Disadvantages Of A 401

Your 401 is a great way to save for retirement, but you also need to understand a few of its shortcomings too:

- Fewer options for mutual funds. Your employer usually hires a third-party administrator to run the companys retirement plan. That administrator picks and chooses which mutual funds you can invest in, limiting your options. Womp-womp.

- Your withdrawals in retirement will be taxed. Remember those tax breaks you get on your 401 contributions? Well, theres a catch.Since you fund a 401 with pretax dollars, you wont pay taxes now, but you will pay taxes on that money in retirement. This could lead to a pretty hefty tax bill depending on what tax bracket youre in when you retire.

- Required minimum distributions . You cant leave your money in your 401 forever. Beginning at age 72, you must start withdrawing a certain amount of your savings each year, or youll pay a penalty.2 Alsothere are penalties for withdrawing money before age 59 1/2. Either way, Uncle Sam wants his share!

- Waiting period. If youre new to a company, you may have to wait a certain length of time to participate in a 401 plan or receive an employer match. Thats not great, but some things are worth the wait!

Now that weve broken down the 401, lets turn our attention to the one and only Roth IRA. Then well compare the two and see if theres a clear winner!

Whats The Difference Between A Roth Ira & A Roth 401

8 minute read

The life expectancy of Americans has grown steadily over the past century so much so that the average American lives 10 years longer today than they did in the 1960s. Even though Congress has since raised the social security retirement age, they havent raised it enough to balance the increase in life expectancy, which means Americans are spending more time in retirement than in years past.

Although this trend in longer lifespans is good news, it can be troubling from a financial perspective. The more years Americans spend in retirement, the more assets theyll need to fund that retirement. Fortunately, there are countless ways to save money for later in life. To help with the task of selecting the right retirement plan, well dive into the details of two popular plans: Roth IRAs and Roth 401s.

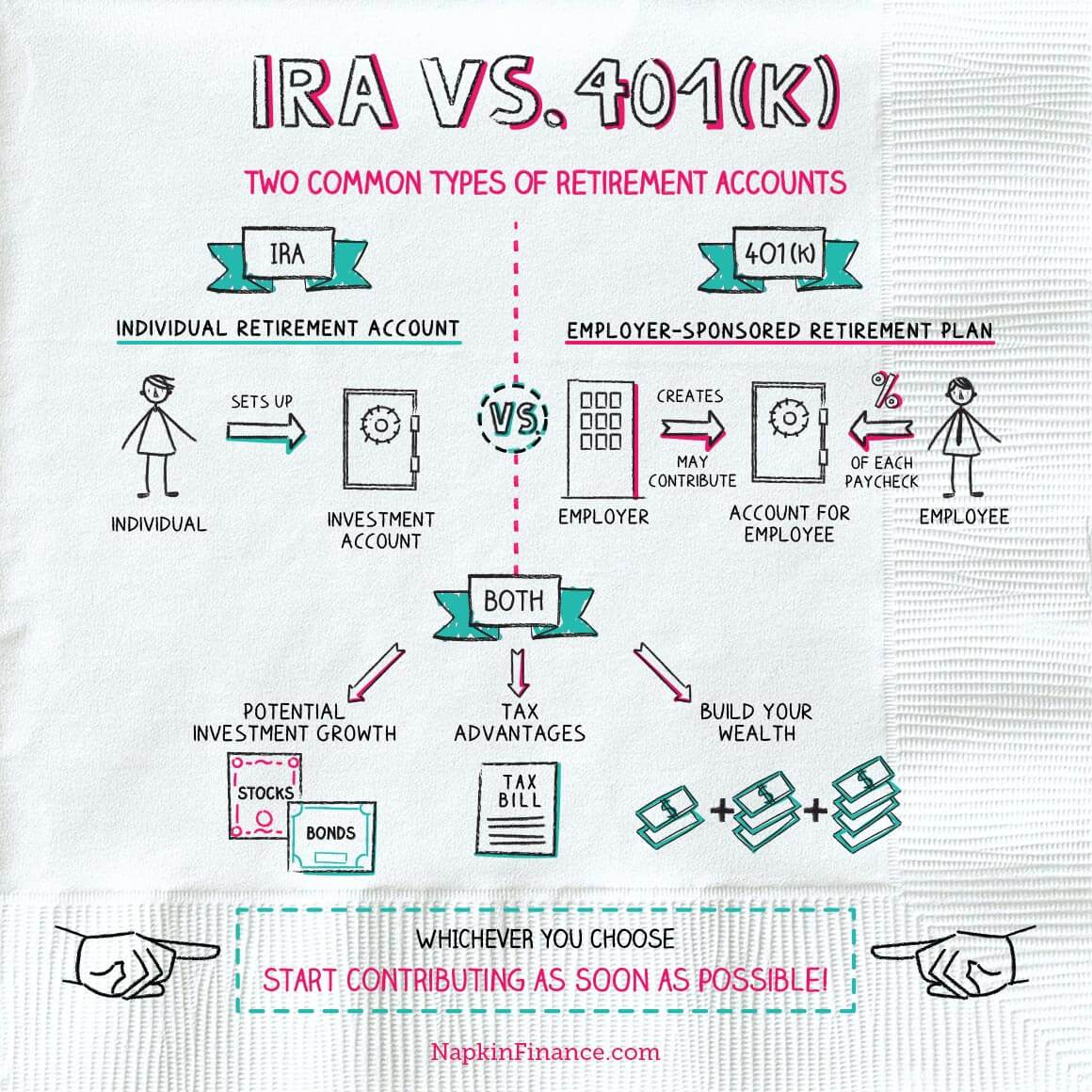

Ira Vs : What Is The Difference

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

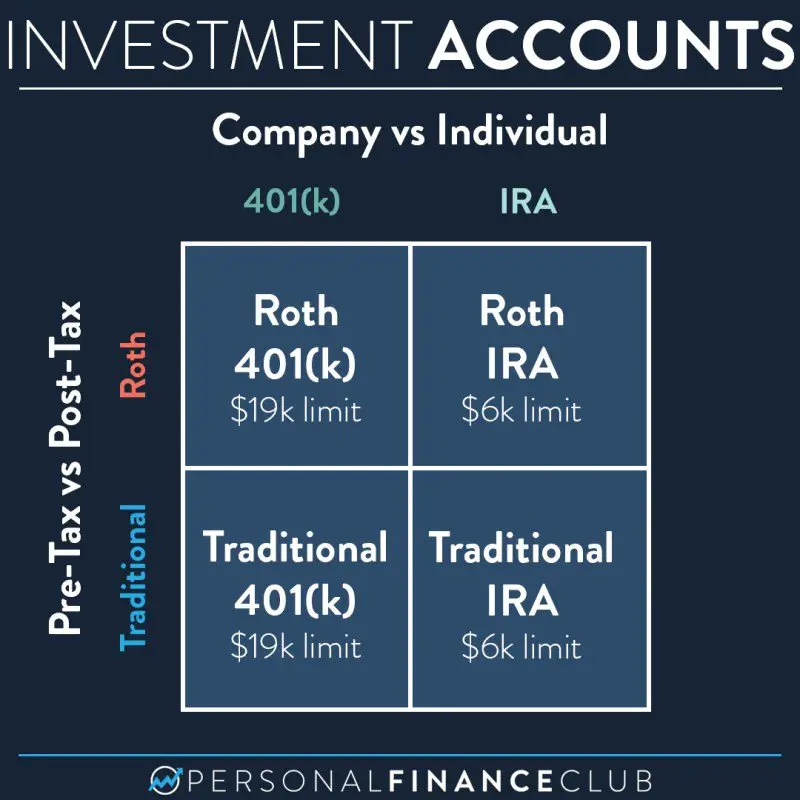

The biggest difference between an IRA vs. a 401 is the amount you can save. You can save over three times as much in a 401 vs. an IRA $20,500 versus $6,000. But not everyone has access to a 401, because these are sponsored by an employer, typically for full-time employees.

Other than that, a traditional IRA and a 401 are similar in terms of their basic provisions and tax implications. Both accounts are considered tax deferred, which means you can deduct the amount you contribute each year unless you have a Roth account, which has a different tax benefit.

Before you decide whether one or all three types of retirement accounts might make sense for you, it helps to know all the similarities and differences between a 401 and a traditional IRA and Roth IRA.

Also Check: How To Liquidate Your 401k

You May Like: How To Request 401k Withdrawal

Should I Use A Roth Ira Or A Roth 401

Its important to talk with a tax planning professional to understand all the tax implications of your decision, but here are a few general rules to follow:

- Roth 401s are typically better for high earners because there are no income limits.

- Roth 401s are preferred by people who started to save for retirement later in life because the contribution limit is higher.

- Roth 401s that offer matching contributions almost always win out over Roth IRAs because matching contributions cost the participant nothing.

- Roth IRAs allow investments to grow longer because they are not subject to RMDs, which may be good for taxpayers hoping to leave their retirement savings for their heirs.

- Taxpayers who are in a less-than-stable financial position may prefer a Roth 401 because they can borrow from their account. They can take a loan of up to 50% of their Roth 401 balance . They will owe interest on this loan, but because they are borrowing money from themselves, those interest payments will be deposited into their Roth 401 account. If those loans are repaid timely, there are no negative tax consequences.

- Taxpayers can take tax- and penalty-free withdrawals from their Roth IRA as long as they pull from the amount theyve contributed. This makes the Roth IRA a good solution for somebody wanting to build a secondary emergency fund.

Roth 401 Vs Roth Ira: Which Is Better For You

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

A growing number of people have access to Roth 401s at work and thats good, because Roths can be a great way to save. The question is, which is best for you: a Roth 401 or a Roth IRA? After all, when it comes to Roth 401 vs. Roth IRA, both types of Roths offer the same valuable benefit: Your investments grow tax-free. As long as you follow the rules, all of your money comes out tax-free in retirement.

You cant really go wrong with either type of Roth. But there are a handful of ways in which the two accounts differ. Depending on your situation, a Roth 401 may be better for you than a Roth IRA, or vice versa.

Weve created a chart for you to compare Roth 401s and Roth IRAs. But first, take these two steps:

Also Check: How Does A 401k Benefit The Employer

Roth Ira Vs 401k Recap

If you contribute to both a Roth IRA and a 401k you are taking advantage of the two biggest retirement accounts. These accounts will help your savings grow faster and larger than a non-tax-advantaged brokerage account.

The more you contribute to your retirement savings accounts each year, the more money you will have in retirement.

Since its impossible to know what tax bracket youll be in at various stages in retirement, its great to have both accounts. Its not a bad idea to have some retirement savings in pre-tax and post-tax accounts.

Then you can strategize your distributions to minimize your tax liability and diversify your retirement holdings.

Dont let a lack of planning when youre young ruin your future.

Being a frequent golfer I get to meet a lot of people, especially older people. Anytime I meet someone who is retirement age I ask them if they wouldve done anything different in their 20s or 30s.

Nine out of 10 times I hear how they wish they had started saving earlier.

Use a 401k and Roth IRA to start funding your retirement plan, and your future self will thank you. Remember: Act as if retirement is on the horizon.

You May Like: How To Move 401k Into Ira

Roth Ira Income Limits

The Roth IRA limits your contributions based on earned income. In other words, how much you can contribute to a Roth IRA depends, in part, on how much you earned in a year. What’s more, the contribution amount allowed can be reduced, or phased out, until it’s eliminated, depending on your income and filing status for your taxes . Income limits are different for 2021 and 2022.

You May Like: How To Do A Direct 401k Rollover

Disadvantages Of A Roth Ira

The Roth IRA sounds pretty awesome, doesnt it? Unfortunately, the Roth IRA does have some limitations that you need to be aware of:

- Lower contribution limits. You can only invest up to $6,500 in a Roth IRA in 2023 or $7,500 if youre age 50 or older.3 When you compare that with the contribution limits for a 401, you might be thinking, Thats it? Thats why 401s and Roth IRAs work better together.

- Income limits. As amazing as the Roth IRA is, theres a chance you might not even be eligible to put money into one. Gasp! If your modified adjusted gross income is higher than $153,000 as a single person or more than $228,000 as a married couple filing jointly, then you wont be able to contribute to a Roth IRA in 2023.4 But dont worry, the traditional IRA is still an optionits better than nothing.

- The five-year rule. This wont be an issue for most folks, but the five-year rule says you cant take money out of your Roth IRA until its been at least five years since you first contributed to the account. Youll get hit with taxes and penalties if you break that rule . And remember: Just like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 .

Roth Ira Contribution Limits

The annual contribution limits are much smaller with Roth IRA accounts than for 401s. For 2021 and 2022, the maximum annual contribution for a Roth IRA is:

- $6,000 if youre under age 50

- $7,000 if youre age 50 or older, which includes a $1,000 catch-up contribution

These limits increase starting in 2023. The new annual contribution limits are:

- $6,500 if you’re under age 50.

- $7,500 if you are age 50 or older.

Also Check: Who Can Open A 401k Plan

Roth Ira Vs : What Are The Major Differences

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Heres the tale of the tape showing how the Roth IRA and the 401 stack up against each other:

|

Feature |

|

|

Penalties for withdrawals before 59 1/2. |

Penalties for withdrawals before 59 1/2. |

Its More Than Just The Contribution Limit

Anthony Battle is a CERTIFIED FINANCIAL PLANNER professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

The Good Brigade / Getty Images

Saving for retirement is an important part of everyones financial plan. Many people use specialized retirement accounts to save because of the tax incentives they provide.

Roth 401s and IRAs are alternatives to traditional 401s and IRAs, which provide a tax deduction on contributions instead of allowing tax-free withdrawals. Roth 401s and Roth IRAs both let you contribute money after youve paid taxes on it, so you can later withdraw the money, plus any earnings, tax free in retirement.

You May Like: Can I Roll One 401k Into Another

Roth Iras Vs Roth 401s

-

Only those making less than $153,000 can contribute .

-

Contribute up to $6,500 per year .

-

No required distributions.

-

Wide range of investment options.

-

You can withdraw contributions freely, but earnings are taxed at 10% if withdrawn before age 59½.

-

You cannot borrow money from your balance, unless you execute a rollover.

-

Contribute up to $22,500 each year .

-

You must start taking distributions at age 72.

-

Only a few investment funds.

-

10% penalty on withdrawals before age 59½.

-

You can borrow up to 50% or $50,000 from your account balance, whichever is smaller.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Don’t Miss: Is An Annuity Better Than A 401k

Important Distinction For Claiming Contributions

Important note: you do not report the employee portion of the Solo 401k contribution on Schedule C. The purpose of Schedule C is calculating your business expenses before determining your earned income from the business.

For pass-through businesses, the employee and employer portion of the Solo 401k contribution is reported on line 15 of Schedule 1. There is a direct connection from Schedule C to Schedule 1. For example, you report business from Schedule C on line 3 of Schedule 1. Then, as part of the Schedule 1 calculation, the employer contribution to your Solo 401k becomes part of your adjusted income. Afterward, that is subtracted out of your taxable income. Finally, report adjusted income on line 8a of Schedule 1 on your 1040 form .

In This Article You’ll Learn

Who is this for? Anyone that hopes to one day retire would benefit from understanding the difference between Roth 401ks and Roth IRAs, and how to navigate them both to your greatest advantage.

Maybe youre here because you just started a new job and your employer offers a Roth 401 option. Perhaps youre self-employed and are looking into starting your own Roth IRA. Or maybe youre in the tech industry and keep hearing about the mega backdoor Roth 401.

Whatever reason youre reading this, its always a good idea to plan for the future. When you hear people use terms like traditional,after-tax,pre-tax, and Roth, its easy to get lost and feel like its complicated. The reality is, its not that complicated once you get the terminology down and understand how each option works.

It does get a bit more complicated when you start analyzing your unique situation and goals and try to choose the best financial plan. The good news is there are plenty of professionals that can walk you through that, and help you make needed adjustments with your Roth 401 and Roth IRA decisions, and beyond.

In this article, were going to break down Roth 401s, Roth IRAs, and everything related. When youre finished, youll have the information you need to be an informed participant when designing your retirement plan with your financial advisor.

You May Like: How Do I Convert A 401k To A Roth Ira

Both The Roth 401 And The Roth Ira Can Help You Reach Your Retirement Goals Each Has Its Advantages And Disadvantages

Roth 401s and Roth IRAs are retirement savings accounts that allow you to contribute with after-tax dollars and take tax-free withdrawals in retirement. They are an alternative to traditional 401s and traditional IRAs, both of which allow pre-tax contributions but require you to pay tax on withdrawals.

While both Roth accounts make it possible to defer taxes until retirement, there are some important differences between a Roth 401 and a Roth IRA:

- Required minimum distributions: Roth 401s require you to begin taking money out at age 72, while Roth IRAs do not have required minimum distributions .

- Eligibility: Because of income limits, higher earners cannot contribute to Roth IRAs.

- Individual/employer accounts: Roth 401s are administered by employers, while Roth IRAs are opened by individuals.

- Contribution limits: Roth 401s have higher contribution limits than Roth IRAs.

Claim Solo 401k Contributions On Your Tax Return For An S

Is your business a corporation? If so, business income and contributions do not pass directly to your personal income tax return. There is a different tax reporting process that requires different tax forms.

Most, but not all, corporations are separate business entities. Therefore, they do not allow earned income to pass directly through to your personal income tax return. An important exception is S-corporations. For an S-corp, business income passes through to owners/shareholders. Youll then report that income to the IRS as taxable. However, S-corporations do have other tax obligations as a corporate entity. This requires the S-corporation to file a tax return separate from the business owners.

The S-corporation files with the IRS using Form 1120-S. List the business portion of the Solo 401k contribution on line 17 . Additional supporting IRS forms are generally required for S-corporations. Some of these are Form 5500, or Form 5500-SF.

You May Like: Where Is My Fidelity 401k Account Number

Roth Ira Vs : An Overview

Both Roth IRAs and 401s are popular tax-advantaged retirement savings accounts that allow your savings to grow tax free. However, they differ where tax treatment, investment options, and employer contributions are concerned.

Contributions to a 401 are made pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. The amounts are tax deductible, thereby reducing your taxable income. However, in retirement, withdrawals are taxed at your then-current income tax rate.

Conversely, there is no tax deduction for contributions to a Roth IRA. However, the contributions and earnings can be withdrawn tax free when in retirement.

In a perfect scenario, investors would use both accounts to put aside funds that can then grow tax deferred for years. However, before deciding on such a move, there are several rules, income limits, and contribution limits that investors should be aware of.