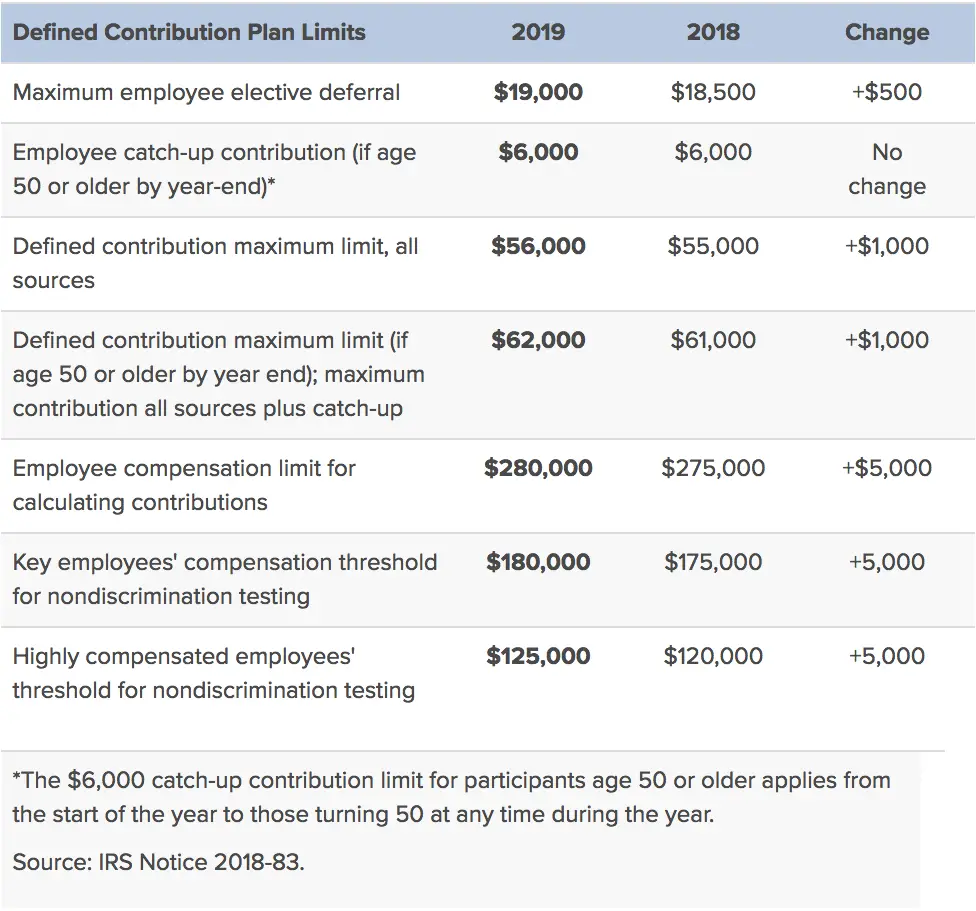

For small business owners, 401 plans offer a great way to save for retirement while also getting a tax break. The contribution limit for 401 plans is $19,500 per year . This means that you can put away a significant amount of money each year, and any contributions that you make will be deducted from your taxable income.

This can result in substantial savings come tax time. In addition, the money in your 401 account will grow tax-deferred, which means that you won’t have to pay taxes on any investment gains until you withdraw the money in retirement. For small business owners, a 401 plan can be an extremely powerful tool for building a secure retirement nest egg.

When Should You Choose A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,500 a year$7,500 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing from a traditional IRA once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Also Check: What Is The Contribution Limit For 401k

Simplified Employee Pension Ira

Another option for self-employed folks is the SEP-IRA. Theyre primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. An advantage of the SEP-IRA is a much higher contribution limit than traditional and Roth IRAs, but unfortunately, there is no Roth option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $66,000 .7

This is a good plan to consider if youre thinking about hiring employees in the future as your business grows. But remember, contributions made to yourself must be the same percentage made to your employees. So, if you put 15% of your salary into your account, you must also contribute 15% of your employees salary into their plan.

Now, lets explore another retirement option for small-business owners with employees.

If You Can Contribute More Than $6000 A Year And Youre Self

If youre a business owner or self-employed person with no employees and you want to set aside more than $6,000 a year, you might want to consider a Solo 401 ).

With this retirement plan, you play the role of both the employer and the employee, which allows you to contribute to the plan in both capacities outlined in #1). In total, you can contribute up to $58,000 for 2021.

Like the employer-sponsored 401 and the traditional IRA, youre not taxed upfront for the money you put in, but you are charged when you withdraw money in retirement.

Dont Miss: Will Walmart Cash A 401k Check

You May Like: How Much Can You Put In A 401k Per Year

How To Open A Roth Ira

In 2023, you can contribute $6,500 a year to your Roth IRAor $7,500 if youre 50 or older.2 You can choose from thousands of mutual funds, making it easy to spread out your investments evenly among the four categories we recommend: growth, growth and income, aggressive growth, and international.

You could open a Roth IRA through an investment company, bank or brokerage. But the best way to open an account is with an experienced investing pro who will act as a teacher and a guide. Remember, you should never invest in anything you dont fully understand. Check out SmartVestor to find a pro in your area who can walk you through each step.

K Vs Rrsp: What Are They How Do They Differ

Do you know the difference between a 401k vs RRSP? If not, dont worry many people dont either!

In this article, well break down the differences between these two retirement savings options.

The average American worker has a 401k retirement savings plan through their employer, while the average Canadian worker has a Registered Retirement Savings Plan .

There are some key differences between the two types of plans that can affect how much money you have in retirement.

Heres a look at the American 401k vs the Canadian RRSP.

Don’t Miss: Which Is Better 401k Or Ira

Thats The Power Of Peppermint

What is a PEP?

Pooled Employer Plans allow small business owners to pool retirement resources with other employers and make retirement plans lessexpensive and easier to manage.

Does my business qualify?

Companies of any size can join a Pooled Employer Plan AND employers starting a new plan may be eligible for SECURE Act tax credits of up to$15,000 over three years.*

Why should I sign up with peppermint?

With peppermint as your plan sponsor, you can give your employees the retirement plan options they want without the cost, risk, and administrative burden of a traditional 401k. Improve employee satisfaction, retention, and recruitment while helping your team save for the future.

What Is A 401k

A 401K is a retirement savings plan sponsored by an employer. It lets employees save and invest for retirement on a tax-deferred basis. This means that the money you contribute to your 401K is not taxed until you withdraw it in retirement.

401Ks are one of the most popular ways to save for retirement. But theyre not the only way. If your employer doesnt offer a 401K, or if youre self-employed, there are still other options available to you.

You May Like: How To Change A 401k To A Roth Ira

Other Considerations For Expat Retirement Accounts

A key concern for American expats with retirement accounts is double taxation the risk of retirement account income being taxed in both the United States and a foreign country . Taxes are bad enough in one country you certainly do not want to pay taxes on the same income in two countries, if possible.

Fortunately, the US tax system offers the American expat three possible provisions to reduce this risk of double taxation:

What Are The Fees Associated With 401 Plans

A few fees are associated with 401 plans, but they can be kept relatively low if you plan ahead. First, there’s the cost of setting up the plan, which can be a few hundred dollars upfront but is often worth it for the long-term benefits.

Second, there are ongoing costs for things like recordkeeping and customer service. These fees can vary depending on the provider, but they’re usually a small percentage of the total assets in the plan.

Finally, there may be fees for special features like investment management or financial planning services. However, these features are generally optional, and you can keep your overall costs down by sticking to the basics.

Read Also: How To Set Up 401k For My Company

Small Business Retirement: What Is A Traditional 401 Plan

Penelope is a retirement platform designed specifically for small business owners. It offers a simple, affordable way to set up and manage a retirement plan without the hassle and expense of traditional retirement plans.

We are partnering with Penelope to bring affordable retirement plans to all small business owners!

Small Business Retirement: What is a Traditional 401 Plan?

Join our platform to access business grants, capital, and growth resources.

A 401 plan is one of the best retirement options for small business owners. This type of plan lets you save money on a pre-tax basis, which can help you grow your savings more quickly. In addition, a 401 plan allows you to contribute more money each year than an IRA. If you’re looking for a solid retirement option for your small business, a traditional 401 plan may be the right choice for you.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How To Move 401k Into Ira

Best Retirement Plans For Small Businesses & The Self

Self-employment is increasingly popular in the United States. According to the Pew Research Center, in 2019 16 million Americans were self-employed, and 29.4 million people worked for self-employed individuals, accounting for 30% of the nations workforce.

Being a small business owner or a solo entrepreneur means youre on your own when it comes to saving for retirement. But that doesnt mean you cant get at least some of the benefits available to people with employer-sponsored retirement plans.

Whether you employ several workers or are a solo freelancer, here are the best retirement plans for you.

| Who Is It Best For? | Eligibility |

|---|---|

|

Self-employed business owners with no employees . |

Higher contribution limits than IRAs. Contributions are tax-deductible as a business expense. |

Smart Tips On How To Save For Retirement Without A 401k

Are you about starting a retirement portfolio but dont want to invest in a 401K? If YES, here are 13 smart tips on how to save for retirement without a 401K. Since it was established in the 1970s, 401k plans have been by far the most popular type of employer-sponsored retirement plan in the U.S., but even with its popularity, millions of Americans do not access these plans for one reason or the other.

In fact, according to a study that was done in March 2016 by the united states Bureau of Labor Statistics , 67 percent of full-time American workers have access to employer-sponsored defined contribution plans and only 48 percent actively participate in these plans. What this means is that a large amount of Americans still do not have access to a 401k plan and as such, they need to find an alternative retirement plan for themselves.

It is not difficult to see why 401k plans are so popular. This savings channel is tax-deferredand it is an easily accessible way for employees to accumulate wealth over time for retirement. Any contribution you make to your 401k plan is task free and this means that they are deducted from your taxable income for that year. The savings in a 401k thus have freedom to grow untaxed until they are ripe for withdrawal .

Here are some ways you can save for your retirement without a traditional 401k.

Recommended Reading: How Do You Move Your 401k When You Change Jobs

Read Also: Can I Get My 401k If I Quit

Leave Money With Previous Employer

Depending on the amount of money in your 401, you may be able to simply leave the funds in your previous employers program. This is typically allowed by plan administrators if you have accumulated $5,000 or more.

While this approach may seem like the simplest way to deal with the money, there are a few drawbacks to keep in mind. To begin with, you will no longer be able to contribute to that 401 plan once you leave an employer.

Letting funds sit might feel like the easier choice in the near term, but it can become complicated to manage multiple plans, and you run the risk of losing track of your funds, adds Voris. The biggest financial mistake many workers make when parting ways with an employer is losing track of their 401, which can add up to a significant loss of retirement income over time.

Its also important to understand that when you leave the money in a previous employers plan, you will be required to begin taking distributions at age 72even if youre still working and have not yet retired.

If you consolidate the money into your new employers plan and continue working past 72, you will not have to begin taking required minimum distributions, explains Katherine Tierney, a senior strategist for Edward Jones. But you can only defer the distributions for the employers plan where youre currently working.

Contribute To A Roth Ira If Youre Eligible

Roth IRA contributions cannot be deducted from your taxes in the current year, but earnings from Roth IRAs are tax-deferred and withdrawals after the age of 59 1/2 are not taxed. The tax deferral on your Roth IRAs earnings is valuable because it expedites your savings growth.

Without any recurring tax implications, you dont have to pull money out of the account each year to pay Uncle Sam. And the ability to withdraw money tax-free in retirement could save you thousands if you are in a high tax bracket when you leave the workforce.

Theres one other advantage of the Roth IRA. Since you contribute to your Roth IRA with after-tax money, you can withdraw your contributions at any time without paying a penalty. You are only penalized for withdrawing earnings, until you reach the age of 59 1/2 and at least five years have passed since your first Roth IRA contribution.

The Roth IRA does have two drawbacks. One, the annual contribution limits are fairly low. In 2021, you can contribute up to $6,000 annually, or $7,000 if youre 50 or older. That limit applies to your combined deposits to Roth and traditional IRA accounts. And two, eligibility for contributing to a Roth IRA is based on your income and tax filing status. As the table below shows, you cant put money in a Roth IRA if you have a high income, unless you use a backdoor Roth IRA strategy.

Also Check: Can You Borrow Money Against Your 401k

Read Also: How To Pull Money From A 401k

Contribute To A Traditional Ira

If your income is too high to contribute to a Roth IRA, then you can contribute to a traditional IRA instead. Those contributions are tax-deductible, unless your spouse has access to a 401 and your household income exceeds $208,000.

The tax structure of the traditional IRA mimics the 401. Contributions are made with pre-tax dollars, earnings are tax-deferred, and distributions are taxable.