Special Case: Inherited Iras

If you inherit an IRA, for the year of the account owner’s death, you will need to use the same RMD the account owner would have used. However, for years following the account owner’s death, your RMD depends on your identity as the designated beneficiary. For example, RMD rules may vary depending on whether you are a surviving spouse, a minor child, or a disabled individual.

Generally, if you inherit an IRA from an account owner who died prior to Jan. 1, 2020, you would calculate your RMD using the IRS Single Life Table. However, if the account owner died after Dec. 31, 2019, you’ll need to follow the RMD rules established by the SECURE Act, which distinguishes between eligible designated beneficiaries, designated beneficiaries, and non-designated beneficiaries. The timeframe and calculation of your RMD can vary greatly depending on which of these categories you belong to as a beneficiary.

For example, some designated beneficiaries may be required to withdraw the entire account by the 10th calendar year following the year of the IRA owners post-2019 death. Meanwhile, some non-designated beneficiaries may be required to withdraw the entire account within five years of the IRA owners death. These rules effectively eliminate the stretch IRA, an estate planning strategy that some beneficiaries of inherited IRAs had used in the past to extend the tax-deferred benefits of an IRA.

Whats The Required Age To Start Taking Rmd

Prior to the Setting Every Community Up for Retirement Enhancement Act, the starting age for RMDs was 70 1/2 years old. But after the SECURE Act was signed into law on December 20, 2019, the age requirement was raised. If youre born on or after July 1, 1949 and your 70th birthday fell on or after July 1, 2019, you are not obligated to take RMDs until you reach the age of 72. However, if you were born before July 1, 1949, the required age will still be 70 1/2. You must withdraw your RMD by December 31 each year after your required beginning date.

What happens if you dont withdraw your RMD? If you fail to take your RMD, or dont take the required amount, youll face penalty charges. You must pay 50% of the RMD that was not withdrawn.

Since RMD is only the floor amount, you are allowed to take more. Note that your RMD distributions are considered taxable income during the year you withdraw them. This is the time the IRS starts collecting taxes you were able to defer from your retirement account. And once you fall under a lower tax bracket by the time you retire, it means youll pay lower taxes.

RMD rules come with certain exceptions:

RMD was Waived in 2020

Insert The Results Into The Rmd Formula

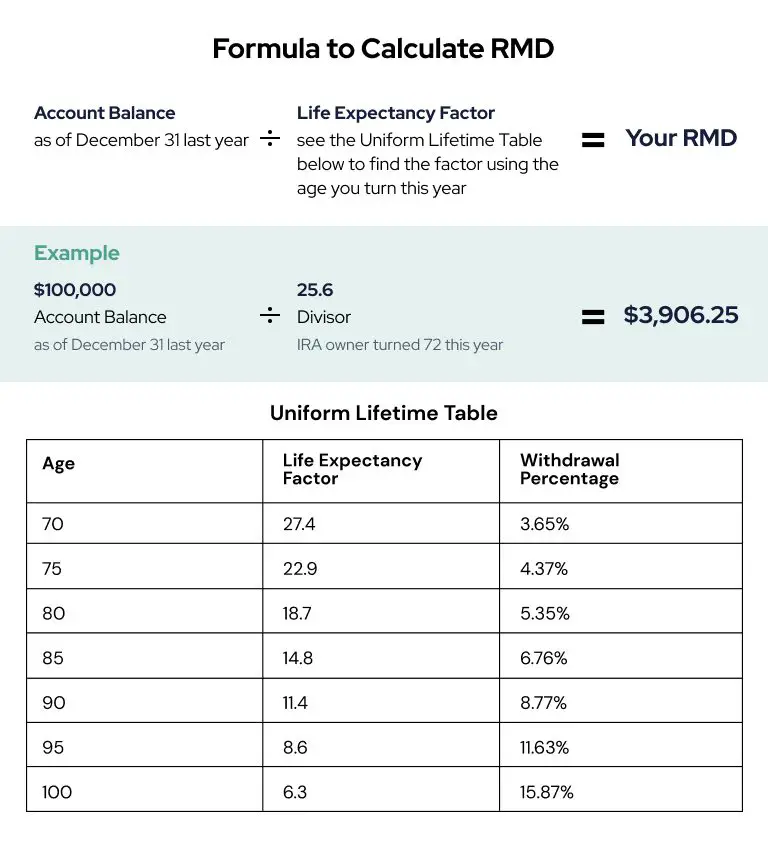

Lastly, we can divide Henry’s retirement account balance by his life expectancy factor using the following template:

Required minimum distribution = Retirement account balance ÷ Life expectancy factor

RMD = $200,000 ÷ 22.9RMD = $8733.62

Through this calculation, we now know that Henry has to withdraw $8733.62 from his retirement account before Dec. 31.

Read Also: How To Borrow Against My 401k

What Is The Point Of This Requirement

In short, taxes. The tax benefits afforded to certain types of retirement accounts are there to incentivize people to save for their retirement. Those benefits are often in the form of a tax deferral, meaning that amounts are deductible when contributed to the plan and taxable at the time of withdrawal. Congress was concerned that these accounts could be used as a way to permanently avoid taxation if the funds accumulated there indefinitely. The RMD rules address this by requiring that a portion be withdrawn each year.

Advance Thinking Can Help You Avoid Costly Mistakes

If you are the owner of an IRA, 401, or other qualified retirement plan, there are three things you probably know about RMDs:

- RMD stands for required minimum distributions.

- You have to do something about RMDs by the time you turn age 72.

- You could be in trouble with the IRS if you dont do it right.

Does that sum it up? If so, youre not alone. RMDs are one of the least understood components of a retirement plan and, frankly, one that many of us dont give much thought to.

Read Also: What Is A 401k Vs Roth Ira

Divide The Two Data Points

Divide your retirement account balance by your life expectancy factor to get your final RMD statistic. Take note that if you have multiple retirement accounts, you will need to calculate a separate RMD statistic for each account. A good practice to save on taxes is to combine your retirement accounts into one plan when you become a senior citizen.

Taxes To Keep In Mind

RMDs are taxed as ordinary income for the tax year in which they are taken. If you have after tax money including non-deductible contributions made to your Traditional IRA, you must calculate your RMD based on the total balance, but your taxable income may be reduced proportionately for the after tax amounts.

Itâs important to withdraw at least the RMD each year. If you do not satisfy all of your RMD, you may be subject to a 50% excise tax on the amount not distributed as required. You can take more than your RMD, however excess amounts taken will not offset the RMD amounts in future years.

Recommended Reading: Can You Contribute To Both 401k And Ira

How Can I Avoid Tax Penalties On Rmds

There is a severe tax penalty for not following the RMD rules. Your financial advisor can help explain the tax treatment for your withdrawals.

- If you do not take a distribution or if you withdraw less than the required amount, you may have to pay a penalty equal to 50% of the amount not taken. You can always take more than the required amount, but the extra withdrawals don’t count toward your required distributions for future years.

- Generally, withdrawals of pretax contributions and earnings are taxed as regular income.

- Withdrawals of RMDs from inherited Roth accounts are tax-free if certain requirements are met.

How Much Are You Required To Withdraw From Your Retirement Account

Once you reach age 72, the IRS requires you to withdraw a minimum amount of money each year from your retirement account. This amount, also known as your Required Minimum Distribution , is determined by your age and account balance so it changes each year.

Do you have multiple IRAs? Even though you must calculate each account individually, you can take your total RMD amount from one account or many.

Did you inherit a retirement account? If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal.

The analysis provided by this tool is based solely on the information provided by you. All examples, if any, are hypothetical and for illustrative purposes and do not represent current or future performance of any specific investment. No guarantees are made as to the accuracy of any illustration or calculation. This information does not serve, either directly or indirectly, as legal, financial or tax advice and you should always consult a qualified legal, financial and/or tax professional when making decisions relative to your individual tax situation. All investments carry a degree of risk, and past performance is not a guarantee of future results. Generally speaking, the greater the return, the greater the risk.

Also Check: How To Check My 401k Amount

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

Company Sponsored Retirement Plans

The requirement to take an RMD depends on whether the individual in question is an owner of the company and whether he or she is still actively employed.

- Ownership: Any individual who owns more than 5% of the company that sponsors the plan as of the date he or she turns age 72 must begin taking RMDs regardless of their ongoing employment status.

- Employment Status: For non-owners as well as those who own 5% or less of the company, the RMD requirement kicks in as of the later of the date the participant reaches age 72 or the date he or she terminates employment. That means a non-owner who is 72 does not have to start taking RMDs as long as he or she remains actively employed by the plan sponsor.

It should also be noted that if a participant who is age 72 passes away, his or her beneficiary may be required to take RMDs even though that person might be under age 72.

Note: For active participants who reached age 70 1/2 on or before December 31, 2019, the RMD requirement kicks in on April 1st of the year following the later of the year the participant reached age 70.5 or the year he or she terminates employment.

Recommended Reading: What Percent Should You Put In 401k

Don’t Miss: Can I Take Money Out Of My 401k

What Is An Rmd

While many 401 participants know about the early withdrawal penalties for 401 accounts, fewer people know about the requirement to make minimum withdrawals once you reach a certain age. These are called required minimum distributions or RMDs, and they apply to most tax-deferred accounts.

Prior to 2019, the age at which 401 participants had to start taking RMDs was 70½. The rule changed in 2019 and the required age to start RMDs is now 72. When you turn 72 the IRS requires you to start taking withdrawals from your 401, or other tax-deferred accounts. If you dont you could face another requirement: to pay a penalty of 50% of the withdrawal you didnt take.

All RMDs from tax-deferred accounts like 401 plans are taxed as ordinary income. If you withdraw more than the required minimum, no penalty applies.

A 401 Is A Defined Contribution Plan

Unlike a defined benefit plan , also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans allow their participants to choose from a variety of investment options. DCPs, 401s in particular, have been gaining in popularity as compared to DBPs. Today, the 401 defined contribution pension plan is the most popular private-market retirement plan. The shift in the choice between DBPs and DCP can be attributed to a number of reasons, one of which is the projected length of time a person is likely to stay with a company. In the past, it was more common for a person to stay with a company for several decades, which made DBPs ideal since deriving the most value out of a DBP required a person to stay with their company for 25 years or more. However, this is no longer the case today, as the workforce turnover rate is much higher. DCPs are highly mobile in comparison to DBPs, and their values do not drop when a person switches companies. When an employee with a 401 plan changes employers, they generally have the option to:

You May Like: How To Cancel 401k Plan

Rmd Rules For Multiple Retirement Accounts

If you have multiple retirement accounts, you have to follow certain rules on how to withdraw your RMDs.

If you have multiple accounts from defined contribution plans, like several 401s from different employers, you must calculate the specific RMD for each account and withdraw the correct amount from each. Your 401 plans and other defined contribution plans will often calculate your RMD for you, but to simplify things you may choose to consolidate your 401s into one account or even roll your savings over into a single IRA.

If you have multiple IRAs, you can withdraw your total RMD amount from one IRA or a portion from each of your IRAs. Unlike defined contribution plans, you donât have to take separate RMDs from each IRA.

Rmds And Inherited 401s

Keep in mind, however, that some companies impose stricter restrictions on how money in their employees 401 plans can be moved around. Some, for instance, may require beneficiaries to take the money out of the account in a lump sum or over the course of five years. You should contact the plan administrator for complete plan rules.

In addition, state laws may affect inherited 401 assets as well. And depending on how much is in the account, estate and inheritance tax laws may come into play as well. In the case of handling inherited 401 assets, its best to seek a tax and financial advisor in your area.

Read Also: Can You Use Your 401k To Pay Off Your House

Here Are The 401 Rmd Rules For 2021 And 2022

401 accounts are workplace retirement savings plans that employees can contribute to with pre-tax dollars, sometimes receiving matching contributions from employers.

Those who contribute to workplace 401s must know the rules for 401 required minimum distributions, or RMDs, since RMD rules mandate that accountholders begin withdrawing money at age 72 or face substantial IRS penalties equal to 50% of the amount that should have been withdrawn.

This guide will explain why RMDs exist, what the RMD rules are for 401 plans, what exceptions exist, how RMDs can be avoided, and how RMDs affect you if you inherit a 401.

What If I Dont Need The Rmd Assets

RMDs are designed to spread your retirement savings and related taxes over your lifetime. If you dont depend on the money to satisfy your spending needs, you may want to consider:

- Reinvesting your distributions in a taxable account to take advantage of continued growth. You can then add beneficiaries to that account without passing along future RMDs to them.

- Gifting up to $100,000 annually to a qualified charity. Generally, qualified charitable distributions, or QCDs, arent subject to ordinary federal income taxes. As a result, theyre excluded from your taxable income.

Don’t Miss: How Long Does It Take To Get 401k After Divorce

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

Rmd Requirements For Inherited 401 Accounts

Dont assume that RMDs are only for people in or near retirement. RMDs are usually required for those who inherit 401s as well. The rules here can get complicated, depending on whether you are the surviving spouse inheriting a 401, or a non-spouse. In most cases, the surviving spouse is the legal beneficiary of a 401 unless a waiver was signed.

Recommended Reading: Can I Use 401k To Pay Taxes

Calculating The Required Minimum Distribution

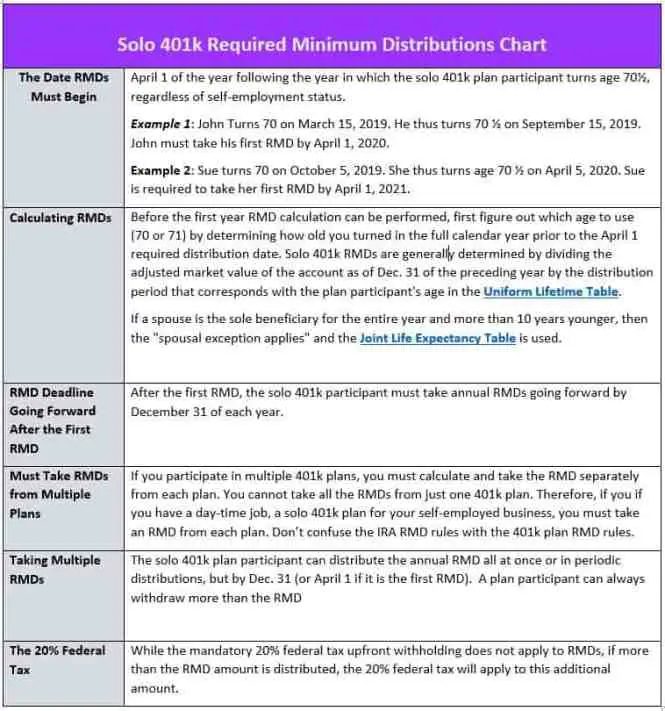

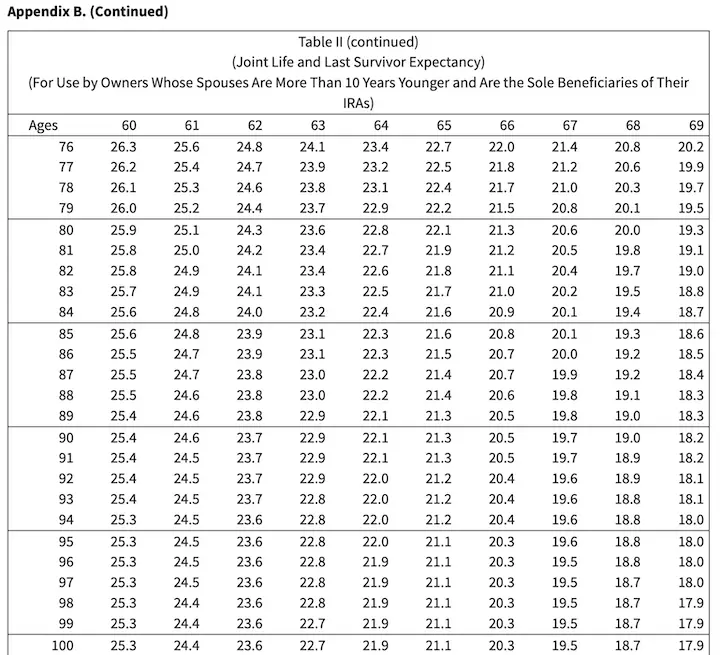

The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRSs Uniform Lifetime Table. A separate table is used if the sole beneficiary is the owners spouse who is ten or more years younger than the owner. In this regard, the following materials will be useful to you in determining required distribution amounts and payout periods:

- worksheets to calculate the required amount

- tables to calculate the RMD during the participant or IRA owners life:

- Uniform Lifetime Table for all unmarried IRA owners calculating their own withdrawals, married owners whose spouses arent more than 10 years younger, and married owners whose spouses arent the sole beneficiaries of their IRAs

- Table I is used for beneficiaries who are not the spouse of the IRA owner

- Table II is used for owners whose spouses are more than 10 years younger and are the IRAs sole beneficiaries

Inherited IRAs – if your IRA or retirement plan account was inherited from the original owner, see “required minimum distributions after the account owner dies,” below.

How Do Required Minimum Distributions Work

While you can invest pre-tax funds in an IRA, you’ll eventually have to pay taxes on that income. For this reason, the IRS is going to start making you take money out of your account once you turn 72, so that they can tax you on your distributions. However, if you’re still working, you can get out of taking distributions until you retire.

These mandatory annual withdrawals are fittingly called required minimum distributions, or RMDs for short. Your RMD requirement is calculated based on your age and the amount of money in your account.

Before 2020, the RMD age for IRAs was 70½, but when the SECURE Act passed in 2019, they raised the age to 72. If you turned 70½ before January 1, 2020, you may be subject to RMDs. A tax advisor can tell you if you are required to take RMDs now or when you turn 72.

If you try to skip an RMD, you can receive a whopping 50% tax penalty from the IRS. However, you may be able to receive anRMD Penalty Waiver to avoid IRS penalties under certain circumstances.

Also Check: Who Do I Contact To Cash Out My 401k