Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

An Early Withdrawal From Your : Understanding The Consequences

OVERVIEW

Cashing out or taking a loan on your 401 are two viable options if you’re in need of funds. But, before you do so, here’s a few things to know about the possible impacts on your taxes of an early withdrawal from your 401.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

You Can Roll It Over To A New Employers Plan

If youre starting a new job, you can roll over your 401k money directly into your new employers retirement plan, in most cases. Thats something to ask about during the onboarding process. You should also ask if your new company will match any of your rollover. If youre lucky, youll get even more money out of your job change.

Read Also: Can I Transfer Roth 401k To Roth Ira

Don’t Miss: How To Use Your 401k Money

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ . However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA.

You Lose Thousands In Potential Growth

Even if youre not deterred by tax penalties, think twice before you sabotage your long-term retirement savings goals. When you withdraw money early, youll miss out on potential future savings growth because you wont gain the perks of compound interest. Compounding is the snowball effect resulting from your savings generating more earnings not only on your principal investment but also on your accrued interest.

Also, if you make a 401k early withdrawal while the market is down, youre doing yourself a disservice because youll be leaving thousands on the table. Its unlikely youll fully recover the lost years of compound interest you would have benefited from. You might need to get creative with a passive income stream to help support you later in life.

Recommended Reading: Can You Rollover A 401k To Another 401 K

You May Like: How Can You Take Out Your 401k

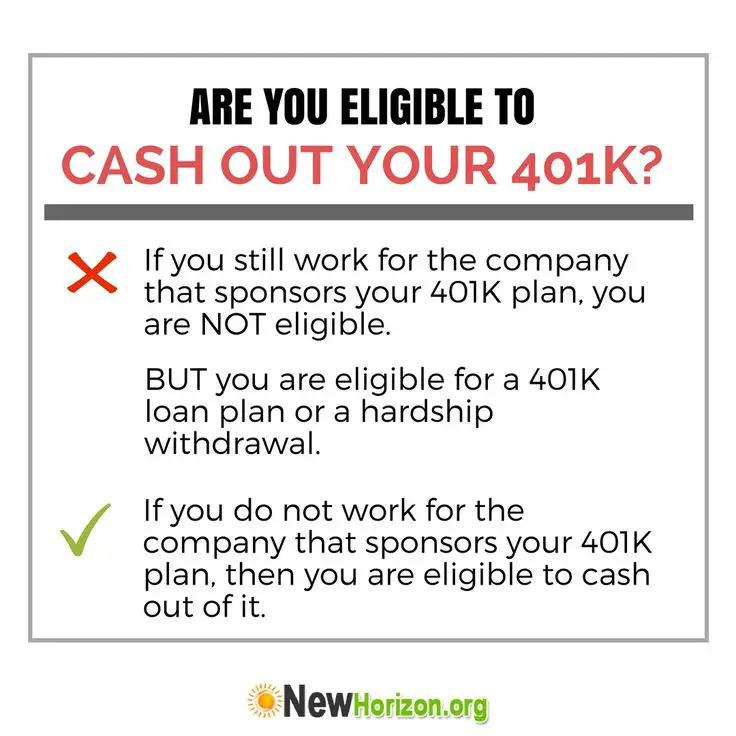

Keeping Your Money In A 401

You are not required to take distributions from your account as soon as you retire. While you cannot continue to contribute to a 401 held by a previous employer, your plan administrator is required to maintain your plan if you have more than $5,000 invested. Anything less than $5,000 will likely trigger a lump-sum distribution.

If you do not need your savings immediately after retirement, then theres no reason not to let your savings continue to earn investment income. As long as you do not take any distributions from your 401, you are not subject to any taxation.

If your account has $1,000 to $5,000, your company is required to roll over the funds into an IRA if it forces you out of the planunless you opt to receive a lump-sum payment or roll over the funds into an IRA of your choice.

How To Max Out Your Retirement Savings

Women face a financial gender gap in retirement. These steps can help you save what youll need.

Why are women more likely to need more moneyand have less savedfor retirement?

Financial realities such as a likelihood of living longer, higher health care costs, the pay gap, the investing gap, and time out of the workforce can all be factors. Thats why saving and investing as much as possible can be a smart way to help close the retirement gender gap.

Also Check: How To Opt Out Of 401k Fidelity

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

How Much You Can Withdraw

You cant just withdraw as much as you want it must be the amount necessary to satisfy the financial need. That sum can, however, include whats required to pay taxes and penalties on the withdrawal.

The recent reforms allow the maximum withdrawal to represent a larger proportion of your 401 or 403 plan. Under the old rules, you could only withdraw your own salary-deferral contributionsthe amounts you had withheld from your paycheckfrom your plan when taking a hardship withdrawal. Also, taking a hardship withdrawal meant you couldn’t make new contributions to your plan for the next six months.

Under the new rules, you may, if your employer allows it, be able to withdraw your employers contributions plus any investment earnings in addition to your salary-deferral contributions. Youll also be able to keep contributing, which means youll lose less ground on saving for retirement and still be eligible to receive your employers matching contributions.

Some might argue that the ability to withdraw not just salary-deferral contributions but also employer contributions and investment returns is not an improvement to the program. Heres why.

Read Also: Can You Roll Over Your 401k To A Roth Ira

Two Annual Limits Apply To Contributions:

You May Like: Can You Create Your Own 401k

How To Withdraw Money From A 401 After Retirement

Shawn Plummer

CEO, The Annuity Expert

When you retire, one of the first things youll want to do is figure out how to access your 401 funds. This can be a little confusing, as there are several ways to go about it. This guide will walk you through the process of withdrawing money from your 401 after retirement. We will also answer some common questions, such as do you pay tax on 401 when you retire? and how do you not run out of 401 money. So read on for all the information you need to make the best decisions for your retirement!

Read Also: How To Get My 401k Early

Rolling Over Your 401k

If you roll over your 401k, you can do it directly from your 401k plan to your new IRA account. This way no taxes are withheld. Set up an IRA with the financial institution of your choice, and its representative will help you contact the institution that manages your 401k plan to request a direct rollover. When you do the rollover, you can choose to have a percentage of the account distributed to you in the form of a check, but this part is subject to tax and penalties. You can also withdraw cash from your IRA after you roll over funds, but youll pay taxes and the 10 percent penalty until you reach the age of 59 and six months.

How To Avoid The Early Withdrawal Penalty

There are a few exceptions to the age 59½ minimum. The IRS offers penalty-free withdrawals under special circumstances related to death, disability, medical expenses, child support, spousal support and military active duty, says Bryan Stiger, CFP, a financial advisor at Betterments 401.

If you dont meet any of those qualifications, you arent entirely out of luck, though. Youve got a couple of options that may let you make penalty-free withdrawals, if youre slightly younger than retirement age or plan your withdrawals methodically.

If youre between age 55 and 59 ½ and you lose your job, the IRS will allow you to withdraw from your 401 plan penalty-free. This is called the Rule of 55, and it applies to everyone within this age group who loses a job, no matter whether youre fired, laid off or voluntarily quit. Stiger says. To qualify for the Rule of 55, the 401 you hope to take withdrawals from must be at the company youve just parted ways with. Note that the Rule of 55 does not apply to IRAs.

There is also the Substantially Equal Periodic Payment exemption, or an IRS Section 72 distribution, say Stiger. With SEPP you can take substantially equal payments from your 401 based on life expectancy. Unlike the Rule of 55, you may use SEPPs to tap an IRA early.

Dont Miss: Whats The Difference Between An Ira And A 401k

Read Also: How Can I Find My 401k Balance

Are Taxes Going Up

Death and taxes are two certainties in life. Generally speaking, taxes increase over time while deductions for most people decrease over time. Unless Congress takes a special action, we know some favorable tax reductions for most middle-class Americans will sunset in 2026.

If you think taxes will be higher in the future, or you know your deductions will be lower, cashing out a 401 to move money to a place that does not pay taxes again can make sense.

Among other things, potential tax-saving strategies may include a rollover to a Roth IRA or buying permanent whole life insurance designed for high cash value accumulation.Note: If passed into law, pending legislation could substantially change Roth IRA regulations after Dec 31, 2021 especially relating to distributions and rollovers.

Read Also: How To Rollover 401k When Changing Jobs

What Are The Penalty

The Internal Revenue Service permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these exceptions, but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal: for costs directly related to the COVID-19 pandemic.

Youll still owe regular income taxes on the money withdrawn, but you wont get slapped with the 10% early withdrawal penalty.

Also Check: Can You Open A Roth 401k On My Own

When Should You Start Collecting Social Security Benefits

We’ll help you decide whether you should retire now and begin collecting your benefits or hold off for a few more years.

You don’t have to wait until you hit 67 to begin collecting benefits. Yes, the full retirement age is currently 67, but you can begin collecting benefits as early as 62.

When you decide to start collecting your Social Security benefits is something that can affect your finances for the rest of your life. And with the big cost-of-living adjustment increase that arrived in 2023, you might want to know whether it’s a good idea to start collecting your benefits now. We’ll answer all those questions and more below.

There are advantages and disadvantages, whether you decide to retire early or wait a few more years. The best place to start your decision is by examining your current financial situation, including any other money you’ve saved over the years through your 401, IRA or other retirement investments to determine what’s best for you.

We spoke with an expert and took the Social Security Administration’s advice into consideration to help you determine the best time to collect your benefits. For more about Social Security, learn how you can pause payments to get more money later.

Qualified Withdrawals Are Tax

If you wait until youre 59 ½, you can take withdrawals on your Roth 401 without paying taxes. That includes contributions as well as earnings. Compare this to a traditional 401, where you avoid the taxes upfront but pay on both contributions and earnings when you withdraw. You can see why, if your employer offers it, a Roth 401 might be a good option.

Recommended Reading: How Do I Find My Old 401k Account

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

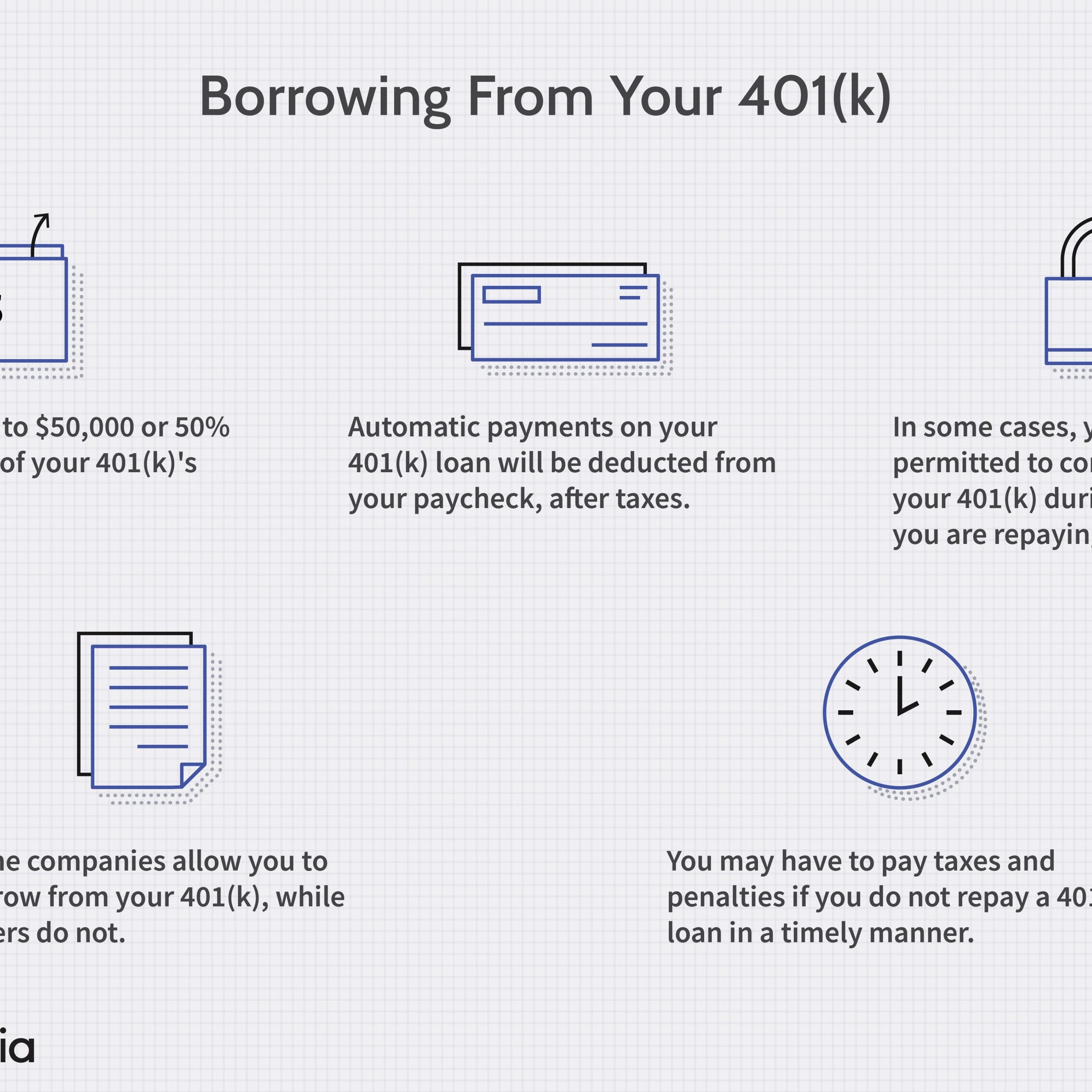

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

You May Like: When Can I Take Out 401k

Get To Know Roth Iras

Once youve built a financial foundation, consider adding a Roth IRA, which can provide tax-free income once you retire. A Roth IRA can be a good alternative if your company doesnt offer a 401.

Another advantage of tax-free withdrawals from a Roth IRA is that Medicare premiums are based on your taxable retirement income. Reducing your health care costs in retirement means youll keep more of the money you have coming in and make your retirement savings last longer.

Also Check: Can You Keep Your 401k In A Chapter 7

Move Your Money To Your New Employer’s Plan

If you have a new employer offering a retirement plan, you may be able to transfer your savings into it.

- Your savings stay invested with the same tax advantages

- You might be able to roll in savings from other retirement plans

- You can make ongoing contributions.

- The investment options depend on what the plan offers.

- You may be able to take out a plan loan, or withdraw money before retirement under certain circumstances

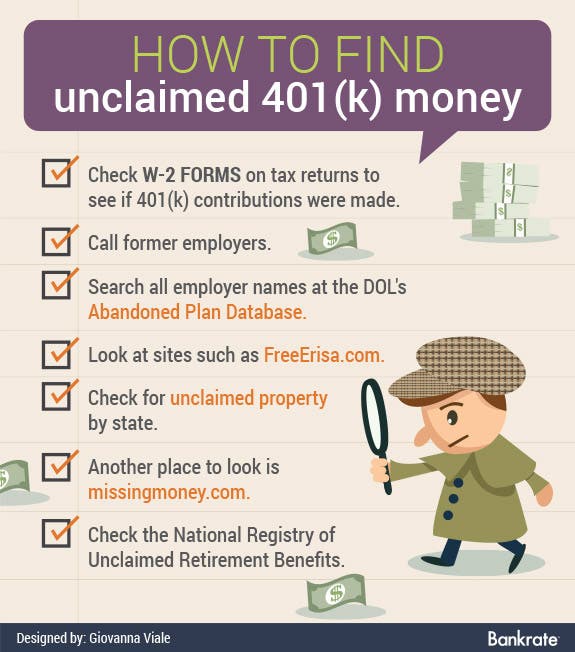

Also Check: How To Check Old 401k Accounts